Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a specific market index, such as the S&P 500. They are designed to be a passive investment strategy, where the fund's manager buys all or a representative sample of the stocks or bonds in the index it tracks. Index funds offer broad diversification, tax efficiency, and low costs, making them a popular choice for investors. When considering when to invest in index funds, it's important to understand that there is no foolproof method for predicting the performance of the market or mutual funds. However, for long-term investors, any time can be a good time to invest in index funds, as they tend to provide solid returns over the long term.

| Characteristics | Values |

|---|---|

| Best time to invest | Any time is a good time for long-term investors. |

| Advantage over active funds | During a strong bull market. |

| Disadvantage compared to active funds | When markets turn volatile. |

| Advantage over active funds | In the long run, lower costs translate to better long-term returns. |

| Best type of fund | Broad market index funds are smart tools for diversification. |

| Dollar-cost averaging | A good option to offset market volatility. |

| Mutual funds | A common time when index funds lose to active funds. |

| Actively managed funds | A skilled or lucky fund manager can outperform the market. |

| Mutual funds | Fees can eat away at your returns. |

| Index funds | Smart tools for diversification. |

| --- | --- |

| How to invest | Through a brokerage account or a retirement account like a Roth IRA. |

| Cost | Depends on the fund and brokerage used. Some funds have a $0 minimum. |

What You'll Learn

Index funds are a passive investment strategy

Low Costs

Index funds have much lower management fees than actively managed funds because they do not require a manager to actively trade or analyse securities. These lower costs can make a significant difference to investment returns over time.

Broad Diversification

Index funds hold a preselected, diversified collection of hundreds or thousands of stocks or bonds, which minimizes the risk of losses. If a single stock or bond in the collection performs poorly, there is a good chance that another is performing well. In contrast, investing in individual stocks means that your savings could take a bigger hit if one of your choices performs poorly.

Tax Efficiency

Index funds are considered tax-efficient because they generally do not trade securities as frequently as actively managed funds, which results in lower taxable capital gains distributions passed along to shareholders. Additionally, when selling a particular security, index funds can choose from hundreds or thousands of lots to sell those with the lowest capital gains and, therefore, the lowest tax liability.

Long-Term Performance

Over the long term, index funds have consistently outperformed other types of mutual funds in terms of total return. This is due to their low costs and broad diversification.

Despite these advantages, index funds are not suitable for everyone. One of the main drawbacks is that they offer no opportunity to beat the market. They are designed solely to match the market's performance or a specific benchmark index. Additionally, during volatile markets, a skilled or lucky active fund manager may be able to outperform the major market indices.

Bond Fund Investment: What Percentage is Smart to Invest?

You may want to see also

They offer broad diversification

Index funds are a great way to achieve broad diversification. They are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. By investing in an index fund, you get exposure to a diverse range of stocks or bonds within that index. This diversification reduces your overall investment risk because if one stock or bond performs poorly, there is a good chance that another is performing well to balance out your losses.

Index funds are passively managed, meaning they aim to replicate the performance of the index they track without any active management. This passive management style results in lower fees for investors. Index funds also tend to have lower transaction costs because they buy and sell securities less frequently than actively managed funds, and they generate less taxable income, which further reduces costs for investors.

The broad diversification offered by index funds means that you can build a well-balanced portfolio with just a few index funds. For example, Vanguard, a popular provider of index funds, suggests that investors can achieve broad diversification with just four of their index funds: the Vanguard Total Stock Market Index Fund, the Vanguard Total Bond Market Index Fund, the Vanguard Total International Stock Index Fund, and the Vanguard Total International Bond Index Fund.

Index funds are a smart choice for investors who want to benefit from broad diversification and lower costs. They are a simple way to invest in a wide range of stocks or bonds without having to actively select and manage individual securities. By investing in index funds, you can easily create a diversified portfolio that matches your desired asset allocation.

Best Funds to Invest in: Where to Start?

