When considering long-term investments, it's important to understand how their value is assessed over time. The question arises: Are long-term investments' values adjusted annually? This inquiry delves into the dynamics of investment valuation, exploring whether the worth of these long-term assets is recalibrated each year or remains static. Understanding this aspect is crucial for investors to grasp the potential impact on their portfolios and make informed decisions regarding their long-term financial strategies.

| Characteristics | Values |

|---|---|

| Adjustment Frequency | Not typically adjusted annually. |

| Market Value | Adjusted based on market performance. |

| Tax Implications | May have tax consequences depending on the jurisdiction. |

| Reporting Period | Usually reported annually in financial statements. |

| Investment Type | Common in long-term investments like stocks, bonds, and real estate. |

| Impact on Financial Statements | Can significantly impact net income and equity. |

| Investment Strategy | Long-term investments are often held for extended periods. |

| Risk Assessment | Adjustments reflect market conditions and potential risks. |

| Historical Data | Past adjustments provide insights into market trends. |

| Regulatory Compliance | Adherence to accounting standards and regulations. |

What You'll Learn

- Tax Implications: Annual adjustments impact tax liability and investment returns

- Market Fluctuations: Yearly adjustments reflect market performance and economic shifts

- Inflation Adjustment: Long-term investments are adjusted for inflation to maintain real value

- Dividend Reinvestment: Annual adjustments affect dividend reinvestment strategies and investment growth

- Capital Gains Taxes: Yearly adjustments influence capital gains tax calculations and investment strategies

Tax Implications: Annual adjustments impact tax liability and investment returns

The concept of annual adjustments for long-term investments is a crucial aspect of financial management, especially when considering the tax implications. When an investor holds a long-term investment, such as stocks, bonds, or mutual funds, for more than a year, the tax treatment can vary depending on the jurisdiction and the specific investment strategy. One of the primary considerations is the impact of annual adjustments on tax liability and investment returns.

In many tax systems, long-term capital gains and qualified dividends are typically taxed at a lower rate than ordinary income. This preferential treatment encourages investors to hold investments for the long term. However, to qualify for this lower tax rate, the investment must meet the criteria of being held for a specific period, often a year or more. Here's where the annual adjustment comes into play.

Every year, the value of an investment is re-evaluated, and this process can significantly impact an investor's tax liability. If an investment has appreciated in value, the investor may be subject to capital gains tax when they sell the asset. The annual adjustment ensures that the tax authorities recognize the investment's growth and apply the appropriate tax rate accordingly. For instance, if an investor purchases a stock for $100 and it grows to $150 over several years, the annual adjustment will reflect this growth, and when the sale occurs, the tax liability will be calculated based on the cumulative appreciation.

Additionally, annual adjustments can affect the timing of tax payments. Investors may need to make estimated tax payments throughout the year if their investment returns are significant. These payments ensure that they cover their tax liability for the year, including any potential capital gains. By adjusting the investment value annually, investors can better estimate their tax obligations and make the necessary payments to avoid penalties.

Furthermore, annual adjustments can impact the overall investment strategy. Investors may need to re-evaluate their portfolio allocations and make adjustments to optimize their tax situation. For example, if an investor has a significant amount of appreciated investments, they might consider tax-loss harvesting by selling other investments at a loss to offset the capital gains and reduce their overall tax liability. This strategic approach highlights the importance of understanding the tax implications of annual adjustments.

In summary, annual adjustments for long-term investments are essential to ensure compliance with tax regulations and to manage tax liabilities effectively. Investors should be aware of these adjustments to make informed decisions regarding their investment strategies and to take advantage of any tax benefits available. Staying informed about the tax rules and seeking professional advice can help investors navigate the complexities of annual adjustments and optimize their financial outcomes.

