Investing in mutual funds is a popular choice for many, especially those who are not experts in the stock market. They are considered a relatively safe investment option, offering diversification and convenience at a low cost. However, there are some negative factors to consider, such as high fees and a lack of control over investment decisions, which may make mutual funds a bad choice for certain investors. So, is it a bad time to invest in mutual funds? Well, that depends on various factors, including your individual situation, financial goals, risk appetite, and investment horizon.

While timing the market is generally not recommended, it is important to be mindful of market conditions and do thorough research before investing.

| Characteristics | Values |

|---|---|

| Is it a bad time to invest in mutual funds? | There is no right or wrong time to invest in mutual funds. It depends on your financial goals and risk tolerance. |

| Advantages of mutual funds | Diversification, convenience, and low cost |

| Disadvantages of mutual funds | High fees, lack of control over investment decisions, diluted returns due to regulations, and high annual expense ratios |

| When is the best time to invest in mutual funds? | There is no fixed criteria, but some suggest investing when markets have hit rock bottom, bond yields are high, or realty sector development has plunged |

| How to invest in mutual funds | Systematic Investment Plans (SIPs) or lump sum investments, depending on your risk appetite and investment goals |

What You'll Learn

High fees and charges

High Annual Expense Ratios

Mutual funds are required to disclose their annual expense ratios, which represent the percentage of fees charged to investors to cover operational costs. While these ratios can be as high as 3%, the industry average was 0.54% in 2020, according to fund manager Vanguard. Excessive annual fees can make mutual funds less attractive, as investors may be able to generate better returns through other investment options, such as investing directly in broad-market securities or exchange-traded funds (ETFs).

Front-end and Back-end Load Charges

Mutual funds may also have different classes of shares, each with its own set of fees. Front-end loads are charges imposed when buying shares of a fund, while back-end loads are contingent deferred sales charges that apply when selling shares. These load fees can range from 2% to 4% and can significantly impact returns, especially for investors who trade their shares frequently.

12b-1 Fees

In addition to load fees, many classes of mutual fund shares also charge 12b-1 fees, which are incurred at the time of sale or purchase. These fees further eat into returns and should be carefully considered when evaluating the potential profitability of a mutual fund investment.

Management Fees

Mutual funds are managed by professional fund managers, and their transaction costs are generally minimal due to the large volume of transactions they handle. However, the fees associated with this management service can impact the overall returns generated by the fund.

Tax Implications

When a mutual fund sells investments at a profit, it will eventually distribute this profit to investors, impacting the capital gains taxes they may owe. It is important to compare each fund's tax cost ratios to understand how much their returns are reduced by taxes.

In conclusion, while mutual funds offer diversification and convenience, the associated fees and charges can be a significant drawback. It is crucial for investors to carefully evaluate and compare the fees associated with different mutual funds to make informed investment decisions.

Bank Loan Funds: A Smart Investment Choice

You may want to see also

Lack of control over investment decisions

When considering investing in mutual funds, it is important to remember that you will have a lack of control over the investment decisions made. Mutual funds are managed by fund managers, who are responsible for selecting the stocks, bonds, or other securities that make up the fund. While these fund managers are experienced professionals, they may not always make decisions that align with your personal investment goals or risk tolerance.

One of the key advantages of mutual funds is that they offer instant diversification by investing in a wide range of individual stocks, bonds, or other securities. This diversification can help reduce the overall risk of your investment portfolio. However, it also means that you may not have a say in the specific investments that are included in the fund. If you prefer to have more control over the exact stocks or securities you invest in, then mutual funds may not be the best option for you.

Additionally, mutual funds often have rules and regulations that govern their investment strategies. These regulations can sometimes result in diluted returns, as mutual funds are not allowed to have concentrated holdings exceeding a certain percentage of their overall portfolio. This means that they may not be able to invest heavily in a particular stock or security, even if it is performing well. As an individual investor, you may feel that you are missing out on potential gains due to these regulations.

