When it comes to long-term investments, the question of whether a stop-loss order is necessary often arises. A stop-loss is a risk management tool that automatically sells an asset when it reaches a certain price, designed to limit potential losses. While stop-losses can provide a safety net and help manage risk, they are not universally required for long-term investors. This paragraph will explore the pros and cons of using stop-losses in long-term investment strategies, considering factors such as market volatility, investment goals, and individual risk tolerance.

| Characteristics | Values |

|---|---|

| Market Volatility | Stop-loss orders can help manage risk by automatically selling if prices fall below a certain level, which is useful in volatile markets. |

| Time Horizon | Long-term investors may not need stop-loss orders as frequently, but they can still benefit from them to protect gains during short-term market fluctuations. |

| Risk Tolerance | Individual risk tolerance varies; some investors prefer more aggressive strategies, while others opt for a safer approach with stop-loss protection. |

| Investment Type | Different investment types may require varying levels of risk management; for instance, stocks might benefit more from stop-loss orders compared to less volatile assets like bonds. |

| Market Conditions | During stable market conditions, stop-loss orders might be less necessary, but they can still provide a safety net during unexpected market drops. |

| Transaction Costs | Frequent use of stop-loss orders may incur higher transaction costs, which could be a consideration for long-term investors. |

| Emotional Control | Stop-loss orders can help investors maintain discipline and avoid emotional decision-making during market volatility. |

| Portfolio Diversification | Diversified portfolios may benefit from stop-loss orders to manage risk across different asset classes. |

| Market News and Events | Staying informed about market news and events can help investors decide when to use stop-loss orders strategically. |

| Historical Performance | Past market performance can provide insights into the effectiveness of stop-loss orders for long-term investors. |

What You'll Learn

- Risk Management: Stop-loss orders can protect long-term investments from significant losses

- Market Volatility: Stop-loss helps manage volatility, especially in volatile markets

- Emotional Control: It prevents emotional decision-making during market downturns

- Strategy Customization: Tailor stop-loss strategies to individual investment goals and risk tolerance

- Long-Term Perspective: Stop-loss can be used to maintain a long-term investment strategy

Risk Management: Stop-loss orders can protect long-term investments from significant losses

Stop-loss orders are an essential tool for investors, especially those with a long-term investment strategy, as they provide a structured approach to risk management. The primary purpose of a stop-loss order is to limit potential losses by automatically triggering a sell order when a predetermined price level is reached. This is particularly crucial for long-term investors who aim to hold their investments for extended periods, as it allows them to protect their capital from sudden and significant market downturns.

In the context of long-term investments, markets can be highly volatile, and prices can fluctuate dramatically over time. While long-term investors typically have a strong belief in the underlying asset's potential, they also understand that short-term market swings can occur. A stop-loss order acts as a safety net, ensuring that investors can exit a position before substantial losses are incurred. For example, if an investor buys a stock with a long-term perspective, a stop-loss order can be set at a price slightly below the purchase price, ensuring that the investment is sold if the stock price drops to that level, thus limiting potential losses.

The beauty of stop-loss orders is their ability to automate the risk management process. Long-term investors often have busy lives and may not always be actively monitoring their portfolios. By setting a stop-loss order, investors can define their risk tolerance and ensure that their investments are managed according to their preferences. This automation also helps to remove the emotional aspect of selling, as it is based on a pre-defined price rather than market sentiment or fear.

Additionally, stop-loss orders can be particularly useful during periods of market uncertainty or when external events impact the investment. For instance, geopolitical tensions or economic crises can cause rapid market declines. With a stop-loss order in place, investors can quickly sell their positions and limit their exposure to these adverse events, thus protecting their long-term investment strategy.

In summary, stop-loss orders are a valuable risk management tool for long-term investors. They provide a means to control potential losses, automate the selling process, and offer protection during volatile market conditions. By incorporating stop-loss orders into their investment strategy, investors can ensure that their long-term goals remain on track, even in the face of short-term market fluctuations. It is a simple yet powerful concept that can significantly contribute to a more secure and successful investment journey.

Unlocking Long-Term Wealth: The Power of Portfolio Diversification

You may want to see also

Market Volatility: Stop-loss helps manage volatility, especially in volatile markets

Market volatility can be a significant concern for investors, especially those with a long-term investment strategy. Volatile markets are characterized by rapid and unpredictable price fluctuations, which can lead to substantial losses if not managed properly. This is where the concept of a stop-loss order becomes crucial. A stop-loss is a powerful risk management tool that can help investors navigate the turbulent waters of volatile markets.