Navigating Market Downturns: Strategies for Long-Term Investing Success

You may want to see also

Market Fluctuations: Yearly adjustments reflect market performance and economic shifts

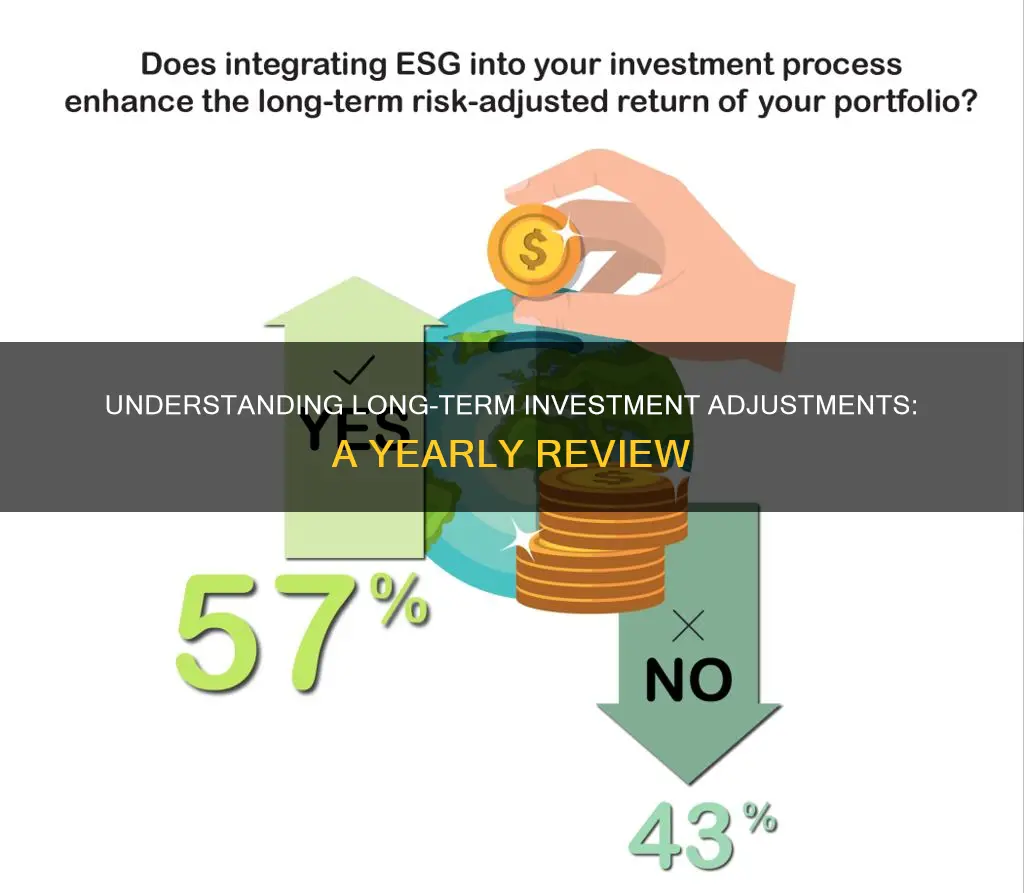

The value of long-term investments is indeed subject to yearly adjustments, reflecting the dynamic nature of financial markets and the broader economy. These adjustments are crucial for investors to understand as they provide a clear picture of the investment's performance over time. Market fluctuations, driven by various factors, play a significant role in these annual revaluations.

One primary factor influencing these adjustments is the overall market performance. Stock markets, for instance, experience annual shifts based on the success or failure of companies and industries. A thriving market with rising stock prices will generally lead to higher valuations for long-term investments, such as mutual funds or index funds. Conversely, a declining market may result in lower investment values, impacting the overall portfolio. These market-wide fluctuations are often a result of economic trends, investor sentiment, and global events, making them a critical consideration for investors.

Economic shifts also contribute significantly to the yearly adjustments. Macroeconomic factors like interest rates, inflation, and GDP growth can impact investment values. For example, central banks' decisions on interest rates can affect bond prices and, consequently, the value of fixed-income investments. Similarly, changes in inflation rates can influence the purchasing power of dividends or interest earned from investments, thus impacting their overall value. Investors must stay informed about these economic indicators to anticipate how they might affect their long-term investments.

