The S&P 500 index fund is a popular investment choice due to its low cost, strong historical performance, and simplicity. By investing in an S&P 500 index fund, you gain exposure to 500 of the largest U.S. companies, providing instant diversification to your portfolio.

When choosing an S&P 500 index fund, it is important to consider factors such as the expense ratio, investment minimum, dividend yield, and inception date. Some of the best S&P 500 index funds in the market include the Fidelity 500 Index Fund, Vanguard 500 Index Fund Admiral Shares, and Schwab S&P 500 Index Fund.

While S&P 500 index funds are a great option for long-term investing, it is always recommended to do your research and consult with a financial advisor to ensure that your investment choices align with your financial goals and risk tolerance.

| Characteristics | Values |

|---|---|

| Popularity | One of the most widely-followed stock market indices in the world |

| Investment type | Exchange-traded fund (ETF) or mutual fund |

| Investment fund type | Passive investment fund |

| Investment fund aim | To replicate the index without active management |

| Investment fund creation | Fund managers create the fund themselves or rely on another company |

| Tracking | Track popular indexes, which are often referenced in financial news as indicators of overall market performance |

| Investor insights | Performance of stocks as a whole |

| Attractiveness to investors | Ownership of a wide variety of stocks, greater diversification, lower risk and attractive returns |

| Cost | Very little for the benefits |

| Suitability for beginners | Yes |

What You'll Learn

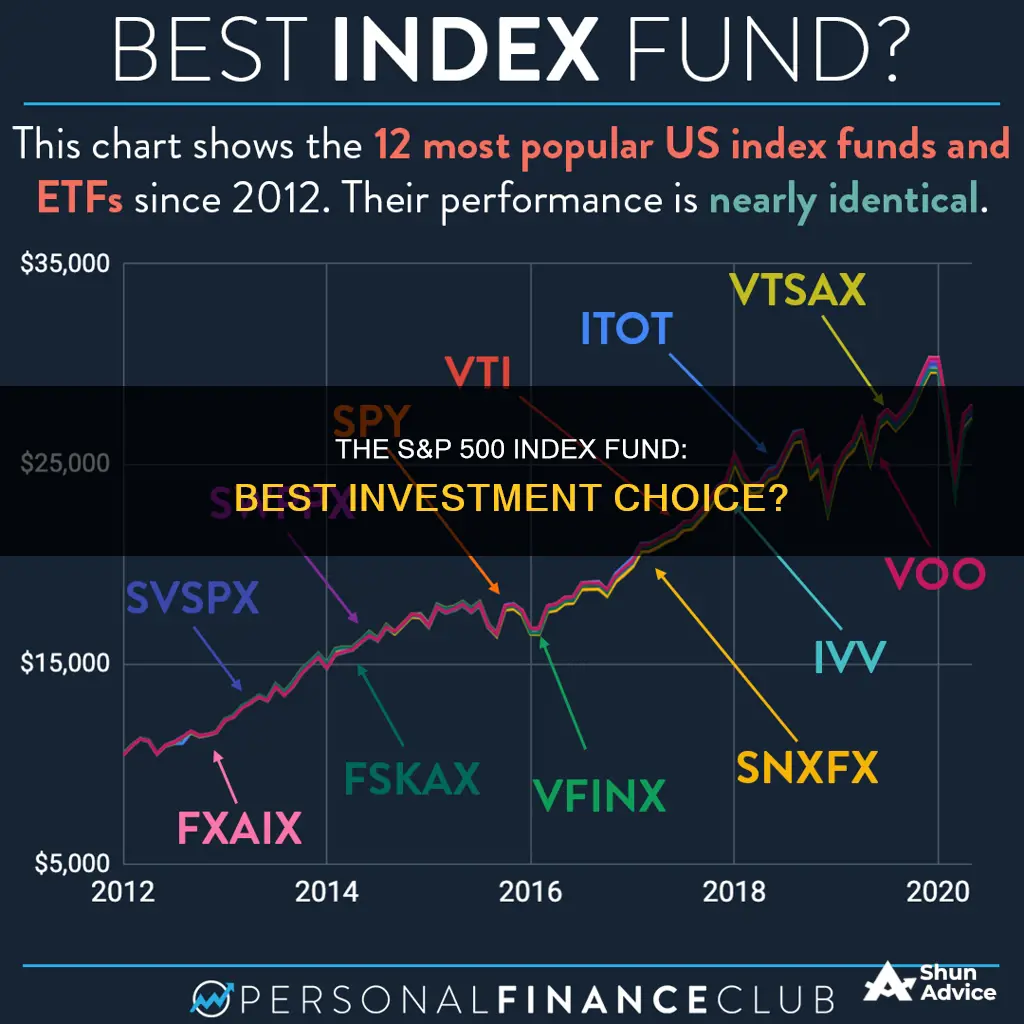

S&P 500 index funds vs. other investment funds

S&P 500 index funds are a popular investment choice due to their low cost, strong historical performance, and simplicity. By investing in an S&P 500 index fund, you gain exposure to 500 of the largest U.S. companies across various sectors, providing instant diversification to your portfolio.

