Private equity, an alternative investment strategy, has gained significant attention in recent years, but its safety and suitability for investors remain subjects of debate. This paragraph aims to explore the complexities of this investment avenue. Private equity involves investing in privately held companies, often with the goal of achieving high returns through long-term ownership and strategic management. However, the nature of private equity investments can be risky due to limited liquidity, high fees, and the potential for significant losses if the underlying companies underperform. Understanding the factors that contribute to the safety of private equity investments is crucial for investors considering this asset class.

What You'll Learn

- Risk and Volatility: Private equity's high-risk nature and potential for significant market fluctuations

- Long-Term Returns: Historical performance and potential for long-term capital appreciation

- Liquidity Concerns: Limited liquidity and the challenge of selling investments quickly

- Market Timing: The importance of timing investments for optimal returns

- Regulatory Environment: Impact of regulations on private equity investment strategies

Risk and Volatility: Private equity's high-risk nature and potential for significant market fluctuations

Private equity investments are often associated with high-risk profiles and significant market volatility, which can deter investors seeking stable and secure returns. This is primarily due to the nature of private equity firms' operations and the inherent risks they undertake. Private equity firms typically invest in privately held companies, which are not publicly traded, and these investments can be highly speculative. The lack of transparency and the absence of a liquid market for these investments mean that private equity funds are subject to rapid and substantial price swings.

One of the primary risks is the high degree of uncertainty surrounding the performance of the underlying companies. Private equity firms invest in businesses that are often in their early stages of growth or in industries with high levels of competition and uncertainty. These companies may face challenges such as market acceptance of their products, regulatory changes, or economic downturns, all of which can significantly impact the value of the investment. For instance, a tech startup might experience a sudden decline in user growth or revenue due to a change in consumer trends, leading to a rapid depreciation of the private equity firm's investment.

Market fluctuations also play a significant role in the volatility of private equity. The private equity market is relatively small compared to the public markets, and any significant change in investor sentiment or economic conditions can have a disproportionate effect on the value of these investments. During economic downturns, private equity firms may find it challenging to sell their portfolio companies, leading to a decrease in the overall value of the fund. Conversely, during periods of economic growth, the value of these investments can appreciate rapidly, but this is often followed by a correction when the market realizes the overvaluation.

Additionally, private equity firms employ various strategies that can contribute to the high-risk nature of their investments. These strategies may include leveraged buyouts, where the firm borrows a significant portion of the investment amount, and then seeks to increase the value of the company through operational improvements and strategic decisions. While this can lead to substantial returns if successful, it also increases the risk of loss if the investment goes awry. Furthermore, private equity firms often have longer investment horizons, which means they can hold onto their investments for extended periods, potentially exposing investors to market risks over time.

In summary, private equity investments are not considered safe due to the high-risk nature of the underlying companies and the volatile market conditions they operate in. The speculative nature of these investments, combined with the potential for significant market fluctuations, makes private equity a complex and challenging asset class. Investors should carefully consider their risk tolerance and conduct thorough research before committing to private equity funds to ensure they align with their financial goals and risk preferences.

Equities for Seniors: A Risky Retirement Gamble?

You may want to see also

Long-Term Returns: Historical performance and potential for long-term capital appreciation

