Venture capital is a high-stakes game that can generate incredible returns but also carries the risk of massive losses. It is a form of financing that helps new and small businesses grow and develop. Venture capital investors provide the funds that young businesses need to grow, hoping to identify tomorrow's leaders early and maximise long-term returns.

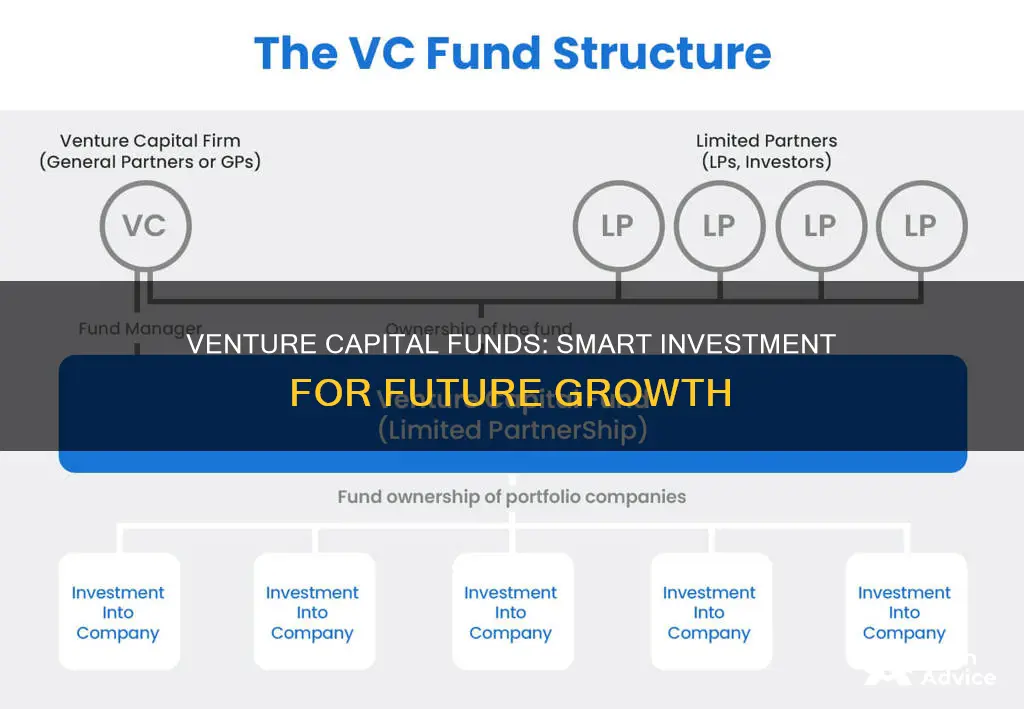

Venture capital funds are pools of money collected from various investors and managed by fund managers who invest in startups. These funds are used as seed money by new firms seeking accelerated growth, often in high-tech or emerging industries.

Venture capital funds are not available to the average investor due to the high risk of failure. However, for wealthy individuals and organisations, they can produce substantial profits.

| Characteristics | Values |

|---|---|

| Type of investment | High-risk/high-return |

| Who it's for | Wealthy individuals, organisations, accredited investors |

| What it funds | Startups, small companies, new businesses |

| Investor involvement | Active role, hands-on management, guidance |

| Investor return | Depends on industry and risk profile, but typically around 30% gross internal rate of return |

| Investment structure | Pooled funds, managed by experienced fund managers |

| Investor type | High-net-worth individuals, institutional investors, family offices |

What You'll Learn

Venture capital funds can help diversify an investment portfolio

Venture capital funds are pooled investment funds that manage the money of investors who seek private equity stakes in startups and small- to medium-sized enterprises with strong growth potential. These investments are generally characterised as very high-risk/high-return opportunities.

