Mutual funds are a popular investment option as they help investors achieve their financial goals. However, it is important to understand how mutual funds are taxed before investing. The taxation of mutual funds depends on various factors such as the type of fund, the holding period, and the nature of the gains. Profits from mutual funds are known as 'capital gains' and are subject to tax. The tax rate can vary depending on whether the gains are short-term or long-term, with long-term capital gains typically taxed at a lower rate. Additionally, dividends received from mutual funds are also taxable, and the tax rate depends on the type of fund and the nature of the dividends. It is crucial to consider the tax implications of mutual fund investments to make informed decisions and maximize returns.

Characteristics of mutual fund investment tax

| Characteristics | Values |

|---|---|

| Taxable | Yes |

| Tax type | Capital gains tax |

| Tax factors | Type of fund, holding period, nature of gains |

| Dividend tax | Yes |

| SIP tax implications | Yes |

| STT | Yes |

What You'll Learn

Capital gains and short-term vs long-term investments

When it comes to capital gains and short-term versus long-term investments, there are several key considerations to keep in mind. Firstly, let's understand what capital gains are in the context of mutual funds.

Capital Gains

Capital gains refer to the profits realised from the sale of mutual fund investments. These gains are subject to taxation, and the applicable tax rates depend on various factors, including the type of mutual fund and the holding period of the investment. Mutual funds offer returns in two main forms: dividends and capital gains. While dividends are paid out of the profits of the company, capital gains arise from the appreciation in the price of the mutual fund units.

Short-Term vs. Long-Term Investments

Now, let's delve into the differences between short-term and long-term investments in mutual funds:

Time Horizon

Short-term investments typically have a duration of a few months to a few years. On the other hand, long-term investments usually span several years or even decades. Short-term investments are suitable for investors seeking quick returns or those with immediate financial needs, while long-term investments are geared towards investors with a longer investment horizon and a higher risk tolerance.

Risk Profile

Short-term investments generally involve lower risk profiles. They often include assets like money market funds or short-duration bond funds, which are less susceptible to interest rate changes. In contrast, long-term investments tend to carry higher risk due to their exposure to market volatility. These investments focus on wealth accumulation over time, aiming for higher returns despite market fluctuations.

Investment Objectives

Short-term investments are often chosen by individuals with short-term financial objectives, such as travel, down payments, or emergency funds. These investors prioritise capital preservation and liquidity. On the other hand, long-term investments align with investors who have long-term financial goals, such as retirement planning, wealth accumulation, and long-term financial security. These investors are willing to take on more risk in exchange for higher potential returns.

Tax Implications

In many cases, short-term investments are taxed at higher rates than long-term investments. Short-term capital gains are typically taxed at ordinary income tax rates, which can be higher than long-term capital gains rates. Holding investments for longer periods may qualify for favourable tax treatment, resulting in lower capital gains taxes. Additionally, long-term investments may offer the benefit of reduced transaction costs due to lower turnover ratios.

In summary, the choice between short-term and long-term mutual fund investments depends on various factors, including an individual's financial goals, risk tolerance, and investment timeframes. Short-term investments offer lower risk and quicker liquidity, while long-term investments provide the potential for higher returns over an extended period.

Mutual Funds in India: Invest Now or Later?

You may want to see also

Dividends and dividend distribution tax (DDT)

Dividends are a return on investment given by a company to its shareholders from profits earned. Dividends are considered income in the hands of the shareholders and are, therefore, taxable.

Dividend Distribution Tax (DDT)

DDT is a tax levied on dividends paid by a company to its shareholders. Instead of taxing the dividend at the shareholder's end, the Income Tax Act states that the dividend should be taxed at the company's end when they distribute the dividend. The DDT is levied over and above the income tax that the company is liable to pay.

In the past, dividends were taxable at source, meaning the scheme had to pay DDT before distributing it to investors. This reduced the amount of dividend payout but was tax-free in the hands of investors. However, with effect from April 1, 2020, DDT has been abolished, and mutual fund dividends are now taxable in the hands of investors. Dividend income will be considered income from other sources, and investors will have to pay tax on it according to their individual tax slabs.

The DDT was payable separately from the income tax liability of a company, and no deduction or credit was allowed for the DDT paid. The DDT had to be paid within 14 days of the declaration, distribution, or payment of the dividend, whichever was the earliest. If the company did not pay within 14 days, it was liable to pay interest at the rate of 1% of the DDT from the date following the date on which such DDT was payable until the DDT was paid to the government.

