Amazon and mutual funds are both popular investment options, but they cater to different investing styles. Amazon is a highly diversified company, with interests in online retail, cloud computing, electronics, and content distribution. Its stock has soared over the years, and it is currently one of the most recognizable names on the planet. On the other hand, mutual funds are investment vehicles that hold a basket of stocks or securities, providing instant diversification and requiring less work to manage.

So, is investing in Amazon stock better than investing in mutual funds? Well, that depends on your personal goals, risk tolerance, and time horizon. Amazon stock could be a good choice if you're looking for potentially large gains and are comfortable with the associated risks, including the potential for large losses. Mutual funds, on the other hand, offer instant diversification, are more hands-off, and can be less stressful due to lower volatility. They are a good option if you want a more passive investment approach and are willing to give up some control to a fund manager.

In conclusion, both Amazon stock and mutual funds can be wise investments, but they cater to different investor needs and preferences. It's important to understand your own financial situation and goals before deciding which investment option is right for you.

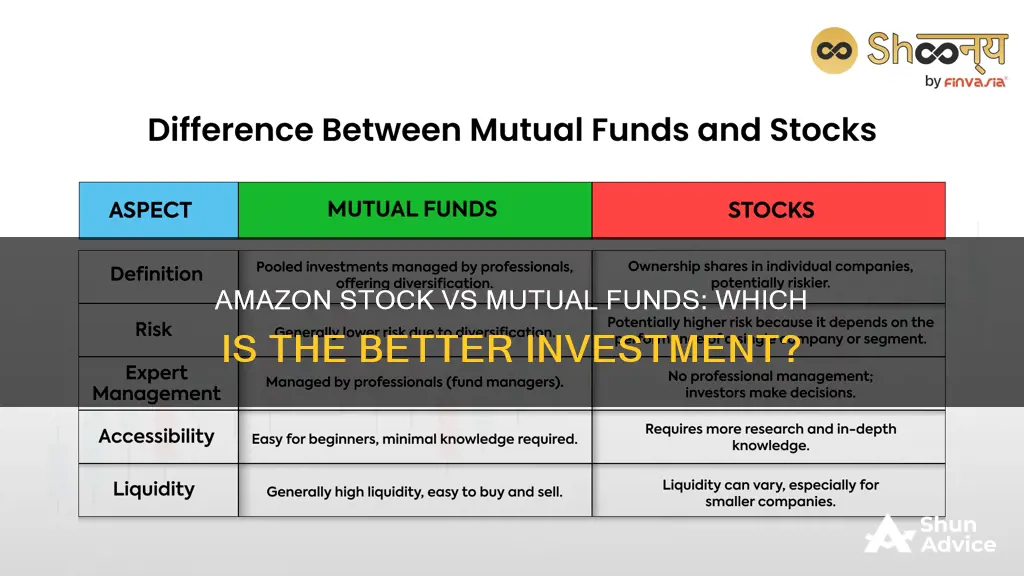

| Characteristics | Values |

|---|---|

| Initial Investment | Mutual funds and stocks can both be started with a small amount of money. |

| Liquidity | Both mutual funds and stocks are very liquid. |

| Capital Required | Mutual funds and stocks do not require much capital. |

| Diversification | Mutual funds offer instant diversification, while stocks require multiple stocks to achieve the same level of diversification. |

| Control | Mutual funds give up some control to a fund manager, while stocks allow for full control over investment choices. |

| Fees | Mutual funds have higher fees than stocks. |

| Tax Efficiency | Mutual funds are less tax-efficient than stocks. |

| Volatility | Stocks are more volatile than mutual funds. |

| Risk | Stocks have higher risk than mutual funds. |

| Returns | Stocks have the potential for higher returns than mutual funds. |

| Research Required | Stocks require more research than mutual funds. |

| Suitability | Mutual funds are suitable for beginners and long-term investors, while stocks are suitable for investors who want more control and are willing to take on more risk. |

What You'll Learn

Amazon's stock performance and valuation

Amazon's stock performance has been impressive over the years, with the company growing from an online bookstore to a global online retail giant with a market value of nearly $1 trillion. Amazon's stock has been popular among individual investors and mutual funds, with its largest mutual fund holder, the Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX), owning more than 12.1 million shares worth $41.9 billion as of April 30, 2021. Amazon's stock is also held by other large mutual funds, such as the Vanguard 500 Index Fund Admiral Shares (VFIAX) and the SPDR S&P 500 ETF Trust (SPY).

