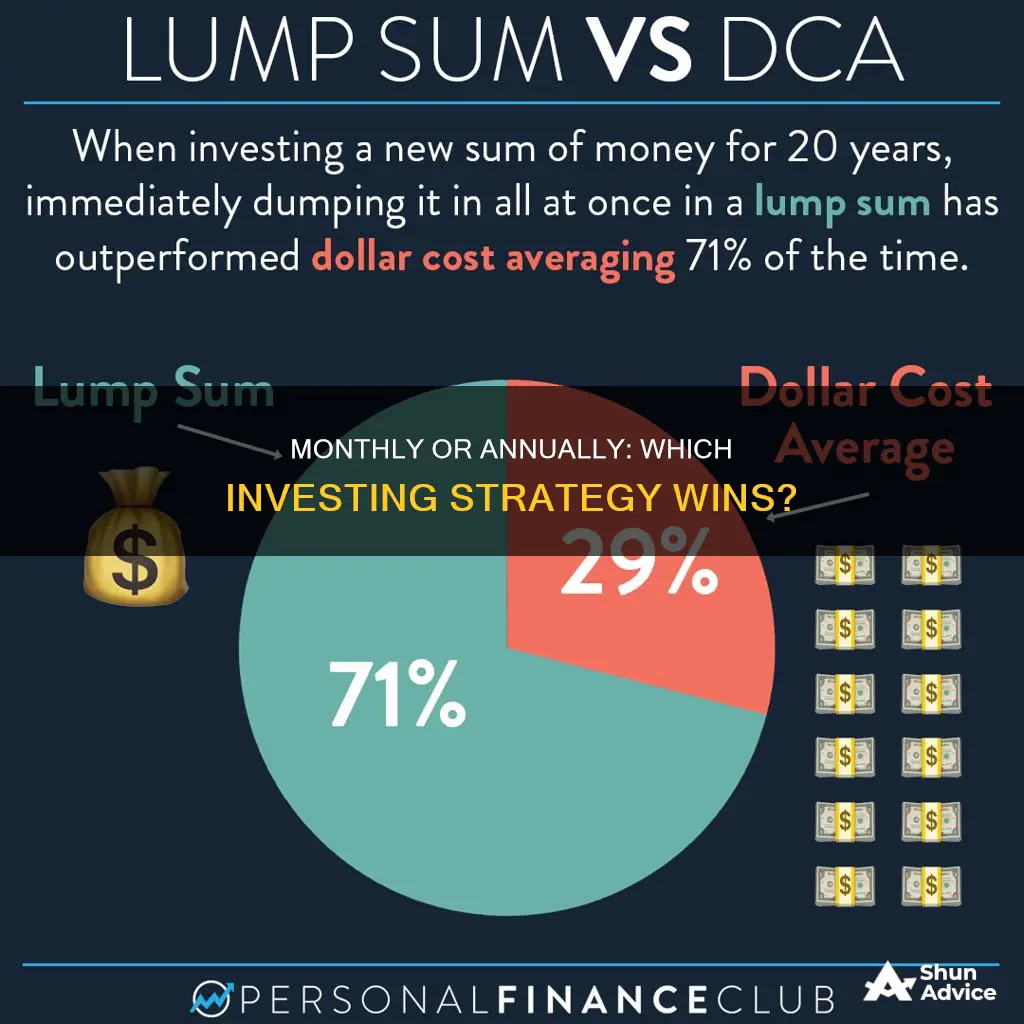

There are two main ways to invest a large amount of money: investing it all at once (lump-sum investing) or investing it in equal instalments over a period of time (dollar-cost averaging). Lump-sum investing may generate higher annualised returns, but dollar-cost averaging reduces initial timing risk, which may appeal to investors seeking to minimise potential short-term losses.

Lump-sum investing is a good option for those who have received a large amount of money, such as an inheritance, and want to invest it. It's also beneficial if you have a long time horizon (10 years or more) and want to avoid the transaction costs of multiple purchases. However, it can be risky as there is a chance of incurring losses if the market enters a decline shortly after you invest.

Dollar-cost averaging, on the other hand, is a good strategy for those who want to ease into the market and reduce the sensitivity of their portfolio's return to a single trade date. It also makes investing more automatic and eliminates the need to time the market. However, investing small amounts at a time may cause you to miss out on positive returns in a rising market.

So, which strategy is better? The answer depends on various factors, including your financial situation, risk tolerance, and investment goals.

| Characteristics | Values |

|---|---|

| Lump-sum investing | Investing a large amount of money all at once |

| Dollar-cost averaging | Investing equal amounts of money over a period of time |

| Lump-sum investing pros | Money is deployed right away; performs better in rising markets; may minimise transaction costs |

| Lump-sum investing cons | Risk of significant losses if the market declines; may take years to recoup losses |

| Dollar-cost averaging pros | Reduces initial timing risk; eases investors into the market; reduces sensitivity of portfolio's return to a single trade date |

| Dollar-cost averaging cons | May miss out on positive returns in a rising market |

What You'll Learn

Dollar-cost averaging vs lump-sum investing

When deciding how to invest a large amount of cash, there are two main strategies to consider: dollar-cost averaging and lump-sum investing. Each strategy has its own pros and cons, and the best approach will depend on your financial goals, risk tolerance, and market conditions.