Venture capital funds are used as seed money by new firms seeking accelerated growth, often in high-tech or emerging industries. They are typically financed by wealthy individuals, companies seeking alternative investments, and other venture funds. The funds are then invested in a number of smaller startups, known as the VC fund's portfolio companies.

Venture capital funds are a way to add further diversification to a typical stock and bond investment portfolio. They are a high-risk, high-reward investment strategy, and investors should be aware that most startups fail. However, the potential for huge gains means that a single successful investment can offset multiple failed ones.

Venture capital funds are structured under the assumption that fund managers will invest in new companies over a period of 2-3 years, deploy all (or nearly all) of the capital within 5 years, and return all capital to investors within 10 years. This long lifetime is due to the time it takes for startups to mature and grow in value.

Venture capital funds tend to be large, ranging from several million to over $1 billion in a single fund, with the average fund size in 2015 being $135 million. The size of VC investments in a given startup can vary widely based on the particular investment theory and practices of each firm.

Investing in larger VC funds has pros and cons. On the one hand, experienced VCs with inside knowledge manage your investments, and most large funds include a diverse base of companies. On the other hand, huge funds frequently fail to deliver market-beating returns as there is sometimes more capital to deploy than high-promise startups to invest in.

Like individual startup investors, fund managers tend to diversify each VC fund by investing in multiple startups within different industries to maximise their chances of landing on a startup that generates returns that more than compensate for all failed investments.

Arbitrage Funds: Strategic Investment Opportunities for Savvy Investors

You may want to see also

The potential for huge returns

Venture capital funds are a high-risk, high-reward investment. While the majority of startups fail, those that succeed can deliver spectacular returns. For example, a single 10-to-1 profit on a successful venture capital (VC) deal could easily offset losses on five failed startups.

VC funds are pools of money, collected from a variety of investors, that are then invested in startups. The investors are typically high-net-worth individuals, institutional investors, and family offices. The funds are managed by experienced fund managers, who are responsible for investing the capital in high-promise startups and delivering competitive returns.

The size of VC investments in a given startup can vary widely based on the particular investment theory and practices of each firm. The influx of VC cash, along with the additional resources, advice, and connections VCs can provide, often helps startups to grow rapidly and dominate their market.

VC firms typically make investments according to a particular thesis, such as supporting startups in a particular stage, industry, or geographic region. For example, a VC firm might invest in biotech startups or companies in a specific geographic region.

While such spectacular outcomes are not the norm, they do illustrate the potential for huge returns that venture capital investments can offer.

Best Funds to Invest in Right Now

You may want to see also

Venture capital funds have the resources to support startups

Venture capital funds are a form of private equity that provides financing to startups and small businesses with long-term growth potential. They are managed by experienced professionals who possess the necessary expertise and resources to support these fledgling companies. Here are some reasons why venture capital funds are well-equipped to back startups:

Financial Resources:

Venture capital funds pool money from various investors, including high-net-worth individuals, institutional investors, and family offices. This allows them to make significant investments in startups, providing the necessary capital for growth and expansion.

Industry Connections and Expertise:

The fund managers of venture capital often have extensive industry connections and expertise. They can leverage these connections to help startups gain access to potential customers, partners, and talent. Additionally, they can provide strategic guidance and mentorship to the startups in their portfolio, helping them navigate the challenges of building a successful business.

Active Involvement and Support:

Venture capital funds take an active role in the management and operations of their portfolio companies. They often hold board seats and provide ongoing support beyond just financial investment. This can include assistance with recruitment, customer acquisition, and accessing additional funding rounds.

Risk Mitigation:

Venture capital funds diversify their investments across multiple startups within different industries. This diversification helps to mitigate the risk of failure, as they recognize that not all startups will succeed. By spreading their investments, they increase the chances of having at least one high-growth company in their portfolio that can generate substantial returns.

Long-Term Commitment:

Venture capital funds typically operate with a long-term horizon, understanding that startup success takes time. They are prepared to invest for a period of 2-3 years and may hold their investments for up to 10 years or more, allowing the startups they back to mature and grow in value.

