Index funds are a popular investment strategy, but some investors might want to avoid them. Index funds are a group of stocks that mirror the performance of an existing stock market index, such as the S&P 500. They are a low-cost, easy way to build wealth, making them attractive to retirement investors. However, some investors might want to avoid them due to a lack of downside protection, the inability to react to advantageous behaviour, and the lack of control over holdings. So, is it too late to invest in index funds?

| Characteristics | Values |

|---|---|

| Investment type | Passive |

| Investment strategy | Index investing |

| Pros | Low cost, easy to invest in, low fees, tax advantages, broad diversification, long-term wealth building |

| Cons | Lack of downside protection, lack of reactive ability, no control over holdings, limited exposure to different strategies, dampened personal satisfaction |

What You'll Learn

Lack of downside protection

Index funds are a popular investment strategy, but they do come with certain drawbacks. One of the main disadvantages is the lack of downside protection. While index funds can provide great returns when the market is performing well, they also leave investors vulnerable during market downturns.

Index funds are designed to mirror the performance of a specific stock market index, such as the S&P 500. This means that when the market goes up, your investment goes up, but when the market takes a turn for the worse, your investment loses value as well. This lack of downside protection can be concerning, especially for investors who are closer to retirement age or who cannot afford to lose their capital.

To mitigate this risk, some investors choose to hedge their exposure to the index by shorting futures contracts or buying put options. However, these strategies can be complex and may not always be effective. Additionally, they may defeat the purpose of investing in index funds, which are meant to be a passive investment strategy.

It's important for investors to understand the risks associated with index funds and to carefully consider their own financial situation and risk tolerance before investing. While index funds can be a great way to build wealth over the long term, they may not offer the level of protection that some investors need, especially during market corrections and crashes.

As with any investment, it's crucial to do your research and understand the potential risks and rewards before committing your capital.

Smart Ways to Invest 1000 Rupees in Mutual Funds

You may want to see also

Lack of reactive ability

Index funds are a passive investment strategy, meaning they are automated to replicate the performance of a chosen index. This means that, unlike active investment strategies, they do not allow for advantageous behaviour.

If a stock becomes overvalued, it will start to carry more weight in the index. This is when astute investors would want to lower their portfolios' exposure to that stock. However, if you invest solely through an index, you will not be able to act on that knowledge. This is known as a lack of reactive ability.

For example, if you have a clear idea that a stock is overvalued or undervalued, you will not be able to act on that knowledge if you invest solely through an index fund. This is because index funds are designed to track a specific index and cannot deviate from that strategy.

Additionally, index funds do not allow investors to take advantage of opportunities elsewhere. This is because indexes are set portfolios, and investors have no control over the individual holdings in the portfolio.

While index funds offer a low-cost, diversified investment strategy, the lack of reactive ability may be a disadvantage for investors who want more control over their portfolios and the ability to react to market changes.

Index & Mutual Funds: Low-Fee Investing Strategies

You may want to see also

No control over holdings

Index funds are a passive investment strategy, meaning that they are designed to mirror the performance of a particular stock market index, such as the S&P 500. This means that investors have no control over the individual holdings in their portfolio. While this can be a benefit in terms of diversification and low costs, it also means that investors cannot choose specific companies they want to own or avoid.

When you buy an index fund, you are buying a set portfolio of stocks that make up the index it tracks. This means that you cannot choose which individual stocks to include or exclude. For example, you may have a favourite bank or food company that you want to own, or you may have ethical concerns about the way a particular company operates. With an index fund, you cannot choose to only include the companies you like or exclude the ones you don't. Your portfolio will simply mirror the index it is tracking.

This lack of control over individual holdings can be a disadvantage for investors who want to have a more hands-on approach to their investments. It can also be a disadvantage if there are certain companies or industries that an investor wants to avoid for moral or personal reasons. For example, an investor may have issues with the way a company treats the environment or the products it makes. With an index fund, the investor would not be able to exclude these companies from their portfolio.

Additionally, index funds do not allow investors to take advantage of specific investment opportunities. For example, if a particular stock becomes overvalued, an astute investor may want to lower their portfolio's exposure to that stock. With an index fund, the investor would not be able to act on this knowledge and would be unable to avoid the potential downside of an overvalued stock.