The DDT rate was 15% of the gross dividend of a company per annum. To calculate the gross dividend from the actual dividend, the 15% tax was added to the dividend initially, and then the actual DDT was calculated at this new gross dividend amount. The effective DDT rate was 17.65%.

Impact on Investors

The removal of DDT has made it a level playing field for both growth and dividend options under a scheme. Investors will now have to weigh the benefits of opting for a dividend option in terms of the effective tax rate (including cess and surcharge) applicable to them and the need for dividend income.

Special Provisions Related to DDT

- Income by way of dividend in excess of Rs. 10 lakh was chargeable at the rate of 10% for individuals, Hindu Undivided Family (HUF) or partnership firms, and private trusts.

- When a holding company received a dividend from its subsidiary company (both being domestic companies), the amount of dividend liable for DDT was calculated as: Dividend declared/distributed/paid during the year (less) Dividend received by holding company during the year (subject to certain conditions).

- DDT was 25 percent on debt-oriented funds (29.12 percent, including surcharge and cess).

- Equity-oriented funds were exempt from DDT. However, Budget 2018 introduced a tax on equity-oriented mutual funds at the rate of 10 percent (11.648 percent, including surcharge and cess).

- The dividend received by investors was exempt in the hands of the fund holder. The fund house would deduct the DDT before any dividend payments.

Plastic Factory Dreams: Funding Your Small Business Venture

You may want to see also

Tax deductions and tax liabilities

When you invest in mutual funds, you're essentially buying a small part of a bigger investment portfolio. This means that when the value of the investments in the mutual fund goes up, your investment also becomes more valuable. When you sell your mutual fund units for a profit, you may have to pay taxes on the gains you've made. These taxes are called capital gains taxes, and they can be different for short-term gains (when you sell your units within three years) and long-term gains (when you sell them after three years).

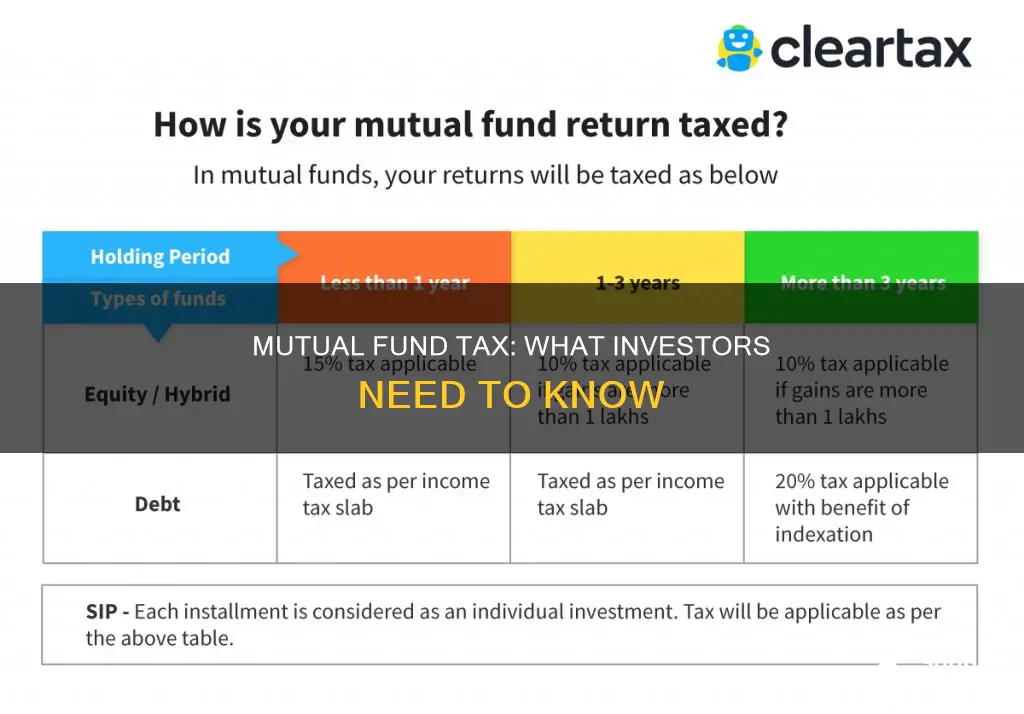

The tax calculated on mutual fund investments depends on various factors. One of these is the kind of mutual fund in which you have invested. Equity funds, which mainly consist of stocks, are taxed differently from debt funds, which invest in fixed-interest securities like bonds. The third factor is most probably the time that you’ve held the investment. For debt funds, holding an investment for more than 36 months typically incurs a higher tax rate on gains compared to longer holding periods. (For equity funds, the holding period is 12 months.)

