The National Pension System (NPS) is a government-backed retirement savings scheme open to employees from the public, private and unorganized sectors. It is professionally managed and offers tax incentives, market-linked returns and flexibility, making it an appealing option for a wide range of investors. However, it's important to assess your financial goals and risk tolerance before investing.

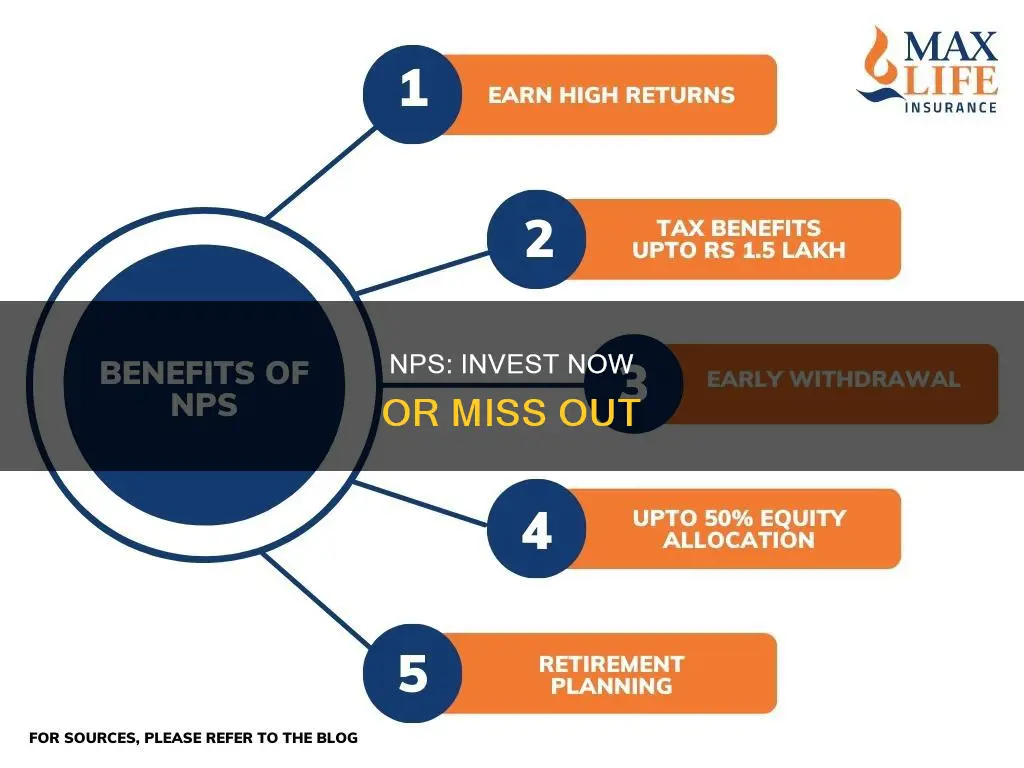

NPS offers a disciplined, long-term investment approach, ensuring financial security in retirement. It provides tax benefits at the time of contribution, on the gains made during the tenure of the account and at the time of withdrawal. The scheme also offers a regular pension after retirement through annuities.

However, it's important to note that NPS returns are subject to market fluctuations, so it is crucial to carefully analyze the associated risks.

| Characteristics | Values |

|---|---|

| Description | National Pension Scheme (NPS) |

| Type | Defined contribution pension plan |

| Regulator | Pension Fund Regulatory and Development Authority (PFRDA) |

| Ideal for | Retirement planning |

| Pros | Tax incentives, market-linked returns, professionally managed, flexibility, low costs, regulated, safe and secure |

| Cons | Tight exit restrictions, 75% cap on equity exposure, enforced annuity purchase |

| Minimum age requirement to invest | 18 years |

| Minimum contribution | Rs 1,000 per year |

| Tax benefits | Up to Rs 1.5 lakh under Section 80C and an additional Rs 50,000 under Section 80CCD(1B) |

| Account types | Tier 1 (mandatory pension account with tax benefits), Tier 2 (optional account with withdrawal flexibility) |

| Investment choice | Active (self-managed portfolio), Auto (fund manager-created portfolio) |

| Investment allocation | Equity, corporate bonds, government securities, alternate investment funds |

| Number of fund managers | 7 |

| Number of annuity service providers | 7 |

What You'll Learn

Tax benefits of NPS

The National Pension Scheme (NPS) offers various tax benefits to its subscribers. Here are the key tax advantages of investing in NPS:

Tax Benefits for Self-Contribution

Employees can claim tax deductions on their contributions to the NPS under Section 80CCD(1) of the Income Tax Act, 1961. The deduction limit is up to 10% of their salary (basic salary + dearness allowance) or a maximum of ₹1.5 lakh per year under Section 80CCE.

