The future of investing is a topic of much speculation and concern, as the global economy faces numerous challenges and uncertainties. With the rise of technology and the increasing interconnectedness of markets, the investment landscape has become more complex and dynamic. While some argue that the future is bright for investors, offering opportunities for significant growth and diversification, others warn of potential risks and threats that could derail the market. This article explores the various factors that could shape the future of investing, including technological advancements, geopolitical tensions, and the impact of climate change, to determine whether the future is indeed safe for investors.

What You'll Learn

- Economic Uncertainty: Global events and policies impact investment stability

- Market Volatility: Fluctuations in stock prices pose risks for long-term investors

- Technological Disruption: Innovation can create new investment opportunities and challenges

- Environmental Concerns: Climate change may affect industries and investment strategies

- Regulatory Changes: Shifts in laws can impact investment returns and market dynamics

Economic Uncertainty: Global events and policies impact investment stability

The global economic landscape is a complex and ever-changing environment, and recent years have been a testament to the unpredictable nature of international affairs. Economic uncertainty has become a pervasive challenge for investors, as global events and policies can significantly impact investment stability. This is particularly true in an era where interconnectedness and interdependence are at an all-time high.

One of the most prominent sources of economic uncertainty is geopolitical tensions. Trade wars, political conflicts, and shifting international alliances can create a volatile environment for investors. For instance, the ongoing trade dispute between major economies has led to increased tariffs, supply chain disruptions, and a general sense of uncertainty. This, in turn, affects the confidence of investors, who may become more cautious or even hesitant to enter the market. As a result, asset prices can fluctuate dramatically, impacting the overall stability of investment portfolios.

Global events, such as pandemics, natural disasters, or financial crises, can also trigger economic uncertainty. The recent global health crisis, COVID-19, is a prime example. The pandemic caused widespread economic disruption, with businesses shutting down, supply chains being interrupted, and governments implementing unprecedented stimulus measures. These events led to a rapid and sharp decline in stock markets worldwide, highlighting the fragility of investment portfolios. Investors had to navigate through a highly uncertain period, making it crucial to understand the potential impact of such global events on their investment strategies.

In addition to geopolitical and global events, changes in government policies and regulations can significantly influence investment stability. Fiscal and monetary policies, tax reforms, and industry-specific regulations are all tools that governments use to shape the economic environment. For instance, a sudden shift in tax policies could affect the profitability of certain industries, leading to a reevaluation of investment decisions. Similarly, changes in interest rates or monetary policies can impact borrowing costs, inflation, and overall market sentiment, thereby influencing investment trends.

To navigate this uncertain terrain, investors must stay informed and adapt their strategies accordingly. Diversification is a key strategy to mitigate risks associated with economic uncertainty. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce the impact of any single event or policy change. Additionally, maintaining a long-term perspective and regularly reviewing investment portfolios can help investors weather short-term volatility. It is also essential to stay updated on global economic trends, news, and expert analyses to make informed decisions.

In conclusion, economic uncertainty stemming from global events and policies is a critical consideration for investors. The interconnected nature of the global economy means that local or regional events can quickly escalate into broader implications. By understanding the potential impact of geopolitical tensions, global events, and policy changes, investors can develop more robust strategies. Staying informed, diversifying portfolios, and adopting a long-term investment approach are essential tools to navigate the challenges of economic uncertainty and ensure a more stable investment future.

State Investment Fuels China and India's Rapid Growth

You may want to see also

Market Volatility: Fluctuations in stock prices pose risks for long-term investors

The concept of market volatility is an inherent aspect of investing, and it can significantly impact long-term investment strategies. Volatility refers to the rapid and significant fluctuations in stock prices, which can create both opportunities and challenges for investors. While short-term traders might capitalize on these price swings, long-term investors need to approach market volatility with a strategic mindset to ensure their financial goals remain on track.

In the realm of long-term investing, the primary objective is often to build wealth over an extended period, typically years or even decades. This approach requires a certain level of tolerance for risk, as markets are inherently unpredictable in the short term. However, market volatility can introduce several risks that long-term investors should be aware of. Firstly, sudden price drops can lead to significant losses, especially for those who are less experienced or emotionally invested in the market. For instance, a 10% decline in stock prices can result in substantial losses for investors who are not prepared for such volatility. This can be particularly concerning for retirement funds or long-term savings plans, where consistent growth is essential.