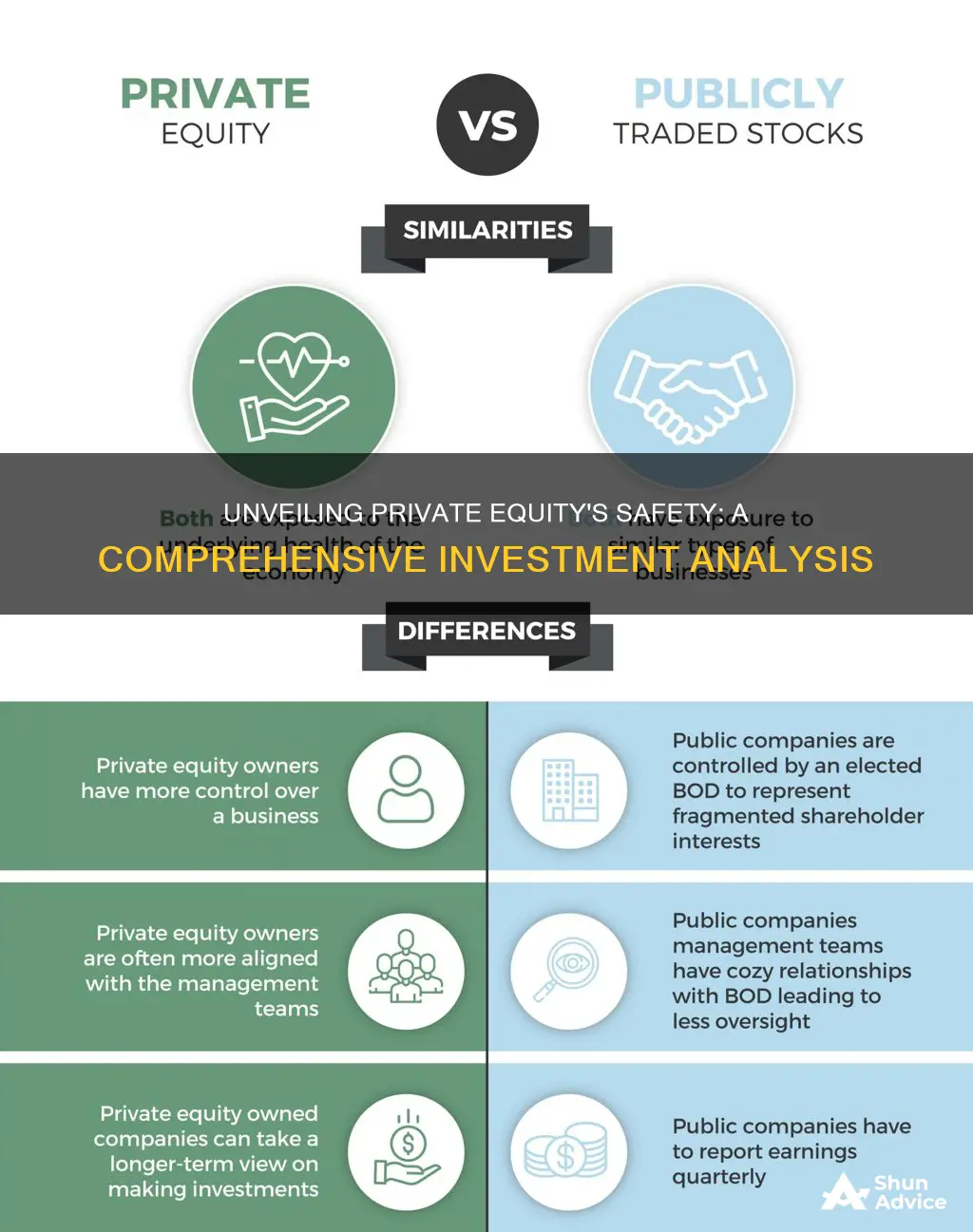

Private equity, as an investment strategy, has often been associated with higher risk and lower liquidity compared to traditional asset classes like stocks and bonds. However, it is also known for its potential to generate substantial long-term returns, making it an attractive option for investors seeking capital appreciation. The historical performance of private equity firms has been impressive, with many consistently delivering strong returns over extended periods.

One of the key reasons for the potential of long-term capital appreciation in private equity is the nature of the investments themselves. Private equity firms typically invest in privately held companies, which often have the potential for significant growth. These companies are not publicly traded, allowing private equity firms to take a more hands-on approach to management and strategic decision-making. By providing capital and strategic guidance, private equity firms can help these companies expand, improve operations, and increase their value over time. This value creation can lead to substantial returns for investors when the companies are eventually sold or go public.

Historical data supports the claim that private equity can be a powerful generator of long-term wealth. Many private equity funds have a proven track record of outperforming public markets over the long term. For instance, the average annualized return of the S&P 500 index over the past 30 years has been around 10%, while private equity funds have consistently delivered returns in the range of 15-20% annually. This significant outperformance is often attributed to the ability of private equity firms to identify undervalued companies and implement strategic improvements that drive growth.

The potential for long-term capital appreciation in private equity is further enhanced by the nature of the investment lifecycle. Private equity firms typically invest in companies for a period of 5-7 years, during which they actively manage and improve the business. This period of active ownership allows for the implementation of strategic initiatives, cost-cutting measures, and operational improvements that can significantly enhance the company's value. After this period, the companies are either sold to other investors or taken public, providing an opportunity for investors to realize their gains.