In volatile markets, asset prices can swing dramatically, often within a short period. For long-term investors, this volatility can be both a challenge and an opportunity. While it's true that long-term investments aim to ride out short-term market fluctuations, there are instances when a sudden and significant drop in price can occur, potentially eroding the gains made over time. This is where stop-loss orders come into play.

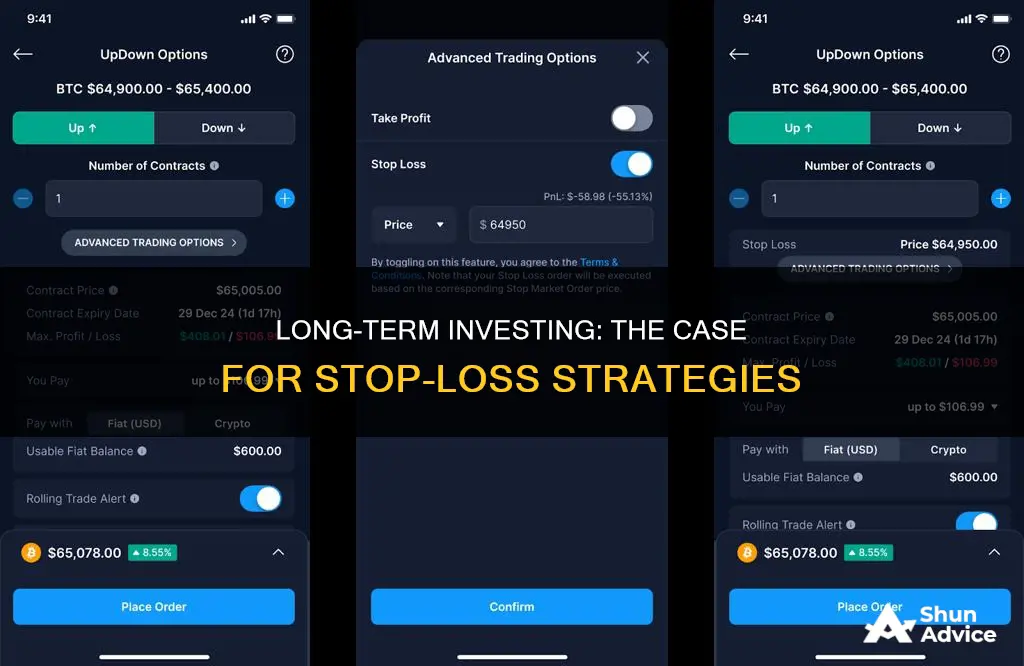

A stop-loss order is an instruction given by an investor to a broker to sell an asset if it reaches a certain price point. This price point is typically set below the current market price for long positions or above for short positions. The primary purpose of this strategy is to limit potential losses by automatically triggering a sell order when the market moves against the investor's position. For long-term investors, setting a stop-loss can provide a sense of security, ensuring that any significant downturn in the market doesn't result in substantial losses.

In volatile markets, stop-loss orders can be particularly effective. When the market is highly unpredictable, setting a stop-loss can help investors avoid the temptation to hold onto a losing position, hoping for a market rebound. By automatically selling at a predetermined price, investors can lock in losses and potentially limit the damage. This is especially important for long-term investors who may not want to constantly monitor their positions, as the stop-loss order acts as a form of automated risk control.

Additionally, stop-loss orders can help investors maintain discipline in their trading strategy. In volatile markets, emotions can run high, and investors might be tempted to make impulsive decisions. By setting a stop-loss, investors can ensure that their emotions don't cloud their judgment, allowing them to stick to their long-term investment plan. This discipline is vital for successful long-term investing, as it helps investors avoid the pitfalls of market volatility.

In summary, market volatility can be a complex and challenging aspect of investing, but the use of stop-loss orders can provide a valuable solution. By setting a stop-loss, investors can effectively manage their risk exposure, especially in volatile markets, and ensure that their long-term investment strategy remains on track. This simple yet powerful tool can help investors navigate the ups and downs of the market with greater confidence and control.

