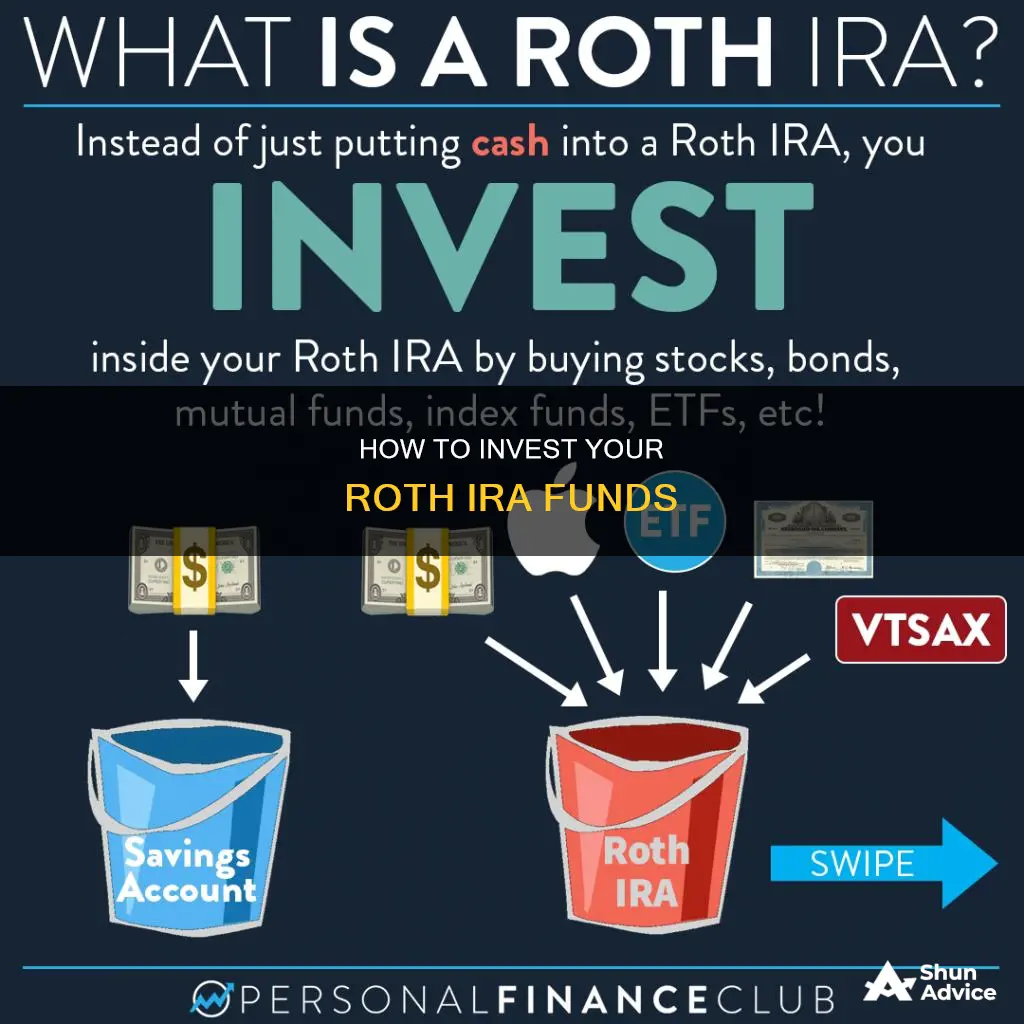

A Roth IRA is a type of tax-advantaged individual retirement account (IRA) that allows you to contribute after-tax dollars toward your retirement. The primary benefit of a Roth IRA is that your contributions and the earnings on those contributions can grow tax-free and be withdrawn tax-free after age 59 ½, assuming the account has been open for at least five years.

While you can't directly invest in individual stocks or bonds with a Roth IRA, you can choose from a variety of investment options, including mutual funds, stocks, bonds, exchange-traded funds (ETFs), certificates of deposit (CDs), and money market funds.

- Dividend stock funds

- Value stock funds

- Nasdaq-100 index funds

- Real estate investment trusts (REITs)

- Target-date funds

- Small-cap stock funds

- Bond funds

| Characteristics | Values |

|---|---|

| Type of account | Individual retirement account (IRA) |

| Tax treatment | After-tax dollars |

| Withdrawals | Tax-free after age 59 1/2, if the account has been open for at least five years |

| Investment options | Stocks, ETFs, bonds, mutual funds, real estate investment trusts (REITs), target-date funds, small-cap stock funds, etc. |

| Income limits for contributions | Yes |

| Annual contribution limits | $7,000 for under 50s, $8,000 for 50s and over (2024) |

What You'll Learn

Dividend stock funds

Dividend stocks are risky in the sense that owning any individual stock is riskier than owning a diversified portfolio of stocks. But dividend stocks are less risky than growth stocks because the companies are well-established. Some have such a long history of consistent and ever-increasing dividend payments that they're called "dividend aristocrats".

