Tesla, a prominent player in the electric vehicle and clean energy sectors, has garnered significant attention from investors worldwide. With its innovative technology, sustainable practices, and market leadership, many wonder if investing in Tesla is a safe long-term strategy. This introduction aims to explore the factors that contribute to the safety and potential of Tesla's investment, considering its financial performance, market position, and future prospects.

What You'll Learn

- Market Volatility: Tesla's stock price fluctuates, impacting long-term investment safety

- Competition: Growing competition in EV market may affect Tesla's dominance and profitability

- Regulatory Changes: Government policies and incentives can impact Tesla's long-term viability

- Innovation and Technology: Tesla's focus on innovation and technology can drive long-term success

- Financial Performance: Consistent financial growth and profitability are key to long-term investment safety

Market Volatility: Tesla's stock price fluctuates, impacting long-term investment safety

The stock market is inherently volatile, and Tesla, as a prominent player in the electric vehicle (EV) industry, is no exception. Its stock price has experienced significant fluctuations, which can impact the long-term investment safety for those considering Tesla as a core holding in their portfolio. Understanding these price movements is crucial for investors to make informed decisions.

One of the primary drivers of Tesla's stock price volatility is the company's rapid growth and market position. As a pioneer in the EV space, Tesla has disrupted traditional automotive manufacturing and captured a significant market share. However, this rapid growth also attracts intense scrutiny and competition. Any news or event related to the company's performance, product releases, regulatory changes, or industry trends can trigger substantial price swings. For instance, a positive announcement about a new battery technology or a successful product launch can lead to a surge in stock prices, while negative news about production delays or regulatory challenges might cause a decline.

Market sentiment and investor confidence play a significant role in Tesla's stock price volatility. The company's unique business model, led by visionary CEO Elon Musk, often attracts strong opinions and emotions. Positive sentiment can drive the stock price higher, especially during periods of strong market performance or when Tesla announces impressive sales figures or technological breakthroughs. Conversely, negative sentiment may emerge during times of market downturns or when there are concerns about the company's ability to meet production targets or manage its finances.

Additionally, Tesla's stock price is influenced by broader market conditions and economic factors. The company's performance is closely tied to the overall health of the automotive industry, consumer spending habits, and global economic trends. During economic downturns or shifts in consumer preferences, Tesla's stock may experience a downturn, impacting long-term investment strategies.

For investors considering Tesla as a long-term investment, it is essential to adopt a comprehensive approach. Diversification is key, as investing in a single stock carries inherent risk. Investors should also consider Tesla's long-term growth prospects, competitive advantages, and its ability to navigate market challenges. Staying informed about industry trends, regulatory changes, and company-specific developments is crucial to making timely investment decisions.

Precious Metals: A Safe and Reliable Investment Option

You may want to see also

Competition: Growing competition in EV market may affect Tesla's dominance and profitability

The electric vehicle (EV) market is experiencing rapid growth, and with it, an increasing number of competitors are entering the arena, posing a significant challenge to Tesla's dominance. This growing competition is a double-edged sword for Tesla; while it presents an opportunity to drive innovation and improve its offerings, it also threatens to erode its market share and profitability. The EV market is still in its early stages, and many traditional automakers are now investing heavily in electric powertrains, aiming to capture a piece of this lucrative pie.

One of the key competitors is Volkswagen, which has committed to investing $33 billion in EVs by 2030, with the goal of becoming a leading EV manufacturer. Volkswagen's ID.3 and the upcoming ID.4 are direct rivals to Tesla's Model 3 and Model Y. Similarly, General Motors is transforming its lineup with all-electric vehicles, including the Chevrolet Bolt and the upcoming Cadillac Lyriq, targeting Tesla's customer base. These traditional automakers have the advantage of established supply chains, manufacturing expertise, and a large customer base, which they can leverage to quickly scale up production and gain market share.

Startups and niche EV manufacturers are also contributing to the competitive landscape. For instance, Lucid Motors, a luxury EV brand, offers high-performance electric cars with advanced technology, challenging Tesla's premium segment. Additionally, companies like Rivian and Lordstown Motors are focusing on specialized EVs, such as electric trucks and SUVs, which cater to specific consumer needs and differentiate themselves from Tesla's product range. As these competitors gain traction, they may attract customers who are seeking alternatives to Tesla's vehicles, potentially impacting Tesla's sales and market position.