In terms of stock performance, Amazon has consistently outperformed the US market and the multiline retail industry. Its earnings grew by 239.8% over the past year, and they are forecast to grow by 19.61% per year. Amazon's stock price is currently trading at 44.8% below its estimated fair value, indicating that it may be undervalued. However, it is important to note that Amazon's stock has been known for its extreme overvaluation according to traditional valuation metrics.

Amazon's business segments include the retail sale of consumer products, advertising, and subscription services through online and physical stores in North America and internationally. The company also manufactures and sells electronic devices, including Kindle, Fire tablets, and Echo, and offers programs that enable third-party sellers to sell their products through its stores. Additionally, Amazon Web Services (AWS) has been a significant driver of revenue and earnings growth for the company.

In summary, Amazon's stock performance has been strong, with consistent earnings growth and outperformance against the market and its industry. The company has a diverse business model and a global presence, which have contributed to its stock's popularity among investors and mutual funds. While Amazon's stock may be undervalued at the moment, it is important to consider its historical overvaluation and conduct thorough research before making any investment decisions.

Maximizing EIDL Funds: Strategies for Savvy Business Investments

You may want to see also

Mutual funds' diversification and management

Mutual Funds Diversification and Management

Mutual funds are a type of investment vehicle that holds a basket of stocks or securities. They are managed by professional fund managers and are designed to provide investors with a diversified portfolio. Diversification is a key investment strategy that helps to reduce systematic risk while maintaining expected returns.

A diversified fund invests across multiple market sectors, assets, and/or geographic regions. By spreading investments broadly, these funds aim to prevent idiosyncratic events in one area from affecting the entire portfolio. Index funds, for example, are considered diversified funds as they track a broad market index. However, they only diversify within a specific universe, such as stocks, and do not hold other assets.

When investing in mutual funds, it is important to consider the level of diversification offered by the fund. A well-diversified fund will invest in a broad array of securities across multiple sectors and geographic regions. This helps to mitigate unsystematic risk, which is often sector-specific, and some systematic risks associated with particular countries or regions.

Some of the top mutual funds that provide diversification and hold Amazon's stock include:

- Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX)

- Vanguard 500 Index Fund Admiral Shares (VFIAX)

- SPDR S&P 500 ETF Trust (SPY)

- Fidelity 500 Index Fund (FXAIX)

These funds offer exposure to a diverse range of stocks and provide investors with a balanced portfolio. Additionally, they have relatively low expense ratios, making them attractive investment options.

It is worth noting that while diversification is essential, over-diversification can be detrimental. Adding too many securities or closely correlated investments can increase overall risk and lower expected returns. Therefore, it is crucial to carefully consider the types of risks an investor wishes to mitigate and maintain a balanced portfolio that aligns with their investment goals and risk tolerance.

Tax-Efficient Fund Investing: Strategies for Smart Returns

You may want to see also

Mutual funds' fees and tax implications

Mutual Funds Fees and Tax Implications

Mutual funds are a great way to invest in a variety of stocks or securities. However, there are some fees and tax implications to be aware of when investing in mutual funds.

Fees

Mutual funds have various fees that investors should be aware of, as these fees can eat into your returns over time. Here are some common fees associated with mutual funds:

- Sales Loads: This is a one-time commission charged by some fund companies when you buy or sell shares, similar to a broker's commission. There are two types of sales loads: front-end loads, which are paid when purchasing fund shares, and back-end or deferred loads, which are paid when redeeming shares.

- Redemption Fees: Some funds charge a redemption fee when shareholders redeem or sell their shares. This fee is typically paid directly to the fund to defray the costs associated with the redemption.

