Investing in a Roth IRA is a smart financial move, and many employers offer this option as part of their retirement benefits. If you're wondering how to invest in a Roth IRA through your workplace, it's a straightforward process that can help you build a secure financial future. Here's a simple guide to get you started: First, understand the benefits of a Roth IRA, which allows tax-free growth and withdrawals in retirement. Next, check with your employer to see if they offer a Roth IRA plan as part of your benefits package. If so, you can typically enroll during your open enrollment period or at any time if your employer allows it. You'll then choose your investment options, such as stocks, bonds, or mutual funds, and contribute a portion of your paycheck directly to your Roth IRA. This process is seamless and often integrated into your payroll system, making it easy to start building your retirement savings today.

What You'll Learn

- Understanding Roth IRA Basics - Learn about tax-free growth and withdrawals

- Employer-Sponsored Plans - Explore options like 401(k)s and 403(b)s

- Contribution Limits and Limits - Understand annual limits and income-based restrictions

- Direct Deposits and Contributions - Set up automatic contributions from your paycheck

- Investment Options and Strategies - Choose investments like stocks, bonds, and mutual funds

Understanding Roth IRA Basics - Learn about tax-free growth and withdrawals

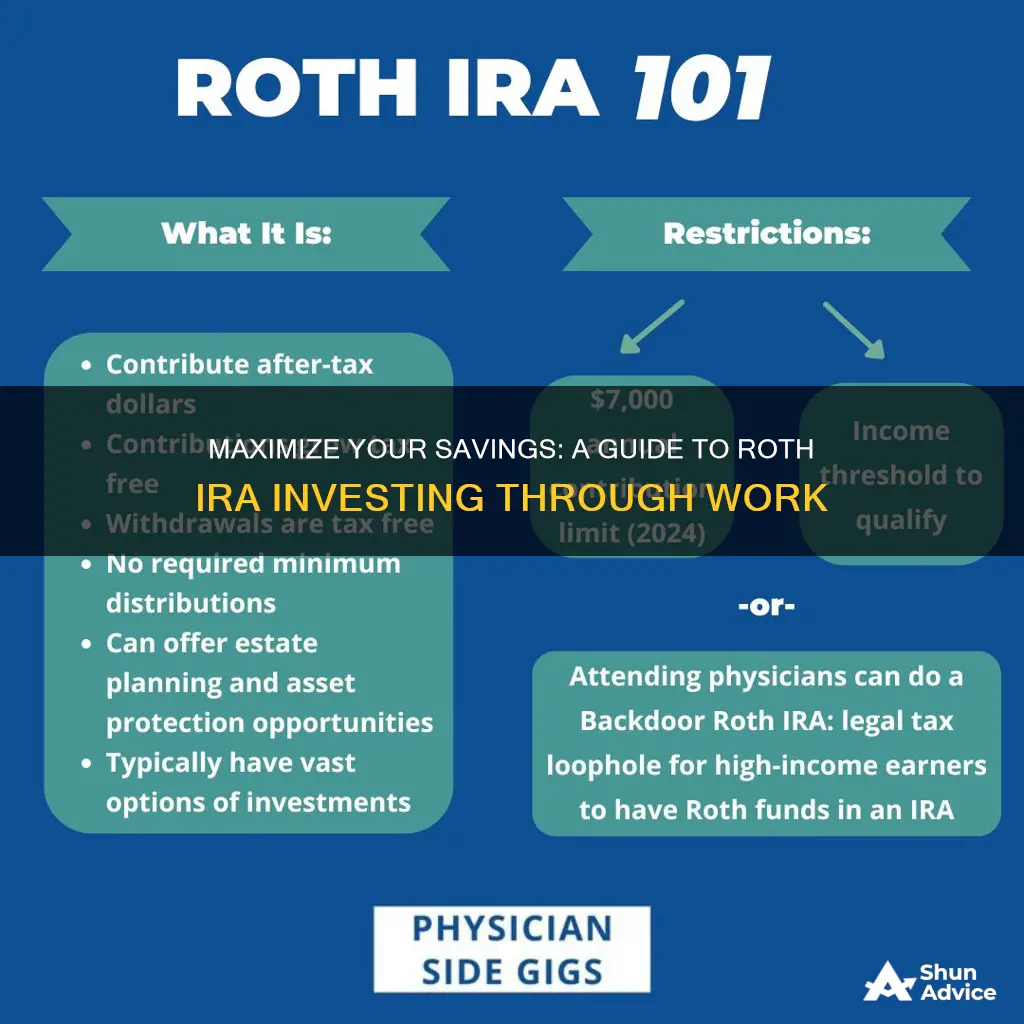

Understanding the fundamentals of a Roth IRA is essential for anyone looking to build a secure financial future. This type of retirement account offers a unique way to save for your later years, providing tax-free growth and withdrawals, which can be a powerful tool for long-term wealth accumulation. Here's a breakdown of the key aspects:

A Roth IRA is an individual retirement account that allows you to contribute after-tax dollars, meaning you don't get a tax deduction for your contributions. However, the real power lies in the tax-free nature of the account's growth. As your investments grow, the earnings and any capital gains are not taxed, and you can withdraw these funds tax-free and penalty-free in retirement. This is a significant advantage over traditional IRAs, where contributions are tax-deductible but withdrawals in retirement are taxed as ordinary income.

The beauty of a Roth IRA is that it encourages long-term savings. Since you're investing post-tax, you can take advantage of the power of compounding. Over time, your investments can grow significantly, and the earnings can accumulate without any additional tax burden. This tax-free growth can be a substantial benefit, especially when compared to traditional retirement accounts.

