Whether dividends received from investments are considered an operating activity cash flow depends on the type of company and the accounting standards used. According to Generally Accepted Accounting Principles (GAAP), dividends received by a company for its own investments are reported as an operating activity, as they represent income generated by the company's financial investment portfolio. However, dividends paid out to shareholders are considered a financing activity under GAAP. On the other hand, International Financial Reporting Standards (IFRS) allow cash paid out to shareholders to be reported as either an operating activity or a financing activity. Therefore, it is important for companies to properly account for dividend activity and comply with the relevant accounting principles to provide accurate and up-to-date records.

What You'll Learn

Dividends received are a sign of income for a company

Dividends received are first reported as a debit to cash in the general ledger. A corresponding entry must then be credited to the ledger as dividend revenue. These entries are recorded twice in order to comply with GAAP as part of the double-entry system.

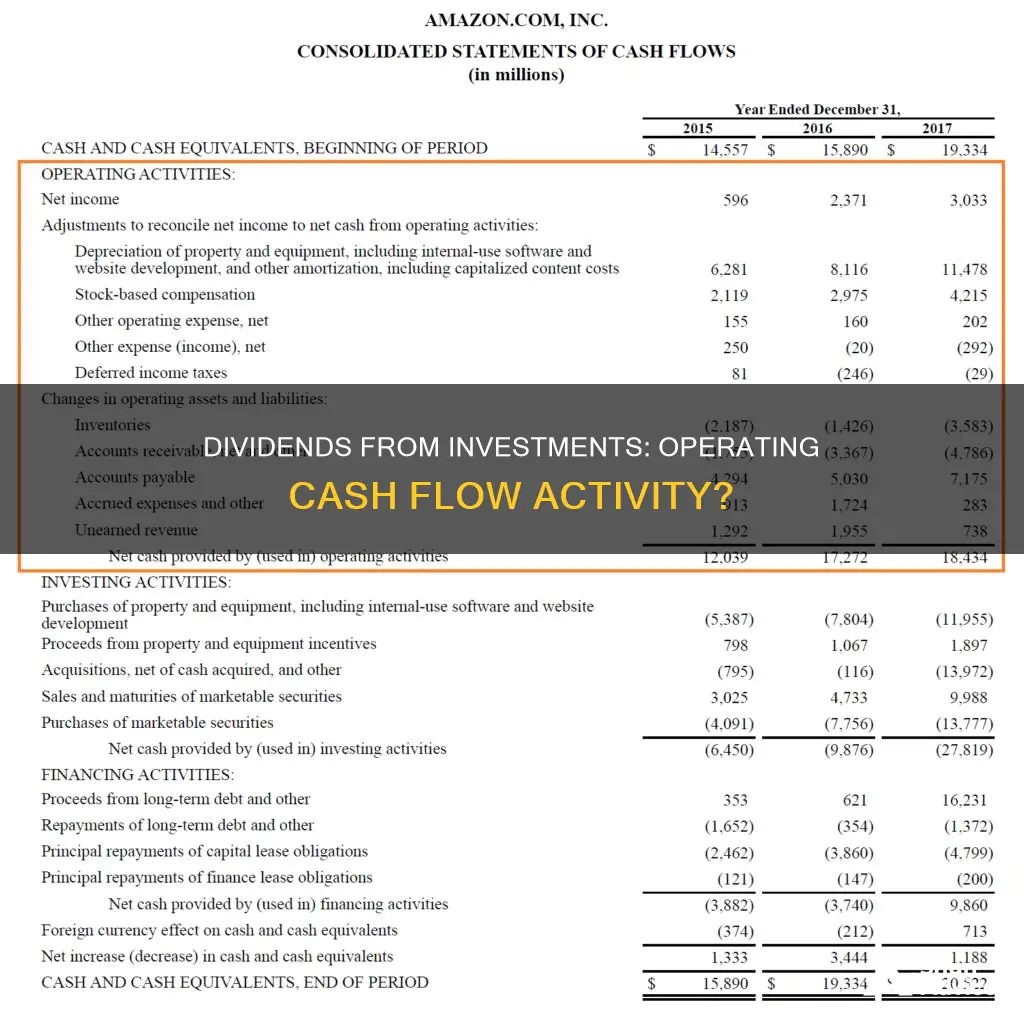

The cash flow statement is one of the three main financial statements required in standard financial reporting. The three sections of the statement—cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities—collectively provide a picture of where the company's cash comes from, how it is spent, and the net change in cash resulting from the firm's activities during a given accounting period.

Cash flow from operating activities (CFO) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a service to customers. It is the first section depicted on a company's cash flow statement. CFO focuses only on the core business and is also known as operating cash flow (OCF) or net cash from operating activities.