In summary, while index funds offer a simple and low-cost way to invest, they also come with a lack of control over individual holdings. This means that investors cannot choose specific companies they want to own or exclude, and they may be unable to avoid potential downsides or take advantage of specific opportunities. For some investors, this lack of control may be a significant disadvantage of index funds.

A Guide to Investing in SBI Magnum Mutual Funds

You may want to see also

Higher risk as you age

It's important to note that as you get older, it becomes harder to recover from investment losses. Therefore, it's crucial to always consider the risk involved. While it's never too late to start investing, the strategies you employ may need to change as you age. Here are some key considerations for investing as you get older:

Asset Allocation:

Your asset allocation, or how you distribute your investments across different types of assets, may need to shift as you get closer to retirement. Younger investors can typically tolerate more risk and allocate a larger portion of their portfolio to stocks or growth stocks. However, as you age, it's generally recommended to shift towards more conservative investments, such as bonds and dividend-paying companies, to preserve capital and focus on income generation. This shift doesn't mean you have to completely avoid stocks, but rather find a balance that aligns with your risk tolerance and financial goals.

Risk Profile:

As you age, it's important to understand and assess your risk profile. While some investors are comfortable with a more aggressive approach, others may prefer stability, especially as they approach retirement. It's crucial to consider your life situation, such as caring for ageing parents or funding a child's education, as these factors will impact your risk tolerance and investment strategies.

Emergency Fund:

Building an emergency fund is essential at any age, but it becomes even more crucial as you get older. Aim to have at least three to six months' worth of living expenses readily available in a savings account, money market account, or liquid CD. This fund can provide a safety net during market downturns or unexpected financial events, ensuring you don't have to dip into your long-term investments prematurely.

Professional Advice:

Seeking professional advice from a financial advisor or planner can be beneficial, especially as your investment strategies become more complex with age. A trusted advisor can help you navigate the shifting landscape of retirement planning, tax considerations, and risk management. They can also provide guidance on specific investment products and strategies suited to your age and financial goals.

Retirement Accounts:

As you approach retirement, it's important to maximise your contributions to retirement accounts, such as 401(k)s or IRAs. These accounts often come with tax advantages and can help you build a substantial nest egg for your golden years. Additionally, catch-up contributions are available for individuals aged 50 and older, allowing you to contribute additional funds to these accounts.

In conclusion, while investing in index funds or other financial instruments later in life can still be beneficial, it's important to be mindful of the higher risks involved. Adjusting your investment strategies, seeking professional advice, and prioritising retirement planning can help you make informed decisions and effectively manage your finances as you age.

