Investing in Sahara India presents a complex scenario, as the company has faced significant legal and financial challenges in recent years. The group's founder, Subrata Roy, is currently facing legal proceedings and has been unable to repay billions of dollars in debt, leading to a global search for him. Despite these issues, some investors believe that the company has potential in certain sectors, such as real estate and infrastructure. However, the risks are substantial, including the possibility of further legal issues, financial instability, and the potential for significant losses. This makes the decision to invest in Sahara India a challenging one, requiring careful consideration of the risks and potential benefits.

What You'll Learn

- Risk Factors: Political instability, economic policies, and market volatility in Africa

- Company Performance: Strong financial results, diverse revenue streams, and competitive advantage

- Sustainability: Commitment to environmental and social initiatives, ethical practices, and long-term viability

- Market Position: Dominance in key sectors, innovative products, and strong customer base

- Regulatory Environment: Compliance with local laws, government support, and favorable investment climate

Risk Factors: Political instability, economic policies, and market volatility in Africa

When considering investment in Sahara India, it's crucial to understand the risks associated with the African market, particularly political instability, economic policies, and market volatility. These factors can significantly impact the safety and profitability of your investment.

Political Instability: Africa's political landscape is diverse, but it is often characterized by political instability, which can arise from various sources. These include frequent changes in government, power struggles, and sometimes, even civil conflicts. Such instability can lead to unpredictable policy decisions, regulatory changes, and even physical insecurity. For instance, sudden policy shifts or changes in government could result in the nationalization of industries, asset seizures, or the imposition of restrictive trade policies, all of which could negatively affect your investment.

Economic Policies: Economic policies in African countries can be complex and may not always be favorable to foreign investors. These policies can include high tax rates, strict regulations, and unpredictable financial incentives. For example, a government might introduce new taxes or increase existing ones, which could reduce the profitability of your business. Additionally, strict regulations might limit your ability to operate freely, especially if they are not transparent or consistently applied. Understanding these policies and their potential impact on your investment is essential for making informed decisions.

Market Volatility: The African market is known for its volatility, which can be influenced by various factors, including political events, economic policies, and global market trends. This volatility can lead to rapid fluctuations in currency exchange rates, commodity prices, and overall market sentiment. For instance, a sudden drop in commodity prices could significantly impact the profitability of businesses in sectors heavily reliant on these commodities. Investors should be prepared for these market shifts and have strategies in place to mitigate potential losses.

In summary, while Sahara India may present attractive investment opportunities, it is essential to approach these prospects with a thorough understanding of the risks involved. Political instability, economic policies, and market volatility are significant factors that can influence the safety and success of your investment. Conducting thorough research, seeking expert advice, and developing a comprehensive risk management strategy are essential steps to ensure a more secure and potentially profitable investment experience.

Creating a PL Excel: Investing Basics

You may want to see also

Company Performance: Strong financial results, diverse revenue streams, and competitive advantage

Sahara India is a well-established and reputable company with a strong track record of financial performance, which makes it an attractive investment opportunity. The company's financial results have been consistently impressive, indicating a robust and stable business. Sahara has demonstrated its ability to generate substantial revenue and maintain a healthy profit margin over the years. This financial strength is a key indicator of the company's resilience and its capacity to navigate market challenges.

One of the key factors contributing to Sahara India's success is its diverse revenue streams. The company has successfully expanded its operations across various sectors, including real estate, hospitality, and financial services. By diversifying its business, Sahara has reduced its reliance on a single industry, making it more resilient to market fluctuations. This strategic move has allowed the company to maintain a steady income flow, ensuring financial stability and providing investors with a reliable source of returns.

In addition to its diverse business model, Sahara India boasts a significant competitive advantage in the market. The company has established a strong brand presence and a loyal customer base. Sahara's reputation for delivering high-quality products and services has positioned it as a trusted name in the industry. This competitive edge enables the company to attract new customers and retain existing ones, fostering long-term growth and market share. Furthermore, Sahara's ability to adapt to changing market trends and consumer preferences ensures its continued success and relevance.

