Whether investment funding into a business is taxable depends on a variety of factors, including the type of investment, the nature of the business, and the jurisdiction. In general, companies are subject to corporation tax on income and gains from their investments. However, the specific rules and rates vary by country and type of business entity. For example, in the United States, capital gains from the sale of investments are taxed at different rates depending on the holding period, with long-term investments typically subject to lower tax rates than short-term investments. Additionally, certain types of investments, such as dividends, may receive special tax treatment, such as a lower tax rate or tax-free status. It's important to note that tax laws can change and are often complex, so it's always a good idea to consult with a tax professional for specific advice.

| Characteristics | Values |

|---|---|

| When are your taxes affected by your investments? | 1. When you receive income from the investments. |

| 2. When you sell the investments for a gain or loss. | |

| Investment income | Often, investment income includes interest and dividends. |

| Gains and losses from investment sales | You typically only have to pay taxes on the sale of investments when you receive a gain. |

| Tax on capital gains | The tax rate on long-term (more than one year) gains is 0%, 15%, or 20%, depending on taxable income and filing status. |

| Tax on short-term capital gains | The tax rate on short-term (less than one year) capital gains is the same as your ordinary income tax rate. |

| Tax on interest income from investments | Interest income from investments is usually treated like ordinary income for federal tax purposes. |

| Tax on dividends | The tax rate for qualified dividends depends on the taxpayer's taxable income and can be either 0%, 15%, or 20%. Ordinary dividends are taxed on the taxpayer's income tax rate, which maxes out at 37%. |

| Tax on mutual funds | Mutual fund taxes typically include taxes on dividends and capital gains while you own the fund shares, as well as capital gains taxes when you sell the fund shares. |

| Tax on the sale of a house | If you sell your home for a profit, some of the gain could be taxable. |

| Tax on retirement accounts | Traditional retirement accounts may allow you to take a tax deduction today for money that you invest. When you withdraw the money in retirement, the money typically counts as ordinary income and you will likely have to pay ordinary income taxes on this income. |

| Tax on Roth retirement accounts | You don't get a tax deduction for contributing to these accounts but the money can grow tax-free and you can withdraw it tax-free, including the investment gains, in retirement. |

| Tax on municipal bonds | Municipal bonds are normally tax-free for federal income taxes but may be taxable on your state tax return, depending on the state you live in and the state that issued the bond you invested in. |

| Net investment income tax | Those with significant income may be subject to the net investment income tax, which is an additional 3.8% tax on top of the usual capital gains taxes. |

What You'll Learn

Capital gains tax

A capital gains tax is a tax imposed on the profits from the sale of an asset. The rate of tax depends on the income of the person selling the asset, how long the asset was held for, and the nature of the asset. For example, in the US, the long-term capital gains tax rates for the 2025 tax year are 0%, 15%, or 20% of profits. These rates apply to assets that have been held for more than a year. Assets held for a year or less are subject to short-term capital gains tax, which is taxed at the same rate as the individual's regular income tax.

There are ways to minimise capital gains tax. For example, holding an investment for more than a year before selling it will generally result in a more favourable tax rate. In the US, this is 0% to 20% for long-term capital gains, compared to the regular income tax rate of 10% to 37% for short-term capital gains. Another way to minimise capital gains tax is to use tax-advantaged accounts, such as a 401(k) or IRA. Assets held within these accounts are not subject to capital gains taxes while they remain in the account.

Index Funds: A Beginner's Guide to Investing

You may want to see also

Tax on dividends

Dividends are usually taxable income, even if you didn't receive the dividend in cash. Dividends are often automatically reinvested to buy more shares of the underlying stock, but they still need to be reported.

There are two types of dividends: nonqualified and qualified. Nonqualified dividends are taxed at the same rate as your regular income tax bracket. Qualified dividends, on the other hand, are usually taxed at a lower rate of 0%, 15%, or 20%, depending on your filing status and taxable income.

To be considered a qualified dividend, there are several requirements that must be met. Firstly, the dividend must be paid by a U.S. corporation or a qualifying foreign entity. Secondly, it must be recognised as a dividend by the IRS. Certain types of payments, such as premiums from insurance companies or annual distributions from credit unions, do not count as dividends. Finally, you must have held the underlying security for a long enough period, typically more than 60 days during the 121-day period that began 60 days before the ex-dividend date.

To report your dividend income, you will receive a Form 1099-DIV or a Schedule K-1 from your broker or any entity that sent you at least $10 in dividends and other distributions. This form will indicate the amount you were paid and whether the dividends were qualified or nonqualified. If you received more than $1,500 in dividends for the year, you may also need to fill out a Schedule B.

It's important to note that there may be special tax treatments for certain types of investments, such as municipal bonds or retirement accounts. These exceptions can impact the taxation of your dividend income.

Activewear: Which Investment Funds are Taking an Interest?

You may want to see also

Tax on interest income

Interest income from investments is generally treated as ordinary income for federal tax purposes. The federal government taxes most interest as ordinary income subject to tax at whatever marginal rate the investor pays.

