Direct financing involves a direct relationship between the investor and the entity receiving the funds, without the use of a third-party service or financial intermediary. In contrast, indirect financing involves an intermediary, such as a broker, dealer, or investment banker, who acts as a go-between by holding a portfolio of assets and issuing claims to savers. When it comes to investing in a mutual fund, it is considered indirect financing as the investor's claim is against the financial intermediary rather than the borrower. The intermediary purchases direct claims from borrowers and transforms them into direct claims, which are then sold to lenders.

| Characteristics | Values |

|---|---|

| Type of financing | Indirect financing |

| Relationship between investor and fund | Intermediary between investor and fund |

| Intermediary | Third-party service such as a broker, financial advisor, or distributor |

| Fees | Commissions or distribution fees |

| Returns | Lower returns than direct financing |

What You'll Learn

Direct vs. Regular Mutual Funds: What’s the Difference?

Direct vs. Regular Mutual Funds: What's the Difference?

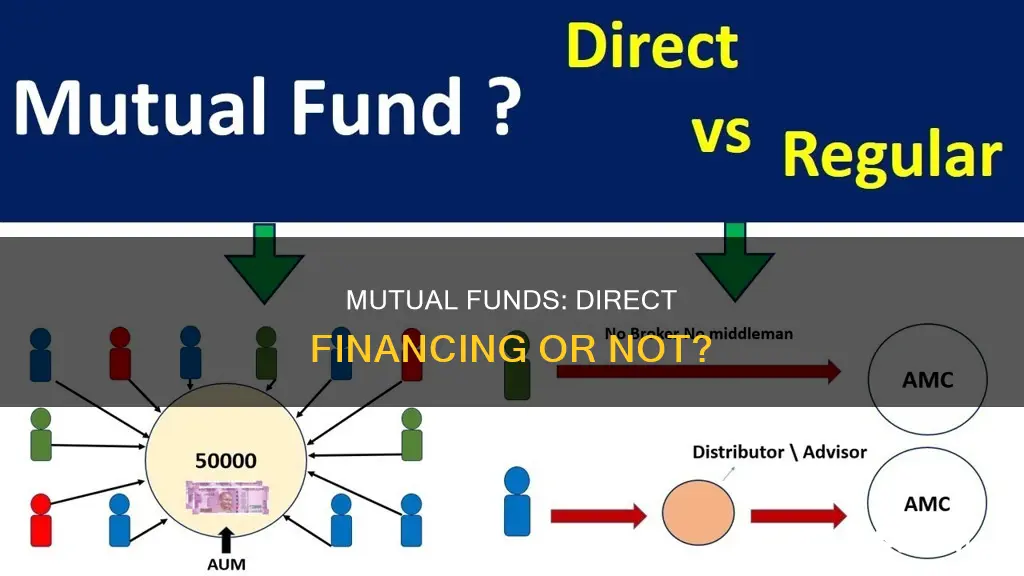

Direct and regular mutual funds are two distinct types of mutual funds tailored to investors' specific preferences and goals. Mutual funds are a collective investment vehicle, pooling resources from investors with a common financial goal. The corpus is managed by a fund house, with managers investing across different instruments like equities, government securities, and corporate bonds.

Here's a detailed comparison of direct and regular mutual funds:

Direct Mutual Funds:

Direct mutual funds are offered directly by the Asset Management Company (AMC) or fund house, without involving intermediaries like brokers, distributors, or financial advisors. Investors can purchase these funds directly from the AMC's website or by visiting their office. There are no commissions or distribution fees paid to third-party intermediaries, resulting in a lower expense ratio than regular plans. The expense ratio is the fee charged for managing and operating the fund.

Direct plans are suitable for investors who want to take control of their investment decisions, conduct market research, and make investment decisions independently. These plans offer higher Net Asset Value (NAV) due to their lower expense ratio, potentially leading to higher overall returns.

Regular Mutual Funds:

Regular mutual funds, on the other hand, are procured through intermediaries like brokers, financial advisors, or distributors. These intermediaries offer services such as investment advice, portfolio evaluation, and transaction assistance. The fund house pays a commission or distribution fee to the intermediary, resulting in a slightly higher expense ratio for regular mutual funds.

