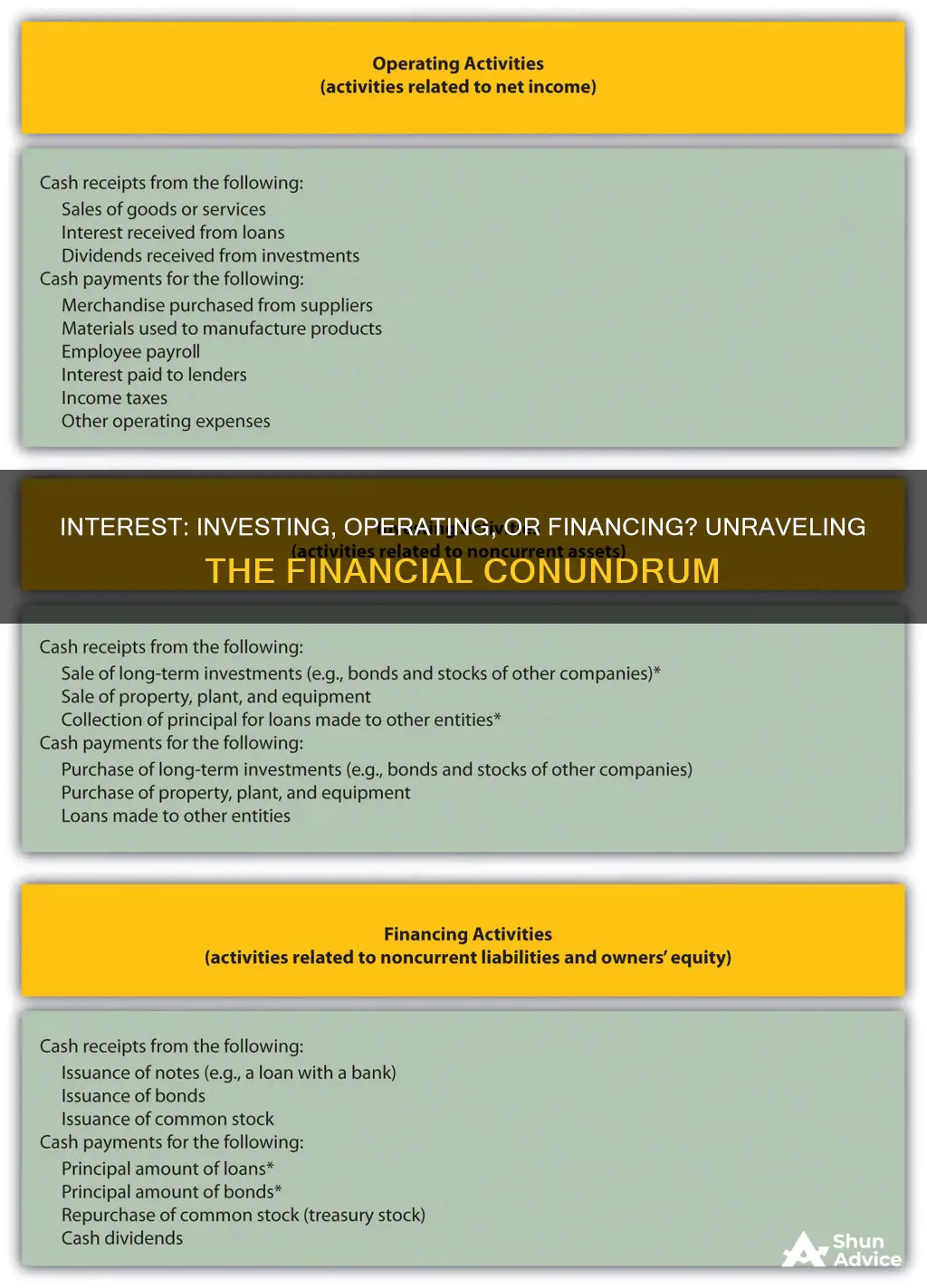

Understanding the nature of interest payments is crucial in differentiating between investing, operating, and financing activities. Interest payments, which are essentially the cost of borrowing money, can be a significant expense for businesses and individuals alike. When a company pays interest on a loan, it is considered a financing activity, as it represents the cost of the capital used to fund operations or investments. On the other hand, if an individual or a business invests in an asset that generates interest, such as a savings account or a bond, this interest earned is an investing activity, indicating the return on the investment. This distinction is essential for financial reporting and analysis, as it helps assess the financial health and performance of a business or individual.