To maintain its leadership, Tesla must continue to innovate and differentiate itself. This includes improving its battery technology, expanding its charging network, and enhancing its over-the-air software updates. Tesla's direct-to-consumer sales model and focus on sustainability and design also set it apart from traditional automakers. However, the company must remain vigilant and adapt to the evolving competitive environment. This might involve strategic partnerships, mergers, or acquisitions to strengthen its position in the market.

In summary, the growing competition in the EV market is a critical factor to consider when assessing Tesla's long-term investment potential. While Tesla has a strong foundation and a head start, the increasing number of competitors could impact its dominance and profitability. Investors should closely monitor Tesla's strategies to counter this competition, ensuring the company's sustained success in a rapidly changing automotive landscape. Staying ahead of the curve through innovation and adaptability will be crucial for Tesla's continued growth and market leadership.

Claiming Investment Management Fees: Strategies for Tax Efficiency

You may want to see also

Regulatory Changes: Government policies and incentives can impact Tesla's long-term viability

The long-term viability of Tesla, a leading electric vehicle (EV) manufacturer, is significantly influenced by regulatory changes and government policies, which can either present opportunities or pose challenges. One of the most critical aspects is the evolution of environmental regulations and incentives. Governments worldwide are increasingly implementing policies to reduce carbon emissions and promote sustainable transportation. These initiatives often favor EV manufacturers like Tesla, as they aim to encourage the adoption of cleaner energy sources. For instance, many countries offer tax credits and rebates for EV purchases, making electric cars more affordable and attractive to consumers. Such financial incentives can directly impact Tesla's sales and market share, especially in regions where these policies are well-established.

However, the regulatory landscape is not without its complexities. As the EV market grows, governments may introduce new regulations that could affect Tesla's operations. For example, some regions might impose stricter emission standards, potentially requiring Tesla to invest in additional technology to meet these new requirements. This could lead to increased costs for the company, which may then be passed on to consumers or impact the overall profitability of the business. Moreover, changes in government policies regarding trade tariffs and import duties can also have a significant effect on Tesla's pricing strategy and competitiveness.

Incentives and subsidies for renewable energy infrastructure and research can further impact Tesla's long-term prospects. As the company heavily relies on battery technology, advancements in this field can lead to more efficient and cost-effective energy storage solutions, benefiting both Tesla and the broader EV industry. Government investments in research and development (R&D) can accelerate innovation, providing Tesla with opportunities to stay ahead of the competition.

On the other hand, regulatory changes can also introduce challenges. Shifts in government policies regarding EV incentives might affect consumer behavior and market demand. If governments reduce or eliminate subsidies, it could impact Tesla's sales, especially in markets heavily reliant on these incentives. Additionally, changes in trade policies or the introduction of new tariffs might affect Tesla's supply chain and manufacturing costs, potentially impacting its profitability and long-term sustainability.

In summary, regulatory changes and government policies play a pivotal role in shaping Tesla's long-term investment prospects. While supportive environmental regulations and incentives can boost Tesla's growth and market position, evolving policies and standards may also present challenges. Staying informed about these regulatory shifts is essential for investors and stakeholders to make well-informed decisions regarding Tesla's future prospects.

Is Your Investment Website as Safe as Your Wallet?

You may want to see also

Innovation and Technology: Tesla's focus on innovation and technology can drive long-term success

Tesla, a pioneer in the electric vehicle (EV) market, has built its reputation on innovation and technology, which are key factors in its long-term success and potential as a safe investment. The company's relentless pursuit of cutting-edge technology has not only set it apart from traditional automakers but has also positioned it as a leader in the rapidly evolving EV industry.

One of the primary reasons Tesla's focus on innovation and technology is so effective is its ability to integrate advanced features and systems into its vehicles. From the Autopilot driving assistance system to the over-the-air software updates, Tesla constantly enhances its cars' capabilities. This not only improves the driving experience but also ensures that Tesla vehicles remain competitive and desirable over time. For instance, Autopilot, a suite of advanced driver-assistance features, has been a game-changer, offering a level of automation that was once unimaginable in mainstream vehicles. This technology not only enhances safety but also showcases Tesla's commitment to innovation, attracting tech-savvy consumers.

Moreover, Tesla's approach to software updates is revolutionary. The company can remotely update its vehicles' software, improving performance, fixing bugs, and adding new features without requiring a physical visit to a service center. This not only ensures that Tesla cars remain cutting-edge but also provides a unique selling point that traditional automakers struggle to replicate. Over-the-air updates have become a hallmark of Tesla's technology-driven approach, keeping customers engaged and satisfied.