- Exchange Fees: These are fees imposed by some funds when shareholders transfer or exchange their shares to another fund within the same fund group.

- Account Fees: Some funds charge account maintenance fees, typically imposed on accounts whose value falls below a certain dollar amount.

- Purchase Fees: Some funds charge a purchase fee when shareholders buy their shares, which is used to defray the fund's costs associated with the purchase.

- Operating Expense Ratio (OER): This is the percentage of fund assets taken out annually to cover operating expenses. Actively managed funds tend to have higher OERs than passively managed funds.

- 12b-1 Fees: These are fees paid by the fund out of fund assets to cover distribution and shareholder service expenses, such as marketing, selling fund shares, and compensating brokers.

- Management Fees: Fees paid out of fund assets to the fund's investment adviser for managing the investment portfolio and administrative fees.

Tax Implications

When investing in mutual funds, there are also tax implications to consider, as you may owe taxes even if your fund shares decline in value. Here are some key points to understand about mutual fund taxes:

- Capital Gains Taxes: In a mutual fund, when the fund sells stocks that have appreciated in value, and there are no capital losses to offset the gains, they are required to distribute those gains to the shareholders. This means you will have to pay capital gains taxes on those distributions, even if you didn't want to take them.

- Taxable Distributions: Mutual funds are required to distribute almost all of their income and gains earned during the year as dividend distributions. If you hold the shares in a taxable brokerage firm account, you will receive a taxable dividend distribution, even if the fund's value went down after you bought it.

- Short-Term vs. Long-Term Capital Gains: Distributions from funds that actively churn their portfolios and generate short-term gains are taxed at a higher rate than those from funds that buy and hold stocks for over a year. Short-term gains are taxed at your regular federal rate, which can be as high as 37%, plus the 3.8% net investment income tax (NIIT) and state income tax. Long-term capital gains are taxed at a maximum of 20%, plus the NIIT and state income tax.

- Tax-Deferred Accounts: To avoid paying taxes on mutual fund gains, consider holding the funds in a tax-deferred account such as an IRA or 401(k). In these accounts, you can focus solely on the fund's pretax returns and ignore the tax implications.

- Tax-Efficient Funds: Index funds and tax-managed funds tend to be more tax-efficient than actively managed funds, as they buy and hold stocks for longer periods, minimizing taxable distributions.

Funding Your Chase You Invest Account: Easy Steps to Follow

You may want to see also

Stocks' trading, gains, and losses

Stocks Trading, Gains, and Losses

Stocks and mutual funds are both popular investment options, allowing investors to build portfolios and grow their wealth. However, they have different traits that appeal to investors with different goals.

A stock represents a share of ownership in a company. When a company does well, its stock price usually goes up, and investors can sell their shares for a profit. Investing in stocks can lead to large gains, but it also comes with the potential for large losses if the stock price drops and doesn't recover. Additionally, investing in stocks can be stressful and time-consuming, as it requires researching and monitoring individual companies.

On the other hand, a mutual fund is a pooled investment that contains shares of many different assets, offering instant diversification. Mutual funds are often considered safer and less complicated than investing in individual stocks. They are managed by professionals, who make trading decisions on behalf of the investors. This takes the complexity and stress out of investing for individuals, who can instead rely on the expertise of fund managers.

When deciding between investing in stocks or mutual funds, it's essential to consider your investment goals, risk tolerance, and time horizon. Stocks are more suitable for investors who can actively monitor their portfolios and the market for opportunities. Mutual funds, on the other hand, are better for those who want a fund manager to handle the complexities of investing.

While stocks offer the potential for higher returns, they also come with higher risk and volatility. Mutual funds, on the other hand, provide instant diversification and lower risk by spreading your investment across hundreds of companies. However, this also means giving up some control, as you rely on the fund manager's decisions.

In terms of costs, stocks often have low trading costs, and many brokerages don't charge trading fees for individual stocks. Mutual funds, on the other hand, usually charge management fees, which can eat into investment returns over time. Actively managed funds typically have higher fees than passively managed funds.