Additionally, they can avail of an extra deduction of up to ₹50,000 under Section 80CCD(1B), which is over and above the ₹1.5 lakh limit of Section 80CCE. This means a total deduction of up to ₹2 lakh is possible.

Tax Benefits for Employer's Contribution

The NPS also offers tax benefits for contributions made by employers. Under Section 80CCD(2), salaried individuals can claim deductions on their employer's contributions. The limit is up to 10% of their salary (basic + dearness allowance) for private sector employees and 14% for central government employees. This benefit is over and above the ₹1.5 lakh limit under Section 80CCE.

Tax Benefits for Self-Employed Individuals

Self-employed individuals contributing to NPS can also claim tax deductions on their contributions. They are eligible for a deduction of up to 20% of their gross income under Section 80CCD(1), with a maximum limit of ₹1.5 lakh under Section 80CCE. They can also avail of the additional deduction of up to ₹50,000 under Section 80CCD(1B).

Tax Benefits on Partial Withdrawal

Investors can make partial withdrawals from their NPS Tier 1 account after three years of investment. Withdrawals of up to 25% of the corpus are tax-exempt under Section 10(12B) for specific purposes like medical expenses, children's education, or marriage.

Tax Benefits on Returns

The returns or gains from investments in the NPS Tier 1 account are not subject to tax until maturity. This means investors can enjoy tax-free market-linked returns during the investment period.

Tax Benefits on Maturity or Lump Sum Withdrawal

Once an investor turns 60 or upon superannuation, they can withdraw up to 60% of their NPS corpus as a lump sum, which is tax-exempt under Section 10(12A). The remaining 40% must be used to purchase annuities, which are also tax-exempt under Section 80CCD(5). However, the income received from these annuities is taxable as per the individual's income tax slab.

Tax Benefits for Corporates/Employers

Employers contributing to their employees' NPS accounts can claim these contributions as business expenses. They are eligible for a deduction of up to 10% of the employee's salary (basic + dearness allowance) under Section 36(1)(iv)(a) from their Profit & Loss Account.

Homes: The Ultimate Investment?

You may want to see also

NPS vs. PPF

The National Pension System (NPS) and the Public Provident Fund (PPF) are both popular government-backed retirement schemes in India. While the NPS is a pension-specific savings vehicle, the PPF is a more general savings vehicle that can also be used for retirement planning. Both have their advantages and disadvantages, and which one is better for an individual depends on their financial goals, risk tolerance, and life circumstances.

Minimum and Maximum Investment Amounts

The minimum annual investment in NPS is Rs 6,000, while there is no upper limit on investments. For PPF accounts, the minimum annual investment is Rs 500 and the maximum you can invest in a year is Rs 1.5 lakh.

Returns

The NPS is a market-linked pension scheme, so returns depend on the performance of pension fund managers and the market. Returns are typically around 12-14%, but there is a market risk and a long investment horizon. The PPF, on the other hand, provides moderate but guaranteed returns, currently at 7.1% compound interest.

Safety

The NPS is market-linked, so it has a relatively low level of safety. The PPF, being a risk-free investment with returns backed by the government, is considered highly safe.

Taxation

The NPS offers tax deductions of up to Rs 2 lakh per year. However, only 40% of the NPS is tax-free, so it is considered a low exemption. The PPF offers tax deductions of up to Rs 1.5 lakh per year and is fully exempted.

Liquidity

Both the NPS and PPF have low liquidity due to their long lock-in periods.

Eligibility and Freedom of Investment

Any Indian citizen between 18 and 70 years old can open an NPS account, while citizens above 18 can open a PPF account. NRIs can open NPS accounts but cannot opt for PPF. The NPS offers more freedom in investment portfolios, while the PPF does not have this flexibility.