Secondly, market volatility can cause investors to make impulsive decisions. During periods of high volatility, emotions often take center stage, leading to panic selling or impulsive buying. Long-term investors should maintain a disciplined approach, focusing on their investment strategy and not letting short-term market fluctuations deter them. It is crucial to remember that market downturns are often temporary, and a well-diversified portfolio can help mitigate the impact of such events.

To navigate market volatility effectively, long-term investors should consider the following strategies. Firstly, diversification is key. By spreading investments across various asset classes, sectors, and industries, investors can reduce the impact of any single market event. A diversified portfolio ensures that the overall risk is managed, and potential losses in one area can be offset by gains in others. Secondly, a long-term perspective is essential. Short-term market fluctuations should not influence investment decisions. Instead, investors should focus on their long-term goals and maintain a consistent investment strategy.

Additionally, regular portfolio reviews are vital. Long-term investors should periodically assess their holdings to ensure they align with their risk tolerance and investment objectives. This process allows for necessary adjustments to the portfolio, ensuring it remains on track despite market volatility. Finally, staying informed about market trends and economic factors can help investors make more informed decisions. While it is challenging to predict market movements with certainty, a comprehensive understanding of the market's drivers can assist in making strategic choices.

In conclusion, market volatility presents both risks and opportunities for long-term investors. While it can lead to significant price fluctuations, a well-prepared and disciplined approach can help mitigate these risks. Long-term investors should focus on diversification, maintaining a long-term perspective, and staying informed to navigate market volatility successfully and ensure the safety and growth of their investments over time.

Transferring Funds: Ally Invest to Ally Savings

You may want to see also

Technological Disruption: Innovation can create new investment opportunities and challenges

The future of investing is indeed a topic of much speculation and concern, especially as we witness the rapid pace of technological disruption across various sectors. This phenomenon, often referred to as 'technological disruption', is reshaping industries and presenting both opportunities and challenges for investors. As we explore this complex landscape, it becomes evident that innovation is a double-edged sword, offering both potential rewards and unforeseen risks.

One of the most significant impacts of technological disruption is the emergence of entirely new markets and investment opportunities. For instance, the rise of blockchain technology and cryptocurrencies has created a new asset class, attracting investors seeking high-risk, high-reward prospects. Similarly, advancements in artificial intelligence (AI) and machine learning have led to the development of innovative financial models, such as algorithmic trading and automated investment platforms. These technologies enable faster, more efficient decision-making, and provide investors with tools to navigate complex markets with precision. However, this rapid evolution also brings challenges, as traditional investment strategies may become obsolete, requiring investors to adapt quickly.

In the financial sector, disruption is evident in the form of fintech startups challenging established banks. These startups leverage technology to offer more accessible, user-friendly, and cost-effective services, attracting a new generation of investors. Mobile banking apps, for example, have revolutionized personal finance, allowing users to manage their money on-the-go. This shift in consumer behavior has forced traditional financial institutions to innovate, leading to the development of more robust digital platforms. As a result, investors in fintech companies are reaping the benefits of this disruption, but they must also navigate the risks associated with rapid industry transformation.