Regular plans are ideal for investors who are new to mutual funds, lack market knowledge, or don't have the time to monitor their portfolio actively. The intermediaries provide ongoing support, monitor the market, and advise on restructuring the portfolio when needed.

Key Differences:

The primary differences between direct and regular mutual funds lie in the following aspects:

- Purchase Method: Direct plans are bought directly from the AMC, while regular plans are purchased through intermediaries.

- Price (NAV): Direct plans have a higher NAV due to their lower expense ratio.

- Ongoing Cost (Expense Ratio): Direct plans have a lower expense ratio as they eliminate intermediary commissions.

- Target Investors: Direct plans cater to investors who want autonomy and are knowledgeable about the market. In contrast, regular plans are suitable for those seeking guidance and support from financial intermediaries.

- Returns: Due to their lower expense ratio, direct plans have the potential to generate higher overall returns over the long term.

- Role of Financial Advisor: Direct plans are for investors who prefer to make investment decisions independently, while regular plans offer the assistance of financial advisors.

In summary, the choice between direct and regular mutual funds depends on an investor's preferences, financial expertise, and goals. Direct plans offer lower fees and potential for higher returns, but require more self-directed management. Regular plans, on the other hand, provide guidance and support through financial intermediaries, making them a prudent choice for new or less knowledgeable investors.

Smart Ways to Gift Investment Funds to Your Kids

You may want to see also

Direct Mutual Funds: No Third-Party Agents Involved

Direct mutual funds are investment schemes that the fund house or asset management company (AMC) provides directly to investors. This means there is no involvement of third-party agents like brokers, distributors, or financial advisors, and investors can purchase these funds directly.

Direct mutual funds were created by the Securities and Exchange Board of India (SEBI) in 2012 to allow investors to purchase mutual funds directly from the issuers. They are managed by the same mutual fund manager as regular mutual funds, and clients invest in the same assets. The key difference is that direct mutual funds have a lower expense ratio because there are no commissions or brokerage fees involved. This results in higher returns for investors.

Direct mutual funds can be purchased through the fund's website or by visiting the fund house in person. They are best suited for investors who are knowledgeable about the market and have the time to monitor their portfolio, as they do not receive expert advice or additional services provided by intermediaries in regular mutual funds.

Direct mutual funds offer a more cost-effective option for investors, as they eliminate the need to pay commissions or fees to third-party intermediaries. This makes them a popular choice for those seeking to maximize their financial returns while diversifying their investment portfolios.

Smart Ways to Invest $15,000 in Mutual Funds

You may want to see also

Regular Mutual Funds: Bought Through Intermediaries

Regular mutual funds are those that are bought through third-party agents like brokers, distributors, or advisors. These intermediaries offer various services, including investment advice, portfolio evaluation, and transaction assistance. The fund house pays the intermediary a commission or distribution fee, which slightly elevates the expense ratio for regular mutual funds compared to direct mutual funds.

Regular mutual funds are best suited for investors who lack market knowledge or the time to monitor their accounts. They are also a good option for those new to the market, as they can benefit from expert advice for a small fee.

The intermediary plays a pivotal role by providing continuous monitoring and making necessary portfolio adjustments to enhance investment returns. Regular plans also offer value-added services, such as maintaining investment records, providing tax proofs, and offering personalised services.

The main drawback of regular mutual funds is the higher expense ratio, which can lead to slightly lower returns. The commission paid to intermediaries is passed on to the investor, impacting the overall gains.

When deciding between direct and regular mutual funds, it's crucial to consider your financial expertise, goals, and preferences. Regular plans offer the benefit of advisor guidance, while direct plans typically offer higher returns due to lower costs.

Venture Capital Funds: Smart Investment for Future Growth

You may want to see also

Direct Financing: Borrowing Funds Directly

Direct financing is a method of financing where borrowers obtain funds directly from the financial market without using a third-party service or intermediary, such as a bank or broker. This is in contrast to indirect financing, where a financial intermediary is involved and lends money to the borrower at a higher interest rate than what they themselves received it at.