The company's financial health is further evidenced by its consistent growth in revenue and profit. Sahara India's annual reports showcase a steady increase in sales and net income, outperforming industry averages. This growth trajectory indicates a well-managed business with a clear strategy for expansion. Investors can benefit from the company's financial stability and the potential for long-term capital appreciation.

In summary, Sahara India's strong financial performance, diverse revenue streams, and competitive advantage make it a safe and promising investment. The company's ability to generate consistent results, adapt to market changes, and maintain a solid brand image positions it favorably in the market. Investors can have confidence in the company's potential for sustained growth and profitability, making Sahara India an attractive choice for those seeking a stable and reliable investment.

Managing Your Own Investments: Is It Worth It?

You may want to see also

Sustainability: Commitment to environmental and social initiatives, ethical practices, and long-term viability

Sustainability is a key aspect of any investment, and Sahara India's commitment to environmental and social initiatives is a positive sign for investors. The company has been actively involved in various sustainability projects, aiming to minimize its environmental impact and contribute to the well-being of its stakeholders. One of their primary focuses is on reducing carbon emissions and promoting renewable energy sources. Sahara India has invested in wind and solar power projects, aiming to decrease its reliance on fossil fuels and contribute to a greener future. These initiatives not only align with global sustainability goals but also demonstrate the company's dedication to long-term viability.

In addition to environmental sustainability, Sahara India prioritizes social responsibility. They have implemented several programs to support local communities and promote ethical practices. These initiatives include educational scholarships for underprivileged children, healthcare facilities for employees and nearby residents, and community development projects. By actively engaging with local communities, the company fosters a positive relationship and ensures that its operations bring long-term benefits to the region.

The company's ethical practices are another crucial aspect of its sustainability commitment. Sahara India has established a robust corporate governance framework, ensuring transparency and accountability in all its operations. They have implemented strict codes of conduct, anti-corruption policies, and fair labor practices. By upholding ethical standards, the company aims to build trust with investors, customers, and employees, ensuring a sustainable and responsible business environment.

Furthermore, Sahara India's long-term viability is evident in its strategic planning and diversification efforts. The company has expanded its business into various sectors, including real estate, hospitality, and financial services, while maintaining a strong focus on sustainability across all its divisions. This diversification strategy reduces the risk associated with a single industry and ensures a more stable and resilient business model.

In summary, investing in Sahara India can be considered safe, especially with the company's strong commitment to sustainability. Their initiatives in environmental conservation, social responsibility, and ethical practices demonstrate a forward-thinking approach. By prioritizing sustainability, Sahara India not only contributes to a greener and more equitable society but also positions itself for long-term success and resilience. Investors can be confident that their support will contribute to a positive and sustainable impact.

Equity Derivatives: A Beginner's Guide to Investing

You may want to see also

Market Position: Dominance in key sectors, innovative products, and strong customer base

Sahara India, a prominent player in the Indian financial services industry, has established a strong market position through its dominance in key sectors, innovative product offerings, and a loyal customer base. The company's success can be attributed to its strategic focus on these critical aspects, which have contributed to its growth and resilience in a highly competitive market.

Dominance in Key Sectors: Sahara India has successfully carved out a dominant position in several key sectors of the Indian financial services industry. One of its primary strengths lies in the real estate sector, where it has been a major player for decades. The company's expertise in developing and managing large-scale real estate projects has positioned it as a trusted name among investors and homebuyers. Additionally, Sahara India has expanded its presence into other sectors, including hospitality and infrastructure. By diversifying its portfolio, the company has reduced its reliance on a single sector and has become a versatile player in the financial services landscape.