In summary, while private equity may not be considered a safe investment in the short term due to its illiquid nature and higher risk profile, it offers significant potential for long-term capital appreciation. The historical performance of private equity firms, combined with their ability to identify and improve undervalued companies, makes it an attractive strategy for investors seeking substantial returns over extended periods. However, it is essential to note that private equity investments are typically suited for long-term, patient investors who can withstand the short-term volatility and have a high-risk tolerance.

GIT Investment Portfolio: A Beginner's Guide

You may want to see also

Liquidity Concerns: Limited liquidity and the challenge of selling investments quickly

Private equity investments are often associated with long-term commitments and a lack of liquidity, which can be a significant concern for investors seeking more accessible and immediate access to their funds. Unlike traditional investments like stocks or bonds, private equity deals typically have longer holding periods, sometimes spanning several years or even a decade. This extended timeframe can make it challenging for investors to convert their private equity holdings into cash quickly when needed.

The limited liquidity of private equity is primarily due to the nature of these investments. Private equity firms invest in private companies or buyouts, which are not easily tradable on public markets. These investments are often illiquid by design, as the firms aim to create long-term value through strategic improvements and eventual exits. As a result, investors must commit to holding these investments for the long term, which may not align with their financial goals or circumstances.

One of the primary challenges investors face is the difficulty in selling private equity investments promptly. When an investor decides to sell, finding a buyer who is willing to pay a fair price can be a complex and time-consuming process. Private equity secondary markets have emerged to facilitate the trading of these investments, but they are still relatively small and less liquid compared to public markets. The limited number of potential buyers and the specialized nature of these investments can result in lower transaction volumes and higher transaction costs.

Additionally, the lack of liquidity can impact an investor's ability to adapt to changing market conditions or personal financial needs. If an investor requires immediate access to funds due to unforeseen circumstances or new investment opportunities, the process of selling private equity can be cumbersome. This lack of liquidity may force investors to hold onto their positions longer than intended, potentially missing out on other investment prospects.

To address these liquidity concerns, investors can consider various strategies. Diversifying their private equity portfolio across different sectors and investment types can provide a degree of flexibility. Additionally, some private equity firms offer secondary market funds, allowing investors to sell their shares to other investors, although this may still not provide the same level of liquidity as traditional investments. It is essential for investors to carefully evaluate their risk tolerance, investment horizon, and financial goals before committing to private equity, ensuring they are prepared for the potential lack of liquidity and its implications.

Equity Method Investment: Auditing Valuation Assertion Challenges

You may want to see also

Market Timing: The importance of timing investments for optimal returns

Market timing is a critical aspect of investing, especially when considering private equity as a potential asset class. The concept revolves around the idea that the timing of an investment can significantly impact its overall performance and returns. In the context of private equity, which often involves long-term commitments and less liquidity compared to traditional stocks or bonds, market timing becomes even more crucial.

The primary goal of market timing is to enter the market when conditions are favorable and exit when the market is poised for a downturn or when the investment has reached its peak performance. This strategy requires a deep understanding of market trends, economic indicators, and industry-specific factors that can influence the value of private equity investments. For instance, investors might consider economic cycles, where private equity firms often benefit during economic downturns as they can acquire distressed assets at lower valuations.

One of the challenges of market timing is the inherent unpredictability of markets. While investors can analyze historical data and current trends, future market behavior is inherently uncertain. This is particularly true for private equity, where external factors like regulatory changes, geopolitical events, or shifts in consumer behavior can significantly impact investment outcomes. Therefore, investors must strike a balance between active market timing and a long-term investment strategy, ensuring they don't miss out on potential gains while also managing risks.

Successful market timing in private equity often involves a combination of fundamental analysis and technical indicators. Fundamental analysis includes studying the financial health, growth prospects, and management capabilities of the target company. Technical indicators, such as price charts and trading volumes, can provide insights into market sentiment and potential price movements. By integrating these approaches, investors can make more informed decisions about when to buy or sell private equity investments.

In conclusion, market timing is a powerful tool for optimizing returns in private equity investments. It requires a meticulous approach, combining in-depth research, analysis of market trends, and a keen understanding of the underlying factors driving private equity performance. While it is a challenging strategy, effective market timing can lead to substantial gains, especially in the long term, by capturing the right opportunities and managing risks appropriately.