When comparing S&P 500 index funds with other investment funds, there are several factors to consider:

Fees and Expense Ratios

One of the critical advantages of S&P 500 index funds is their low cost. Index funds are passively managed, aiming to mirror the performance of the S&P 500 index, and they have lower expense ratios compared to actively managed funds. The expense ratio represents the fees deducted from your investment returns, so a lower expense ratio means more of your money is working for you. When choosing between different S&P 500 index funds, look for those with the lowest expense ratios, as this can significantly impact your long-term returns.

Investment Minimums and Requirements

Some S&P 500 index funds have minimum investment requirements, while others have no minimum initial investment. If you are just starting or prefer more flexibility, consider funds without minimums. Additionally, some funds may charge transaction fees or sales loads, so be sure to review the fund's prospectus for any additional costs.

Track Record and Performance

While past performance doesn't guarantee future results, it's essential to consider a fund's track record. Look for funds with a long history of competent management and strong returns that closely mirror the S&P 500 index's performance. This indicates effective fund management and a higher likelihood of future success.

Diversification and Sector Exposure

Although all S&P 500 index funds provide exposure to a diverse range of large U.S. companies, there may be slight differences in their holdings. Some funds might have a higher concentration in specific sectors, like technology. If you want broader diversification, consider funds with a more even distribution across sectors.

Convenience and Accessibility

Consider the convenience and accessibility of purchasing the fund. You can buy S&P 500 index funds directly from mutual fund companies or through brokerages. Some brokerages may offer a more comprehensive range of funds or provide additional tools and resources for investors.

Other Investment Funds

Now, let's compare S&P 500 index funds with other types of investment funds:

Mutual Funds

Mutual funds are actively managed funds that aim to outperform the market. They usually have higher expense ratios than index funds due to the cost of hiring fund managers who actively select investments. Mutual funds often have higher investment minimums, and you may encounter sales loads or transaction fees. Mutual funds can provide more targeted investment strategies and may be suitable if you want a more hands-on approach or specific sector exposure.

Exchange-Traded Funds (ETFs)

ETFs are similar to index funds in that they track an index, but they trade on an exchange like stocks. ETFs can be bought and sold throughout the trading day, offering more flexibility than index funds, which are bought and sold at the end of the trading day. ETFs typically have lower expense ratios than mutual funds, and they often have lower investment minimums or no minimums at all. ETFs are a good option if you want more frequent trading capabilities and lower costs.

Sector-Specific Funds

If you want to focus on a particular sector or industry, you might consider sector-specific funds. These funds invest only in companies within that sector, providing targeted exposure. For example, you could invest in a technology sector fund or a healthcare sector fund. Sector funds can be riskier since they lack the diversification of S&P 500 index funds, but they can also offer higher potential returns if that specific sector performs well.

International Funds

To diversify your portfolio beyond U.S. equities, you might consider international stock and bond funds. These funds invest in companies or government bonds from other countries, providing exposure to global markets. International funds can help protect your portfolio from the volatility of a single country's market and economic downturns.

In conclusion, S&P 500 index funds offer a simple, low-cost way to gain diversified exposure to the performance of 500 large U.S. companies. When comparing S&P 500 index funds, consider fees, investment minimums, track record, and sector exposure. Additionally, when comparing with other investment funds like mutual funds, ETFs, sector-specific funds, and international funds, weigh factors such as management style, trading flexibility, diversification, and cost to determine which type of fund aligns best with your investment goals and risk tolerance.

Proof of Funds: Investment Account Letter Requirements

You may want to see also

The pros and cons of S&P 500 index funds

S&P 500 index funds are a popular investment choice due to their low cost, strong historical performance, and simplicity. They are also a great way to diversify your portfolio instantly. Here are some pros and cons to help you decide if investing in S&P 500 index funds is right for you.

Pros of S&P 500 Index Funds:

- Low cost and expense ratios: Index funds are fairly inexpensive compared to other types of mutual funds, and S&P 500 index funds are no exception. They have lower expense ratios than actively managed funds, which tend to have higher fees. The expense ratios for the best S&P 500 index funds can be as low as 0.015% to 0.04%.

