Whether or not investment funding is taxable depends on the type of investment and a few other factors. Most investment income is taxable, but the exact tax rate will depend on several factors, including your tax bracket, the type of investment, and how long you own the investment before selling.

For example, if you sell an asset for more than you paid for it, your profit (minus your cost basis) is called a capital gain and is usually taxable. The rate you pay depends on how long you held the asset before selling. The tax rate on capital gains for most assets held for more than a year is 0%, 15%, or 20%. Capital gains taxes on most assets held for less than a year correspond to ordinary income tax rates, which are typically higher.

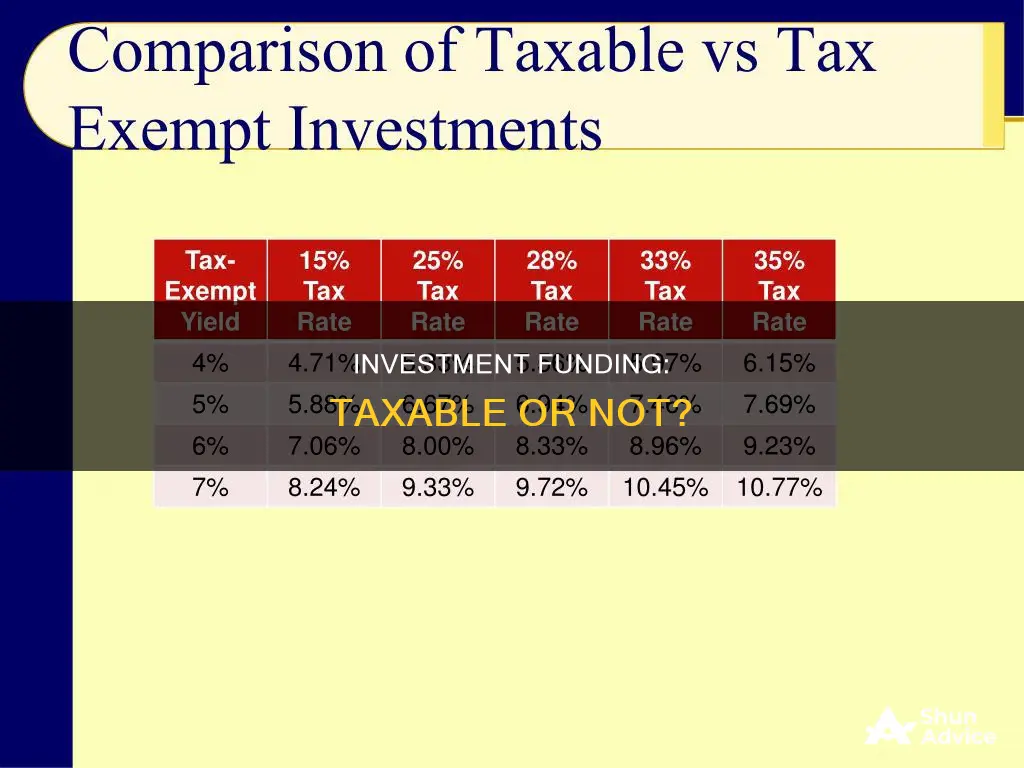

Additionally, interest income from investments is usually treated like ordinary income for federal tax purposes and is generally taxed at your ordinary income tax rate. However, interest income from certain types of investments, such as municipal bonds, may be exempt from federal tax.

It's important to note that there may be exceptions and special tax treatments for certain types of investments, so it's always a good idea to consult a tax professional or use tax software to ensure you're complying with tax regulations.

| Characteristics | Values |

|---|---|

| Type of investment | Capital gains, dividends, interest income |

| Tax rate factors | Tax bracket, type of investment, how long you owned the investment before selling |

| Capital gains | Profits from selling assets |

| Capital gains tax rate (short-term) | Ordinary income tax rates (10%, 12%, 22%, 24%, 32%, 35%, or 37%) |

| Capital gains tax rate (long-term) | 0%, 15%, or 20% |

| Dividends | Ordinary or qualified |

| Ordinary dividends tax rate | Ordinary income tax rates |

| Qualified dividends tax rate | 0%, 15%, or 20% |

| Interest income tax rate | Ordinary income tax rates |

| Net investment income tax (NIIT) | 3.8% |

| Alternative minimum tax (AMT) | N/A |

| Unrelated business taxable income (UBTI) | N/A |

What You'll Learn

Capital gains from the sale of assets

Capital gains refer to the profits you get when you sell an asset. They can be subject to either short-term or long-term tax rates, depending on how long you owned the asset.