Overall Comparison

Both the NPS and PPF offer attractive features for retirement planning. The PPF is a suitable choice for long-term investors seeking predictable and steady returns, while the NPS provides the opportunity to customise asset allocation and invest in higher-risk assets for potential long-term wealth creation. The NPS may be a better option for those seeking higher returns and willing to accept higher risk, while the PPF is ideal for those who are risk-averse.

Shark Tank: Payback Time?

You may want to see also

How NPS works

The National Pension Scheme (NPS) is a social security initiative by the Central Government of India. The scheme encourages people to invest in a pension account at regular intervals during their employment. After retirement, subscribers can take out a certain percentage of the corpus. As an NPS account holder, you will receive the remaining amount as a monthly pension.

The NPS scheme is open to employees from the public, private and unorganised sectors, except those from the armed forces. Central Government employees joining on or after 1 January 2004 are covered under the NPS mandatorily. The NPS scheme is also open to all Indian citizens on a voluntary basis.

The NPS account can be opened with Point of Presence (POP) entities, which include most private and public sector banks and several financial institutions. Individuals can also open their NPS account online through the eNPS website.

An NPS account holder must contribute a minimum of Rs. 6,000 every year. After retirement, they can choose to withdraw a part of the sum, about 60%, and the remaining amount, preferably 40% of the total invested sum, is used to purchase an annuity and for setting up a regular income post-retirement.

The NPS has two types of accounts: Tier I and Tier II. The Tier I NPS account is non-withdrawable until the account holder is 60 years old or retired. On the other hand, a Tier II NPS account functions as a voluntary savings account, and individuals holding these accounts can withdraw their money whenever they want.

The sum of money that accumulates in an NPS account depends on two factors: the annual contributions made into the account, and the income generated from investing 40% of the maturity amount in purchasing annuities.

REITs: Recession-Proof Investment?

You may want to see also

Retirement planning with NPS

The NPS is a great retirement savings option, offering a disciplined, long-term investment approach to ensure financial security in retirement. It is professionally managed and offers several advantages, including tax incentives, market-linked returns, flexibility, and more, making it an attractive investment option for a wide range of investors.

Regular Pension After Retirement

One of the most significant benefits of NPS is the guarantee of a steady post-retirement income. When your NPS matures, you will receive 60% of the corpus as a lump sum, while the remaining 40% is used to purchase annuities, which provide a regular pension. This ensures financial stability throughout your retirement years.

Professional Management

The NPS is regulated and overseen by the PFRDA (Pension Fund Regulatory and Development Authority), ensuring professional management of your investments. There are authorised pension fund managers who manage portfolios on your behalf, adhering to strict guidelines set by the PFRDA. This provides peace of mind and addresses concerns about the safety of your investments.

Choice of Investments

The NPS offers two broad options: Active and Auto Choice. With Active Choice, you can select your own asset allocation across government securities, corporate bonds, equity, and alternative investment funds. The Auto Choice automatically adjusts your asset allocation based on your age. You also have the flexibility to switch between these choices twice a year for free.

Tax Benefits

The NPS provides significant tax advantages at different stages: when contributing, on gains during the tenure, and at withdrawal. Individual taxpayers can claim deductions on contributions under NPS of up to Rs 1.5 lakh in a financial year under Section 80C. Additionally, NPS subscribers can claim an extra deduction of up to Rs 50,000 per financial year under Section 80CCD (1B). The entire amount, including the annuity income, is tax-free at maturity.

Flexibility in Investing

NPS offers flexibility in terms of contribution timing and amount. You can start with as little as Rs 1,000 per year, and there are no restrictions on when you invest. This makes it an excellent option for self-employed individuals with variable income.

Early Start Advantage

While you can start saving for retirement at any age, the NPS provides the benefit of early compounding. The earlier you start, the more time your investments have to grow, potentially resulting in a larger retirement corpus.

Protection for Your Family

The NPS offers pension plans that extend beyond your own life, providing continued pension income to your spouse even after your demise. This ensures your family's financial needs are met and provides peace of mind.