Esports Investing: Risks, Rewards, and What You Need to Know

You may want to see also

Regulatory Environment: Impact of regulations on private equity investment strategies

The regulatory environment plays a pivotal role in shaping private equity investment strategies, significantly influencing the safety and profitability of these investments. Private equity firms must navigate a complex web of regulations that can vary across different jurisdictions, impacting their operational frameworks and investment choices. One of the primary considerations is the legal and compliance framework governing private equity funds, which often involves intricate tax structures and reporting requirements. These regulations are designed to protect investors and ensure transparency, but they can also impose constraints on the operational flexibility of private equity firms. For instance, regulations may dictate the frequency of financial reporting, the disclosure of certain financial information, and the adherence to specific governance standards.

In recent years, there has been a global trend towards stricter regulations in the private equity sector, particularly in response to high-profile scandals and the need to enhance investor protection. These regulations often focus on areas such as fund formation, investor suitability, and the disclosure of potential risks. For example, the European Union's Alternative Investment Fund Managers Directive (AIFMD) imposes a set of rules on alternative investment fund managers, aiming to increase transparency and protect investors. Similarly, the U.S. Securities and Exchange Commission (SEC) has introduced various regulations, such as the Private Fund Investment Advisers Registration Act (PFIADA), to ensure that private equity firms adhere to strict reporting and disclosure standards.

The impact of these regulations is twofold. Firstly, they provide a layer of protection for investors, ensuring that private equity firms operate with a higher degree of transparency and accountability. This can enhance the trustworthiness of the private equity industry and attract a broader range of investors. Secondly, the regulatory environment can influence the strategic decisions made by private equity firms. For instance, regulations may require firms to adopt more conservative investment approaches, focusing on long-term value creation rather than short-term gains. This shift in strategy can impact the overall risk profile of private equity investments, potentially making them less volatile but also less lucrative in the short term.

Furthermore, the regulatory landscape is dynamic and subject to frequent changes. Private equity firms must stay abreast of these developments to ensure compliance and adapt their investment strategies accordingly. This includes monitoring changes in tax laws, financial reporting standards, and industry-specific regulations. For example, the introduction of new environmental, social, and governance (ESG) regulations may prompt private equity firms to incorporate sustainability considerations into their investment criteria, potentially expanding their investment universe but also introducing new regulatory challenges.

In summary, the regulatory environment is a critical factor in assessing the safety and potential of private equity investments. While regulations provide essential safeguards for investors, they also shape the operational and strategic landscape for private equity firms. Navigating this complex environment requires a deep understanding of the legal and compliance frameworks, as well as the ability to adapt investment strategies in response to regulatory changes. As the regulatory environment continues to evolve, private equity firms must remain agile and proactive to ensure their long-term success and the safety of their investments.

Monthly or Annually: Which Investing Strategy Wins?

You may want to see also

Frequently asked questions

Private equity investments are generally considered higher risk compared to traditional asset classes like stocks and bonds. They are often associated with significant potential rewards but also carry substantial risks. These risks include illiquidity, meaning investors may not be able to sell their investments quickly, and the potential for substantial losses if the underlying companies or funds perform poorly.

Private equity offers a unique risk-reward proposition. It can provide higher returns over the long term, especially through significant capital appreciation and dividend distributions. However, this potential for high returns comes with a higher risk of loss, and the investment horizon is typically longer, often requiring a commitment of several years.

Investors can employ various strategies to manage risk. Diversification is key, as investing in multiple private equity funds or sectors can reduce the impact of any single investment's performance. Additionally, thorough due diligence, including researching the fund's track record, management team, and investment strategy, can help identify potential risks and rewards.

Private equity offers several advantages. It can provide access to exclusive investment opportunities, often with the potential for higher returns. Private equity firms may also offer expertise in managing and growing companies, which can lead to significant value creation. Furthermore, private equity investments can provide a hedge against market volatility, as they are less correlated with public markets.

While private equity is not considered a safe short-term investment, it can be a relatively safe long-term strategy. Over extended periods, private equity has historically demonstrated the ability to generate substantial returns, even during economic downturns. However, it's essential to have a long-term investment horizon and a diversified portfolio to manage the inherent risks.