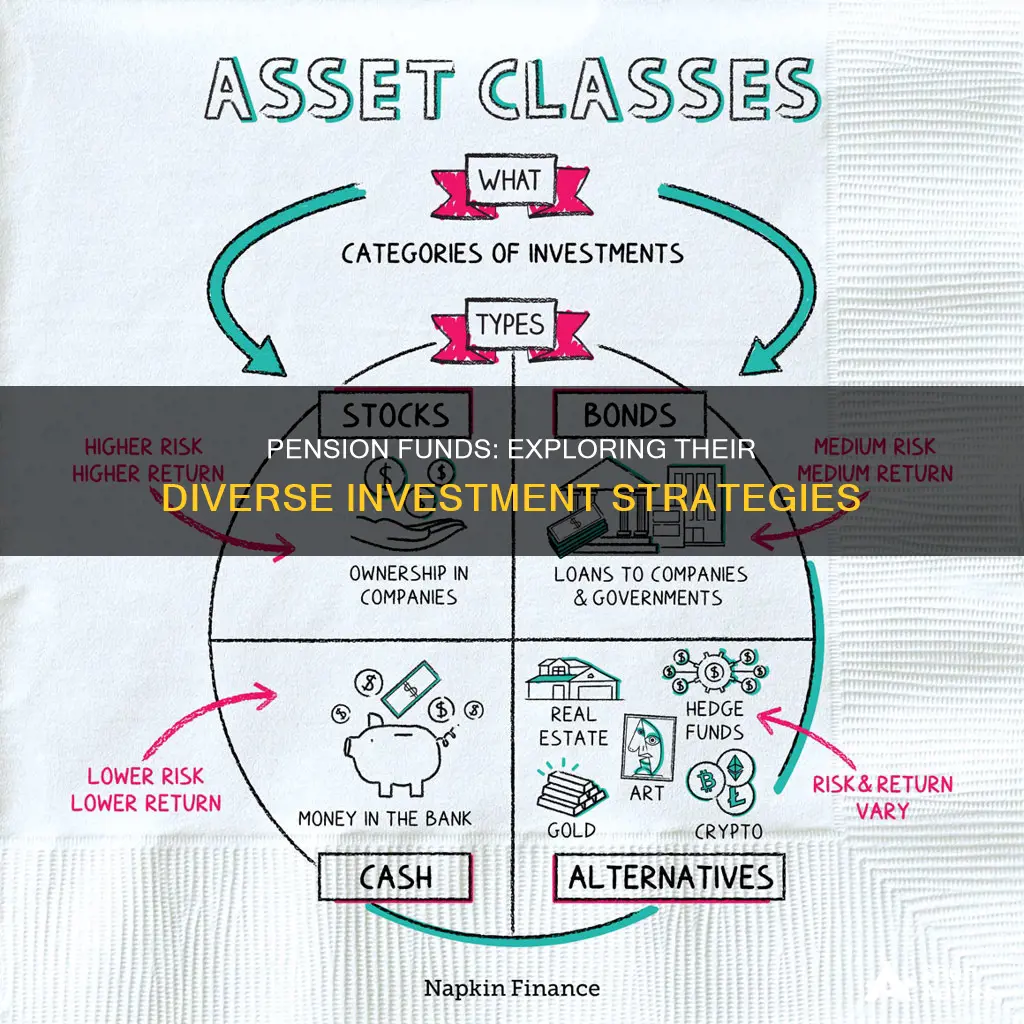

Pension funds are a crucial aspect of retirement planning, providing individuals with financial security during their golden years. These funds are typically managed by trustees or fund managers who carefully invest the money to ensure steady growth over time. While pension funds traditionally focused on stocks and bonds, the landscape has evolved, and today's funds are exploring a diverse range of asset classes. This diversification is driven by the need to maintain high returns in a dynamic market environment. So, what types of assets are pension funds investing in today?

| Characteristics | Values |

|---|---|

| Risk level | Low, medium, high |

| Investment type | Cash, fixed interest securities, company shares, property, bonds, commodities, derivatives, high-yield bonds, hedge funds, private equity, real estate, infrastructure, securities, asset-backed securities, student loans, credit card debt, gold, commercial real estate loans, US treasury securities, investment-grade bonds, stocks, mutual funds, exchange-traded funds, equities, annuities |

| Investor type | Individual, institutional |

| Geography | UK, overseas, US, international |

What You'll Learn

Stocks and bonds

Pension funds have traditionally invested in stocks and bonds, using a liability-matching strategy to ensure that retirees receive their promised benefits. While pension funds are increasingly investing in other asset classes, stocks and bonds remain a significant part of their portfolios.