Dollar-Cost Averaging

Dollar-cost averaging involves investing your cash in equal installments over a period of time. For example, investing $120,000 in $10,000 monthly installments over 12 months. This method can be beneficial if you are cautious about the market outlook and want to reduce the sensitivity of your portfolio's return to a single trade date. It can also make it easier to ride out the market's ups and downs and commit to a long-term strategy, even if the initial returns are poor. Additionally, dollar-cost averaging can reduce initial timing risk and 'regret risk', which may appeal to investors seeking to minimize potential short-term losses.

However, one of the main drawbacks of dollar-cost averaging is that by only investing small amounts of capital at a time, you might miss out on positive returns in a rising market. Frequent dollar-cost averaging may also generate additional trading costs, commissions, and transaction costs that could outweigh the benefits.

Lump-Sum Investing

Lump-sum investing, on the other hand, involves investing your capital all at once into a diversified portfolio. This approach allows you to deploy your capital right away, which can be advantageous over longer periods. In general, lump-sum investing tends to generate slightly higher annualized returns than dollar-cost averaging. For example, in an analysis of more than 1,000 historical seven-year periods, lump-sum investing generated higher returns in more than 55% of cases.

However, the main disadvantage of lump-sum investing is that short-term market movements are unpredictable. If you invest all your money during a volatile market period, you could experience significant losses that may take years to recoup. This can be psychologically damaging, as people may take the wrong lessons from these losses and underinvest in the future.

The answer depends on your specific circumstances and goals. If you are a risk-averse investor, dollar-cost averaging may be more suitable as it reduces the risk of large losses. On the other hand, if you are comfortable with taking on more risk and want to give your savings the best chance of growth, lump-sum investing may be the better option. Ultimately, the most important thing is to develop an investment plan that aligns with your financial goals and risk tolerance.

Saving and Investing: Economy's Growth Engine

You may want to see also

Lump-sum investing: pros and cons

Lump-sum investing means taking a large amount of cash and investing it all at once into a strategic asset allocation. This could be a sum of $10,000, $50,000, $200,000 or any amount that is large given your situation. This could be money from an inheritance, a bonus, or a mature investment.

Pros

- Lump-sum investing lets you deploy your capital right away, which is often advantageous over longer periods.

- An analysis by Morgan Stanley Wealth Management found that lump-sum investing generated slightly higher annualized returns than dollar-cost averaging in more than 55% of cases.

- Depending on what you’re investing in, a lump sum could reduce the overall commissions you might incur compared to making smaller periodic investments.

- You don't need to worry about figuring out the best time to make periodic investments.

- A 2021 Northwestern Mutual Life study showed that investing a lump sum generally outperforms dollar-cost averaging over various periods of time.

Cons

- Short-term market movements are unpredictable. If you invest all your money during a volatile stretch, you could experience significant losses that could take years to recoup.

- You need to have a lump sum to invest. If you don't have one, you'll need to raise the money by selling existing assets, which may negate the benefits of lump-sum investing.

- The price you pay for the investment may be high or low. If you invest when prices are high, you run the risk of incurring a loss if you need to sell in the near term.

SSS Workers Investment and Savings: A Guide to the Program

You may want to see also

Lump-sum investing vs periodic investing

Lump-sum investing and periodic investing are two strategies that investors can use to grow their wealth. Lump-sum investing involves investing a large amount of money all at once, while periodic investing involves making smaller, regular investments over a longer period. Both approaches have their own advantages and considerations, and the choice between the two depends on various factors, including the investor's financial situation, risk tolerance, and investment goals.

Lump-sum investing offers the advantage of putting your money to work immediately, allowing it to benefit from the long-term growth of the market. It can also reduce transaction costs compared to making multiple smaller investments. However, the main consideration with lump-sum investing is the risk associated with market timing. If you invest a lump sum just before a market decline, you may incur significant losses that could take a long time to recover. Therefore, lump-sum investing is generally recommended when the time horizon for the investment is sufficiently long (typically 10 years or more) to ride out any short-term fluctuations.

Periodic investing, on the other hand, is a strategy that aims to automate investments and eliminate the need to time the market. The most common form of periodic investing is dollar-cost averaging, where a fixed amount is invested at regular intervals. This strategy smooths out market price fluctuations and reduces the impact of losses during sudden market downturns. Dollar-cost averaging is particularly useful for investors with small streams of discretionary savings who are seeking long-term investments. While it may cause you to miss out on positive returns in a rising market, it can be less stressful than worrying about making a lump-sum investment at the right time.

