When considering whether risk investment is safe, it's important to understand that it involves a trade-off between potential high returns and the possibility of significant losses. Risk investments, such as stocks, real estate, or venture capital, can offer substantial financial gains but also carry the risk of substantial financial losses. The key to making informed decisions is to carefully assess your risk tolerance, diversify your portfolio, and conduct thorough research to minimize potential pitfalls. Additionally, seeking advice from financial advisors can help you navigate the complexities of risk investments and make choices that align with your financial goals and risk profile.

What You'll Learn

- Risk Assessment: Evaluate potential risks and benefits of investment

- Diversification: Spread investments to reduce individual asset risk

- Historical Performance: Analyze past data to predict future outcomes

- Regulatory Compliance: Ensure investments adhere to legal and ethical standards

- Risk Management: Implement strategies to mitigate potential losses

Risk Assessment: Evaluate potential risks and benefits of investment

When considering whether to invest in something, it's crucial to conduct a thorough risk assessment. This process involves evaluating the potential risks and benefits associated with the investment to make an informed decision. Here's a detailed guide on how to approach this:

Identify Risks: Begin by identifying all the potential risks related to the investment. This could include market risks, such as fluctuations in stock prices or economic downturns, or specific risks tied to the investment itself. For instance, if investing in a startup, consider the risk of the business failing, the industry's volatility, or the potential for regulatory changes affecting the sector. Make a comprehensive list of these risks, ensuring you cover all bases.

Analyze Benefits: Alongside the risks, it's essential to understand the potential benefits. What are the expected returns or gains from this investment? Is it a high-growth opportunity, a stable income stream, or a long-term asset appreciation? Quantify and qualify these benefits as much as possible to have a clear picture of what you stand to gain.

Risk Mitigation Strategies: Develop strategies to mitigate the identified risks. This might involve diversifying your portfolio to spread risk, implementing stop-loss orders to limit potential losses, or seeking expert advice to navigate specific industry risks. For example, if investing in real estate, consider hiring a property manager to handle maintenance and tenant issues, thus reducing personal risk.

Risk-Benefit Analysis: Perform a comprehensive risk-benefit analysis by comparing the identified risks against the expected benefits. Assign a probability and impact score to each risk and benefit, considering both the likelihood of occurrence and the potential severity of the outcome. This analysis will help you understand the overall risk profile of the investment.

Decision-Making: Based on your risk assessment, make a decision. Weigh the potential rewards against the risks and determine if the benefits outweigh the costs. If the risks are manageable and the benefits are substantial, the investment might be worth pursuing. However, if the risks are too high or the benefits are not significant enough, it may be best to pass on the opportunity.

Remember, risk assessment is a critical step in investment decision-making, ensuring that you are well-informed and prepared for any potential outcomes. It allows you to make strategic choices and adapt your investment strategy as needed.

Is Policy Bazaar Safe? Unlocking the Investment Risks

You may want to see also

Diversification: Spread investments to reduce individual asset risk

Diversification is a fundamental strategy in investing that aims to reduce the risk associated with individual assets. It involves spreading your investments across various asset classes, sectors, and geographic regions to minimize the impact of any single investment's performance on your overall portfolio. By diversifying, you can achieve a more balanced and stable investment approach, which is crucial for long-term financial success.

The core principle behind diversification is to avoid putting all your eggs in one basket. When you invest in a single asset or a limited range of similar assets, you expose yourself to higher risk. If that particular investment underperforms or experiences a decline, it can significantly impact your entire portfolio. For example, imagine investing heavily in a single tech stock. If the company faces financial troubles or the industry experiences a downturn, your investment could take a substantial hit. However, by diversifying, you mitigate this risk.

To implement diversification, consider the following strategies:

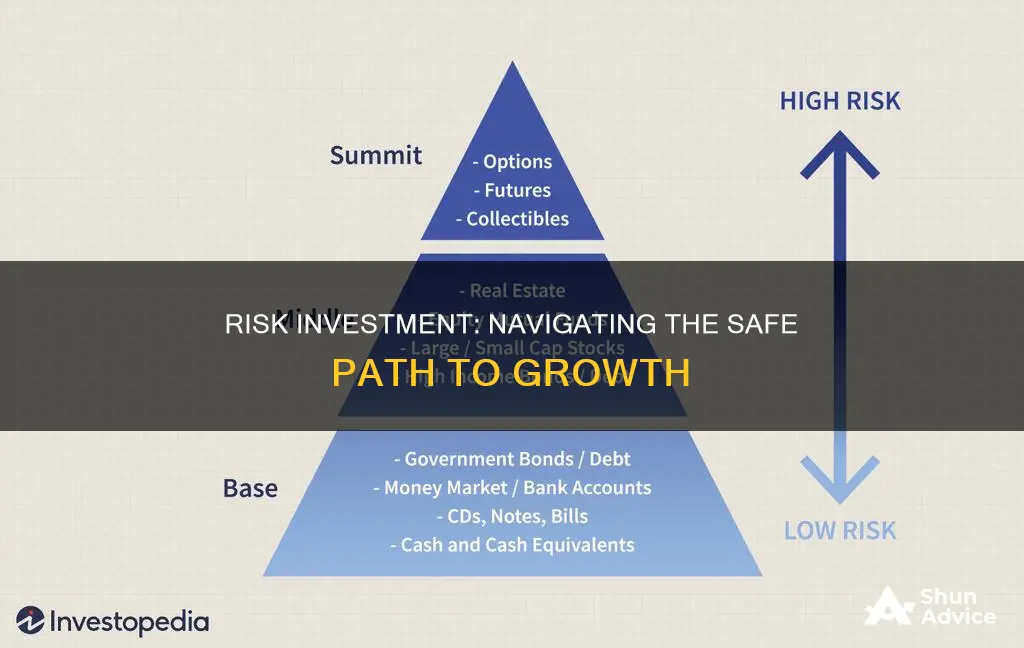

- Asset Allocation: Divide your portfolio into different asset classes such as stocks, bonds, real estate, commodities, and cash. Each asset class has its own risk and return characteristics. By allocating your investments across these classes, you can create a well-rounded portfolio. For instance, stocks generally offer higher potential returns but come with higher risk, while bonds provide more stability.

- Sector Allocation: Diversify within the stock market by investing in various sectors like technology, healthcare, finance, and consumer goods. Different sectors perform differently based on economic conditions and industry-specific factors. By spreading your investments across sectors, you reduce the risk associated with any single sector's performance.

- Geographic Diversification: Consider investing in companies and assets from different countries and regions. International markets can offer opportunities for growth and diversification. This strategy helps reduce the impact of country-specific risks and economic events on your portfolio.

- Correlations and Beta: Study the correlations between different assets. Assets that are not highly correlated tend to move independently, reducing the overall risk. Additionally, understand the beta of individual investments, which measures their volatility relative to the market. Lower beta assets are less sensitive to market fluctuations.

By employing these diversification techniques, you create a robust investment strategy. It's important to remember that diversification does not guarantee profit or protect against losses in a declining market, but it does provide a more stable and balanced approach to investing. Regular review and rebalancing of your portfolio are essential to maintain the desired level of diversification.

Private Equity: Minimum Investment Requirements Explained

You may want to see also

Historical Performance: Analyze past data to predict future outcomes

When considering the safety of risk investments, delving into historical performance and data analysis is crucial. This approach provides valuable insights into the potential risks and rewards associated with such investments. By examining past trends and patterns, investors can make more informed decisions and better understand the likelihood of future outcomes.

Historical data analysis involves studying the performance of risk investments over a specific period. This includes reviewing financial records, market trends, and economic indicators related to the investment in question. For instance, if you're investing in a particular stock, you'd analyze its historical price movements, volume trends, and performance against market benchmarks. This analysis can reveal patterns and correlations that may not be immediately apparent. For example, you might discover that a stock's performance tends to follow a seasonal pattern, with higher returns during certain months. This knowledge can help investors make strategic decisions about when to buy or sell.

Furthermore, historical performance data allows investors to assess the volatility and risk associated with an investment. By examining past price fluctuations and market reactions, investors can estimate the potential range of outcomes. This is particularly important for risk investments, as it provides a realistic expectation of potential gains and losses. For instance, analyzing historical data might reveal that a particular investment has a 70% chance of generating a positive return over the next year, with an average return of 15%. This information is essential for risk assessment and can guide investors in diversifying their portfolios accordingly.

Additionally, historical data analysis can help identify any recurring issues or patterns that may impact investment safety. For example, if multiple risk investments have historically underperformed during economic recessions, this could be a significant risk factor to consider. Investors can use this information to develop strategies that mitigate potential losses during such periods. It's also worth noting that historical performance should be compared across different time frames and market conditions to ensure a comprehensive understanding of the investment's behavior.

In summary, analyzing historical performance and past data is a fundamental step in assessing the safety of risk investments. It empowers investors to make informed choices, understand potential risks, and predict future outcomes with a certain degree of accuracy. By studying market trends, price movements, and economic indicators, investors can navigate the complexities of risk investments with greater confidence and potentially minimize potential losses.

Are T-Bills Risk-Free Investments?

You may want to see also

Regulatory Compliance: Ensure investments adhere to legal and ethical standards

In the world of finance, where the potential for high returns often comes hand in hand with significant risks, regulatory compliance is a critical pillar that safeguards investors and the integrity of the financial system. When it comes to risk investments, ensuring that these ventures adhere to legal and ethical standards is not just a recommendation but a necessity. This is because the investment landscape is heavily regulated to protect investors from fraudulent activities, ensure fair practices, and maintain market stability.

Regulatory compliance in the context of risk investments involves a comprehensive set of rules and guidelines that must be followed. These regulations are designed to prevent and detect illegal activities such as insider trading, market manipulation, and fraudulent schemes. For instance, financial authorities often require investment firms to report suspicious activities, maintain accurate records, and disclose potential conflicts of interest. By adhering to these standards, investors can have a certain level of assurance that the investment process is transparent and fair.

