Compound interest is a powerful financial tool that can work wonders for your money, but it typically requires an initial investment. However, there are strategies to harness the power of compound interest without an upfront investment. This guide will explore innovative ways to continuously grow your wealth through compound interest, even without a starting capital. By understanding these methods, you can learn to leverage the power of compounding to build a substantial financial future, regardless of your initial financial situation.

What You'll Learn

- Leverage: Use debt or credit to increase potential returns

- Debt Management: Strategically manage debt to maximize interest accumulation

- Fractional Shares: Invest in small portions of stocks to benefit from compounding

- Dividend Reinvestment: Reinvest dividends to compound returns over time

- Peer-to-Peer Lending: Offer loans to others and earn interest on repayments

Leverage: Use debt or credit to increase potential returns

Leverage is a powerful financial strategy that can significantly amplify your returns when used effectively. It involves utilizing debt or credit to increase the potential gains from an investment. This concept is particularly useful when aiming to achieve continuous compound interest without an initial substantial investment. Here's how you can leverage this strategy:

Understanding Leverage: Leverage essentially means borrowing money to make an investment, allowing you to control a larger amount of assets than your own capital. This borrowed capital can be in the form of loans, credit lines, or other financial instruments. The key is to use this debt strategically to maximize returns. For instance, if you have a $10,000 investment and borrow an additional $10,000 to invest, you've effectively doubled your potential return.

Calculating Returns with Leverage: When applying leverage, the compound interest calculations become more complex. You need to consider the interest accrued on both the initial investment and the borrowed amount. For example, if you invest $10,000 at an annual interest rate of 5%, and simultaneously borrow $10,000 at the same rate, your total investment becomes $20,000. The interest earned on this $20,000 will be higher than the interest on a single $10,000 investment, thus increasing your returns.

Risk Management: While leverage can boost returns, it also increases risk. Interest payments on borrowed funds must be made, and if the investment doesn't perform as expected, the debt can become a burden. It's crucial to carefully manage the risk by ensuring that the potential upside justifies the interest expense. Additionally, maintaining a diversified portfolio can help mitigate risks associated with leverage.

Strategic Timing and Market Conditions: Timing is critical when using leverage. Market conditions should be favorable, and you should have a clear strategy for when to enter and exit positions. During volatile markets, leverage can work against you, so it's essential to monitor market trends and adjust your strategy accordingly.

By employing leverage strategically, you can significantly enhance the potential for continuous compound interest growth, even without a large initial investment. However, it requires careful planning, risk management, and a thorough understanding of market dynamics.

Interest Rate Shifts: Unlocking Investment Spending Secrets

You may want to see also

Debt Management: Strategically manage debt to maximize interest accumulation

Managing debt strategically is a powerful approach to maximize interest accumulation and potentially build wealth over time. Here's a detailed guide on how to strategically manage debt for this purpose:

Understand the Power of Compound Interest: Before diving into debt management, grasp the concept of compound interest. This is the process where interest is calculated on both the initial principal and the accumulated interest from previous periods. The key to maximizing interest accumulation is to harness the power of compounding. When you have debt, you essentially have a loan that earns interest. The goal is to make this interest work in your favor.

Prioritize High-Interest Debt: Not all debts are created equal. Identify the debts with the highest interest rates. These are the ones that will drain your finances the fastest if left unattended. Prioritize paying off these debts first. By eliminating high-interest debt, you free up more money to contribute to other financial goals.

Debt Snowball Method: Consider using the debt snowball method as a strategic approach. This involves paying off the smallest debts first, regardless of interest rate, and then rolling the savings from those payments into the next smallest debt. This method provides a psychological boost as you see debts disappear quickly, motivating you to continue. Over time, this strategy can lead to significant interest savings.

Refinance or Consolidate: Explore options to refinance or consolidate your debt. Refinancing allows you to secure a lower interest rate, which can significantly reduce the overall cost of your debt. Debt consolidation combines multiple debts into a single, more manageable payment with potentially better terms. These strategies can help you manage debt more efficiently and potentially increase the interest you accumulate on the remaining debt.

Negotiate and Communicate: Don't be afraid to negotiate with creditors or lenders. You might be able to secure lower interest rates, reduced monthly payments, or even a repayment holiday. Open communication can lead to better terms and potentially more favorable interest rates. Additionally, understanding your rights as a borrower can empower you to make informed decisions about debt management.

Build an Emergency Fund: While managing debt, it's crucial to have an emergency fund. This fund will help you cover unexpected expenses without relying on high-interest debt. Aim to save enough to cover at least three to six months' worth of living expenses. This strategy ensures that you don't fall back into a debt trap when emergencies arise.

Remember, strategic debt management is about making informed choices to work with the power of compound interest. By prioritizing high-interest debt, using effective repayment methods, and negotiating favorable terms, you can maximize interest accumulation and potentially build a stronger financial future.