In addition to in-vehicle technology, Tesla's focus on innovation extends to its manufacturing processes and supply chain. The company's commitment to vertical integration, where it controls various aspects of production, from design to manufacturing, allows for greater efficiency and cost control. This strategic move enables Tesla to offer competitive pricing while maintaining high-quality standards. By optimizing its supply chain and manufacturing processes, Tesla can quickly adapt to market demands and technological advancements, ensuring its long-term sustainability.

Tesla's dedication to innovation and technology also extends to its energy storage and solar panel business. The company's Powerwall and Powerpack products revolutionize energy storage, offering a sustainable and efficient solution for homes, businesses, and even entire communities. This diversification into energy storage and solar technology not only strengthens Tesla's position in the market but also contributes to its overall long-term success and resilience.

In conclusion, Tesla's focus on innovation and technology is a powerful driver of its long-term success and potential as a safe investment. The company's ability to integrate advanced features, provide over-the-air software updates, optimize manufacturing processes, and diversify into energy storage solutions sets it apart in the EV market. As Tesla continues to innovate, it is likely to maintain its competitive edge, attract a loyal customer base, and solidify its position as a leader in the automotive and energy sectors. This commitment to technological advancement and innovation makes Tesla a compelling choice for investors seeking long-term growth and stability.

Understanding Portfolio Investment Entities in New Zealand

You may want to see also

Financial Performance: Consistent financial growth and profitability are key to long-term investment safety