You may want to see also

They have low fees

One of the most significant advantages of investing in index funds is their low fees. Index funds are passively managed, meaning they aim to replicate the performance of a particular market index without active management. As a result, they have much lower management fees than other funds. Instead of paying for a manager to actively trade and select securities, the index fund's portfolio simply duplicates that of its designated index. This passive approach leads to significantly reduced costs for investors.

The low fees associated with index funds are particularly evident when comparing them to actively managed funds. Actively managed funds typically have expense ratios above 1%, whereas index funds often have fees of less than 0.4%. This difference may seem negligible, but it compounds over time and can result in substantial savings for investors. For example, some index funds charge as little as $3 to $10 per year for every $10,000 invested. This fee structure makes index funds an attractive option for those seeking a low-cost investment strategy.

Additionally, index funds tend to have lower transaction costs since they hold investments for longer periods without frequent buying and selling. This results in reduced taxable capital gains distributions, further enhancing their cost-effectiveness.

It is worth noting that while index funds offer low fees, they may not be suitable for everyone. They are designed to match the performance of a specific index, so there is no opportunity to outperform the market. If investors seek to beat the market, they may need to explore other investment options or actively managed funds. Nevertheless, for those prioritising cost-efficiency and long-term wealth accumulation, index funds present a compelling opportunity.

When considering index funds, it is essential to evaluate their expense ratios and compare them with other funds tracking similar indexes. While index funds are generally more affordable than actively managed funds, some index funds are cheaper than others. Conducting thorough research and analysing the fees associated with different index funds can help investors make informed decisions and maximise their returns.

Bond Funds: Best Time to Invest and Why

You may want to see also

They are tax-efficient

Index funds are tax-efficient for a number of reasons. Firstly, they generate less taxable income than other types of funds. This is because they trade securities less frequently, which results in fewer taxable capital gains distributions that must be passed on to shareholders.

Secondly, index funds have the advantage of being able to choose which lots of securities to sell when selling a particular security. This means they can sell the lots with the lowest capital gains and, therefore, the lowest tax bill.

Thirdly, index funds are passively managed. This means they do not have a fund manager actively trading and trying to beat the market. As a result, they have much lower management fees than other funds, which can make a big difference to returns over time.

Finally, index funds are often invested through mutual funds, which, unlike ETFs, are not priced until the end of the day. This can help to reduce taxable capital gains distributions.

Lumpsum Mutual Fund Investment: Timing for Maximum Returns

You may want to see also

They are low-maintenance

Index funds are a great investment option for those who want to take a more hands-off approach to investing. They are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a specific market index, such as the S&P 500. This passive investment strategy means that you don't have to actively select which stocks or bonds to invest in, as the fund's manager will buy all or a representative sample of the stocks or bonds in the index it tracks. This makes index funds a low-maintenance investment option.

- Broad Diversification: Index funds contain a preselected collection of hundreds or thousands of stocks, bonds, or both. This diversification helps to minimize losses, as the strong performance of some investments can offset the poor performance of others.

- Lower Risk: Index funds offer lower risk compared to investing in individual stocks or bonds. If one stock or bond in the fund performs poorly, the overall impact on your investment is reduced due to the diversification.

- Low Costs: Index funds typically have lower fees than actively managed funds. They have lower management fees because they are passively managed, and they also tend to have lower transaction costs since they buy and sell less frequently.

- Tax Efficiency: Index funds are tax-efficient because they generate less taxable income. They also have the flexibility to choose which lots of securities to sell, allowing them to minimize capital gains and reduce your tax bill.

- Professional Management: Index funds have professional portfolio managers who ensure that the fund performs in line with the index it tracks. You benefit from their expertise without paying high fees, as the fund's management is passive.

Overall, index funds are a low-maintenance investment option that provides broad diversification, low costs, and professional management. They are a great choice for investors who want to invest in a simple, efficient, and cost-effective way.