One of the key aspects of regulatory compliance is the protection of investor rights and interests. This includes ensuring that investors receive accurate and complete information about the investment opportunities they are considering. Investment firms are required to provide detailed disclosures, risk assessments, and potential consequences of the investment. This transparency empowers investors to make informed decisions, especially when engaging in high-risk ventures. Moreover, regulations often mandate that investment advisors and brokers act in the best interest of their clients, providing suitable investment advice and products.

Ethical considerations also play a vital role in regulatory compliance. Investment firms must ensure that their practices do not exploit vulnerable investors or engage in unethical behavior. This includes avoiding conflicts of interest, providing fair treatment to all investors, and avoiding misleading or manipulative marketing tactics. Ethical standards also extend to the treatment of employees, ensuring fair wages, safe working conditions, and adherence to labor laws. By upholding these ethical principles, investment firms contribute to a more stable and trustworthy financial environment.

To ensure compliance, investment firms should establish robust compliance programs. These programs should include regular training for staff, comprehensive policies and procedures, and a dedicated compliance team. Regular audits and risk assessments can help identify potential issues and ensure that all activities are in line with legal and ethical standards. Additionally, staying updated with changing regulations and industry best practices is essential to maintain a strong compliance posture. By embracing regulatory compliance, investment firms can mitigate risks, protect their reputation, and foster trust with investors, ultimately contributing to the long-term sustainability of the industry.

Exploring the Safest Investment Options: Minimizing Default Risk

You may want to see also

Risk Management: Implement strategies to mitigate potential losses

When it comes to investing, risk management is a critical aspect that cannot be overlooked. It involves implementing strategies to identify, assess, and mitigate potential losses, ensuring that your investments are as safe and secure as possible. Here are some key strategies to consider:

Risk Assessment: Begin by thoroughly evaluating the risks associated with your investments. This process involves identifying the potential threats and their likelihood and impact. For instance, consider market volatility, economic cycles, industry-specific risks, and even geopolitical factors. Create a comprehensive risk profile for each investment opportunity, allowing you to make informed decisions. Tools like risk matrices and heatmaps can help visualize and prioritize risks, ensuring you focus on the most critical areas.

Diversification: One of the most effective ways to manage risk is through diversification. Spread your investments across various asset classes, sectors, and geographic regions. By diversifying, you reduce the impact of any single investment's performance on your overall portfolio. For example, if you invest in a mix of stocks, bonds, real estate, and commodities, a decline in one area may be offset by gains in another. Diversification also helps in managing concentration risk, where a significant portion of your portfolio is invested in a limited number of assets.

Risk Mitigation Techniques: Implement specific strategies to minimize potential losses. One approach is to use stop-loss orders, which automatically sell an asset when it reaches a certain price, limiting potential downside. Another technique is to employ hedging, where you take a position in a derivative security to offset potential losses in the underlying asset. For instance, buying put options can protect against potential stock market declines. Additionally, consider using risk-reducing financial instruments like futures, forwards, or swaps to manage exposure.

Regular Review and Monitoring: Risk management is an ongoing process. Regularly review and update your risk assessment to account for changing market conditions and new information. Monitor your investments' performance and adjust your strategies accordingly. Stay informed about economic trends, industry news, and global events that could impact your investments. By actively managing and reassessing risks, you can make timely decisions to protect your capital and optimize returns.

Risk Tolerance and Investment Goals: Understanding your risk tolerance is essential. It refers to your ability and willingness to withstand price fluctuations and potential losses. Assess your investment goals, time horizon, and financial situation to determine an appropriate risk level. More aggressive investors might be comfortable with higher-risk investments, while conservative investors may prefer safer options. Aligning your investment strategies with your risk tolerance ensures a more balanced and secure approach.

Smart Investment Strategies: Where to Invest Your Money

You may want to see also

Frequently asked questions

While investing in risky assets can offer higher potential returns, it is generally considered less safe compared to more conservative investments. Risky assets, such as stocks or certain types of bonds, are more volatile and can experience significant price fluctuations, which may result in losses. It's important to understand your risk tolerance and diversify your portfolio to manage potential risks.

Evaluating investment safety involves several factors. Firstly, consider the underlying asset or security and its historical performance. Research the company or entity offering the investment and analyze their financial health, management team, and business model. Additionally, assess your own risk tolerance and investment goals to ensure the chosen investment aligns with your strategy.

No investment is entirely risk-free, and even low-risk investments carry some level of risk. However, certain investments, like government bonds or high-quality corporate bonds, are generally considered safer due to their lower volatility and higher credit ratings. It's crucial to understand the risks associated with each investment and make informed decisions based on your financial objectives.

Investing in the stock market carries various risks, including market risk, company-specific risk, and liquidity risk. Market risk refers to the potential decline in stock prices due to economic conditions or market sentiment. Company-specific risk is related to the performance and stability of individual companies. Liquidity risk is the possibility of not being able to sell an investment quickly without incurring a loss. Diversification and long-term investment strategies can help mitigate these risks.