Unlocking Long-Term Wealth: A Guide to Investing in Nifty 50

You may want to see also

Emotional Control: It prevents emotional decision-making during market downturns

Emotional control is a critical aspect of successful long-term investing, especially when navigating the volatile markets. It involves maintaining a rational and disciplined approach, even during periods of market turmoil. The primary goal is to prevent emotional decision-making, which can often lead to impulsive and potentially detrimental actions. When the market takes a downturn, investors might experience fear, anxiety, or even panic, which can cloud their judgment and lead to hasty choices.

One of the key benefits of emotional control is the ability to stick to a well-defined investment strategy. Long-term investors typically have a clear vision of their financial goals and the steps needed to achieve them. By maintaining emotional equilibrium, investors can avoid making short-term decisions that might deviate from their long-term objectives. For instance, during a market crash, an emotionally controlled investor is less likely to sell their investments prematurely, fearing further losses. They understand that short-term market fluctuations are common and often temporary, and they remain committed to their strategy, allowing their investments to recover over time.

This emotional discipline is particularly important when dealing with stop-loss orders, a common risk management tool. A stop-loss order is designed to limit potential losses by automatically selling an asset when it reaches a certain price. While stop-loss orders can be beneficial, they should be used strategically and not as a crutch for emotional investors. Emotionally driven investors might set overly aggressive stop-loss levels, triggering sales during minor corrections, which could result in missed opportunities for long-term gains. By practicing emotional control, investors can set more reasonable stop-loss points, ensuring that their investments are protected without hindering their long-term potential.

Additionally, emotional control enables investors to make informed decisions based on research and analysis rather than impulsive reactions. During market downturns, it is essential to review and rebalance portfolios, making adjustments based on market conditions and individual goals. Emotionally stable investors can analyze the underlying causes of market declines and make strategic moves, such as buying quality assets at discounted prices or reallocating investments to take advantage of new opportunities. This approach allows investors to stay the course and potentially benefit from the market's eventual recovery.

In summary, emotional control is a powerful tool for long-term investors, enabling them to make rational decisions during market downturns. It encourages investors to stick to their investment strategies, set appropriate stop-loss levels, and make informed choices based on research. By maintaining emotional discipline, investors can navigate market volatility with confidence, ensuring that their long-term financial goals remain on track. This approach is essential for building wealth over time and weathering the inevitable storms in the financial markets.

Long-Term Investing: Understanding the Credit-Debit Balance

You may want to see also

Strategy Customization: Tailor stop-loss strategies to individual investment goals and risk tolerance

When it comes to long-term investing, the concept of stop-loss orders can be a valuable tool for managing risk, but its necessity and implementation should be tailored to individual investment goals and risk tolerance. Here's how you can customize your stop-loss strategy:

Understand Your Investment Objectives: Begin by clearly defining your investment goals. Are you aiming for long-term wealth accumulation, retirement planning, or a specific financial target? For instance, if your goal is to build a substantial retirement fund, you might be willing to accept more short-term volatility to achieve your long-term vision. In contrast, a more conservative approach with tighter stop-loss limits could be preferable for those seeking a steady, consistent growth strategy.

Risk Tolerance Assessment: Every investor has a unique risk tolerance level, which is influenced by their financial situation, investment horizon, and personal circumstances. Some investors are comfortable with higher risks and are willing to endure significant short-term fluctuations in exchange for potential long-term gains. Others prefer a more conservative approach, prioritizing capital preservation. Assess your risk tolerance by considering factors like your financial needs, the time you can afford to invest, and your emotional comfort with market volatility.

Customizing Stop-Loss Placement: The placement of stop-loss orders should be tailored to your investment strategy. For long-term investors, a dynamic approach might be more suitable. Instead of a fixed percentage, consider using a moving average or a relative strength index (RSI) to determine the optimal stop-loss level. This allows for more flexibility, adjusting the stop-loss as the investment appreciates or when market conditions change. For instance, you could set a stop-loss at a certain percentage below the 200-day moving average, ensuring that short-term dips don't trigger unnecessary sell-offs.

Combining Stop-Loss with Other Risk Management Tools: Strategy customization also involves integrating stop-loss orders with other risk management techniques. Diversification is a powerful tool to manage risk, so ensure your portfolio is well-diversified across asset classes, sectors, and regions. Additionally, consider using trailing stop-loss orders, which move the stop-loss price as the stock price rises, locking in profits while allowing for potential upside. Combining these strategies can provide a more comprehensive risk management framework.