Direct financing is often done by borrowers selling securities and/or shares to raise money and avoid the high-interest rates of financial intermediaries. Transactions can be considered direct finance even when a financial intermediary is included, as long as no asset transformation has taken place. For example, if a household buys a government bond through a broker and the bond is sold in its original state, this would be considered direct financing.

Direct financing involves a direct relationship between the investor and the entity receiving the funds. Examples of direct financing include:

- Taking out a loan from a friend

- Investing in a friend's new business

- Selling stock on the stock market

Direct financing is made possible through financial markets, where lenders (investors) lend their savings directly to borrowers. Brokers, dealers, and investment bankers play important roles in direct financing by acting as matchmakers and bringing lenders and borrowers together.

The financial system provides three key services for savers and borrowers: risk-sharing, liquidity, and information.

- Risk-sharing: Investors tend to hold a collection of assets (a portfolio) that provides relatively stable returns. The financial system allows savers to hold many assets and share risk.

- Liquidity: Financial markets and intermediaries provide trading systems that make financial assets more liquid and easier to exchange for money or other assets.

- Information: Financial markets and intermediaries produce useful information about potential borrowers for investors, reducing information asymmetry.

In summary, direct financing is a method of borrowing funds that circumvents the use of third-party services, resulting in lower interest rates for borrowers. It involves a direct relationship between investors and recipients and is facilitated by financial markets and intermediaries.

Best Mutual Funds to Invest in the USA

You may want to see also

Indirect Financing: Intermediary Involvement

Indirect financing involves an intermediary between the investor and the entity receiving the funds. In this context, investing in a mutual fund is considered indirect financing. When investing in mutual funds, investors pool their money together to purchase a diversified portfolio of stocks, bonds, or other securities. This is done through an intermediary such as a broker, distributor, or financial advisor, who offers various services like investment advice, portfolio evaluation, and transaction assistance.

The fund house or asset management company (AMC) pays a commission or distribution fee to these intermediaries, which slightly increases the expense ratio for regular mutual funds compared to direct mutual funds. This commission ultimately affects the investors' overall returns, as the fund house passes on these charges to the investor.

Regular mutual funds are an excellent option for those new to investing or those who do not have the time or expertise to monitor their portfolio actively. By investing through intermediaries, investors gain access to additional services such as maintaining investment records, assistance with the investment process, tax proof during tax filing, and personalised advice.

The Securities and Exchange Board of India (SEBI) regulates both direct and regular mutual funds, offering the same level of protection. However, the distinction lies in the expense ratio and the guidance received, which can impact potential returns. Regular mutual funds are ideal for those seeking comprehensive support and assistance throughout their investment journey.

Mutual funds are a popular investment vehicle, providing individual investors with access to a professionally managed portfolio. They are known for their diversification, low investment requirements, and professional management. By pooling resources from multiple investors, mutual funds offer a convenient way to invest in a wide range of assets.

Mortgage Investment Strategies to Boost College Funds

You may want to see also

Frequently asked questions

Direct mutual funds are purchased directly from the fund house or asset management company (AMC) without involving intermediaries like brokers, distributors, or financial advisors. Regular mutual funds, on the other hand, are procured through these intermediaries who offer services such as investment advice and portfolio evaluation.

Direct mutual funds have a lower expense ratio since there are no commissions or distribution fees paid to third-party intermediaries. This results in potentially higher returns compared to regular mutual funds. Direct plans also offer investors full control over their investment decisions and portfolio management.

Regular mutual funds are ideal for investors who are new to investing and seek guidance. Intermediaries provide continuous monitoring, portfolio adjustments, and additional services such as maintaining investment records and providing tax proofs. While there is a nominal convenience fee, regular mutual funds offer improved service quality and potentially higher returns through expert advice.

The choice depends on your financial expertise, goals, and preferences. If you are well-versed in investments and have a deep understanding of the market, direct mutual funds may be preferable as they offer full control and potentially higher returns due to lower expenses. However, if you are a beginner, regular mutual funds provide the security, convenience, and expert advice needed to navigate the complexities of the market.