The choice between lump-sum and periodic investing depends on individual circumstances and risk tolerance. Lump-sum investing generally outperforms periodic investing over time, but it carries the risk of incurring larger losses in the short term. Periodic investing, through dollar-cost averaging, can provide a more gradual approach to building wealth, making it suitable for investors who want to avoid significant losses. Additionally, combination strategies exist that incorporate both lump-sum and periodic investing, allowing investors to benefit from the advantages of both approaches. Ultimately, investors should assess their financial situation, risk tolerance, and investment goals before deciding on the investment strategy that aligns best with their needs.

S-Corp Savings: Investing for Growth and Security

You may want to see also

Lump-sum investing: when is it used?

Lump-sum investing is often considered when an individual receives a large amount of cash all at once, such as an inheritance, a gift, a court settlement, lottery winnings, or the sale of a business or real estate. It may also be an option for those who are already financially well-off, such as those with matured bonds or certificates of deposit.

The main advantage of lump-sum investing is that it allows individuals to deploy their capital right away, giving their money more time to grow. This approach generally generates slightly higher annualised returns than dollar-cost averaging (DCA), which involves investing equal amounts over a fixed period. For example, a Vanguard research paper found that lump-sum investing outperformed DCA 68% of the time across global markets measured after one year.

However, lump-sum investing carries the risk of incurring significant losses if the investment is made at the peak of the market, just before a decline. This risk can be mitigated by having a long time horizon for the investment (10 years or more), providing a longer window to ride out market fluctuations. Additionally, lump-sum investing may help minimise transaction costs compared to multiple purchases over time.

Lump-sum investing is generally recommended for long-term investors who want to put their money to work as soon as possible, riding out any bumps in the market over time. It is also a good option when current interest rates on low-risk cash accounts are close to zero, as the opportunity cost of investing is then relatively low.

From Saving to Investing: Strategies for Your Financial Journey

You may want to see also

Lump-sum investing: other considerations

Lump-sum investing is a strategy that can be employed when an investor has a large amount of cash to add to their portfolio. This could be due to a variety of reasons, such as receiving an inheritance, a bonus, or selling a business or mature investment. When deciding whether to invest a lump sum, it is important to consider the potential risks and benefits compared to other strategies such as dollar-cost averaging.

One advantage of lump-sum investing is that it allows investors to deploy their capital right away and take advantage of market growth. Historical market trends indicate that the returns of stocks and bonds exceed those of cash investments. By investing a lump sum, investors can gain exposure to the markets sooner, which can lead to positive returns over the long term. This approach can be particularly beneficial for long-term investors who can ride out any short-term bumps along the way.

However, one of the main considerations when investing a lump sum is the risk associated with market timing. Short-term market movements are unpredictable, and investing a large sum during a volatile period could result in significant losses. This could have both psychological and financial impacts, as investors may take away the wrong lessons from experiencing significant losses and underinvest in the markets relative to their financial goals.

Another factor to consider is the opportunity cost of keeping cash on the sidelines. If interest rates on low-risk cash accounts are close to zero, the opportunity cost of not investing a lump sum may be relatively low. However, if interest rates are higher, investing a lump sum may be less attractive as the cash could be earning a return in a safe and liquid account.

It is also important to note that lump-sum investing may not be feasible for everyone. In order to make a lump-sum investment, investors need to have a substantial amount of cash available. Additionally, the performance of a lump-sum investment is dependent on market conditions, and there is a risk of incurring losses if the investment is sold in the near term.

When deciding between lump-sum investing and other strategies, it is crucial to consider factors such as risk tolerance, investment goals, and market conditions. While lump-sum investing may offer higher returns over the long term, it also carries a higher level of risk. Investors should carefully evaluate their financial situation and seek professional advice before making any investment decisions.

Why You're Not Saving and Investing: Excuses Debunked

You may want to see also

Frequently asked questions

Investing monthly or annually is a strategy known as cost averaging or dollar-cost averaging, where you invest equal amounts over a period of time. A lump-sum portfolio, on the other hand, involves investing a large amount of cash all at once.

Investing monthly or annually can reduce initial timing risk and may be preferable for investors who want to minimise potential short-term losses. It also makes investing more automatic and eliminates the need to time the market.

A lump-sum portfolio allows you to deploy your capital right away and generally results in higher annualised returns compared to investing monthly or annually. It can also minimise transaction costs by investing a large sum all at once.

There is no one-size-fits-all answer as both strategies have their advantages and disadvantages. Historical data suggests that lump-sum investing tends to outperform cost averaging, but cost averaging can be a more suitable option for risk-averse investors. Ultimately, the decision should be based on an individual's financial situation, risk tolerance, and investment goals.