When comparing Amazon and Apple as potential stock investments, analysts consider both to be good options for long-term portfolios. Amazon is highly diversified, having revolutionized online shopping, launched a successful video streaming service, and created a profitable cloud computing wing. Apple, on the other hand, remains a cash cow, generating high gross profits and authorizing stock buyback plans to attract more investors. Over the last five years, Apple has returned 295% compared to Amazon's 110%. However, in the long run, analysts prefer Amazon due to its more diversified list of offerings.

In conclusion, both stocks and mutual funds can be smart additions to your investment portfolio. Stocks offer the potential for higher returns but come with higher risk and require active management. Mutual funds provide instant diversification, convenience, and professional management, but may result in lower returns. The choice between the two depends on your investment goals, risk tolerance, and the amount of control you want over your investments.

Public PE Fund: Exploring Alt Investment Opportunities

You may want to see also

Stocks' research requirements and emotional rollercoaster

Stocks Research Requirements

Stock research is a method of analyzing stocks based on factors such as a company's financials, leadership team, and competition. When researching a stock, it is helpful to know terms such as revenue, earnings per share, and price-earnings ratio. There are five steps to researching stocks:

Get to Know Your Research Tools

Many brokers offer research tools on their platforms, and you can also use a free online stock screener. A good broker or stock screener will allow you to build and save screens, compare individual stocks against each other and the wider stock market benchmarks, view historical returns, and screen funds to see their holdings.

Gather Your Stock Research Materials

Start with a company you're interested in. Review the company's financials by pulling together documents such as Form 10-K (an annual report) and Form 10-Q (a quarterly update) that are filed with the U.S. Securities and Exchange Commission (SEC).

Narrow Your Focus

Zero in on key line items such as revenue, net income, earnings and earnings per share (EPS), price-earnings ratio (P/E), return on equity (ROE), and return on assets (ROA).

Turn to Qualitative Stock Research

Ask yourself questions such as: How does the company make money? Does the company have a competitive advantage? How good is the management team? What could go wrong?

Put Your Stock Research into Context

Look at historical data to gain insight into the company's resilience during tough times, reactions to challenges, and ability to improve its performance and deliver shareholder value over time. Compare the company to industry averages and its peers.

Emotional Rollercoaster

Investing in stocks can be an emotional rollercoaster. According to Prospect Theory (1979), losses have a higher emotional impact than equivalent gains. This means that losing $100,000 has a greater emotional toll than the satisfaction of gaining the same amount. This impacts how investors adjust their strategies. For example, despite knowing that market dips are a good time to invest, investors respond with uncertainty.

Market cycles can evoke emotions such as confidence, euphoria, nervousness, and fear. When the stock market is rising, investors feel confident and want to invest more. As prices reach all-time highs, euphoria sets in, and investors feel that prices will continue to rise. However, when prices fall, investors become nervous and fearful, and may lock in losses by selling at market lows.

Emotions can cause investors to do the opposite of what they should be doing. For example, instead of buying low and selling high, emotions can cause investors to buy high and sell low. Riding the emotional rollercoaster can lead to self-defeating behavior and poor investment decisions.

To manage the emotional rollercoaster of investing, it is important to embrace volatility, make a plan and stick to it, and stay focused on the long term.

Invest Your Provident Fund: A Guide to Getting Started

You may want to see also

Frequently asked questions

Amazon has a diversified list of offerings and is arguably the most diversified company in America. It has revolutionized the way people shop, launched a video streaming service, and created a profitable cloud computing wing. Amazon's stock has soared over the years and is popular among individual investors and mutual funds.

Amazon stock currently has a rich value. AMZN stock has a trailing P/E of 43, which is significantly higher than that of other stocks. Amazon's stock price is also more volatile, having declined by 54% in the last bear market compared to 28% for Apple (AAPL).

Investing in Amazon gives you ownership of a single company, whereas mutual funds offer instant diversification by pooling your investment into a basket of assets, often containing hundreds of stocks and bonds. Mutual funds are also more hands-off and require less monitoring, whereas investing in individual stocks like Amazon requires more research and analysis of the underlying company.