In summary, venture capital funds have the financial resources, industry expertise, and operational support capabilities to help startups succeed. They actively manage their investments, mitigate risks through diversification, and are committed to the long-term growth of their portfolio companies.

Index Funds vs Savings: Where Should Your Money Go?

You may want to see also

Venture capital funds have the expertise to support startups

Venture capital funds are managed by experienced fund managers who are responsible for investing collective capital into high-promise startups. These fund managers are experts in their field, often with extensive knowledge of specific industries, and they play an active and hands-on role in the management and operations of the companies they invest in.

Venture capital fund managers have the expertise to support startups because they are skilled at spotting the lucky few startups that make it big. They have inside knowledge and a large network of connections, which they can leverage to help startups grow rapidly and dominate their market. They also have negotiating credibility, which is an advantage when it comes to securing funding for the companies in their portfolio.

Additionally, venture capital fund managers provide guidance and advice to the startups they invest in. They often hold a board seat, which gives them a level of control over the decisions the company makes. They may, for example, have a say in hiring decisions, acquisitions, and other strategic moves. This level of involvement can be beneficial for startups, as they can benefit from the fund managers' experience in growing companies.

Furthermore, venture capital fund managers have a vested interest in the success of the startups they invest in. They typically receive a percentage of the profits made by the fund, so they are incentivized to help the companies in their portfolio succeed. This alignment of interests can be beneficial for startups, as they can be assured that the fund managers are working towards the same goal.

Overall, venture capital funds have the expertise to support startups because they are managed by skilled and experienced professionals who have the knowledge, resources, and incentives to help the companies in their portfolio succeed.

Key Factors for Investors to Consider in Mutual Funds

You may want to see also

Venture capital funds are experienced

Why Venture Capital Funds Are Experienced

Venture capital funds are managed by experienced fund managers, or general partners, who are responsible for making smart investment decisions and maximising returns for investors. These fund managers are experts in their field, with extensive knowledge of growing companies. They are skilled at identifying and investing in startups with high growth potential, using their inside knowledge to make informed decisions.

General partners have a range of responsibilities, including raising funds from investors, sourcing top startups, performing due diligence, and providing value-added services to portfolio companies. They play an active and hands-on role in the management and operations of the companies they invest in, often holding a board seat and providing guidance and connections. Their experience and industry expertise can be invaluable to startups, helping them navigate challenges and increase their chances of success.

The track record of top VC funds demonstrates the importance of experience and expertise. These funds consistently generate market-beating returns, outperforming public market benchmarks such as the S&P 500. Their ability to identify and invest in the most promising startups is key to their success, and their reputation and connections give them access to the best deals.

The performance of venture capital funds is closely linked to the skill and experience of their fund managers. By investing in VC funds, investors can leverage the expertise of these professionals, benefiting from their ability to spot high-potential startups and manage investments effectively. The experience of VC fund managers is a key advantage, reducing risk and improving the chances of successful outcomes.

Hedge Funds: Higher Returns, Lower Risk than Mutual Funds

You may want to see also

Frequently asked questions

Venture capital funds can be a great way to diversify your portfolio and get in on the ground floor of the next big startup. They offer the potential for huge returns, but it's important to remember that they also come with significant risks.

Investing in a venture capital fund is generally considered a high-risk move, as the majority of startups fail. There is a chance you could lose your entire investment. It's important to do your research before investing in any venture capital fund.

To invest in a venture capital fund, you'll need to find a fund that aligns with your investment goals and has a strong track record of success. Keep in mind that many venture capital funds are only open to accredited investors who meet certain income or net worth requirements.

Historically, only accredited investors were able to invest in venture capital. However, in recent years, the rules have changed to allow non-accredited investors to participate through equity crowdfunding platforms. This has opened up new opportunities for individuals who want to invest in startups and small businesses.