In conclusion, the NPS is a prudent and reliable choice for individuals seeking to secure their retirement. It offers a well-regulated, flexible, and cost-effective way to save for the future, with the added benefit of tax incentives. However, it's important to remember that NPS returns are subject to market fluctuations, so careful consideration of associated risks is essential before investing.

Movie Investment: Why Take the Risk?

You may want to see also

NPS investment options

The National Pension System (NPS) offers a range of investment options to its subscribers. Here are the key features and considerations for NPS investment options:

Investment Choices

The NPS provides two main investment choices: Active Choice and Auto Choice.

- Active Choice: This option offers complete flexibility, allowing you to design your investment portfolio by distributing your investments across four asset classes: equities (E), corporate bonds (C), government securities (G), and alternative investment funds (A). You can choose the percentage allocation to each asset class based on your risk appetite, financial knowledge, and future goals. The Active Choice strategy is suitable for individuals who want full control over their NPS investments and are confident in their financial understanding.

- Auto Choice: With this option, the NPS automatically adjusts your investment allocation based on your age. The allocation will be higher in equities when you are younger and will gradually shift towards more conservative investments as you get older. The Auto Choice mode includes three Life Cycle Fund Options: LC 75 (Aggressive Auto Choice), LC 50 (Moderate Auto Choice), and LC 25 (Conservative Auto Choice). This option is suitable for those who want the risk associated with their investments to auto-adjust as they approach retirement.

Asset Classes

The four asset classes available under NPS are:

- Equities (E): This option offers a "High risk - High Return" opportunity, with funds invested in equity. Subscribers can choose to invest up to 75% of their portfolio in this asset class.

- Corporate Bonds (C): Funds are invested in fixed-income-bearing debt instruments. There is no cap on the maximum investment in this asset class.

- Government Securities (G): Funds are invested in government securities, offering relatively lower risk compared to equities. There is no cap on the maximum investment in this asset class.

- Alternative Investment Funds (A): Funds are invested in real estate and infrastructure. Due to the high risk associated with this asset class, the maximum investment is capped at 5%.

Flexibility

The NPS offers flexibility in terms of investment timing and amount. You can invest whenever you prefer, making it suitable for self-employed individuals with variable income. The minimum investment amount is as low as Rs. 1,000 per year, allowing you to start building your retirement savings with a small amount. Additionally, you have the option to change your asset mix and investment choice twice in a financial year for both Tier I and Tier II NPS accounts.

Tax Benefits

The NPS provides tax advantages at multiple stages: when contributing, on gains during the tenure, and at withdrawal on maturity. This is known as the EEE (exempt on contribution, exempt on gain, exempt on maturity) tax benefit. Individual taxpayers can claim a deduction on contributions under NPS of up to Rs. 1.5 lakh per financial year under Section 80C. Additionally, NPS subscribers can claim an extra deduction for investment of up to Rs. 50,000 per financial year under Section 80CCD (1B), over and above the deduction under Section 80C.

Fund Managers

When investing in NPS, you can choose from a list of authorised pension fund managers, such as HDFC Pension Management Co. Ltd, Reliance Capital Pension Fund Ltd, and UTI Retirement Solutions Ltd. These fund managers are responsible for managing your portfolio and ensuring adherence to the guidelines prescribed by the Pension Fund Regulatory and Development Authority (PFRDA).

Invest Early: Compounding Returns

You may want to see also

Frequently asked questions

NPS stands for National Pension System. It is a government-sponsored pension program open to employees from the public, private and unorganized sectors.

NPS offers tax incentives, market-linked returns, flexibility, and professional management. It is a great retirement savings option, offering financial security in retirement.

In NPS, your money is pooled in a pension fund. You can contribute annually until you turn 60. The minimum age requirement to invest is 18 years. You can avail tax deductions on your contributions.

NPS is market-linked and offers higher potential returns compared to PPF. It also has slightly higher liquidity with multiple opportunities for partial withdrawal. However, PPF offers secured and stable returns with almost no risk.

NPS may be a good investment option if you are looking for a retirement savings plan with tax benefits and market-linked returns. However, consider your financial goals, risk tolerance, and other factors before deciding. It is important to diversify your investments and not rely solely on NPS.