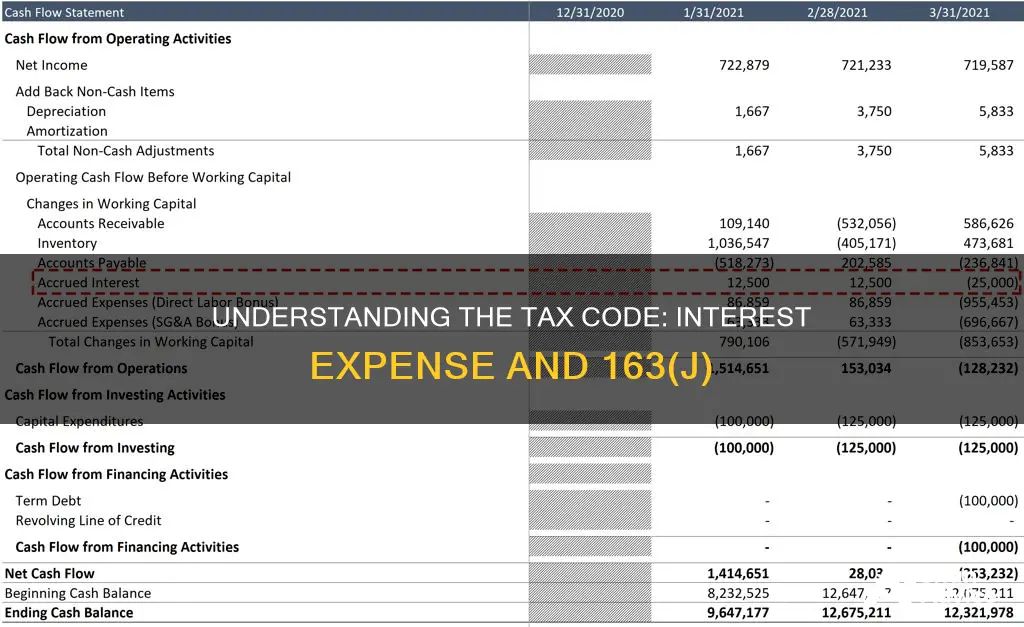

The Internal Revenue Service (IRS) has provided instructions on Form 8990 regarding the section 163(j) limitation on the deductibility of business interest expense. This limitation applies to interest expense incurred by a sole proprietor, a corporation, a pass-through entity, or an entity subject to tax under IRC §511. The definition of interest for the purposes of this limitation is broader than the general definition used for federal income tax purposes. Partnerships engaged in per se non-passive activities, such as trading activities, are subject to section 163(j) at the partnership level. However, there are exceptions, such as for small business taxpayers who are not required to file Form 8990. The limitation also does not apply to interest expense allocated by a trading partnership to a partner who does not materially participate. It is important to note that the applicability of section 163(j) may change from year to year, as seen in the 2021 and 2022 taxable years.

| Characteristics | Values |

|---|---|

| Investment interest expense subject to 163(j) | Yes, for partnerships engaged in per se non-passive activities under section 469, such as trading activities |

| Investment interest expense not subject to 163(j) | For small business taxpayers, C corporations with an interest in a partnership, and for the 2022 taxable year |

What You'll Learn

Interest expense of a partnership engaged in per se non-passive activities under section 469

The 2018 Proposed Regulations would have provided that interest expense of a partnership engaged in per se non-passive activities under section 469, such as trading activities, is fully subject to section 163(j) at the partnership level. However, the 2020 Proposed Regulations would reverse this rule and would require the partnership to bifurcate its items between partners that materially participate and those that are passive investors.

Any interest expense allocated to the active partners would be subject to section 163(j) at the partnership level, taking into account all other items allocated to the active partners. All items allocable to passive investors would be separately stated and allocated to such partners and would be subject to section 163(d) at the partner level.

A passive activity is generally any activity that involves the conduct of a trade or business in which the taxpayer does not materially participate. However, a special exception exists under Temp. Regs. Sec. 1.469-1T(e) (6) whereby the activity of trading personal property for the account of owners of interests in the activity is not a passive activity, regardless of whether such activity is a trade or business activity.

For this purpose, personal property is defined under Sec. 1092(d) as any personal property of a type that is actively traded. Regs. Sec. 1.469-4(a) provides that a taxpayer's activity includes any activity conducted through a partnership. Under Temp. Regs. Sec. 1.469-2T(c), an interest in an activity includes both an interest in property used in an activity and an interest in an activity held through the partnership.