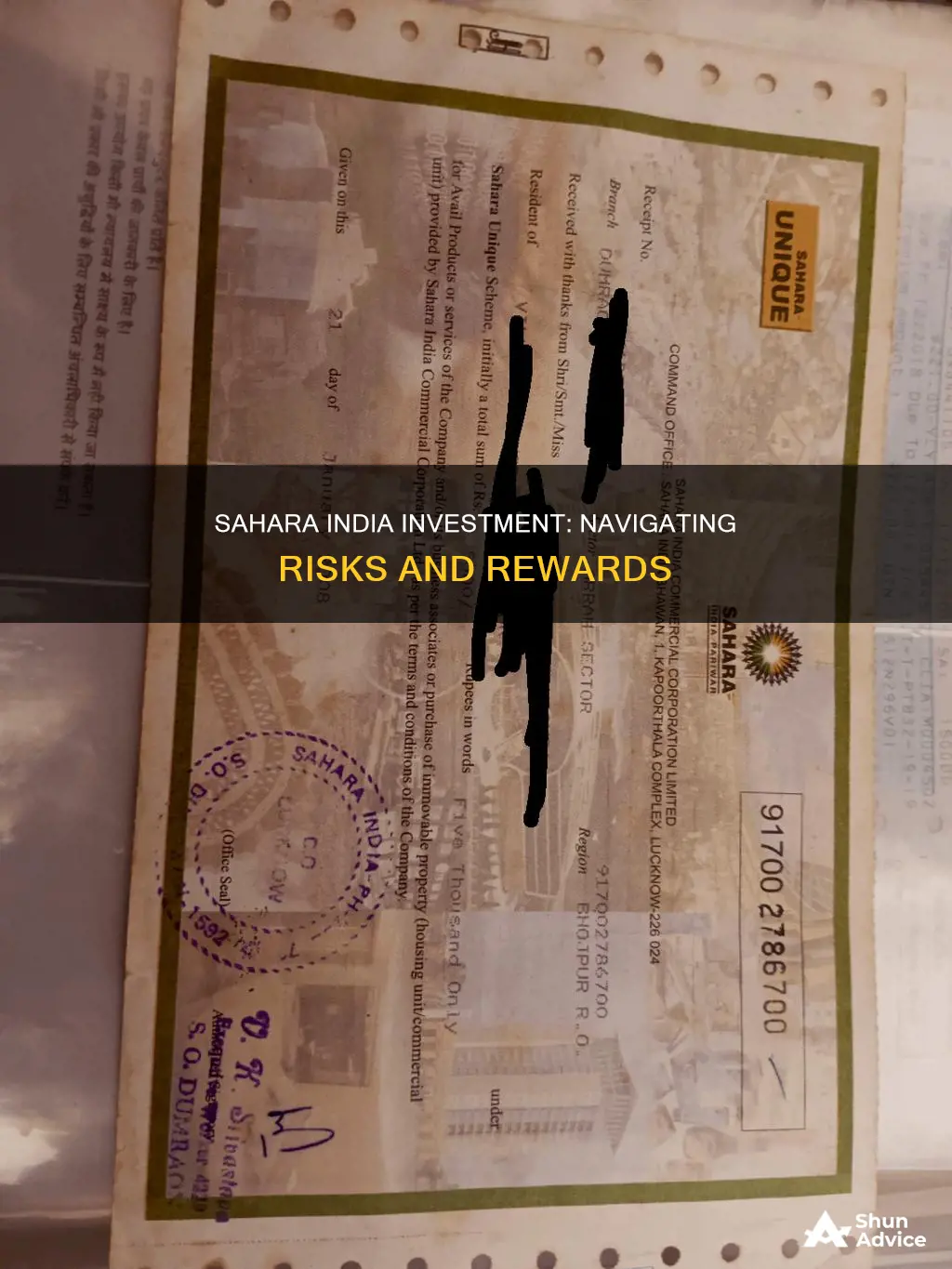

Innovative Products and Services: Innovation is at the core of Sahara India's market strategy. The company continuously introduces new and improved products and services to meet the evolving needs of its customers. For instance, Sahara India has developed a range of investment schemes tailored to different risk appetites and financial goals. These schemes offer investors a variety of options, from short-term gains to long-term wealth creation. Moreover, the company has embraced digital transformation, launching online platforms that provide easy access to investment opportunities and financial advice. This digital approach has not only enhanced customer convenience but has also opened up new avenues for market expansion.

