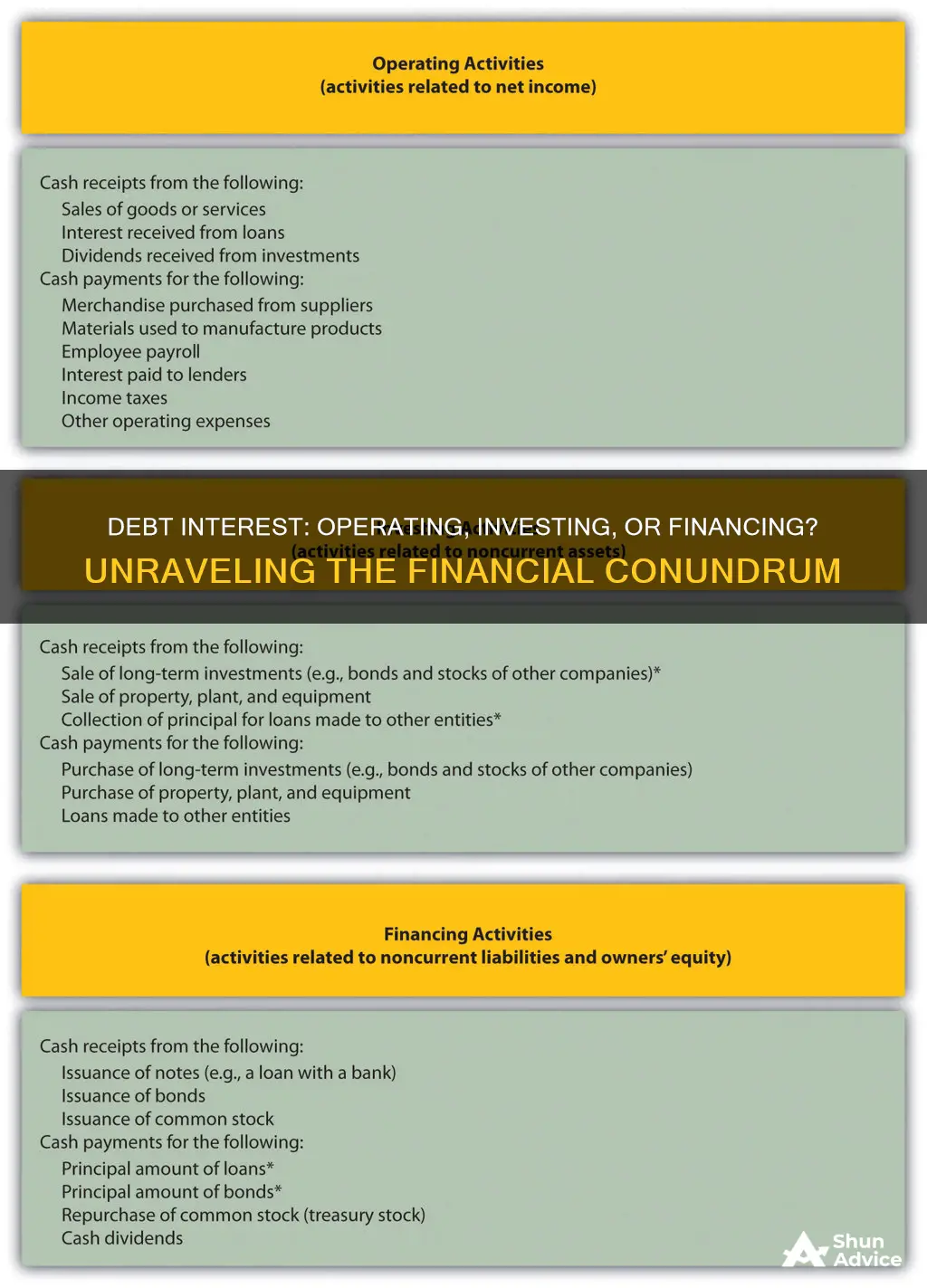

The classification of interest paid on debt as an operating, investing, or financing activity is an important consideration for financial reporting and analysis. Interest payments on debt can be categorized based on their nature and the purpose of the debt. Operating activities are those directly related to the primary business operations, such as sales, production, and administrative expenses. Investing activities involve the acquisition or disposal of long-term assets and investments. Financing activities, on the other hand, pertain to the company's financial structure, including issuing shares, repaying debt, and paying dividends. Understanding the classification of interest payments is crucial for assessing a company's financial health, liquidity, and overall capital structure.