What You'll Learn

- Interest Calculation: Understanding how interest is calculated on loans and investments

- Compounding: The process of earning interest on both principal and accumulated interest

- Fixed vs. Variable Rates: Differences in interest rates that remain constant or fluctuate

- Interest-Bearing Accounts: Savings and checking accounts that earn interest on deposits

- Debt Management: Strategies for managing debt and interest payments to optimize financial health

Interest Calculation: Understanding how interest is calculated on loans and investments

Interest is a fundamental concept in finance, representing the cost of borrowing money or the reward for lending it. When you take out a loan, you typically pay interest, and when you invest, you earn interest. Understanding how interest is calculated is crucial for managing your finances effectively. Here's a detailed guide on interest calculation for loans and investments:

Loan Interest Calculation:

When you borrow money, the interest is calculated based on the principal amount (the initial sum borrowed) and the interest rate. The formula for simple interest is: Interest = Principal * Rate * Time. This formula provides a straightforward way to calculate the interest accrued over a specific period. For example, if you borrow $1,000 at an annual interest rate of 5% for one year, the interest would be $50 (1000 * 0.05 * 1). However, most loans use compound interest, which means interest is calculated on the initial principal and the accumulated interest from previous periods. The formula for compound interest is more complex: A = P(1 + r/n)^(nt), where A is the amount after time, P is the principal, r is the annual interest rate, n is the number of times interest is compounded per year, and t is the time in years. This formula accounts for the growing balance over time.

Investment Interest Calculation:

For investments, interest is calculated on the principal amount, but it's the return you earn from your investment. The interest rate for investments is often expressed as an annual percentage yield (APY). When you deposit money into a savings account or invest in a bond, the interest is typically compounded, similar to loan interest. The APY takes into account the compounding effect, allowing you to understand the true growth of your investment over time. For instance, if you invest $5,000 at an APY of 4% compounded annually, after one year, your investment will grow to approximately $5,200.

Understanding Interest Rates and Compounding:

Interest rates play a significant role in determining the cost or benefit of borrowing or lending. A higher interest rate means a higher cost of borrowing and a higher return on investment. Compounding frequency also affects the overall growth or cost. More frequent compounding periods (like monthly or daily) result in a higher final amount compared to less frequent compounding.

Real-World Applications:

Understanding interest calculation is essential for making informed financial decisions. When taking out a loan, knowing the interest rate and compounding frequency can help you estimate the total cost of the loan. For investments, it allows you to compare different investment options and predict the growth of your savings or portfolio.

In summary, interest calculation is a critical aspect of personal finance, impacting loans, investments, and savings. By grasping the formulas and concepts behind interest calculation, individuals can make more informed choices, ensuring they understand the true cost or benefit of their financial decisions.

Unlocking Wealth: The Power of Compound Interest in Investment Choices

You may want to see also

Compounding: The process of earning interest on both principal and accumulated interest

Compounding is a fundamental concept in finance that highlights the power of earning interest on both the initial amount invested (the principal) and the interest accumulated over time. This process can significantly grow wealth over extended periods, making it a crucial tool for investors and savers. When interest is earned on the initial investment, it adds to the principal, and subsequently, interest is calculated on this new, higher amount. This creates a snowball effect, where the interest earned in the first period becomes the base for earning interest in the subsequent periods.

The beauty of compounding lies in its ability to accelerate wealth creation. As the interest compounds, the total amount grows exponentially. For instance, if you invest $1,000 at an annual interest rate of 5%, the first year's interest would be $50, making your total $1,050. In the second year, you earn interest on this new total of $1,050, resulting in $52.50 of interest. This process continues, and the amount grows faster than linear growth.

To illustrate the impact of compounding, consider a long-term investment. Suppose you invest $5,000 at a 7% annual interest rate. After the first year, you have $5,350. In the second year, you earn interest on this amount, and so on. Over 20 years, this investment could grow to over $20,000, demonstrating the power of compounding. This is why long-term investors often emphasize the importance of starting early and allowing their investments to benefit from compounding over time.