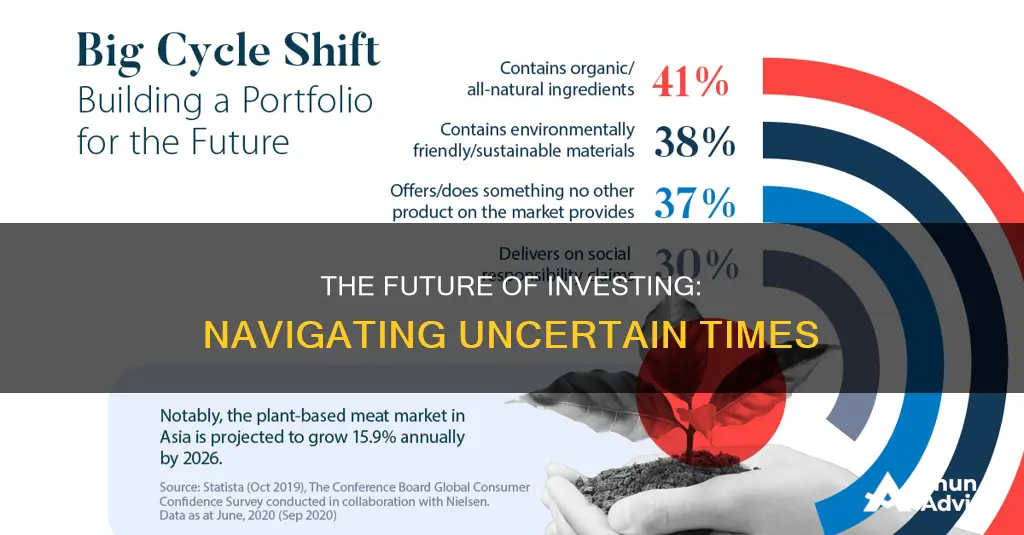

Another area of technological disruption with significant investment implications is renewable energy and sustainability. The global push towards a greener economy has spurred innovation in clean energy technologies, creating new investment avenues. Investors are increasingly directing their capital towards companies developing solar panels, wind turbines, and energy storage solutions. This shift is not only driven by environmental concerns but also by the potential for substantial returns as governments and corporations strive to meet sustainability goals. However, the transition to a low-carbon economy also presents challenges, such as the need for substantial infrastructure investments and the potential for regulatory changes.

As technology continues to advance, investors must stay agile and adaptable. The key to success in this evolving landscape is a deep understanding of emerging trends and the ability to identify disruptive technologies with long-term potential. Diversification is also crucial, as certain sectors may experience rapid growth while others face disruption. Investors should consider a mix of traditional and innovative assets, ensuring their portfolios are well-positioned to navigate the complexities of the future investment environment.

In conclusion, technological disruption is reshaping the investment landscape, presenting both opportunities and challenges. Investors must embrace innovation while remaining vigilant to the risks it may introduce. By staying informed, adaptable, and diversified, investors can position themselves to capitalize on the rewards of technological advancement while mitigating potential pitfalls. The future of investing is undoubtedly a dynamic and exciting prospect, demanding a proactive and strategic approach.

AI Investing: Navigating the Risks and Rewards

You may want to see also

Environmental Concerns: Climate change may affect industries and investment strategies

The future of investing is indeed a complex and evolving landscape, and one of the critical factors that investors and analysts are increasingly considering is the impact of environmental concerns and climate change. As the world grapples with the urgent need to address climate-related challenges, it is becoming evident that these issues will significantly influence various industries and, consequently, investment decisions.

Climate change is expected to have far-reaching effects on numerous sectors, and investors are now more aware of the potential risks and opportunities associated with these environmental concerns. One of the primary areas of impact is the energy industry. The transition to a low-carbon economy is already underway, with many countries and companies committing to renewable energy sources. This shift may lead to a decline in the traditional fossil fuel sector, affecting the profitability of related businesses. Investors are now more inclined to support and invest in companies that demonstrate a commitment to sustainable and environmentally friendly practices, such as renewable energy production, energy efficiency, and carbon capture technologies.

Additionally, climate change can disrupt various other industries, including agriculture, transportation, and real estate. For instance, changing weather patterns and extreme weather events can impact crop yields, affecting food production and supply chains. This, in turn, may influence the performance of companies in the agricultural sector and related industries. Similarly, the transportation industry is facing challenges due to the rise of electric vehicles and the need for infrastructure upgrades to accommodate new energy sources. Real estate investments are also being re-evaluated, as properties in areas prone to severe weather events or those that can adapt to changing environmental conditions may become more desirable.

Investors are encouraged to consider the long-term sustainability of their investments and the potential risks associated with environmental degradation. This includes assessing the resilience of companies to climate-related disruptions and their ability to adapt to new regulations and market trends. Many investors are now adopting a more proactive approach by integrating environmental, social, and governance (ESG) factors into their investment strategies. This involves screening investments based on their environmental impact, carbon emissions, and commitment to sustainable practices. By doing so, investors can contribute to the transition to a more sustainable economy while also managing potential risks.

In summary, environmental concerns and climate change are becoming integral considerations in the investing landscape. Investors are increasingly aware of the potential disruptions and opportunities presented by these global challenges. By focusing on industries and companies that demonstrate a commitment to sustainability and resilience, investors can navigate the evolving market dynamics and contribute to a more environmentally conscious future. Staying informed about climate-related risks and trends will be crucial for making well-informed investment decisions in the years to come.