| Characteristics | Values |

|---|---|

| Nature of Expense | Interest paid on debt can be classified as a financing expense. |

| Timing of Payment | It is typically paid periodically, often annually or semi-annually, depending on the loan terms. |

| Impact on Cash Flow | Interest payments can affect a company's cash flow, reducing the amount available for operations. |

| Tax Deductibility | In many jurisdictions, interest on debt is tax-deductible, which can impact a company's financial statements. |

| Capital Structure | It is a component of a company's capital structure, which includes equity and debt financing. |

| Interest Rates | The rate at which interest is paid can vary based on market conditions and the type of debt. |

| Debt Classification | Interest on short-term debt is often considered an operating expense, while long-term debt interest may be classified as a financing expense. |

| Industry Variations | Different industries may have varying practices in classifying interest payments. |

| Regulatory Considerations | Financial reporting standards, such as GAAP or IFRS, provide guidelines for classifying interest expenses. |

What You'll Learn

- Interest Expense: Operating cost related to debt, impacting cash flow

- Debt Repayment: Financing activity, affecting long-term financial stability

- Capital Structure: Balance between debt and equity, influencing financial health

- Interest Coverage Ratio: Measures ability to pay interest, a key financial metric

- Debt Refinancing: Strategic decision to manage debt, impacting cash flow

Interest Expense: Operating cost related to debt, impacting cash flow

Interest expense is a critical component of a company's financial operations, representing the cost associated with borrowing money. It is an operating cost, as it directly relates to the day-to-day functioning and management of a business. When a company incurs debt, whether through loans, bonds, or other financial instruments, it is obligated to pay interest on that debt. This interest expense is a recurring cost that impacts the company's cash flow and overall financial health.

The classification of interest expense as an operating cost is essential for understanding a company's financial performance and stability. Operating costs are those directly associated with the primary business activities and revenue generation. In the case of interest expense, it is a necessary outflow that arises from the company's decision to leverage its capital structure. This cost is not a one-time expense but rather a recurring payment that must be considered in the company's ongoing financial planning.

When analyzing a company's financial statements, interest expense is typically reported under the 'Operating Expenses' or 'Cost of Operations' section. This classification highlights its operational nature, as it is not a one-time investment or a non-operating activity. Instead, it is a regular cost that the company must manage and plan for to ensure its long-term sustainability. By recognizing interest expense as an operating cost, investors and analysts can gain insights into the company's ability to manage its debt and its overall financial efficiency.

The impact of interest expense on cash flow is significant. As a regular outflow, it reduces the company's available cash, which is crucial for funding day-to-day operations, investing in growth opportunities, and meeting financial obligations. High interest expenses can strain a company's cash reserves, especially if the business is already facing financial challenges or has limited access to additional funding. Effective management of interest expense is, therefore, essential to ensure a healthy cash flow and the overall financial viability of the business.

In summary, interest expense is an operating cost that arises from a company's debt obligations. It is a recurring financial outflow that impacts cash flow and must be carefully managed. Understanding the nature of interest expense as an operating cost is vital for assessing a company's financial health, stability, and its ability to manage its debt effectively. This knowledge is essential for investors, analysts, and business leaders to make informed decisions regarding the company's financial strategy and overall performance.

Unlocking Land's Potential: Exploring Investment Interest in Real Estate

You may want to see also

Debt Repayment: Financing activity, affecting long-term financial stability

The classification of interest paid on debt as an operating, investing, or financing activity is an important consideration for businesses and investors, especially when assessing a company's financial health and stability. When a company incurs debt, the interest it pays on that debt can have different implications depending on the nature of the debt and its intended use.