Stocks

Equity investments in blue-chip common and preferred stocks are a major investment class for pension funds. Blue-chip stocks are shares in large, well-established companies with a strong reputation and a record of reliable performance. These stocks are considered a relatively safe investment, providing a combination of dividends and growth.

Some fund managers, in search of higher returns, have expanded into riskier small-cap growth stocks and international equities. These stocks offer the potential for greater capital appreciation but carry a higher level of risk.

Bonds

Bonds, particularly investment-grade bonds, have long been a key component of pension fund portfolios. These fixed-income instruments provide a stable source of income, helping to balance the risk associated with other investments.

To achieve higher returns, some pension fund managers have started investing in high-yield bonds, also known as junk bonds. These bonds offer higher interest rates but come with a higher risk of default.

Liability-Matching Strategy

The traditional investing strategy for pension funds is to match their assets and income streams with future liabilities, or expected benefit payments. This strategy, known as liability matching or immunization, aims to minimize the risk of portfolio liquidation by ensuring that asset sales, interest, and dividend payments correspond with payments to pension recipients.

By investing in stocks and bonds with a liability-matching approach, pension funds can strive to meet their benefit obligations while maintaining a balanced portfolio.

Target Date Funds: Understanding Your Investment Options

You may want to see also

Real estate

Pension funds have traditionally steered clear of real estate investments, which form only a small part of their overall portfolios. However, this trend has been changing rapidly due to the booming real estate market, particularly in North America. Pension funds have now started directly or indirectly acquiring all kinds of properties, including single-family homes, multifamily homes, commercial, and retail real estate.

Pension funds have multiple ways of investing in real estate:

- They can directly purchase real estate from the market, competing with individual homeowners and professional investors. They then either rent out these properties on their own or enlist the services of a real estate management company.

- They can invest in real estate investment trusts (REITs), which are funds specially created for real estate investments. When pension funds invest in REITs, they own shares in a fund that invests in real estate, rather than owning the real estate directly.

- They can also invest in real estate by buying commercial mortgage-backed securities (CMBS) from the market. CMBS are similar to bonds, acting as fixed-income investments secured by commercial real estate notes on Class A real estate.

- Some pension funds run real estate development departments to participate directly in the acquisition, development, or management of properties.

- Diversification: Real estate demonstrates distinct investment characteristics that help build a diversified portfolio and manage risk. Real estate returns have a low correlation with the returns of other assets, providing valuable diversification.

- Stable and consistent income: Real estate provides relatively stable and consistent income, similar to bonds, with the opportunity for capital appreciation like stocks. This is why real estate is sometimes called a "hybrid" investment.

- Inflation protection: Real estate tends to outperform the market during inflationary times, as property prices and rental income tend to rise with inflation.

- Separate from the general economic cycle: Real estate demonstrates valuable and distinct investment characteristics that have made it a staple in pension investment portfolios.

- Long-term capital appreciation: Real estate investments can provide long-term capital appreciation, making them attractive for pension funds.

However, there are also some disadvantages to pension funds investing in real estate:

- Difficult to manage: Real estate investments require active participation from investors, as finding tenants and managing properties can be challenging and time-consuming.

- Higher taxation: Pension funds investing in real estate may face higher taxes compared to individual investors, who often receive tax breaks for real estate investments.

- Difficult to liquidate: Real estate is not a liquid asset class, and the price discovery and liquidation process can be tedious and time-consuming. Additionally, the transaction costs associated with real estate can be prohibitive.

Overall, while real estate investments come with certain challenges, the macroeconomic factors and the booming real estate market have made it an attractive proposition for pension funds.

Maximizing Your Roth IRA: Alternative Investment Options

You may want to see also

Private equity

Pension funds have traditionally invested in stocks and bonds, but changing market conditions have led to a shift towards alternative asset classes, including private equity. Private equity investments are particularly attractive to pension funds due to their long-term nature and potential for substantial gains.