Inventories Management and Inter-corporate Investments: Strategies for Success

You may want to see also

Regulatory Changes: Shifts in laws can impact investment returns and market dynamics

The future of investing is indeed a topic of concern and speculation, especially when considering the potential impact of regulatory changes. Shifts in laws and regulations can significantly influence investment returns and market dynamics, creating both opportunities and challenges for investors. Here's an analysis of how these regulatory changes can shape the investment landscape:

Market Volatility and Uncertainty: Regulatory changes often introduce an element of uncertainty into the market. When new laws are introduced or existing ones amended, investors may experience increased volatility. This is particularly true if the changes are sudden or unexpected, as they can disrupt established investment strategies. For instance, a sudden tax reform could impact the profitability of certain investment vehicles, causing a shift in market trends and investor behavior.

Impact on Investment Vehicles: Different investment products and sectors are subject to specific regulations. Changes in laws can directly affect the performance and appeal of these investment vehicles. For example, stricter environmental regulations might discourage investments in fossil fuel companies, leading to a shift in capital allocation towards renewable energy sectors. Similarly, modifications in financial regulations could impact the availability and accessibility of certain investment options, such as derivatives or leveraged products.

Compliance and Cost Implications: Regulatory shifts often require investors and financial institutions to adapt their practices to meet new standards. This adaptation process can be costly and time-consuming. Increased compliance requirements may lead to higher operational expenses, which could, in turn, impact investment returns. Additionally, changes in laws might necessitate the implementation of new technologies or systems, further adding to the financial burden.

Long-Term Investment Strategies: Investors with a long-term perspective may find regulatory changes advantageous. Well-planned strategies that consider potential regulatory shifts can help mitigate risks. For instance, investors could diversify their portfolios across different jurisdictions to take advantage of varying regulatory environments. However, this approach requires thorough research and a deep understanding of the legal frameworks in different regions.

Impact on Market Participants: Regulatory changes can influence the behavior of various market participants. Institutions and individual investors may adjust their investment strategies based on the perceived risks and opportunities presented by new laws. This dynamic can lead to shifts in market power, with certain players gaining or losing influence. As a result, the overall market dynamics and investment returns may be significantly altered.

In summary, regulatory changes play a pivotal role in shaping the investment landscape. Investors must stay informed and adapt their strategies to navigate the potential risks and opportunities arising from these shifts. A proactive approach, coupled with a comprehensive understanding of the regulatory environment, is essential for making informed investment decisions in an ever-changing market.

Peer-to-Peer Lending: Navigating Risks and Rewards

You may want to see also

Frequently asked questions

While the global economy has faced numerous challenges in recent years, including the ongoing pandemic and geopolitical tensions, it is still considered a favorable time for investing. Many experts believe that the long-term growth prospects remain positive, especially in sectors like technology, renewable energy, and healthcare. Diversifying your investment portfolio and staying invested for the long term can help mitigate short-term market volatility.

Market volatility is an inherent risk in investing, but there are strategies to manage it. One approach is to invest in a well-diversified portfolio, including a mix of stocks, bonds, and alternative investments. Regularly reviewing and rebalancing your portfolio can help maintain its risk profile. Additionally, considering long-term investment horizons and staying invested through market cycles can provide a smoother journey.

The safety of investments depends on various factors, including market trends, regulatory changes, and industry-specific risks. Generally, defensive sectors like utilities, consumer staples, and healthcare tend to be more stable during economic downturns. However, it's essential to research and analyze each sector's fundamentals, growth prospects, and potential risks before making investment decisions.

Government policies and regulations significantly impact investment safety and market stability. Fiscal and monetary policies can influence interest rates, inflation, and overall market sentiment. Staying informed about economic policies, tax regulations, and trade agreements can help investors make more informed choices. Additionally, understanding the political landscape and its potential effects on specific industries is crucial for long-term investment planning.

While it's challenging to predict and protect against all external factors, having a well-diversified portfolio and an emergency fund can provide a safety net. Consider investing in various asset classes and regions to reduce concentration risk. Additionally, regularly reviewing and updating your investment strategy, including insurance coverage and risk management techniques, can help safeguard your investments during unforeseen events.