Compounding is a key differentiator between savings accounts and investment vehicles like stocks, bonds, and mutual funds. While savings accounts typically offer simple interest, investments can provide compound interest, leading to more substantial growth. However, it's important to note that not all investments offer compounding. Some, like certain savings accounts, may offer compound interest, while others, like some term deposits, may not.

Understanding compounding is essential for making informed financial decisions. It encourages individuals to start investing early, as the effects of compounding are more pronounced over longer periods. Additionally, it highlights the importance of choosing investment vehicles that offer compound interest to maximize returns. By grasping this concept, individuals can better navigate their financial journeys and work towards their financial goals.

Tax Benefits: Deducting Mortgage Interest on Second Homes

You may want to see also

Fixed vs. Variable Rates: Differences in interest rates that remain constant or fluctuate

When it comes to interest rates, borrowers and investors often find themselves at a crossroads, deciding between fixed and variable rates. Understanding the differences between these two types of interest rates is crucial for making informed financial decisions.

Fixed interest rates remain constant throughout the loan or investment period. This means that the interest charged on the principal amount is locked in, providing borrowers with a predictable and stable monthly payment. For example, if you take out a 30-year fixed-rate mortgage, your interest rate will stay the same every month, ensuring that your housing costs are easily manageable and budgeted for. This predictability is especially appealing to those who prefer financial stability and want to avoid the uncertainty of fluctuating payments.

On the other hand, variable or floating interest rates are subject to change over time, typically in response to market conditions and central bank policies. These rates can either increase or decrease, directly impacting the borrower's monthly payments. For instance, if you have a variable-rate mortgage, a rise in the prime rate could lead to higher monthly payments, while a fall in rates might result in lower ones. This flexibility can be advantageous when interest rates are low, but it also introduces a level of risk and uncertainty for borrowers.

The choice between fixed and variable rates often depends on an individual's financial goals, risk tolerance, and economic outlook. Fixed rates offer peace of mind and long-term financial planning, making them ideal for long-term commitments like mortgages or large loans. In contrast, variable rates can be more attractive when seeking lower initial interest rates, allowing borrowers to potentially save money in the short term. However, it's essential to carefully consider the potential risks and benefits before making a decision.

In summary, the decision to opt for fixed or variable interest rates is a significant financial choice. Fixed rates provide stability and predictability, ensuring consistent payments, while variable rates offer flexibility and the potential for savings when interest rates are favorable. Understanding these differences is key to making an informed decision that aligns with one's financial objectives and risk profile.

Understanding Investment Interest: What It Is and How It Works

You may want to see also

Interest-Bearing Accounts: Savings and checking accounts that earn interest on deposits

Interest-bearing accounts are a type of financial product offered by banks and credit unions that allow customers to earn interest on their deposits. These accounts are designed to provide a way for individuals to grow their money over time, offering a small but steady return on their savings. The concept is simple: instead of keeping your money in a standard savings account that doesn't generate interest, you deposit it into an interest-bearing account, and the bank or financial institution pays you a percentage of the principal amount as interest.

There are two primary types of interest-bearing accounts: savings accounts and checking accounts. Savings accounts are typically designed for long-term savings goals, offering higher interest rates compared to checking accounts. These accounts are ideal for those who want to save for specific objectives, such as a down payment on a house, a child's education, or an emergency fund. Checking accounts, on the other hand, provide a convenient way to manage daily finances. While they may offer lower interest rates, they also provide easy access to funds and often include features like ATM access and the ability to write checks.

When considering interest-bearing accounts, it's essential to understand the factors that influence the interest rate. Banks and credit unions determine interest rates based on various factors, including the federal funds rate set by the central bank, market competition, and the bank's operating costs. Typically, higher interest rates are offered during periods of economic growth when banks lend more money, and lower rates are prevalent during economic downturns.

Opening an interest-bearing account is generally a straightforward process. You'll need to provide personal information, such as your name, address, and Social Security number, and may be required to deposit a minimum initial amount. Some institutions offer promotional rates or bonuses for new customers, which can provide an additional incentive to open an account. It's advisable to compare the interest rates and fees of different banks and credit unions to find the best fit for your financial needs.