- Diversification: S&P 500 index funds provide instant diversification as they track the performance of 500 large U.S. companies across various sectors. By investing in an S&P 500 index fund, you gain exposure to a broad range of industries with a single investment.

- Strong historical performance: The S&P 500 index has delivered robust returns over the years, with an average annual return of nearly 10% since 1928. While past performance does not guarantee future results, the S&P 500's track record makes it an attractive investment option.

- Passive investment strategy: S&P 500 index funds are passively managed, meaning they aim to mirror the performance of the S&P 500 index without actively trying to beat the market. This passive strategy can lead to better returns over the long term, as actively managed funds rarely outperform the market consistently.

- Simplicity and accessibility: S&P 500 index funds are straightforward investment options, especially for beginners. They provide an easy way to gain exposure to some of the largest and most successful U.S. companies. Additionally, some S&P 500 index funds have no minimum investment requirements, making them accessible to investors of all levels.

Cons of S&P 500 Index Funds:

- Lack of active management: While passive management can be a benefit, it may also be seen as a drawback for investors who prefer a more hands-on approach. With S&P 500 index funds, there is no active decision-making regarding which stocks to buy or sell, as the fund simply mirrors the index.

- Limited customization: S&P 500 index funds track a specific benchmark index, and all funds with the same benchmark will have similar holdings. This lack of customization may be a disadvantage for investors who want more control over their investment strategies.

- Sector concentration risk: The S&P 500 index is heavily weighted towards the technology sector, which currently makes up around 28% of the index. While this can be advantageous when tech stocks are performing well, it also means the index fund's performance is closely tied to the tech sector's performance.

- Potential for underperformance: While S&P 500 index funds aim to mirror the index's performance, there may be times when they underperform due to various factors such as fees and taxes. Additionally, the S&P 500 index may not always be the best-performing index, and there may be other indexes or investment strategies that offer higher returns during certain periods.

Uncover Hedge Fund Investment Strategies: A Guide

You may want to see also

How to choose the right S&P 500 index fund

When choosing the right S&P 500 index fund, there are a few key factors to consider. Here are some guidelines to help you make an informed decision:

- Expense Ratio: As S&P 500 index funds are passively managed, the expense ratio, which represents the fees for fund upkeep, should be relatively low. Since all S&P 500 index funds perform similarly, the fees can make a significant difference. Look for funds with expense ratios below 0.20%, or even lower if possible.

- Minimum Investment: Index funds usually have different minimum investment requirements for taxable accounts and IRAs. Ensure that the fund you choose aligns with the amount you have available to invest initially and that you can purchase additional shares in amounts that fit your budget. Some funds have no minimum investment requirements, offering greater flexibility.

- Dividend Yield: Dividends can boost your returns, especially during market downturns. Compare the dividend yields between index funds to find the most attractive option.

- Inception Date: If you value a long track record, consider the fund's inception date. Older funds provide insight into how the fund has navigated both bull and bear markets over time.

- Performance and Track Record: Evaluate the fund's performance and how closely it tracks the S&P 500 index. While all S&P 500 index funds aim to replicate the index, some may do so more accurately than others. Additionally, consider the fund's long-term performance and how it has fared during different market conditions.

- Reputation and Size: Opt for well-established funds from reputable fund managers. Larger funds with more assets under management may offer greater stability and lower fees due to economies of scale.

- Brokerage and Trading Costs: Consider the brokerage platform you plan to use and the associated trading costs. Some brokerages offer commission-free trades or waive certain fees for specific funds.

Remember, you only need one S&P 500 index fund in your portfolio. These funds tend to have similar returns, so there is little benefit in splitting your assets between multiple funds. Instead, focus on finding the fund that best aligns with your investment goals, budget, and risk tolerance.

Real Estate Funds in India: A Guide to Investing

You may want to see also

How to invest in an S&P 500 index fund

S&P 500 index funds are a great way to invest in the stock market without having to pick individual stocks. Here's a step-by-step guide on how to invest in an S&P 500 index fund:

- Understand what an S&P 500 index fund is: An S&P 500 index fund is a type of investment fund, either a mutual fund or an exchange-traded fund (ETF), that tracks the performance of the S&P 500 stock market index. The S&P 500 index is made up of about 500 large public U.S. companies and is considered a bellwether for the U.S. stock market.

- Research and compare different S&P 500 index funds: There are many S&P 500 index funds offered by different financial institutions, such as Vanguard, Fidelity, and Charles Schwab. Compare the funds' expense ratios, which represent the annual fees charged by the fund manager. Also, consider the fund's performance over the past five to ten years, the fund's size (assets under management), and the reputation of the fund manager.