Understanding Interest: How Simple and Compound Rates Impact Your Investment Growth

You may want to see also

Fractional Shares: Invest in small portions of stocks to benefit from compounding

Fractional shares are a powerful tool for investors who want to benefit from the power of compounding without needing a large initial investment. This strategy allows you to invest in a small portion of a stock, making it accessible to a wider range of investors. Here's how it works and why it's a great way to start building wealth:

Fractional shares enable you to own a fraction of a single stock, meaning you don't need to purchase a full share to participate in the market. For example, if a stock is priced at $100 per share, you can invest in a fraction of it, such as 1/10th, which would cost you $10. This approach is particularly advantageous for stocks with high share prices, making it easier for beginners to get started. By investing in fractional shares, you can gradually build a diversified portfolio and benefit from the long-term growth of the market.

The beauty of fractional shares is that they allow you to take advantage of compounding interest or returns. As your investments grow, the accumulated gains can be reinvested, generating even more returns over time. This process compounds the growth of your portfolio, leading to significant wealth accumulation. For instance, if you invest in a fractional share and it increases in value, the profit can be used to purchase additional fractions, allowing your investment to grow exponentially.

To get started with fractional shares, you can use various online investment platforms and brokerage firms that offer this feature. These platforms provide a user-friendly interface, making it simple to buy and manage fractional shares. Many of these services also offer automated investment plans, known as dollar-cost averaging, which can help you invest regularly and benefit from market volatility. By setting up regular investments, you can ensure that you're consistently buying into the market, allowing your money to work for you over the long term.

Additionally, fractional shares provide an opportunity to learn and educate yourself about investing. You can start by investing in well-known, stable companies and gradually expand your knowledge. As you become more familiar with the market, you can make more informed decisions and potentially increase your investments. This approach allows beginners to gain experience and build confidence in their investment journey.

In summary, fractional shares offer a unique way to invest in the stock market, allowing individuals to benefit from compounding returns without a substantial initial investment. It provides an accessible entry point into the world of investing, empowering people to take control of their financial future. With the right guidance and a long-term perspective, fractional shares can be a powerful tool for building wealth and achieving financial goals.

Interest Rate Evolution: From Primary to Investment

You may want to see also

Dividend Reinvestment: Reinvest dividends to compound returns over time

Dividend reinvestment is a powerful strategy for growing your wealth over time, especially when combined with the concept of compound interest. This method allows you to harness the power of compounding without an initial large investment. Here's how it works:

When you own shares of a company that pays dividends, you receive a portion of the company's profits in the form of cash. Instead of spending this money, you can choose to reinvest it back into the company's stock. This process is known as dividend reinvestment. By doing so, you're essentially purchasing additional shares with the dividend income you generate. Over time, this strategy can lead to significant wealth accumulation.

The beauty of dividend reinvestment lies in its ability to create a self-sustaining cycle of growth. As you reinvest dividends, the number of shares you own increases. With each new share, you earn dividends, which can then be reinvested, leading to further share purchases. This compounding effect allows your wealth to grow exponentially. For example, if you receive a $100 dividend and reinvest it, you'll own more shares, generating a higher dividend next year, and so on.

To implement this strategy, you can set up automatic reinvestment plans with your brokerage account. Many online brokers offer dividend reinvestment programs that allow you to automatically reinvest dividends into the same stock or a diversified portfolio. This automation ensures that you consistently grow your holdings, even during market fluctuations.

It's important to note that dividend reinvestment is most effective over the long term. Markets can be volatile in the short term, but historically, dividends have provided a steady source of income and contributed to long-term wealth creation. By reinvesting dividends, you're taking advantage of the power of compounding and the potential for significant returns over time, even without an initial substantial investment. This strategy is particularly appealing to those who prefer a hands-off approach to investing and want to benefit from the power of compound interest without the need for a large starting capital.

Budget Surplus Impact: Interest Rates and Investment Strategies

You may want to see also

Peer-to-Peer Lending: Offer loans to others and earn interest on repayments

Peer-to-peer lending is a powerful way to harness the concept of compound interest without requiring a substantial initial investment. This method allows you to act as a lender, providing financial assistance to individuals or businesses in need, and earn interest on the repayments. Here's a step-by-step guide to getting started:

Choose a Platform: The first step is to select a reputable peer-to-peer lending platform that facilitates these transactions. Numerous online platforms connect borrowers and lenders, offering a secure and regulated environment. Research and compare different platforms to find one that aligns with your financial goals and risk tolerance. Look for platforms that provide transparency, robust borrower verification processes, and competitive interest rates.

Register and Verify: Once you've chosen a platform, you'll need to register and complete the necessary verification processes. This typically involves providing personal details, income information, and proof of identity. A thorough verification process ensures the security of both borrowers and lenders.

Lend Money: After setting up your account, you can start lending. Peer-to-peer lending platforms usually offer various lending options, such as personal loans, business loans, or even real estate-backed loans. Assess your risk appetite and choose loans that match your financial goals. You can lend small amounts or diversify your portfolio by lending to multiple borrowers.

Understand Repayment Terms: It's crucial to understand the repayment structure of the loans you offer. Typically, borrowers agree to repay the loan over a specified period, with regular interest payments. The interest rate and repayment schedule will vary depending on the borrower's creditworthiness and the platform's policies. Ensure you comprehend the terms to estimate your potential earnings accurately.