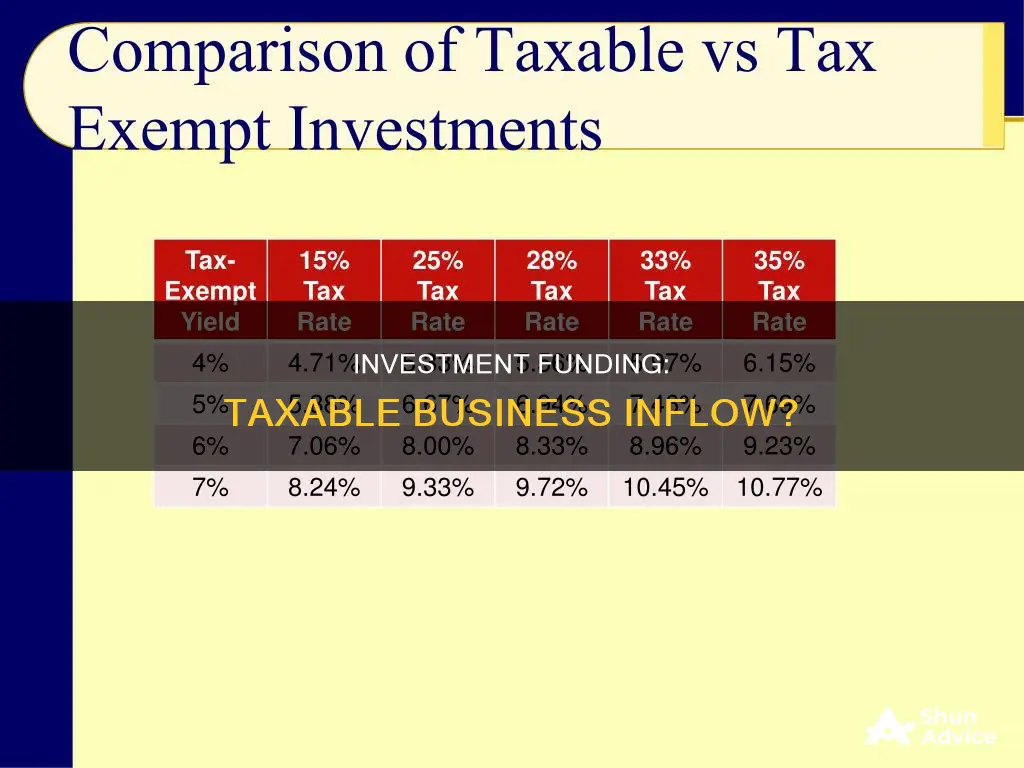

The exception is interest on bonds issued by US states and municipalities, most of which are exempt from federal income tax. Investors may also get a break from state income taxes on interest. For example, US Treasury securities are exempt from state income taxes, while most states do not tax interest on municipal bonds issued by in-state entities.

Shareholders benefit from a preferential tax rate only if they have held shares for at least 61 days during the 121 days beginning 60 days before the ex-dividend date. Any days on which the shareholder's risk of loss is diminished do not count toward the minimum holding period.

For example, an investor who pays federal income tax at a marginal 35% rate and receives a qualified $500 dividend on a stock owned in a taxable account for several years owes up to $100 in tax. If the dividend is non-qualified or the investor did not meet the minimum holding period, the tax is $175.

Non-qualified dividends are taxed at regular income tax rates, which are typically higher.

SBI Blue Chip Fund: A Smart Investment Strategy

You may want to see also

Tax on mutual funds

Taxes on Mutual Funds

Mutual fund taxes typically include taxes on dividends and capital gains while you own the fund shares, as well as capital gains taxes when you sell the fund shares. The tax rate you pay depends on the type of distribution you get from the mutual fund, as well as other factors.

Mutual funds are investment companies that invest the collective contributions of their thousands of shareholders in numerous securities called portfolios. When a mutual fund distributes earnings and other payouts to shareholders, it is known as a distribution. The major distribution for most funds comes at the end of each year, when net amounts are calculated—capital gains and other earnings minus the expenses of running the funds.

If you receive a distribution from a fund that results from the sale of a security the fund held for less than a year, that distribution is taxed at your ordinary income tax rate. If the fund held the security for 12 months or more, however, then those funds are subject to the capital gains tax instead.

If you sell your mutual fund shares for a profit, you might incur capital gains tax. Waiting at least a year to sell your shares could lower your capital gains tax rate.

There are two kinds of dividends: non-qualified and qualified. The tax rate on non-qualified dividends is the same as your regular income tax bracket. The tax rate on qualified dividends is usually lower: 0%, 15%, or 20%, depending on your taxable income and filing status.

Mutual funds that invest in bonds might receive interest payments from those bond investments. Your portion of that interest may also be taxable income, even if you reinvest it. The interest on some bonds, including municipal bonds and US treasuries, may be tax-free.