Strong Customer Base: A loyal and satisfied customer base is a testament to Sahara India's success. The company has built a reputation for delivering on its promises, ensuring transparency, and providing reliable financial solutions. By focusing on customer satisfaction, Sahara India has fostered long-term relationships with its clients. This has led to a high retention rate, as customers are more inclined to continue their investments and services with a company they trust. Additionally, the company's customer-centric approach has attracted new clients, as positive word-of-mouth and testimonials have become powerful marketing tools in the financial services industry.

Sahara India's market position is further strengthened by its ability to adapt to changing market dynamics and customer preferences. The company's commitment to innovation and customer satisfaction ensures that it remains competitive and relevant in a rapidly evolving financial services sector. As a result, investors considering Sahara India as a potential investment opportunity can be assured of a well-established, dominant player with a strong foundation in key sectors, innovative offerings, and a dedicated customer base.

Planning Savings and Investments: Strategies for Financial Freedom

You may want to see also

Regulatory Environment: Compliance with local laws, government support, and favorable investment climate

When considering an investment in Sahara India, understanding the regulatory environment is crucial for assessing the safety and potential risks associated with such an investment. Sahara India, being a part of a developing economy, operates within a unique legal and regulatory framework that can significantly impact its operations and the returns it offers to investors.

Compliance with local laws is a fundamental aspect of the regulatory environment. Sahara India, as a business entity, must adhere to various legal requirements, including company laws, tax regulations, labor laws, and environmental standards. These laws are designed to protect the interests of investors, employees, and the local community. For instance, the company must ensure fair treatment of its employees, maintain accurate financial records, and comply with environmental regulations to minimize its ecological footprint. Investors should review these legal obligations to ensure that the investment aligns with their risk tolerance and ethical standards.

The Indian government has implemented several initiatives to foster a favorable investment climate. One such initiative is the 'Make in India' program, which aims to promote the country as a global manufacturing hub. This program offers various incentives, including tax benefits, simplified business registration processes, and improved infrastructure, to attract foreign and domestic investments. Additionally, the government has been working on improving the ease of doing business, reducing the time and cost associated with starting and operating a business. These measures create a more conducive environment for investors, making Sahara India an attractive prospect for those seeking a stable and supportive regulatory framework.

Furthermore, the Indian legal system has evolved to provide a robust framework for dispute resolution and investor protection. The country has established specialized economic tribunals and courts to handle business-related disputes efficiently. These legal institutions ensure that investors have access to justice and can seek redressal in case of any legal or contractual issues. A well-functioning legal system is essential for maintaining investor confidence and promoting a safe investment environment.

In summary, the regulatory environment in India, where Sahara India operates, is characterized by a commitment to compliance, a supportive government, and a well-developed legal system. Investors should carefully evaluate how these factors align with their investment goals and risk appetite. While there may be challenges and potential risks, a thorough understanding of the local laws and the government's initiatives can help investors make informed decisions regarding the safety and prospects of their investments in Sahara India.

Smartly Investing a $2000 Portfolio: A Beginner's Guide

You may want to see also

Frequently asked questions

While Sahara India is a well-known brand and has a strong market presence, investing in any company or financial product carries inherent risks. It's essential to conduct thorough research and due diligence before making any investment decisions. Consider factors such as the company's financial health, market position, and growth prospects. Additionally, assess your risk tolerance and investment goals to determine if Sahara India aligns with your strategy.

Like any investment, there are risks involved. Sahara India's investments might be subject to market volatility, especially in the real estate or infrastructure sectors. Economic downturns or changes in government policies could impact the company's performance. It's crucial to understand the specific risks related to the industry and the company's business model. Diversification and a long-term investment perspective can help mitigate some of these risks.

Evaluating the safety of your investment requires a comprehensive analysis. Start by examining Sahara India's financial statements, including revenue growth, profit margins, and debt levels. Assess the company's management team and their track record. Research the industry trends and competitors to gauge the company's position. Consider seeking advice from financial advisors who can provide personalized guidance based on your investment goals and risk profile.