Additionally, the specific nature of the investment itself plays a role in these yearly adjustments. Different investment vehicles have varying methods of valuation. Some, like real estate investment trusts (REITs), are valued based on the performance of the underlying properties. Others, such as private equity funds, may be valued using multiple methods, including comparable company analysis and discounted cash flow models. Each investment type has its own set of factors that contribute to annual adjustments, ensuring that investors have a comprehensive understanding of their holdings.

In summary, the value of long-term investments is adjusted annually to reflect market performance and economic shifts. These adjustments are essential for investors to make informed decisions, rebalance their portfolios, and align their investments with their financial goals. Staying informed about market trends, economic indicators, and the specific characteristics of investments is key to navigating the complexities of long-term investing.

Unlocking Long-Term Wealth: Strategies for Finding Compounding Investments

You may want to see also

Inflation Adjustment: Long-term investments are adjusted for inflation to maintain real value

When it comes to long-term investments, one crucial aspect to consider is the impact of inflation on their value. Inflation, which refers to the general rise in prices of goods and services over time, can significantly affect the purchasing power of an investment. To ensure that long-term investments retain their real value, it is essential to adjust them for inflation.

Inflation adjustment is a process that accounts for the changing purchasing power of money due to inflation. This adjustment is particularly important for long-term investments as it helps investors understand the true growth or decline of their investments in real terms. By adjusting for inflation, investors can make more informed decisions and manage their portfolios effectively.

The concept of inflation adjustment is based on the idea of maintaining the purchasing power of an investment. As inflation increases, the value of money decreases, and the same amount of money can buy fewer goods or services. Therefore, to keep up with the rising costs, long-term investments need to be adjusted to reflect the current purchasing power. This adjustment ensures that the investment's value remains stable and represents its true worth in the market.

There are various methods to adjust long-term investments for inflation. One common approach is to use inflation-indexed securities or inflation-adjusted bonds. These financial instruments are designed to provide returns that are linked to inflation, ensuring that the investment's value keeps pace with the changing economic conditions. By investing in such securities, investors can effectively protect their capital from the eroding effects of inflation.

Additionally, investors can also use inflation-adjusted investment vehicles, such as inflation-protected securities or inflation-linked funds. These investment options are specifically designed to provide returns that are adjusted for inflation, allowing investors to maintain the real value of their investments over time. By incorporating these strategies, investors can navigate the challenges of inflation and ensure that their long-term investments remain a stable and reliable asset.

Silver's Long-Term Investment Potential: A Comprehensive Analysis

You may want to see also

Dividend Reinvestment: Annual adjustments affect dividend reinvestment strategies and investment growth

Dividend reinvestment is a powerful strategy for long-term investors, allowing them to compound their wealth over time by reinvesting the dividends earned from their investments. This approach can significantly impact investment growth, especially when considering the annual adjustments that come with it. When an investor reinvests dividends, they essentially purchase additional shares of the dividend-paying stock, which can lead to a snowball effect in their investment portfolio.

The process is straightforward: each time a dividend is received, it is used to buy more shares of the same stock, thus increasing the investor's holdings. Over time, this strategy can result in a substantial accumulation of shares, especially if the dividends are reinvested annually. Annual adjustments are crucial in this context because they ensure that the investor's portfolio remains dynamic and responsive to market changes.

One key aspect of annual adjustments is the impact of market fluctuations on the value of the investment. If the stock price increases, the reinvested dividends will purchase fewer shares, potentially diluting the overall growth of the investment. Conversely, if the stock price decreases, the reinvested dividends will buy more shares, which can lead to a faster accumulation of wealth. This dynamic nature of dividend reinvestment requires investors to make periodic adjustments to their strategies.

To optimize dividend reinvestment, investors should consider the following: first, regularly review their investment portfolio and dividend history. This review will help identify patterns and trends, allowing investors to make informed decisions about when and how to reinvest. Second, set clear financial goals and regularly assess progress. Annual adjustments can be made based on these goals, ensuring that the investment strategy remains aligned with the investor's objectives.