Operating expenses are those directly related to the day-to-day operations of a business. Interest paid on short-term debt, such as bank loans or lines of credit, is often considered an operating expense. This is because these debts are typically used to finance ongoing operational needs, such as managing inventory, covering payroll, or funding day-to-day business activities. For example, a retail store might use a short-term loan to finance its inventory purchases, and the interest paid on this loan would be an operating expense, contributing to the store's overall operational costs.

Investing activities, on the other hand, involve the acquisition and disposal of long-term assets and other investments. Interest paid on long-term debt, such as bonds or term loans, is generally classified as a financing activity. This is because long-term debt is often used to finance major capital expenditures, business expansions, or other long-term projects. For instance, a company might issue bonds to finance the construction of a new factory, and the interest paid on these bonds would be a financing activity, reflecting the cost of raising capital for a specific investment.

Financing activities are those that affect the company's capital structure and long-term financial stability. Interest paid on debt can have a significant impact on a company's financial health, especially when it comes to long-term debt. High interest payments can reduce a company's cash flow, impacting its ability to invest in growth, pay dividends, or service other debts. For example, a company with a large amount of long-term debt and high interest payments might struggle to maintain its financial stability, especially during economic downturns or periods of increased interest rates.

In summary, the classification of interest paid on debt as an operating, investing, or financing activity depends on the nature of the debt and its intended use. Short-term debt interest is often an operating expense, while long-term debt interest is typically a financing activity. Understanding these distinctions is crucial for assessing a company's financial health and stability, as well as for making informed investment decisions. Effective management of debt and interest payments is essential for maintaining a strong financial position and ensuring long-term success.

Understanding Carry-Forward Rules for Investment Interest Expenses

You may want to see also

Capital Structure: Balance between debt and equity, influencing financial health

The concept of capital structure is a critical aspect of financial management, focusing on the balance between a company's debt and equity financing. This balance significantly influences a company's financial health and overall performance. When a company's capital structure is well-managed, it can lead to improved financial stability, enhanced growth prospects, and a reduced risk of financial distress.

Interest payments on debt are a crucial component of capital structure. When a company takes on debt, it typically pays interest on that debt, which is a significant expense. This interest expense is a direct outflow of cash and can impact a company's financial health in several ways. Firstly, high interest payments can reduce a company's free cash flow, which is the cash available after all expenses, including interest, have been paid. This reduced free cash flow can limit a company's ability to invest in growth opportunities, pay dividends to shareholders, or service other financial obligations.

The classification of interest payments on debt can vary depending on the nature of the debt and the accounting standards applied. Generally, interest payments on debt are considered a financing activity in the context of the statement of cash flows. This is because the primary purpose of taking on debt is to finance a company's operations or investments, and the interest payments are a cost associated with this financing. As such, interest payments on debt are not typically classified as operating or investing activities, which are more related to the day-to-day business operations and strategic investments, respectively.

However, it's important to note that the impact of interest payments on a company's financial health can vary. For some companies, especially those with a high degree of financial leverage, interest payments can be a significant burden. High interest expenses can lead to a higher debt-to-equity ratio, which may increase financial risk. On the other hand, for companies with a well-managed capital structure, interest payments can be a manageable part of their overall financial strategy, allowing them to maintain a healthy balance between debt and equity.

In summary, interest payments on debt are a critical aspect of capital structure, impacting a company's financial health and stability. While these payments are not typically classified as operating or investing activities, they are a significant expense that can influence a company's ability to invest in growth, pay dividends, and manage other financial obligations. Understanding the balance between debt and equity and the implications of interest payments is essential for companies to maintain a healthy and sustainable financial position.

Tax Benefits: Deducting Mortgage Interest on Second Homes

You may want to see also

Interest Coverage Ratio: Measures ability to pay interest, a key financial metric

The Interest Coverage Ratio is a financial metric that provides insight into a company's ability to meet its interest payment obligations. It is a crucial indicator of a company's financial health and stability, especially in relation to its debt. This ratio measures the number of times a company's earnings before interest and taxes (EBIT) can cover the interest expense. In simpler terms, it shows how many times the company's operating income can pay off the interest on its debts.