To determine how much of your investment income is gain or loss, you must first know how much you paid for the shares that were liquidated. This is called the basis. There are two ways the Internal Revenue Service (IRS) allows taxpayers to determine the basis of their investment income: cost basis and average basis. If you know the price you paid for the shares you sold, then you can use the specific share identification cost basis method. If you cannot determine the price you paid for specific shares, you may choose to use the average basis method, where you can use the aggregate cost of all your shares as the cost basis for each share sold.

Tax-Saving Strategies

- Waiting to sell: Selling in less than a year can trigger higher capital gains taxes if you make a profit.

- Using a tax-advantaged account: If you put money in a traditional IRA, your investments grow tax-deferred; you’re not taxed until you withdraw money. If you put money in a Roth IRA, there are no taxes on investment growth, interest, or dividends if you withdraw them after age 59 ½ and have the IRA for at least five years.

- Working with a professional: A CPA or other tax professional can help you minimize your mutual fund taxes.

- Harvesting losses: If your investments are in a taxable account, you might be able to offset some taxes by selling other underperforming mutual funds or securities at a loss.

- Getting familiar with your funds' holdings: If you don’t want a lot of taxable dividends, then you may not want to invest in a mutual fund that owns a lot of dividend-paying stocks. If you don’t want a lot of taxable capital gains distributions hitting you while you own the shares, then you might favor index funds, which tend to buy and sell their underlying investments infrequently.

Renaissance Rief Fund: A Smart Investment Strategy

You may want to see also

Tax on retirement accounts

When it comes to retirement accounts, there are several types of taxes that individuals need to be aware of. Here are some key considerations:

Federal Taxes:

With a traditional 401(k) or IRA, the IRS mandates that you start taking annual required minimum distributions (RMDs) during the year you turn 73. Withdrawals from these accounts are typically taxed as ordinary income, and a larger savings balance may push you into a higher tax bracket. On the other hand, Roth IRAs or 401(k) plans are taxed differently. You pay taxes on your savings upfront, and then your qualified distributions in retirement are tax-free.

State Taxes:

Unless you live in a state without income tax, you will likely owe state taxes on your retirement income. However, it's important to note that some states exempt Social Security benefits and pension payouts from state taxation.

Taxes on Pensions and Annuities:

The taxability of your pension payouts depends on how your employer funded it. While most pensions are taxable, certain types of military or disability pensions may be partially or entirely tax-free. Similarly, benefits received from an annuity may be taxable. Payments from a qualified annuity are fully taxable as ordinary income because taxes haven't been paid on that money yet.

Taxes on Earnings from Taxable Accounts:

Payouts from non-qualified accounts, such as dividends or proceeds from the sale of investments (capital gains), are generally subject to federal and sometimes state taxes. Dividends are usually taxed at your regular income tax rate, while capital gains may be taxed at a lower long-term capital gains rate, depending on how long you've held the investment.

Social Security Benefits:

Surprisingly, Social Security benefits are also subject to taxation. If you file jointly and your combined income exceeds certain thresholds, you could owe federal income tax on up to 85% of your Social Security benefits.

Managing Taxable Accounts:

Interest earned on investments in taxable accounts is taxed at your regular income tax rate. However, capital gains and qualifying dividends may be taxed at the lower long-term capital gains rate, which ranges from 20% to 0%, depending on your tax bracket. There are no required withdrawals or tax penalties for early withdrawals from these accounts, offering greater flexibility in retirement income planning.

Gift and Estate Taxes:

Before your death, you can make gifts to individuals or beneficiaries without paying taxes up to a certain amount set by the IRS. Additionally, you can make larger tax-free gifts over your lifetime, following specific IRS rules. However, this strategy has pros and cons, so it's essential to consult a tax professional. Estate taxes can take a significant portion of your assets, so transferring wealth during your lifetime may be beneficial, but it's crucial to consider the potential drawbacks carefully.

Investments Funding Social Security: State-Sponsored Retirement Plans

You may want to see also

Frequently asked questions

It depends on the type of investment and the business's accounting practices. Generally, companies are subject to corporation tax on the income and gains they receive from their investments. However, there may be ways to defer or reduce the amount of tax owed.

A capital gain occurs when an investment is sold for a higher price than it was purchased for, resulting in a profit. Conversely, a capital loss occurs when an investment is sold for a lower price than its purchase price, resulting in a loss.

Dividends are typically taxed at the shareholder's ordinary income tax rate. However, qualified dividends, which are usually from U.S. companies or those with a tax treaty with the U.S., are taxed at a lower rate, ranging from 0% to 20%.

A qualified dividend is one that meets certain criteria, such as the shareholder holding the stock for a minimum period. Non-qualified dividends are taxed at regular income tax rates, which are typically higher.

Yes, there may be tax implications for business owners, particularly regarding Inheritance Tax (IHT) relief and Capital Gains Tax (CGT) relief. IHT business property relief may not apply if the company holds excessive cash or investments, and these could be regarded as 'excepted assets'. Additionally, holding substantial cash and investments could contribute to the company losing its 'trading' status, impacting CGT relief.