Emerging Market Funds: Where to Invest and How

You may want to see also

Low-cost, passive investment strategy

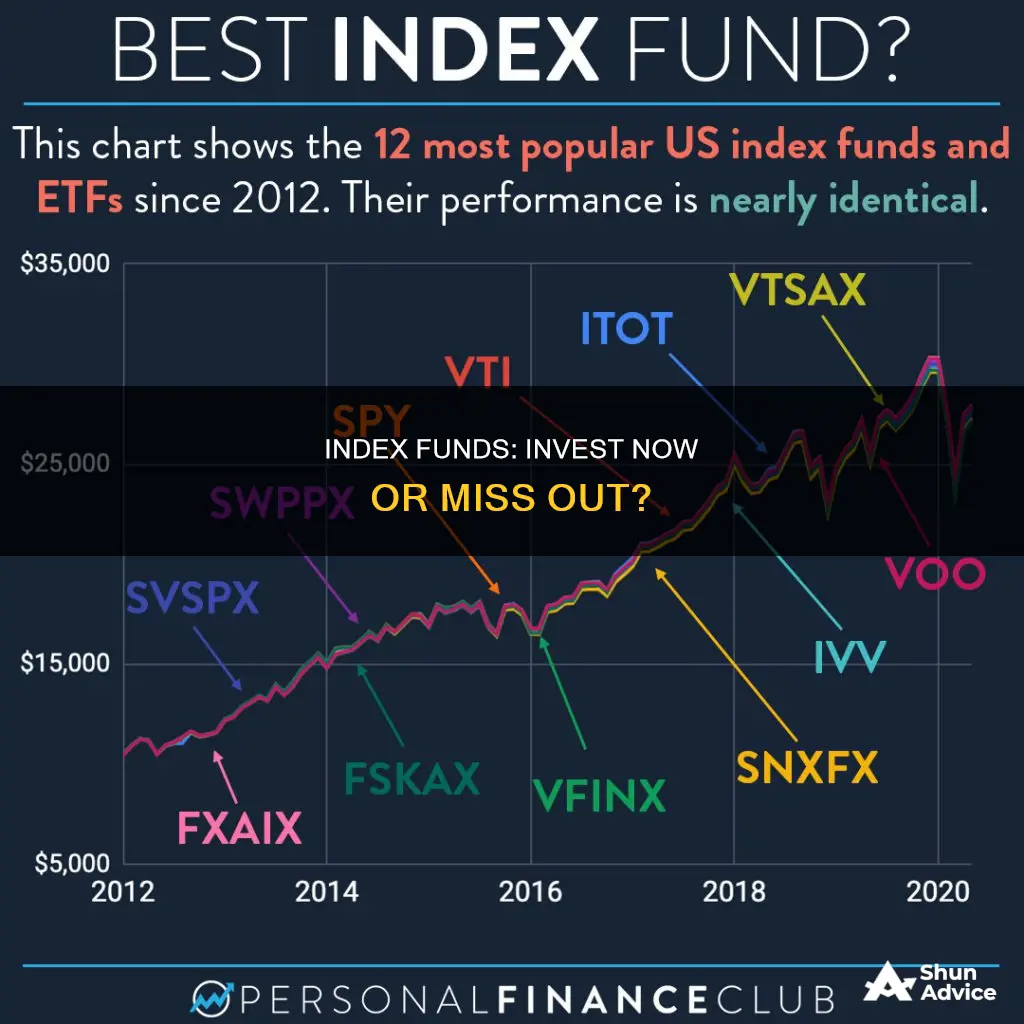

Index investing is a popular investment strategy that is often used synonymously with the term passive investing. Passive investing is a long-term strategy for building wealth by buying securities that mirror stock market indexes and holding them for a long time. This strategy aims to cut the costs of deciding which securities to invest in.

- Lower fees: Passive funds tend to be less expensive to operate than active funds because they don't require costly research. The average fee for actively managed stock mutual funds was 0.65% in 2023, while the average fee for passive funds was 0.05%.

- Tax efficiency: Index funds that use a buy-and-hold strategy typically generate low or no taxable capital gains annually for shareholders.

- Simplicity: Owning an index or group of indices is easier to implement and understand than a dynamic strategy that requires constant research and adjustment.

However, there are also some drawbacks to this strategy:

- Lack of flexibility: Passive funds are limited to a specific index or set of investments and are not allowed to make many changes. This means investors are locked into those holdings, regardless of market conditions.

- Smaller potential returns: Passive funds rarely beat their benchmark index and usually return slightly less due to operating costs.

- Lack of downside protection: Passive investors are vulnerable to market corrections and crashes because they have a lot of exposure to stock index funds.

- Lack of reactive ability: Passive investors cannot take advantage of overvalued or undervalued stocks because they cannot adjust their portfolios accordingly.

- No control over holdings: Investors in passive funds cannot choose the individual holdings in the portfolio.

Overall, a low-cost, passive investment strategy can be a good option for investors who want to take a hands-off approach, reduce fees, and generate steady returns over the long term. However, it's important to consider the potential drawbacks and decide if this strategy aligns with your investment goals and risk tolerance.

Axis Bluechip Fund SIP: A Smart Investment Strategy

You may want to see also

Frequently asked questions

It's never too late to invest, but it's important to consider your financial situation. If you're close to retirement, it's crucial to assess the level of risk you're comfortable with and consult with a financial advisor to make informed decisions.

No, there are no age restrictions on investing in index funds. However, it's generally advisable to start investing as early as possible to benefit from compound interest over time.

Before investing in index funds, it's essential to have a clear financial goal, conduct thorough research, and choose a reputable brokerage or mutual fund company to purchase the funds from. It's also important to consider the fees and expenses associated with the investment.