Additionally, investors should be mindful of tax implications. Dividend reinvestment may trigger tax events, especially if the reinvestment leads to a significant increase in the number of shares held. Understanding the tax rules and planning accordingly can help minimize the impact of taxes on investment growth. In summary, dividend reinvestment with annual adjustments is a powerful tool for long-term wealth accumulation, requiring investors to stay informed, adapt their strategies, and consider the market's ever-changing dynamics.

Unraveling the True Nature of Short-Term vs. Long-Term Investments

You may want to see also

Capital Gains Taxes: Yearly adjustments influence capital gains tax calculations and investment strategies

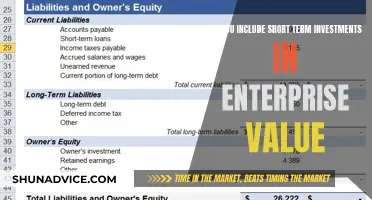

The concept of capital gains taxes and their relationship with yearly investment adjustments is a crucial aspect of financial planning and investment strategies. When it comes to long-term investments, the value of these assets is typically not adjusted annually, which can have significant implications for investors and their tax obligations. This is in contrast to short-term investments, where daily or frequent adjustments in value are more common and can impact tax treatment.

Long-term investments, such as stocks, bonds, or real estate held for an extended period, are generally valued based on their fair market value at the end of each tax year. This means that the investment's value is not updated frequently, and any gains or losses are calculated based on the holding period, which is typically more than one year. For instance, if an investor purchases a stock for $100 and sells it after five years for $150, the capital gain is $50, and this gain is taxed accordingly.

Yearly adjustments in capital gains tax calculations are essential to ensure fair taxation and to encourage long-term investment strategies. By not adjusting the value of long-term investments annually, investors can benefit from tax advantages. This approach allows investors to realize gains over an extended period, potentially reducing the tax burden. For example, if an investor sells a long-term investment at a higher price, the capital gain is lower, and the tax rate may be more favorable, especially for high-income earners who can utilize lower tax brackets.

However, this approach also means that investors might not reflect the current market value of their investments in their tax calculations. This can be a concern for those who want to make informed decisions about their portfolios. To address this, some investors may opt for more frequent rebalancing or adjustments to their investment strategies, ensuring that their holdings align with their risk tolerance and financial goals.

In summary, the lack of yearly adjustments in the value of long-term investments is a deliberate strategy to promote long-term wealth-building and provide tax benefits. It encourages investors to hold investments for the long haul, potentially reducing tax liabilities. Understanding this concept is vital for investors to make informed choices and optimize their investment strategies while navigating the complexities of capital gains taxes.

Nurture Your Future Self: A Guide to Long-Term Self-Investment

You may want to see also

Frequently asked questions

Long-term investments are typically not adjusted annually. These investments are generally held for an extended period, often several years or more, and are not subject to frequent revaluation. The value of long-term investments is primarily determined by their purchase price and any subsequent changes in the market value of the underlying assets. Annual adjustments are not a standard practice for these investments.

It is recommended to review your long-term investments at least once a year, but more frequently if you are actively managing your portfolio. Regular reviews help you stay informed about the performance of your investments and make necessary adjustments to your investment strategy. However, the frequency of review may vary depending on individual circumstances and the nature of the investments.

The reporting requirements for long-term investments can vary depending on your jurisdiction and the type of investment. In many cases, the change in value of long-term investments is not reported annually. Instead, the focus is on the overall gain or loss realized upon the sale or disposal of the investment. It's essential to consult with a tax professional or financial advisor to understand the specific reporting requirements applicable to your situation.

Yes, the value of long-term investments can decrease over time, especially if the underlying assets are subject to market fluctuations. Market conditions, economic factors, and changes in the value of the assets can all impact the overall value of the investment. It's important to have a long-term perspective and not make investment decisions based solely on short-term market movements.

Holding long-term investments can offer several advantages. Firstly, long-term investments often provide the opportunity for compound growth, where the earnings from the investment are reinvested, leading to exponential growth over time. Secondly, long-term investments are generally less volatile in the short term, reducing the impact of market fluctuations. This strategy allows investors to weather short-term market volatility and focus on the potential for long-term wealth accumulation.