When it comes to withdrawals, Roth IRA owners have the freedom to take out their contributions at any time, tax-free and penalty-free. This flexibility is a significant advantage, as it allows you to access your savings without incurring penalties or taxes. Additionally, you can withdraw earnings from a Roth IRA after a certain period, typically five years, without paying taxes on those earnings. This feature is particularly attractive for those who want to ensure they have accessible funds for various financial goals.

Setting up a Roth IRA through your employer's retirement plan is often straightforward. Many employers offer a Roth option alongside traditional retirement plans. By contributing to a Roth IRA, you're investing in a tax-advantaged account that can provide substantial benefits over time. It's a strategic way to build a secure financial future, especially when combined with other retirement savings strategies.

In summary, a Roth IRA is a powerful tool for retirement savings, offering tax-free growth and the freedom to withdraw contributions and earnings without penalties. It's an excellent way to secure your financial future, providing a tax-efficient and accessible way to save for retirement. Understanding these basics can empower individuals to make informed decisions about their retirement planning.

The Retirement Mortgage Dilemma: Pay Off or Invest?

You may want to see also

Employer-Sponsored Plans - Explore options like 401(k)s and 403(b)s

When it comes to investing in a Roth IRA through your employer, there are several options to consider, primarily in the form of employer-sponsored retirement plans. These plans are designed to help you save for retirement while often offering tax advantages and employer contributions. Two of the most common types of these plans are 401(k)s and 403(b)s.

A 401(k) plan is a retirement savings plan typically offered by employers to their employees. It allows you to contribute a portion of your paycheck before taxes, which reduces your taxable income. The contributions are then invested, and the earnings grow tax-deferred until you start withdrawing in retirement. Many employers also offer matching contributions, which is essentially free money that can significantly boost your savings. To participate, you'll need to fill out an enrollment form and choose your investment options. It's important to understand the investment options available, as they can vary widely. These may include mutual funds, stocks, bonds, and target date funds, each with its own level of risk and potential return.

On the other hand, a 403(b) plan is similar to a 401(k) but is designed for employees of public schools, certain tax-exempt organizations, and state and local governments. The rules and contributions limits for 403(b)s are generally the same as those for 401(k)s, but the tax treatment of contributions can vary. Some 403(b) plans allow after-tax contributions, which can be a good option if you expect to be in a lower tax bracket in retirement. Like 401(k)s, 403(b)s also offer a variety of investment options, allowing you to tailor your portfolio to your risk tolerance and financial goals.