Short-term capital gains

Short-term capital gains refer to profits from the sale of assets held for a year or less. They are taxed according to ordinary income tax brackets, which range from 10% to 37%.

Long-term capital gains

Long-term capital gains refer to profits from the sale of assets held for more than a year. They are taxed at 0%, 15%, or 20%.

Net capital gains

Net capital gains are the result of netting capital gains and capital losses. Net capital gains are taxed at different rates depending on overall taxable income, although some or all net capital gains may be taxed at 0%.

Capital gains tax rate 2024

In 2024, single filers with a taxable income of $47,025 or less, joint filers with a taxable income of $94,050 or less, and heads of households with a taxable income of $63,000 or less pay 0% on qualified realised long-term gains.

If your taxable income exceeds those amounts, you may be subject to 15% and 20% tax rates.

Capital gains tax rate 2025

The following rates and brackets apply to long-term capital gains sold in 2025 (reported on taxes filed in 2026):

| | Married filing jointly | Married filing separately |

|---|---|---|

|| $89,250 | $44,625 |

| 0% | $553,850 | $276,900 |

| 15% | $653,850 | $326,900 |

| 20% | N/A | N/A |

How to reduce capital gains tax

- Hold your assets for more than a year so you can qualify for the long-term capital gains tax rate, which is significantly lower than the short-term rate for most assets.

- Use tax-advantaged accounts such as 401(k) plans, individual retirement accounts, and 529 college savings accounts.

- Rebalance with dividends by putting dividend income into your underperforming investments instead of reinvesting it in the investment that paid the dividends.

- Use the home sales exclusion, which allows you to exclude up to $250,000 in gains from a home sale if you're single, and up to $500,000 if you're married filing jointly.

- Look into tax-loss harvesting, which involves selling off specific assets at a loss to offset gains and reduce your taxable income.

- Consider a robo-advisor, which can employ tax-loss harvesting as part of its service.

Citadel Hedge Fund: A Guide to Investing with the Best

You may want to see also

Dividends as taxable income

Dividends are usually taxable income in the year they are received. Dividends are portions of a company's earnings that are distributed to shareholders. They are typically taxable, even if they are automatically reinvested to buy more shares.

There are two types of dividends: non-qualified and qualified. The tax rate on non-qualified dividends is the same as your regular income tax bracket. The tax rate on qualified dividends is usually lower, at 0%, 15%, or 20%, depending on your taxable income and filing status.

For the 2024 tax year, qualified dividends are taxed at 0% if your taxable income falls below:

- $47,025 for those filing Single or Married Filing Separately

- $63,000 for Head of Household filers

- $94,050 for Married Filing Jointly or Qualifying Surviving Spouse filing status

The qualified dividend tax rate increases to 15% for taxable income above:

- $47,026 through $518,900 for Single Filers

- $47,026 through $291,850 for Married Filing Separately filers

- $63,001 through $551,350 for Head of Household filers

- $94,051 through $583,750 for Married Filing Jointly or Qualifying Surviving Spouse filers

For income above the upper limits of the 15% bracket, a 20% tax rate is applied to any remaining qualified dividend income. Depending on your specific tax situation, qualified dividends may also be subject to the 3.8% Net Investment Income Tax.

Non-qualified dividends are taxed as income at rates up to 37%.

To determine whether a dividend is qualified, it must meet certain criteria set by the IRS. Firstly, it must be paid by a U.S. corporation or a qualifying foreign entity. Secondly, it must be a dividend in the eyes of the IRS, excluding premiums paid by an insurance company, annual distributions by credit unions, and dividends from co-ops or tax-exempt organisations. Lastly, the underlying security must be held for long enough, typically more than 60 days during the 121-day period starting 60 days prior to the ex-dividend date.

Dividends received from tax-free municipal bonds, certain mutual funds, and some other sources are usually exempt from federal income tax.

A Beginner's Guide to Vanguard Mutual Funds Investing

You may want to see also

Taxes on investments in a 401(k)

With a Roth 401(k), the tax situation is different. The money you contribute is made with after-tax dollars, meaning you don't get a tax deduction for the contribution at the time you make it. Since you've already been taxed on the contributions, you won't be taxed on your distributions, provided your distributions are qualified. To be qualified, the Roth account must have been established five years ago, and you must be at least 59 1/2 years old.