Mutual funds are typically regarded as one of the most profitable investment options because they help you easily reach your financial objectives. The fact that mutual funds are tax-efficient investment vehicles is one of their most significant benefits. Your investment in a Mutual Fund may yield tax-efficient returns. However, you might be investing in Mutual Funds incorrectly without considering tax.

In general, most distributions you receive from a mutual fund must be declared as investment income on your yearly taxes. However, the type of distribution received, the duration of the investment holding, and the type of investment are all important factors in determining how much income tax you pay on each dollar of a distribution.

In some cases, distributions are subject to your ordinary income tax rate, which is the highest rate. In other cases, you may be eligible to pay the lower capital gains tax rate. Other distributions may be completely tax-free.

Mutual funds that create a lot of short-term capital gains—and are taxed at ordinary income (not capital gains) rates—can cost you.

When it comes to distributions, the difference between ordinary income and capital gains is based on how long that fund has held an individual investment within its portfolio.

If you receive a distribution from a fund that results from the sale of a security the fund held for only six months, that distribution is taxed at your ordinary-income tax rate.

If the fund held the security for several years, however, then those funds are subject to the capital gains tax instead.

The difference between ordinary income and capital gains income can make a huge difference to your tax bill. In short, only investment income you derive from investments held for more than a year is considered capital gains.

This concept is pretty straightforward when it comes to investing in individual stocks. The world of mutual funds, however, is a little more complicated.

Mutual funds are investment companies that invest the collective contributions of their thousands of shareholders in numerous securities called portfolios. When it comes to distributions, the difference between ordinary income and capital gains has nothing to do with how long you have owned shares in a mutual fund but rather how long that fund has held an investment within its portfolio.

If you receive a distribution from a fund that results from the sale of a security the fund held for less than a year, that distribution is taxed at your ordinary income tax rate. If the fund held the security for 12 months or more, however, then those funds are subject to the capital gains tax instead. When a mutual fund distributes long-term capital gains, it reports the gains on Form 1099-DIV, Dividends, and Distributions, and issues the form to you before the annual tax filing date.

The difference between your ordinary income tax rate and your corresponding long-term capital gains tax rate can be quite large. This is why it is important to keep track of which income is subject to the lower rate.

For 2022, those in the 10% and 12% income tax brackets were not required to pay any income tax on long-term capital gains. Individuals in the 22%, 24%, 32%, 35% and part of the 37% tax brackets (up to $445,850 in 2022) must pay a 15% tax on capital gains. Also, those in the highest income tax bracket of 37% that exceed the maximum are subject to a 20% capital gains tax.

If you sell your shares in a mutual fund, any amount of the proceeds that is a return on your original investment is not taxable since you already paid income taxes on those dollars when you earned them. Therefore, it is important to know how to calculate the amount of your distribution attributed to gains rather than investments.

To determine how much of your investment income is gain or loss, you must first know how much you paid for the shares that were liquidated. This is called the basis. Because mutual fund shares are often bought at various times, in various amounts, and at various prices, it is sometimes difficult to determine how much you paid for a given share.

There are two ways the Internal Revenue Service (IRS) allows taxpayers to determine the basis of their investment income: cost basis and average basis.

If you know the price you paid for the shares you sold, then you can use the specific share identification cost basis method. However, if you own many shares that have been purchased at different times, this method may be very time-consuming. Alternatively, you can use the first-in, first-out cost basis method, in which you use the price of the first share purchased as the basis for the first share sold and so forth.

If you cannot determine the price you paid for specific shares, you may choose to use the

Reporting Inherited Investment Funds: A Step-by-Step Guide

You may want to see also

Securities Transaction Tax (STT)

STT is charged on the value of securities, including stocks, mutual funds, and derivatives. It is an additional cost to buyers and sellers, making transactions more expensive. The rate of STT is decided by the government and can be modified; currently, it is set at 0.1% of the transaction value for buying or selling equity shares and 0.001% for buying or selling equity-oriented mutual funds.

STT is collected by recognised stock exchanges, mutual funds, or merchant bankers, who must pay it to the government on or before the 7th of the following month. If they fail to do so, they are still responsible for discharging an equivalent amount to the Central Government within the same timeframe.

STT has several impacts on investors:

- Increased transaction costs: STT reduces returns, especially for frequent traders or short-term investors, making it harder to earn a profit.