Furthermore, mutual funds may not be suitable for investors who want to actively manage their portfolios and make frequent trades. Mutual funds are typically designed for long-term investment and may not be as flexible as other investment options when it comes to buying and selling individual holdings. If you prefer to have the freedom to make your own investment decisions and react quickly to market changes, then mutual funds may feel restrictive.

It's important to remember that mutual funds are a passive investment option, which means that you are entrusting your money to the fund manager to make investment decisions on your behalf. This lack of control can be beneficial for investors who don't have the time or expertise to actively manage their portfolios. However, for those who want a more hands-on approach to investing, the lack of control over investment decisions may be a significant drawback. Ultimately, it's essential to carefully consider your investment goals, risk tolerance, and personal preferences before deciding whether to invest in mutual funds.

Climate Change Mitigation: Investing for a Sustainable Future

You may want to see also

Diluted returns

However, it can be hard to predict which stocks will perform well, and most investors who want to diversify their portfolios are partial to mutual funds. Mutual funds are considered a relatively safe investment, keeping risk at a minimum compared to stocks or bonds. They offer diversification and convenience at a low cost, and are managed by experienced fund managers.

There is no best time to invest in mutual funds; individuals can make investments as and when they wish. However, it is always better to catch the funds at a lower Net Asset Value (NAV) rather than a higher price, as this will maximise returns and lead to higher wealth accumulation.

Overall, while diluted returns can be a negative factor for mutual funds, they are still considered a safe investment option for those looking to diversify their portfolios.

A Secure Future: Investing in Public Provident Funds

You may want to see also

Volatile markets

When markets are highly volatile, it can be difficult for inexperienced investors to accurately identify market lows and highs. Even professional fund managers may struggle with this. Therefore, sticking to a predetermined investment strategy is key to successful timing and generating solid returns in mutual funds.

While there is no hard-and-fast rule for investing in mutual funds during volatile markets, there are some general guidelines that can help. One approach is to divide your investment amount into equal parts and then invest in your fund of choice at fixed intervals. This strategy eliminates the need to time the market precisely and reduces the overall risk. Systematic Investment Plans (SIPs) are a popular way to implement this strategy, allowing investors to select a fixed amount to invest in their chosen fund at regular intervals such as monthly, quarterly, biannual, or annual.

Another benefit of SIPs is rupee cost averaging. For example, if you invest a fixed amount in an equity scheme through a SIP when the Net Asset Value (NAV) is high, you will get fewer units. Conversely, when the NAV is low, you will receive more units. Over time, the average cost per unit decreases, which is a useful risk management tool for long-term investors.

It is important to remember that mutual funds are considered relatively safe investments and can lead to good returns when used correctly. They keep risk at a minimum compared to stock or bond investments. However, there are circumstances in which mutual funds may not be the best choice, especially when considering certain negative factors such as high fees and a lack of control over investment decisions.

In summary, volatile markets can be navigated successfully by investing in mutual funds, particularly with the help of professional fund managers. Strategies such as dividing your investment and using SIPs can further reduce risk and improve returns over time. As always, investors should consider their financial goals, risk tolerance, and investment horizon before making any investment decisions.

Index Funds: When to Invest for Maximum Returns

You may want to see also

Long-term investment horizons

When it comes to long-term investment horizons, mutual funds are a relatively safe option. They are a good way for investors to diversify their portfolios with minimal risk. However, there are some negative factors to consider, such as high fees and a lack of control over investment decisions.

The timing of your investment in mutual funds is important, especially for equity funds or funds with a large equity exposure. The returns from these funds are directly linked to the performance of the stock market, so it is crucial to identify the ideal entry and exit points to earn good returns. However, it is challenging even for professional fund managers to accurately predict the highs and lows of the market. Therefore, investors should stick to the predetermined investment strategy set by the fund managers to achieve successful timing and maximise returns.

One strategy to mitigate the risks associated with market timing is to divide your investment amount into equal parts and invest at regular intervals through a Systematic Investment Plan (SIP). This approach eliminates the need to time the market and can help you avoid investing all your money at the market peak, forcing you to sell at a loss when prices crash. With SIPs, you can invest a fixed amount at regular intervals, such as monthly, quarterly, biannual, or annual. This strategy can lower your overall risk and average out losses over the long term, potentially improving your profit potential over time.