The partnership's activity of trading securities involves the conduct of a trade or business, which is not a passive activity. For example, hedge funds are private investment partnerships that seek to maximize returns through active portfolio management rather than long-term capital appreciation. Their activities go beyond mere investing and constitute trading.

How to Deduct Accrued Interest on Investment Purchases?

You may want to see also

Investment interest expense allocated to C corporations

The 2018 Proposed Regulations would have provided that interest expense of a partnership engaged in per se non-passive activities under section 469, such as trading activities, is fully subject to section 163(j) at the partnership level. However, the 2020 Proposed Regulations would reverse this rule and would require the partnership to bifurcate its items between partners that materially participate and those that are passive investors.

Any interest expense allocated to the active partners would be subject to section 163(j) at the partnership level, taking into account all other items allocated to the active partners. All items allocable to passive investors would be separately stated and allocated to such partners and would be subject to section 163(d) at the partner level.

The definition of "business interest expense" is interest expense that is properly allocable to a non-excepted trade or business or that is floor plan financing interest expense. Both terms exclude investment income. The current iteration of IRC §163(j) is considerably more encompassing than its predecessor; it applies regardless of whether the debt is incurred by a sole proprietor, a corporation, a pass-through entity, or an entity subject to tax under IRC §511.

For the 2021 taxable year, taxpayers were subject to the section 163(j) limitation. However, this limitation did not apply for the 2022 taxable year. Any business interest expense that was disallowed in 2021 due to the limitation was carried forward to 2022 and was no longer subject to the limitation in that year.

Diverse Investments: Do They Dilute Interest Earnings?

You may want to see also

The definition of 'interest' for federal income tax purposes

Interest expense is subject to Section 163(j) of the Internal Revenue Code, which limits the deductibility of business interest expense. This section applies to interest expense incurred by a partnership, corporation, or pass-through entity.

The definition of 'interest' under Section 163(j) is broader than the definition of 'interest' for federal income tax purposes more generally. This means that not all interest expenses are treated equally for tax purposes.

For example, 'business interest expense' is defined as interest expense that is properly allocable to a non-excepted trade or business, or that is floor plan financing interest expense. Both terms exclude investment income.

On the other hand, 'investment interest expense' refers to interest paid on debt used to purchase investments, such as margin loans for stock purchases. This type of interest expense is typically subject to limitations on deductibility, such as under Section 163(d).

It is important to note that the treatment of interest expense can vary depending on the specific circumstances and tax regulations in place at the time. For instance, the 2018 Proposed Regulations would have subjected interest expense from trading activities to Section 163(j) at the partnership level, while the 2020 Proposed Regulations would require partnerships to bifurcate their items between active and passive partners, with different tax treatments for each group.

Understanding Simple Interest Rates: Calculating Your Investment Returns

You may want to see also

The 2018 Proposed Regulations

The 2020 Proposed Regulations reversed this rule and required partnerships to bifurcate their items between active partners and passive investors. Any interest expense allocated to active partners would be subject to section 163(j) at the partnership level, while all items allocable to passive investors would be separately stated and allocated to such partners and would be subject to section 163(d) at the partner level.

Interest Rates: Impacting Investment Patterns and Decisions

You may want to see also

The 2020 Proposed Regulations

It's important to note that the 2020 Proposed Regulations are subject to change and may be updated or modified by the IRS. Taxpayers should consult with a tax professional to understand how these regulations may impact their specific situation and to stay informed about any updates or changes.

Acorn Investments: Interest Payments and Your Money

You may want to see also

Frequently asked questions

The 163(j) limitation is a rule that applies to the deductibility of business interest expense.

The 2018 Proposed Regulations stated that interest expense of a partnership engaged in per se non-passive activities under section 469 is fully subject to section 163(j) at the partnership level. The 2020 Proposed Regulations would require the partnership to bifurcate its items between partners that materially participate and those that are passive investors.

A pass-through entity is a small business taxpayer that is not required to file Form 8990. However, if a partner or shareholder of a pass-through entity is required to file Form 8990, the entity must provide certain information to the partner or shareholder upon request.

A "business interest expense" is an interest expense that is properly allocable to a nonexcepted trade or business or that is floor plan financing interest expense. Both terms exclude investment income.