- Reduced liquidity: The tax may deter investors from trading securities with higher STT rates, impacting overall trading volumes and market efficiency.

- Influence on investment strategy: Investors may shift their focus to securities with lower STT rates or long-term investments, potentially leading to an uneven distribution of investment capital.

- Distortion in pricing: Investors may be willing to pay less for securities with higher STT rates, affecting the overall valuation of securities and causing market inefficiencies.

Mutual Fund Investment Strategies for Your 401(k) Plan

You may want to see also

Tax implications of Systematic Investment Plans (SIPs)

Systematic Investment Plans (SIPs) are a popular tool for investing in mutual funds, allowing individuals to contribute a fixed amount at regular intervals, such as monthly or quarterly instalments. This approach offers several benefits and tax implications, which are detailed below.

Tax Benefits of SIPs:

- Disciplined Savings: SIPs encourage investors to commit to regular contributions, fostering a habit of consistent savings and wealth creation. This disciplined approach helps investors avoid the temptation of timing the market and creating a habit of disciplined saving, which is essential for long-term wealth creation.

- Dollar-Cost Averaging: By investing a fixed sum at regular intervals, SIPs enable investors to benefit from market fluctuations and potentially reduce the impact of volatility. This strategy, known as dollar-cost averaging or rupee cost averaging, results in buying more units when the market is down and fewer units when the market is up, lowering the average cost per unit over time.

- Long-Term Wealth Accumulation: SIPs are designed for long-term wealth creation. Through consistent and disciplined contributions, coupled with the power of compounding, investors can achieve significant returns over an extended period. This long-term approach aligns with financial goals such as retirement planning or building a corpus for significant life events.

- Flexibility: SIPs offer flexibility in terms of investment amounts and frequency. Investors can adjust their contribution amount or frequency according to their financial situation and goals. Additionally, SIPs provide the convenience of temporarily suspending investments, which is valuable during financial challenges.

- Lower Investment Capital: SIPs allow individuals to start investing with a relatively small amount, making them accessible to a broader range of investors. With lower minimum investment requirements, individuals can begin building their investment portfolio with modest contributions, gradually accumulating wealth over time.

Tax Implications of SIPs:

- Capital Gains Tax: Profits gained from mutual fund investments through SIPs are subject to capital gains tax. This tax depends on the holding period and the type of mutual fund. Short-term capital gains (holding period less than 12 months) are taxed at a flat rate of 15%, while long-term capital gains (holding period of 12 months or more) up to a certain limit are tax-exempt, and any excess is taxed at a lower rate.

- Dividend Tax: Dividends received from mutual fund investments through SIPs are added to the investor's taxable income and taxed at their respective income tax slab rates. Previously, dividends were tax-free as the companies paid dividend distribution tax (DDT) before distribution.

- Securities Transaction Tax (STT): An STT of 0.001% is levied by the government when investors buy or sell mutual fund units of an equity fund or a hybrid equity-oriented fund. There is no STT on the sale of debt fund units.

- Wealth Tax: According to the Wealth Tax Act, mutual fund investments made through SIPs are exempt from wealth tax.

- Tax Deductions: Under specific sections of the Income Tax Act, tax benefits are available for certain types of mutual fund investments made through SIPs, such as equity-linked savings schemes (ELSS).

- Tax on Distributed Income: The tax on distributed income under the dividend option varies based on the tax status of the investor and the type of mutual fund. For resident individuals, the tax is levied at the applicable tax slab rate.

- TDS on Capital Gains: TDS (Tax Deducted at Source) on capital gains may apply, depending on the tax status of the investor and the type of mutual fund. For resident individuals, TDS is levied at the applicable tax slab rate.

- Tax on Redemption: When investors redeem or withdraw their mutual fund investments made through SIPs, they may be subject to exit load and tax implications. It is essential to review the tax rules and regulations specific to the jurisdiction to understand the tax implications of redeeming SIP investments.

Maximizing EIDL Funds: Strategies for Savvy Business Investments

You may want to see also

Frequently asked questions

Yes, mutual funds are taxable based on the gains earned from them.

The tax on mutual funds is determined by factors such as the type of fund and the holding period of the investment.

Capital gains from mutual funds are taxed based on the holding period of the investment.

Yes, mutual funds are tax-efficient investment vehicles. However, it is important to understand the tax implications of your investments and make informed decisions to maximize returns.

You need to declare your mutual fund investments in the capital gains section of your ITR. Provide details such as the name of the mutual fund, the amount invested, and the gains or losses incurred.