Additionally, SIPs offer the benefit of rupee cost averaging. For example, if you invest a fixed amount in a SIP when the market is high, you will get fewer units. Conversely, when the market is low, you will receive more units for the same investment amount. Over time, the average cost per unit becomes more favourable.

While there is no fixed criterion for the best time to invest in mutual funds, the current market conditions with falling NAVs present a good opportunity. By investing now, you can potentially generate attractive returns when the markets start rising again. However, it is impossible to predict market movements with certainty, and further declines may occur. Therefore, it is essential to consider your investment objectives, risk tolerance, and investment horizon before making any decisions.

In summary, while mutual funds offer a relatively safe long-term investment option, it is crucial to be mindful of the timing and potential fees associated with them. By investing through SIPs and focusing on long-term horizons, you can improve your chances of success and maximise returns over time.

Rockbridge Fund: A Guide to Investing Wisely

You may want to see also

Frequently asked questions

It's never a bad time to start a Systematic Investment Plan (SIP) in mutual funds. The longer you stay in the market, the better your returns will be.

If you are looking for diversification in your portfolio, mutual funds are a good option. They are also a good choice if you are not an expert in stock market dynamics, as they are operated by experienced fund managers.

Mutual funds offer diversification, convenience, and professional management at a low cost. They also help to reduce the risk of overconcentration in your portfolio by investing in dozens or hundreds of individual stocks, bonds, or other securities.

Yes, there are some risks to consider. Mutual funds may have high fees, such as annual expense ratios and load charges, which can eat into returns. They also give up control over investment decisions to fund managers, and their returns may be diluted due to rules and regulations.

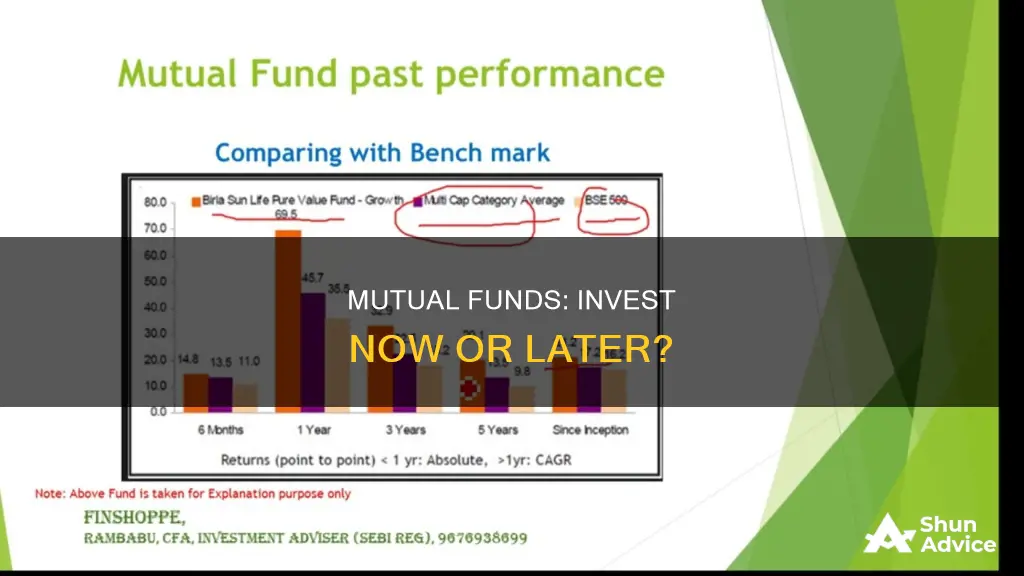

When comparing mutual funds, consider the fund's operating expense ratios, loads or one-time sales commissions, and transaction fees. While past performance is not a guarantee of future results, it is worth looking at the fund's track record of matching or outperforming the market.