Regular Review and Adjustment: Long-term investing often involves a dynamic market environment, so regular review and adjustment of your stop-loss strategy are essential. Market conditions, economic trends, and your personal financial situation may change over time. Periodically assess your investment performance and risk exposure, making adjustments to your stop-loss levels and overall strategy as needed. This ensures that your risk management approach remains aligned with your evolving investment goals and risk tolerance.

Navigating Investment Decisions: Strategies for Choosing the Right Terms

You may want to see also

Long-Term Perspective: Stop-loss can be used to maintain a long-term investment strategy

When considering a long-term investment strategy, the use of stop-loss orders can be a valuable tool to manage risk and protect your capital. While long-term investing often emphasizes patience and a buy-and-hold approach, the inherent volatility of financial markets means that investors should still be prepared for potential downturns. This is where stop-loss orders come into play, offering a way to limit potential losses and maintain a disciplined investment approach.

A stop-loss order is an instruction to sell an asset if it reaches a certain price point. For long-term investors, this can be particularly useful as it provides a mechanism to manage risk without actively monitoring the market. By setting a stop-loss, you define a maximum allowable loss for a position, ensuring that you don't lose more than you're comfortable with. This is especially important in volatile markets where asset prices can fluctuate significantly over time. For instance, if you believe in the long-term growth potential of a particular stock, a stop-loss can be set to automatically sell if the stock price drops by a specified percentage, thus limiting potential losses during a short-term market downturn.

The key advantage of using stop-loss orders in a long-term investment strategy is the ability to maintain discipline and emotional detachment from the market. Long-term investing often requires a patient and unemotional approach, and stop-loss orders can help investors stick to their strategy by providing a clear rule for selling. This is crucial because it prevents emotional decisions, such as selling during a temporary market decline, which can be detrimental to long-term performance. By setting a stop-loss, investors can ensure that they sell only when the fundamental value of the investment has been significantly compromised.

Additionally, stop-loss orders can provide a sense of security and peace of mind. Knowing that you have a defined risk limit in place can reduce anxiety and allow investors to focus on their long-term goals. This is particularly important for long-term investors who may have other commitments and responsibilities, as it ensures that their investment strategy remains on track even during periods of market volatility.

In summary, while long-term investing often emphasizes a buy-and-hold strategy, incorporating stop-loss orders can be a prudent risk management technique. It allows investors to maintain their long-term perspective by providing a clear rule for selling, protecting capital, and ensuring emotional detachment from short-term market fluctuations. By setting appropriate stop-loss levels, investors can safeguard their long-term investment strategy and potentially enhance their overall risk-adjusted returns.

Unlocking Long-Term Wealth: A Guide to Smart Stock Investing

You may want to see also

Frequently asked questions

While stop-loss orders are commonly used in short-term trading strategies, they can also be beneficial for long-term investors. A stop-loss order is a type of order that allows investors to set a maximum loss limit on a position. For long-term investments, a stop-loss can be used to protect capital and manage risk. It ensures that if the market moves against your position, you can automatically sell at a predetermined price, limiting potential losses. This is especially useful in volatile markets or when holding investments for extended periods.

In long-term investing, a stop-loss order is typically set at a price slightly below the current market price for a buy position or above the market price for a sell position. This way, if the investment's value drops (in a buy position) or rises (in a sell position) significantly, the order will trigger a sale, locking in a loss at the specified price. This strategy helps investors avoid substantial losses and maintain a disciplined approach to risk management.

Yes, stop-loss orders are versatile and can be applied to both long and short positions. For long positions, it helps limit potential downside risk, while for short positions, it can protect against unexpected market rallies. In long-term investing, stop-loss orders are often used to manage risk in volatile markets, ensuring that investors don't hold onto losing positions for too long.

One potential drawback is that frequent market fluctuations might trigger stop-loss orders, leading to unnecessary selling. This can result in locking in losses prematurely, especially in investments with long-term growth potential. Additionally, stop-loss orders may not always be executed at the exact price set, as market conditions can vary. It's important to set realistic stop-loss levels and regularly review them to minimize this risk.

Reviewing and adjusting stop-loss orders is a crucial aspect of long-term investing. It's recommended to set a stop-loss strategy initially, but then periodically reassess it, especially when market conditions change significantly. You should consider adjusting the stop-loss levels based on the investment's performance, market trends, and your risk tolerance. Regular reviews ensure that your risk management strategy remains effective and aligned with your long-term investment goals.