Both of these employer-sponsored plans provide an excellent opportunity to save for retirement, especially when combined with potential employer matching contributions. They offer a convenient way to invest in a retirement account, often with the added benefit of tax advantages and employer-provided investment options. It's important to review the details of your specific plan, including contribution limits, withdrawal rules, and investment choices, to make the most of this benefit.

In summary, exploring 401(k)s and 403(b)s can be a significant step towards securing your financial future. These plans provide a structured way to save and invest for retirement, often with the support of your employer. Understanding the specifics of your plan will enable you to make informed decisions about your retirement savings strategy.

The Great Debate: Home Sweet Home or Loan Freedom?

You may want to see also

Contribution Limits and Limits - Understand annual limits and income-based restrictions

When it comes to contributing to a Roth IRA through your employer, it's crucial to understand the contribution limits and income-based restrictions to ensure you're maximizing your retirement savings effectively. The IRS sets annual contribution limits for Roth IRAs, which are designed to encourage long-term savings and provide tax advantages. For the tax year 2023, the annual contribution limit for a Roth IRA is $19,500, or $26,000 if you are 50 or older. This limit applies to both traditional and Roth IRAs, ensuring a consistent framework for retirement savings. It's important to note that this limit is per year, and contributions above this amount will not be accepted by the IRS.

Additionally, there are income-based restrictions that can impact your ability to contribute to a Roth IRA. If your income exceeds certain thresholds, you may be subject to a phase-out of the Roth IRA contribution limit. For the 2023 tax year, the phase-out begins at $132,000 of modified adjusted gross income (MAGI) for single filers and $198,000 for married filing jointly. If your MAGI exceeds these limits, your contribution limit will gradually decrease until it reaches zero. These income-based restrictions are in place to ensure that contributions are accessible to those who need them most and to prevent potential tax advantages from being misused.

Understanding these contribution limits and restrictions is essential for several reasons. Firstly, it helps you plan your retirement savings strategy effectively. By knowing the annual limit, you can ensure that you contribute the maximum amount allowed without incurring penalties. Secondly, being aware of the income-based phase-out allows you to make informed decisions about your investments and retirement planning, especially if you are approaching the upper income limits. It's important to note that these limits are subject to change annually, so staying updated with the latest IRS guidelines is crucial.

To maximize your Roth IRA contributions, consider the following strategies. If you are close to the phase-out limit, you might want to adjust your investment strategy or explore other retirement savings options. Additionally, if you have a spouse with a lower income, they may be able to contribute to your Roth IRA, providing a tax-advantaged way to save for both of your retirements. It's also beneficial to review your financial situation regularly and make adjustments to your contributions as your income and expenses change.

In summary, understanding the annual contribution limits and income-based restrictions is vital for effectively managing your Roth IRA. By adhering to these guidelines, you can ensure that your retirement savings grow tax-free and provide financial security for your future. Remember to stay informed about any changes in IRS regulations to make the most of your retirement savings strategy.

Don't Invest: When to Hold Off

You may want to see also

Direct Deposits and Contributions - Set up automatic contributions from your paycheck

Setting up automatic contributions to your Roth IRA is a convenient and efficient way to save and invest a portion of your earnings regularly. This method, often referred to as direct deposit or payroll contributions, allows you to invest in your retirement without even thinking about it, making it a popular choice for those who want to build their retirement savings effortlessly. Here's a step-by-step guide to help you get started:

- Understand the Process: Begin by familiarizing yourself with the concept of direct deposit into your Roth IRA. This process involves setting up an arrangement with your employer to contribute a specified amount directly to your retirement account. It's a seamless way to save, as the contributions are made automatically, ensuring consistency in your savings strategy.

- Contact Your Employer: Reach out to your human resources department or payroll team to initiate the process. Inform them about your interest in setting up Roth IRA contributions through direct deposit. They will provide you with the necessary forms or instructions to complete. This step is crucial as it involves coordinating with your employer to ensure the correct amount is deducted from your paycheck and directed to your chosen retirement account.