The formula for calculating the Interest Coverage Ratio is straightforward: EBIT is divided by the interest expense. A higher ratio indicates that the company's earnings are sufficient to cover its interest payments multiple times over, which is generally considered a positive sign. For instance, if a company has an EBIT of $100,000 and an interest expense of $20,000, its Interest Coverage Ratio would be 5, meaning its earnings can cover the interest five times.

This ratio is particularly important for investors and creditors as it provides a clear picture of a company's capacity to manage its debt. A high Interest Coverage Ratio suggests that the company is in a strong financial position and is likely to be able to handle its debt obligations. This can attract investors who prefer companies with a lower risk profile. On the other hand, a low ratio might indicate that a company is struggling to generate enough income to cover its interest payments, which could be a cause for concern.

It's worth noting that the threshold for what constitutes a good Interest Coverage Ratio can vary depending on the industry. Some sectors, like utilities or telecommunications, often have lower ratios due to the nature of their business and the stability of their cash flows. In contrast, high-growth industries might have lower ratios initially but can improve them over time as they scale.

In summary, the Interest Coverage Ratio is a vital tool for assessing a company's financial strength and its ability to manage debt. It provides a clear and concise measure of a company's capacity to pay interest, offering valuable insights to investors and creditors alike. Understanding this ratio can help in making informed decisions regarding investments and lending.

Interest Rates: Rising or Falling? The Investment Outlook

You may want to see also

Debt Refinancing: Strategic decision to manage debt, impacting cash flow

Debt refinancing is a strategic financial move that involves replacing existing debt with new debt, often to improve the terms and conditions of the loan. This decision can significantly impact a company's cash flow and overall financial health, making it a crucial aspect of financial management. When a company decides to refinance its debt, it is essentially restructuring its debt obligations, which can lead to several potential benefits.

One of the primary reasons for debt refinancing is to manage cash flow more effectively. Interest payments on debt can be a significant expense for businesses, and refinancing can help reduce these costs. By securing a new loan with a lower interest rate, companies can free up cash that would otherwise be allocated to high-interest debt payments. This improved cash flow can then be directed towards other critical business operations, such as investing in growth opportunities, paying dividends to shareholders, or strengthening the company's balance sheet.

The impact of debt refinancing on cash flow is twofold. Firstly, the reduced interest payments directly increase the available cash for the company. Secondly, the act of refinancing often involves negotiating new terms, which may include extending the repayment period. While this might seem counterintuitive, extending the loan term can actually decrease the overall interest paid over time, as the interest is calculated on the principal amount for a more extended period. This strategy can provide a more stable and predictable cash flow pattern, allowing businesses to better plan and manage their financial resources.

However, debt refinancing is a strategic decision that requires careful consideration. It is not a one-size-fits-all solution and should be tailored to the specific financial situation and goals of the company. For instance, if a company is in the early stages of its lifecycle, refinancing might not be the best use of resources, as the focus should be on growth and expansion. On the other hand, established businesses with a solid financial foundation may find refinancing advantageous, especially if they can secure more favorable terms.

In conclusion, debt refinancing is a powerful tool for managing debt and optimizing cash flow. It allows companies to take control of their financial obligations, potentially reducing interest expenses and improving overall financial stability. When considering refinancing, businesses should carefully evaluate their financial health, growth prospects, and the potential impact on their cash flow to make an informed decision that aligns with their strategic objectives. This strategic approach to debt management can contribute to the long-term success and sustainability of a company.

Unraveling Acorn's Interest: A Deep Dive into Investment Rewards

You may want to see also

Frequently asked questions

Interest paid on debt is typically classified as a financing activity. It represents the cost of borrowing and is a non-operating expense, as it is not directly related to the company's core operations.

Interest paid on debt is a liability, while interest on investments is an asset. Debt interest is an outflow of cash, whereas investment interest is an inflow, representing the return on the company's investments.

No, interest paid on debt is generally not classified as an operating expense. Operating expenses are directly related to the day-to-day business activities and revenue generation. Debt interest is a financing cost and is usually reported in the financing section of the cash flow statement.

Interest paid on debt affects the cash flow statement by reducing net cash flow. It is reported as a cash outflow under financing activities. On the income statement, it is an expense, impacting the net income and, consequently, the earnings per share.