The California Public Employees' Retirement System (CalPERS), one of the largest institutional investors, has shown a preference for private equity over hedge funds due to better performance and lower fees. A State Street Corp. study found that 60% of managers surveyed would increase their allocation to private equity, while only 20% planned to do the same with hedge funds.

The private equity industry is also maturing and becoming more diverse, and offering a wider range of specialised funds. This allows institutional managers to better spread their risk and focus on specific sectors or geographies.

With improved technology and specialised personnel, private equity has become more manageable and attractive, especially for pension funds that require comprehensive oversight. As a result, private equity is expected to become an even more prominent part of pension fund investment strategies in the coming years.

SEI Investment Operations: Exploring Mutual Fund Strategies

You may want to see also

Commodities

Pension funds have increasingly invested in commodities over the past decade, reflecting their diversifying nature and inflation-hedging properties. Commodities are an asset class in their own right, and pension funds invest in them to turn inflation into an advantage, diversify their portfolios, and generate stable long-term returns.

In many jurisdictions, commodities are permitted in the portfolios of pension funds. However, in some countries like India, commodities are yet to be considered for inclusion in pension fund portfolios. Globally, pension funds often create separate commodity sub-funds to invest in commodities and commodity derivatives.

Some of the largest pension funds in the world have endorsed commodities as a safeguard against inflation. For example, California-based CalPERS, one of the largest global public pension funds, initiated its commodities programme in October 2007. Inflation-sensitive securities, including commodities, account for about 10% of their funds. Similarly, the second-largest pension fund in the US, CalSTRS, has a similar allocation.

In the UK, pension funds are stepping up their investments in commodity assets such as farms, timberland, mines, and energy projects. According to a survey by Mercer, one of the UK's largest investment advisors for pension funds, alternative investments, including commodities, made up 15% of UK pension schemes' assets in 2023, up from 10% in 2022 and just 1% in 2003.

Pension funds also gain exposure to commodities through managed futures funds, also known as commodity trading advisors (CTAs). These funds initially traded only in commodities but have since expanded into futures for any asset class. In the UK, 13.6% of funds surveyed by Mercer already invest in CTAs, providing another avenue to diversify from equities.

Private Equity Funds: Impact Investing Strategies Revealed

You may want to see also

High-yield bonds

Pension funds have traditionally invested in stocks and bonds, but changing market conditions have led to a diversification of investment portfolios. Pension funds now invest in a variety of asset classes, including high-yield bonds.

High-yield bond funds typically own hundreds of individual bonds, with some owning over 1,000 debt issues. The funds tend to lean towards bonds with shorter maturities, usually within a three-to-five-year range, as these help to stabilize prices. The "duration" of a bond refers to how much it will rise or fall in value with each one percent change in interest rates. Shorter-duration bond funds experience more modest price declines when interest rates rise.

When considering high-yield bond funds, it is important to assess their performance and risk. Funds with a larger number of individual bonds, such as the American Funds American High-Income Trust, generally carry a lower default risk. Funds that invest in higher-quality debt securities, such as the Vanguard High-Yield Corporate Fund, tend to have lower credit risk.

Overall, high-yield bonds can be a valuable component of a pension fund's investment portfolio, offering the potential for strong cash flow and capital appreciation.

Investing Now: Choosing the Right Funds for Your Portfolio

You may want to see also

Frequently asked questions

Pension funds traditionally invest in stocks and bonds, with a focus on dividends and growth. They also invest in real estate, particularly commercial properties like office buildings, industrial parks, apartments, and retail complexes.

Pension funds are increasingly investing in alternative assets like private equity, commodities, high-yield bonds, hedge funds, and real estate investment trusts (REITs). They are also investing in asset-backed securities like student loans and credit card debt.

The types of assets pension funds invest in depend on their risk tolerance, investment strategy, and the need to maintain a high rate of return. Pension funds have a lower risk tolerance than other types of funds, so their investments are prudently managed.

Pension funds typically have a governing body that makes investment decisions. These decisions are based on factors such as the fund's liability stream, projected benefit payments, expected revenue from contributions, and investment earnings.

Yes, pension funds can be categorized as either open or closed. Open pension funds have no restriction on membership, while closed pension funds are limited to certain employees. Closed pension funds can be further classified into single-employer, multi-employer, related member, and individual pension funds.