- Decide how much you want to invest: Determine how much money you are comfortable investing in the S&P 500 index fund. Keep in mind that investing in the stock market carries risks, and there is always the potential to lose money. Diversifying your investments and investing for the long term can help mitigate some of these risks.

- Open a brokerage account: You will need a brokerage account to purchase the S&P 500 index fund. You can open an account with a broker that offers the fund you want to invest in. Some popular brokers include Vanguard, Fidelity, Charles Schwab, and TD Ameritrade. Compare the fees and features of different brokers before choosing one.

- Purchase the S&P 500 index fund: Once you have opened a brokerage account and decided on the specific S&P 500 index fund you want to invest in, you can place a buy order through your broker's website or trading platform. Specify the number of shares or the dollar amount you want to invest.

- Monitor your investment: After purchasing the S&P 500 index fund, regularly review its performance and how it aligns with your investment goals and risk tolerance. Remember that investing in the stock market is typically a long-term strategy, and short-term fluctuations are normal.

By following these steps, you can invest in an S&P 500 index fund and gain exposure to a diversified portfolio of large U.S. companies. Remember to do your own research and consult with a financial advisor before making any investment decisions.

Cocolife Fixed Income Fund: A Smart Investment Strategy

You may want to see also

The differences between S&P 500 index funds and ETFs

The S&P 500 Index is a snapshot of the US economy, measuring the market capitalization of the country's 500 largest corporations. It is a benchmark for any S&P 500 ETF, which means the financial institution managing the ETF buys stock in every company listed in the index.

S&P 500 Index Funds and ETFs are similar in many ways. Both are index funds, which means they are a type of investment fund that is based on a preset basket of stocks or an index. They are passively managed, aiming to replicate the performance of the S&P 500 index. They are also both known for their low costs and strong long-term returns.

However, there are some key differences between the two:

- Trading mechanism: S&P 500 Index Funds can only be bought and sold at the end of the trading day, based on the fund's net asset value (NAV). ETFs, on the other hand, trade throughout the day on a stock exchange, just like stocks, and their price fluctuates based on supply and demand.

- Minimum investment: ETFs usually have a lower minimum investment than index funds. Often, all it takes to invest in an ETF is the amount needed to buy a single share, and some brokers offer fractional shares. Index funds, on the other hand, often have minimum investment requirements set by brokers, which can be quite high.

- Capital gains taxes: ETFs are generally more tax-efficient than index funds. When you sell an ETF, you are selling it to another investor, and the capital gains taxes on that sale are yours alone to pay. With index funds, the fund manager may have to sell securities to generate cash to pay to investors, which can result in capital gains taxes even if you haven't sold your shares.

- Cost: Both ETFs and index funds can have very low expense ratios. However, ETFs may also incur a cost called the bid-ask spread, which is the difference between the price a buyer is willing to pay and the price a seller is willing to accept. This is usually small for high-volume ETFs. Index funds may have shareholder transaction costs and management fees, which tend to be lower for ETFs.

- Liquidity: Since index funds are bought and sold at the end of the trading day, they have less liquidity than ETFs, which can be traded throughout the day.

S&P 500 Index Funds are a good choice for investors who want a diverse portfolio but can't or don't want to buy the stocks of all 500 companies individually. They are also suitable for those seeking passive index investing, as the index reflects the state of the market as a whole.

S&P 500 Index Funds are considered a good investment for beginners as they are a straightforward, low-fee way to gain exposure to successful US companies. They are also good for long-term investing, as the index has shown positive long-term returns, averaging around 10% annually over the last 90 years.

However, it's important to remember that the performance of the S&P 500 Index Funds will fluctuate with the market and that they may underperform during certain market conditions.

Mutual Fund App Investments: Safe or Scam?

You may want to see also

Frequently asked questions

S&P 500 index funds are a popular investment choice due to their low cost, strong historical performance, and simplicity. They are also a great way to diversify your portfolio as they provide exposure to some of the biggest companies in the U.S. across multiple sectors and industries.

When choosing an S&P 500 index fund, consider the fund's expense ratio, investment minimum, track record, and the reputation of the fund manager. The expense ratio is particularly important as it directly affects your returns. The longer the fund has been in operation and the higher its assets under management (AUM), the more information you will have about its performance history and potential stability.

You can invest in an S&P 500 index fund by purchasing it directly from a mutual fund company or a brokerage. You will need to open an investment account, such as a brokerage account, individual retirement account (IRA), or Roth IRA, and then buy the fund through that account. You can either select a fixed dollar amount to spend or choose a number of shares to purchase.