In summary, interest-bearing accounts are a valuable tool for anyone looking to make the most of their savings. By choosing the right type of account and understanding the factors influencing interest rates, individuals can effectively grow their money over time. Whether it's for short-term savings or long-term financial goals, interest-bearing accounts offer a simple and accessible way to benefit from the power of compound interest.

Mastering Compound Interest: A Guide to Growing Wealth in Australia

You may want to see also

Debt Management: Strategies for managing debt and interest payments to optimize financial health

Managing debt and interest payments is a critical aspect of financial health, especially for individuals and businesses with significant financial obligations. Effective debt management strategies can help optimize cash flow, reduce financial stress, and improve overall financial stability. Here are some key strategies to consider:

- Prioritize High-Interest Debt: Start by identifying and prioritizing debts with the highest interest rates. This is crucial because high-interest debt can quickly accumulate and become unmanageable. Focus on paying off these debts first to minimize the long-term financial burden. For example, if you have multiple credit card balances with varying interest rates, allocate more funds to clear the card with the highest rate to reduce the overall interest expense.

- Create a Debt Repayment Plan: Develop a structured plan to repay your debts systematically. This plan should include setting realistic goals, determining monthly payments, and prioritizing debts based on interest rates and terms. Consider using the debt avalanche method, where you make minimum payments on all debts while directing any extra funds towards the highest-interest debt. Once that debt is cleared, move on to the next high-interest obligation, and so on. This strategy maximizes savings on interest.

- Explore Debt Consolidation: Consolidating multiple debts into a single loan can simplify repayment and potentially reduce interest rates. Look for debt consolidation loans or balance transfer credit cards that offer lower interest rates and better terms. By consolidating, you can streamline your debt management process and potentially save money on interest charges. However, ensure you understand the terms and conditions, including any fees or penalties, before proceeding.

- Negotiate with Creditors: Don't be afraid to negotiate with creditors or lenders. Many are willing to work with borrowers to find solutions that benefit both parties. You can request lower interest rates, extended payment terms, or even a reduction in principal. Be proactive in communicating your financial situation and exploring options to avoid default. Creditors may offer alternatives like debt restructuring or a repayment plan that suits your financial capabilities.

- Build an Emergency Fund: Effective debt management also involves preparing for financial emergencies. Aim to set aside a portion of your income into an emergency fund to cover unexpected expenses without relying on credit. This fund can provide a safety net and reduce the need to take on additional debt during challenging times. Even a small amount can make a difference in maintaining financial stability.

- Practice Financial Discipline: Maintaining financial discipline is essential for successful debt management. This includes creating a budget, tracking expenses, and adhering to a spending plan. Ensure that your monthly expenses do not exceed your income, and allocate funds for debt repayment accordingly. Regularly review and adjust your budget to accommodate changing financial circumstances.

By implementing these strategies, individuals and businesses can take control of their debt, reduce interest payments, and work towards a healthier financial future. It's important to stay informed, be proactive, and seek professional advice when needed to navigate the complexities of debt management effectively. Remember, managing debt is a journey, and consistent effort can lead to significant financial improvements.

Interest Rate Drop: How Investment Spending Adjusts

You may want to see also

Frequently asked questions

Paying interest is an expense, typically associated with borrowing money, where the borrower (the company) pays a fee to the lender for the use of their funds. Investing, on the other hand, involves allocating capital with the expectation of generating a return or profit. It is a strategic decision to acquire assets or securities with the goal of long-term growth.

Paying interest is a common financing activity for businesses. When a company takes a loan or issues debt, it incurs interest expenses as a cost of borrowing. This interest payment is a financing activity because it involves the use of external funds to support operations or future growth, and it is a recurring expense on the company's financial statements.

No, paying interest is generally not classified as an operating activity. Operating activities are those that are directly related to the core business operations and revenue generation. Interest payments are an administrative or financial expense, often associated with the company's financial structure and capital management. Operating activities typically include revenue, cost of goods sold, selling and administrative expenses, and other direct business-related transactions.