If you withdraw money from a traditional 401(k) before the age of 59 1/2, you may have to pay a 10% penalty on top of the taxes, unless you qualify for one of the exceptions. These exceptions include receiving the payout over time, qualifying for a hardship distribution, leaving your job and being over a certain age, being a survivor of domestic abuse, getting divorced, giving birth or adopting a child, becoming disabled, putting the money in another retirement account, using the money to pay an IRS levy or certain medical expenses, being a victim of a disaster, overcontributing to your 401(k), or being in the military. Additionally, a provision in the Secure 2.0 Act now allows special emergency 401(k) distributions of up to $1,000 per year without the 10% penalty.

If you don't take a required minimum distribution from your traditional 401(k) when you're 73, the Internal Revenue Service can assess a penalty of 25% of the amount not distributed. This penalty may be reduced to 10% if you take a corrective distribution and meet other requirements.

Property Funds: A Smart Investment Guide for South Africans

You may want to see also

Mutual fund taxes

- Waiting at least a year to sell your shares could lower your capital gains tax rate.

- Holding mutual fund shares inside a retirement account could defer the tax on the interest, dividends or gains your mutual fund distributes.

- Tax-loss harvesting and choosing funds less likely to distribute taxable income are other options.

- Holding investments for a certain period of time can qualify their dividends for a lower tax rate.

- Holding dividend-paying investments inside of a retirement account can be a way to defer taxes on investments.

Low-Cost Index Funds: When to Steer Clear

You may want to see also

Tax on the sale of a house

If you sell your home for a profit, the amount you make over what you paid for it is called a capital gain, and it may be subject to capital gains tax. However, there are some exemptions and deductions that can help reduce the amount of tax you owe.

Capital Gains Tax on the Sale of a House

The capital gains tax on the sale of a house depends on the amount of profit made from the sale. This is usually the difference between the purchase price and the sale price. If you owned the home for a year or less before selling, short-term capital gains tax rates may apply. The rate is typically equal to your ordinary income tax rate.

If you owned the home for longer than a year before selling, long-term capital gains tax rates may apply. These rates are often lower than short-term rates. Many people qualify for a 0% tax rate, while others pay either 15% or 20%, depending on their filing status and taxable income.

Who Qualifies for the Home Sale Capital Gains Tax Exclusion?

There are several criteria that must be met to qualify for the home sale capital gains tax exclusion:

- The home must be your primary residence.

- You must have owned the home for at least two years in the five years before the sale.

- You must have lived in the house for at least two years in the five years before the sale (this can be non-consecutive and temporary absences don't count).

- You cannot have claimed the home sale capital gains exclusion for another home in the two years before the sale of this home.

- You cannot have bought the house through a like-kind exchange in the past five years.

- You cannot be subject to expatriate tax.

How to Minimize Capital Gains Tax on the Sale of a House

- Live in the house for at least two years.

- See if you qualify for an exception, such as selling due to work, health, or an unforeseen event.

- Keep receipts for home improvements as they can increase your cost basis and lower your capital gains tax.

- If you have a loss on the sale of your home, you may be able to offset other capital gains or take a deduction.

A Guide to Investing in Motilal Oswal S&P 500 Index Fund

You may want to see also

Frequently asked questions

Yes, capital gains are generally taxable. The tax rate depends on how long you held the asset before selling. Short-term capital gains (assets held for a year or less) are usually taxed at ordinary income tax rates, while long-term capital gains (assets held for more than a year) are typically taxed at lower long-term capital gains tax rates.

Dividends are usually taxable income. There are two types of dividends: non-qualified and qualified. Non-qualified dividends are taxed at your regular income tax bracket, while qualified dividends are taxed at lower capital gains tax rates.

Generally, you don't pay taxes on contributions to a traditional 401(k) until you make a withdrawal. Taxes on withdrawals are treated as regular income. With a Roth 401(k), you pay taxes upfront, but qualified distributions in retirement are not taxable.

Mutual funds typically include taxes on dividends, interest, and capital gains distributed while you own the fund shares, as well as capital gains taxes when you sell the fund shares.

If you sell your primary residence for a profit, a portion of the gain could be taxable. The IRS allows you to exclude up to $250,000 of capital gains on your primary residence if you're single and $500,000 if you're married and filing jointly.