Earn Compound Interest: As the borrower repays the loan, you earn interest on the principal amount lent. The beauty of compound interest is that you earn interest not only on the initial amount but also on the accumulated interest. Over time, this can lead to significant growth in your earnings. Regularly monitor the performance of your loans and consider refinancing or reinvesting the proceeds to maximize your returns.

Diversify Your Portfolio: To manage risk and maximize returns, consider diversifying your peer-to-peer lending portfolio. Spread your investments across different borrowers, loan types, and platforms. This strategy reduces the impact of any single loan default and provides a more stable income stream. Regularly review and adjust your portfolio to align with your financial objectives.

Peer-to-peer lending offers an accessible way to engage with compound interest, allowing you to become a lender and earn returns on your investments. By carefully selecting platforms, understanding repayment terms, and diversifying your portfolio, you can navigate this financial instrument effectively and potentially grow your wealth over time.

Unleash Your Investment Curiosity: 5 Tips to Show You Care

You may want to see also

Frequently asked questions

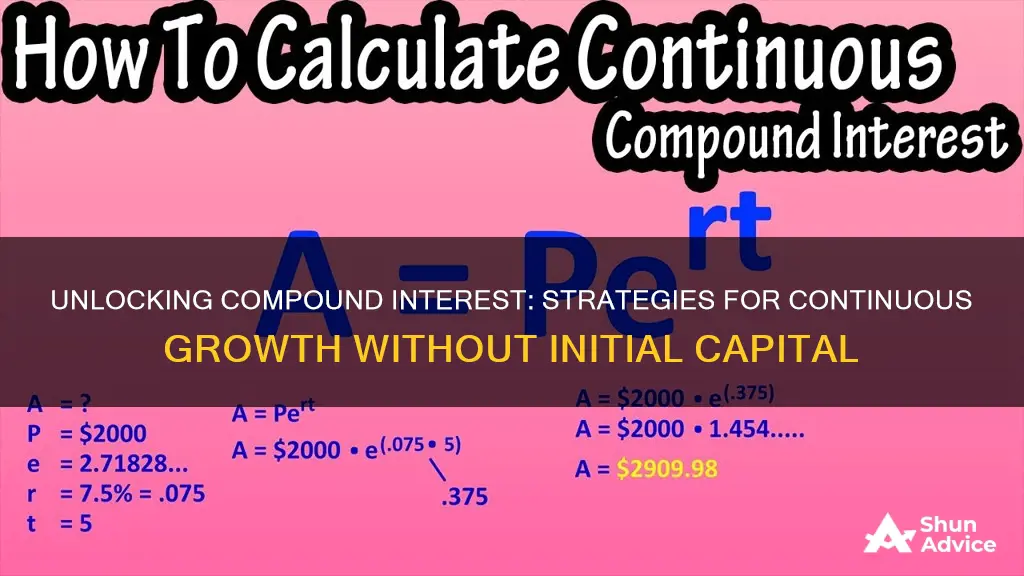

While compound interest typically requires an initial investment, you can still use the concept to grow your savings over time. The key is to understand that compound interest is not just about the initial amount but also the interest earned on that amount. You can achieve this by regularly adding small amounts to your savings account or investment vehicle. The formula for continuous compounding is FV = PV * e^(rt), where FV is the future value, PV is the present value (your initial savings), 'e' is the base of the natural logarithm, 'r' is the interest rate, and 't' is the time in years.

Yes, you can utilize the power of compound interest to grow your savings exponentially over time. The strategy here is to focus on the frequency of compounding and the interest rate. The more often the interest is compounded, the faster your savings will grow. You can achieve this by choosing investment options that offer high-interest rates and frequent compounding periods. Additionally, consider setting up automatic transfers from your paycheck or regular income to invest a fixed amount regularly, allowing your savings to benefit from compound interest without a large initial deposit.

Here are some strategies:

- High-Interest Savings Accounts: Look for savings accounts that offer competitive interest rates and compound interest regularly. While the initial deposit may be small, the power of compounding can make it grow significantly over time.

- Regular Investments: Set up a direct deposit or automatic transfers to invest a fixed amount regularly. Many investment platforms allow you to invest in various assets, and the frequency of your investments can be adjusted to suit your preferences.

- Dividend Reinvestment: If you own stocks that pay dividends, reinvesting those dividends can lead to compound growth over time, even with a modest initial investment.

- Peer-to-Peer Lending: Some peer-to-peer lending platforms offer the option to lend small amounts and earn interest, which can compound over time.

Absolutely! Here are a few methods:

- High-Yield Savings Accounts: Some online banks offer high-yield savings accounts with competitive interest rates, allowing your money to grow without the need for a large initial deposit.

- Free Investment Apps: Several apps provide free investment accounts, often with fractional shares, enabling you to invest small amounts and benefit from compound interest over time.

- Index Funds and ETFs: These investment vehicles offer diversification and low costs, allowing you to invest a small amount regularly and grow your wealth through compound interest and market returns.