Positive (and increasing) cash flow from operating activities indicates that the core business activities of the company are thriving. It provides an additional measure/indicator of profitability potential, beyond the traditional ones like net income or EBITDA.

Pension Plans: Cash, Investments, and Your Retirement Future

You may want to see also

Dividends received are first reported as a debit to cash

Dividends are a sum of money that a publicly-listed company pays out to its shareholders. They are a common way for companies to return capital to their shareholders, and they are typically paid out on a quarterly basis. Dividends received by a company for its own investments are reported as an operating activity under GAAP (generally accepted accounting principles). This is because an operating activity is any activity that has a direct impact on cash flow, whether it is money coming in or going out.

The statement of cash flows generally consists of three primary sections: operating activities, investing activities, and financing activities. Dividends received are included in the "operating activities" section of the statement of cash flows. This is because they represent income coming into the company as a result of the company's own financial investment portfolio.

On the other hand, dividends paid out by a company to its shareholders are considered a financing activity under GAAP. Therefore, they are reported in the "financing activities" section of the statement of cash flows. Dividends paid out reduce the company's retained earnings and cash balance by the total value of the dividend.

Cash Advance Investment Strategies: A Guide to Getting Started

You may want to see also

Dividends paid are reported in the financing section

Dividends received from investments are considered dividend income and are recorded in the operating section of the cash flow statement as a cash inflow. This is because dividends received are an indication of income coming into the company as a result of the company's own financial investment portfolio.

However, dividends paid are reported in the financing section of the cash flow statement. This is because, when a company pays out dividends to its shareholders, this action is considered a financing activity under GAAP (generally accepted accounting principles). A negative financing activity number indicates that the company has paid out capital, such as making a dividend payment to shareholders.

Extra Cash? Here's How to Invest Wisely

You may want to see also

Dividends received are an operating activity under GAAP

Generally Accepted Accounting Principles (GAAP) are established by the Financial Accounting Standards Board, and they make provisions for various types of investment activities, including the distribution of dividends. Dividends received by a company for its own investments are reported as an operating activity under GAAP. This is because an operating activity is any activity that has a direct impact on cash flow, whether it is money coming in or going out of the company. Dividends received are an indication of income coming into the company as a result of the company's own financial investment portfolio.

Dividends received are first reported as a debit to cash in the general ledger. A corresponding entry must then be credited to the ledger as dividend revenue. These entries are recorded twice to comply with GAAP as part of the double-entry system. This is important because it helps to prevent companies from manipulating their books. Revenue recognition has been manipulated by companies in the past, and GAAP requirements are designed to prevent this from occurring.

GAAP differs from International Financial Reporting Standards (IFRS) in that IFRS allows cash paid out to shareholders to be reported as either an operating activity or a financing activity. IFRS is generally less prescriptive in the classification of certain items in the statement of cash flows. The general principle is that cash flows are classified in the manner most appropriate to the business. Under IFRS, dividends received can be classified as either an operating activity or an investing activity.

Restricted Cash: A Viable Investment Option?

You may want to see also

Dividends received by non-financing companies

When a company pays out dividends to its shareholders, this is considered a financing activity. However, when a company receives dividends, this is an operating activity. This is an important distinction to make, as it impacts how the company reports its cash flow. The statement of cash flows generally consists of three primary sections: operating activities, investing activities, and financing activities.

To account for dividends received, companies will need to enter the information in their general ledger. Dividends received are first reported as a debit to cash in the general ledger, with a corresponding credit entry as dividend revenue. These entries are recorded twice to comply with GAAP's double-entry system. Proper accounting of dividend activity helps prevent companies from manipulating their books and accurately reflects the company's financial health.

Cashing Out of Circle Invest: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Cash flow from operating activities (CFO) indicates the amount of money a company brings in from its regular business activities, such as manufacturing and selling goods or providing services to customers. It does not include long-term capital expenditures or investment revenue and expenses. CFO is also known as operating cash flow (OCF) or net cash from operating activities.

Dividends received by a company for its own investments are reported as an operating activity under GAAP (generally accepted accounting principles). Dividends received are an indication of income coming into the company as a result of the company's own financial investment portfolio.

When a company pays out dividends to its shareholders, this is considered a financing activity under GAAP. It is reported as such on the company's statement of cash flows. However, under International Financial Reporting Standards (IFRS), cash paid out to shareholders can be reported as either an operating activity or a financing activity.

Examples of cash flow from operating activities include salaries paid out to employees, cash paid to vendors and suppliers, cash collected from customers, interest income, and dividends received.

The cash flow statement is one of the three main financial statements required in standard financial reporting. It provides a picture of where a company's cash comes from, how it is spent, and the net change in cash over a given accounting period. Operating activities are core to the business and are recurring, while investing and financing activities may be one-time or sporadic.