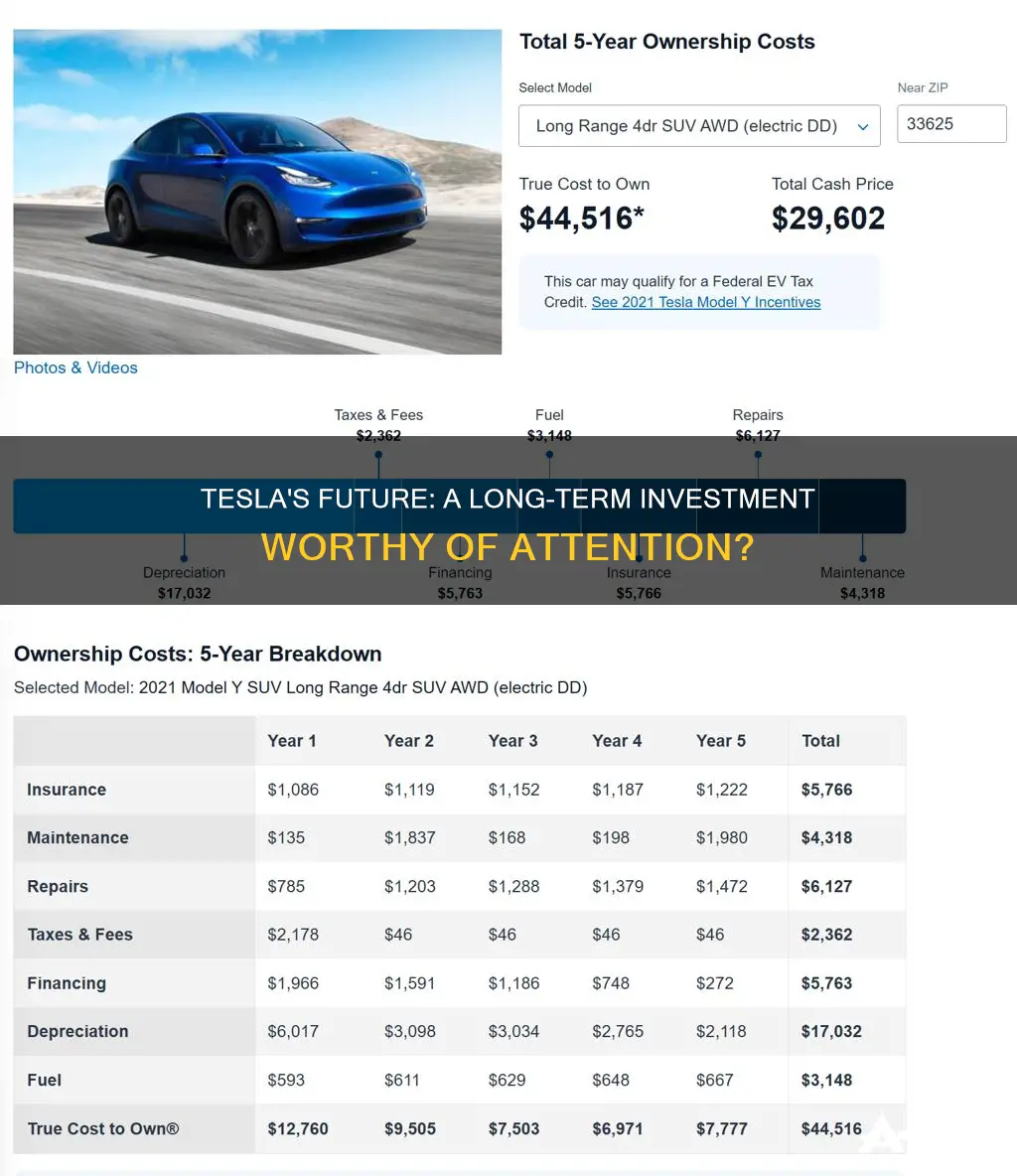

When considering Tesla as a long-term investment, one of the most critical factors to evaluate is its financial performance and stability. Tesla, Inc. has demonstrated remarkable financial growth over the years, which has been a significant factor in attracting investors. The company's consistent revenue growth, coupled with its ability to turn a profit, indicates a strong financial foundation.

In recent years, Tesla has experienced substantial revenue increases, with a notable surge in sales and revenue in 2021, despite the global chip shortage. This resilience in the face of industry challenges showcases Tesla's ability to navigate market fluctuations and maintain its growth trajectory. The company's focus on innovation and its unique position in the electric vehicle (EV) market have contributed to its financial success.

Profitability is another essential aspect of long-term investment safety. Tesla has made significant strides in improving its profit margins, which have been expanding over time. The company's gross margin has shown an upward trend, indicating better cost management and pricing power. Additionally, Tesla's focus on reducing costs and optimizing production processes has led to improved operating margins, making it more financially stable.

The consistent financial growth and profitability of Tesla are underpinned by its strong market position and brand value. The company has successfully established itself as a leader in the EV industry, with a loyal customer base and a unique value proposition. This brand strength allows Tesla to command premium prices and maintain a competitive edge in the market. As a result, investors can have confidence in the company's ability to sustain its financial performance over the long term.

However, it is important to note that while Tesla's financial performance is impressive, it is not without its risks. The company's high growth rates and innovative nature also expose it to certain vulnerabilities. Investors should carefully consider the potential impact of regulatory changes, technological disruptions, and market competition on Tesla's financial stability. Despite these risks, Tesla's consistent financial growth and profitability make it an attractive long-term investment option for those seeking exposure to the EV market and sustainable energy solutions.

Risk Tolerance: When is Your Appetite for Risk Highest?

You may want to see also

Frequently asked questions

While Tesla has experienced significant growth and is a well-known brand in the automotive industry, it is important to approach it as a long-term investment with caution. The company's stock has been highly volatile, with rapid price fluctuations, which can be a concern for risk-averse investors. However, Tesla's innovative technology, strong brand value, and market leadership in the electric vehicle (EV) space make it an attractive long-term prospect. The company's focus on sustainability and its ability to disrupt traditional automotive manufacturing could lead to substantial returns over time.

Tesla's investment risks include regulatory and policy changes, as the company's success heavily relies on government incentives and subsidies for electric vehicles. Any shift in these policies could impact Tesla's sales and profitability. Additionally, the company's high growth expectations and rapid expansion might lead to challenges in maintaining profit margins and managing costs effectively. Tesla's competition in the EV market is also growing, which could impact its market share and long-term viability.

Tesla has demonstrated impressive financial performance, with consistent revenue growth and increasing market share in the EV segment. The company's focus on vertical integration and in-house manufacturing has allowed it to control costs and maintain a competitive edge. However, when compared to traditional automakers, Tesla's profitability is still a concern due to high research and development (R&D) expenses and production challenges. Nevertheless, the company's financial health is improving, and it is making strides in becoming more efficient and sustainable.

Investing in Tesla long-term could offer several advantages. Firstly, the company's technological advancements and innovation in battery technology and autonomous driving could lead to significant breakthroughs, making Tesla a leader in the industry. Secondly, the global shift towards electrification and sustainability provides a favorable market environment for Tesla's growth. Lastly, the company's strong brand and customer loyalty can drive long-term revenue growth and market dominance.