For the lowest ongoing expenses, look for passively managed funds. Active management options charge higher fees than passive management and rarely outperform them.

Unlock Real Estate Funding: Strategies for Investors

You may want to see also

Value stock funds

Because of their usually lower volatility, value stock funds can make an attractive addition to a Roth IRA. And, of course, any dividends can be ploughed back into the value stock fund, too.

A Roth IRA is a special individual retirement account (IRA) where you pay taxes on money going into your account, and then all future withdrawals of earnings are free from tax and penalty once you reach age 59 1/2 and the Roth IRA has been open at least five years.

In comparison to earnings, you can withdraw contributions tax- and penalty-free at any time.

U.S. Investment Fund Transition to Schwab: What, When, Why?

You may want to see also

Nasdaq-100 index funds

One of the simplest ways to gain exposure to the Nasdaq-100 is through fund-related products, such as annuities, which have consistently performed well over time.

- Shelton NASDAQ-100 Index Direct (NASDX)

- Invesco QQQ Trust ETF (QQQ)

When investing insection funds, it is important to consider factors such as expenses, taxes, investment minimums, long-run performance, expense ratios, trading costs, fund options, and convenience.

It is also worth noting that while it is theoretically possible to lose everything in an index fund, the odds of this happening are very low due to the diversification of these funds.

Emerging Markets: Where to Invest and Why

You may want to see also

Real estate investment trusts (REITs)

REITs are required to meet certain standards set by the IRS, including:

- Returning a minimum of 90% of taxable income as shareholder dividends each year

- Investing at least 75% of total assets in real estate or cash

- Receiving at least 75% of gross income from real estate

- Having a minimum of 100 shareholders after the first year of existence

- Ensuring that no more than 50% of shares are held by five or fewer individuals during the last half of the taxable year

By adhering to these rules, REITs don't pay tax at the corporate level, which allows them to finance real estate more cheaply and earn more profits to disburse to investors.

There are three broad categories of REITs: equity, mortgage, and hybrid. Equity REITs operate like a landlord and handle all the management tasks associated with owning a property. Mortgage REITs, on the other hand, don't own the underlying property but instead own debt securities backed by the property. Hybrid REITs are a combination of both equity and mortgage REITs.

When it comes to investing in REITs, you can purchase them through an investment or brokerage account. Publicly-traded REITs are traded on an exchange like stocks and ETFs, while public non-traded REITs are registered with the SEC but are not available on an exchange. Private REITs, on the other hand, are generally exempt from SEC registration and have fewer disclosure requirements.

REITs offer several advantages, including steady dividends, high returns, liquidity, and lower volatility. However, they also come with certain drawbacks, such as heavy debt, low growth and capital appreciation, tax burdens, and illiquidity for non-traded and private REITs.

Overall, REITs are a great option for those looking to invest in real estate without the hassle and risks associated with owning and managing properties.

Dave Ramsey's Investment Strategy: Specific Fund Choices

You may want to see also

Target-date funds

These funds are managed by professionals and invest in a mix of stocks, bonds, and other assets. The mix of investments is adjusted over time, taking on more risk when the investor is younger and gradually becoming more conservative as they approach retirement. This adjustment is made based on a "glidepath", which is a strategy that determines the level of risk the fund is exposed to at each stage of the investor's journey towards retirement.

To invest in a target-date fund, an individual simply needs to choose the fund with a target retirement date closest to their own. The fund's portfolio manager will then take care of rebalancing the fund's investments over time to ensure they remain appropriate for investors as they progress through their careers.

Bonds vs Mutual Funds: Where Should You Invest?

You may want to see also

Frequently asked questions

A Roth IRA is a type of individual retirement account that lets you contribute after-tax money to save for retirement. The money grows tax-free and can be withdrawn tax-free after age 59 ½ as long as the account has been open for at least five years.

A Roth IRA can be opened at a traditional broker or robo-advisor. Before you get started, double-check if you qualify to make contributions based on your income and tax filing status.

You can invest in a variety of securities, including mutual funds, stocks, bonds, exchange-traded funds (ETFs), certificates of deposit (CDs), and money market funds.