Index Funds: When to Start Investing for Maximum Returns

You may want to see also

Frequently asked questions

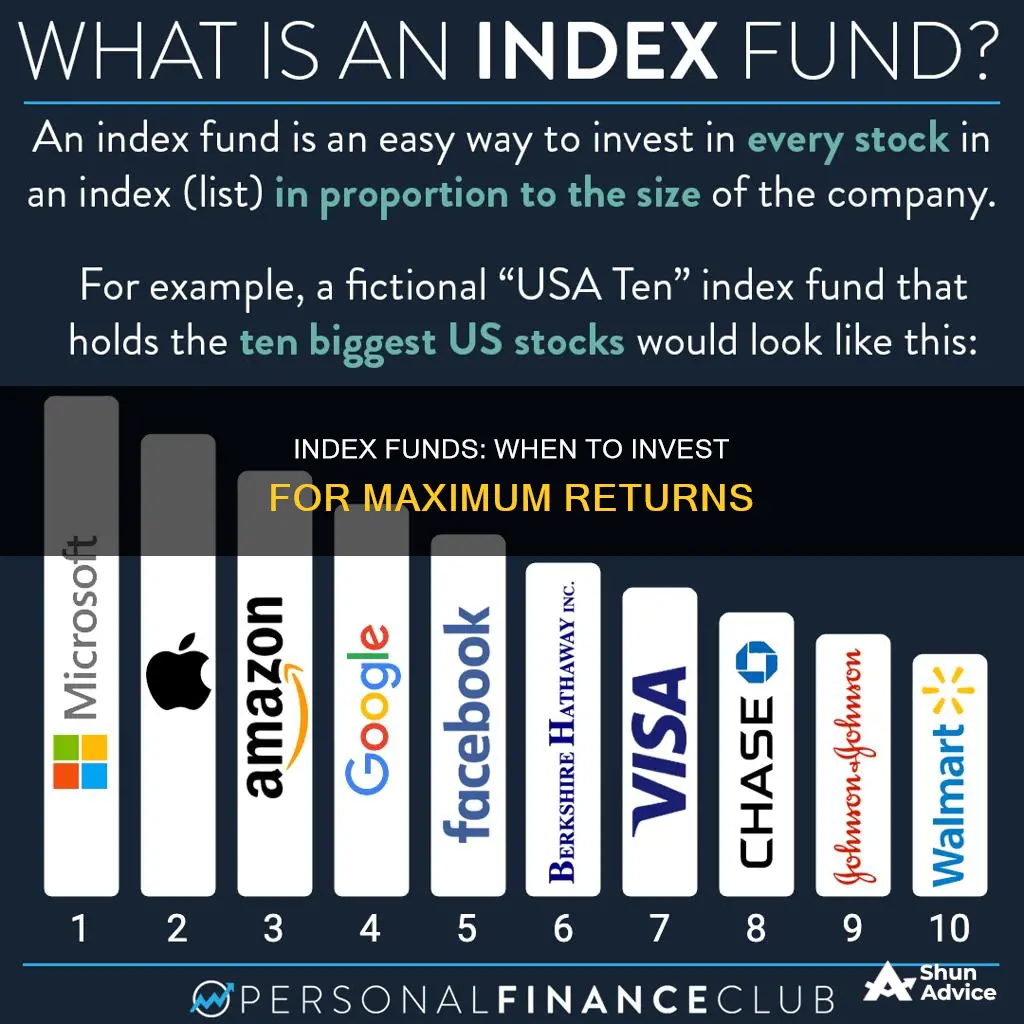

An index fund is a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500. Index funds are designed to be a passive investment strategy, where the fund's manager buys all or a representative sample of the stocks or bonds in the index it tracks.

Index funds offer broad diversification, tax efficiency, and low costs. They are also easy to invest in and have low fees. Additionally, they have consistently outperformed other types of mutual funds over the long term.

One drawback of index funds is that they rise and fall with the index they track. For example, if you invest in a fund that tracks the S&P 500, you will be vulnerable to market drops. Another drawback is that diversification can limit upside potential.

When choosing an index fund, consider the geographic location of the investments, the market sector, and the market opportunity. Compare the expenses of each fund and consider the tax implications. Additionally, look at the long-run performance of the fund and the expense ratio.