- Complete the Necessary Forms: Your employer will likely provide you with specific forms or authorization documents. These documents will allow your employer to make regular contributions on your behalf. Carefully review the forms to ensure the accuracy of the information, including the contribution amount, frequency, and the name and details of your Roth IRA. Double-checking these details is essential to avoid any discrepancies.

- Choose Contribution Amount and Frequency: Decide on the amount you want to contribute to your Roth IRA regularly. It's advisable to start with a percentage of your paycheck that is manageable but also meaningful for your long-term savings goal. You can choose to contribute a fixed amount or a percentage of your earnings. Additionally, determine the frequency of these contributions. You might opt for weekly, bi-weekly, or monthly deposits, depending on your pay schedule and preferences.

- Set Up the Direct Deposit: Once you have the necessary forms filled out and approved, your employer will set up the direct deposit process. This involves configuring their payroll system to transfer the designated amount from your paycheck to your Roth IRA. The frequency of these contributions will align with your chosen pay schedule, ensuring a steady flow of savings into your retirement account.

By setting up automatic contributions through direct deposit, you benefit from the power of compound interest, allowing your investments to grow over time. This method also provides a sense of financial discipline, as you're contributing regularly without the temptation to spend the money. Remember, the key to successful investing is consistency, and direct deposit makes it easier to stay on track with your retirement savings strategy.

Retirement Investments: Living Off Profits

You may want to see also

Investment Options and Strategies - Choose investments like stocks, bonds, and mutual funds

When it comes to investing in a Roth IRA, you have a variety of options to consider, each with its own level of risk and potential for growth. Here's a breakdown of some popular investment choices and strategies to help you make informed decisions:

Stocks: Investing in stocks means purchasing shares of individual companies. This can be a powerful way to build wealth over time, as stocks have historically shown strong long-term growth potential. You can choose to invest in specific companies you believe in or opt for a broader approach by investing in index funds or exchange-traded funds (ETFs) that track a particular market or sector. Diversification is key here; consider spreading your investments across different industries and company sizes to manage risk.

Bonds: Bonds are essentially loans made to governments or corporations. When you buy a bond, you're lending money and receiving regular interest payments in return. Bonds are generally considered less risky than stocks but offer lower potential returns. They provide a steady income stream and are often used for long-term wealth building or as a hedge against stock market volatility. Government bonds, corporate bonds, and municipal bonds are common types to explore.

Mutual Funds: These are investment funds that pool money from many investors to invest in a diverse range of assets, such as stocks, bonds, or a mix of both. Mutual funds are managed by professionals who decide how to allocate the fund's assets. This strategy offers instant diversification, making it a popular choice for beginners. You can find mutual funds focused on specific industries, market sectors, or investment styles, allowing you to align your investments with your financial goals and risk tolerance.

When selecting investments, it's crucial to consider your investment horizon, risk tolerance, and financial goals. Diversification is a key strategy to manage risk; by spreading your investments across different asset classes and sectors, you can potentially reduce the impact of any single investment's performance on your overall portfolio. Additionally, regularly reviewing and rebalancing your portfolio can help ensure it stays aligned with your investment strategy as your financial situation and goals evolve.

Silver's Investment History: 1800s

You may want to see also

Frequently asked questions

Check your employee benefits package or contact your HR department to confirm if your employer provides a Roth IRA contribution as part of your retirement plan. Many employers offer this option as a way to encourage employees to save for retirement.

The process typically involves enrolling during the annual open enrollment period or when you start a new job. You will need to fill out the necessary forms, which may include providing personal and financial information. Your employer's payroll or benefits department will guide you through the process and help set up regular contributions.

Yes, investing in a Roth IRA through your employer has tax advantages. Contributions are made with after-tax dollars, meaning you don't get an immediate tax deduction like you would with a traditional IRA. However, the earnings and withdrawals in a Roth IRA are tax-free, providing a long-term benefit. This type of retirement savings plan is an excellent way to build tax-free savings for your future.