Long-term investing is a powerful strategy for building wealth, but it requires a solid understanding of the market and a disciplined approach. This guide will provide a comprehensive overview of how to learn and master long-term investing. It will cover essential topics such as setting clear financial goals, understanding risk tolerance, and creating a well-diversified portfolio. We'll explore the benefits of investing in various asset classes, including stocks, bonds, and real estate, and discuss how to research and select the right investments. Additionally, we'll delve into the importance of patience and a long-term mindset, as well as strategies for staying invested during market volatility. By the end of this guide, you'll have the knowledge and confidence to embark on your long-term investing journey.

What You'll Learn

- Understand Long-Term Goals: Define your financial objectives and align investments accordingly

- Diversify Your Portfolio: Spread investments across asset classes to manage risk

- Research and Education: Stay informed through books, courses, and financial news

- Create a Plan: Develop a structured approach with clear milestones and adjustments

- Monitor and Review: Regularly assess performance, rebalance, and make informed adjustments

Understand Long-Term Goals: Define your financial objectives and align investments accordingly

Understanding your long-term financial goals is a crucial step in the journey of long-term investing. It provides a clear direction and helps you make informed decisions about your investment strategy. Here's a guide to help you define your financial objectives and align your investments accordingly:

Identify Your Financial Goals: Start by listing down all your financial aspirations. This could include retirement planning, saving for a child's education, purchasing a home, or building a substantial emergency fund. Each goal has a unique timeline and importance. For instance, a retirement goal might be 15 years away, while an emergency fund goal could be more immediate. Prioritize these goals based on their urgency and significance in your life.

Define Specific Objectives: Make your goals as specific as possible. Instead of a vague goal like "saving for retirement," define a precise target, such as "accumulating $500,000 for retirement by the age of 65." This clarity will enable you to measure your progress and make adjustments as needed. For example, if you aim to buy a house in 5 years, determine the exact amount required for the down payment and the associated costs.

Consider Time Horizons: Long-term investing often involves different time horizons for various goals. For long-term goals like retirement, you might have a 20-30 year timeframe. In contrast, short-term goals like a wedding fund or a car purchase may only require a few years of planning. Tailor your investment approach to each goal's time horizon, as this will influence the level of risk and the types of investments you make.

Risk Assessment: Evaluate your risk tolerance, which is the level of risk you are comfortable taking with your investments. This assessment is crucial as it determines the types of assets you should invest in. Generally, younger investors can afford to take on more risk, investing in stocks and aggressive funds, as they have a longer time horizon to recover from potential market downturns. As you get closer to your retirement age, you may want to shift your portfolio towards more conservative investments to preserve capital.

Create a Roadmap: Once you have a clear understanding of your goals and risk tolerance, create a financial roadmap. This roadmap should outline the steps you need to take to achieve each goal. It might include setting up regular investment contributions, automating your savings, or adjusting your spending habits to meet your financial objectives. Regularly review and update this roadmap to ensure it remains aligned with your evolving circumstances.

By defining your long-term goals and aligning your investments accordingly, you can make informed decisions that are tailored to your specific needs. This process empowers you to take control of your financial future and work towards achieving your dreams. Remember, long-term investing is a journey, and understanding your goals is the first step towards a successful and rewarding financial path.

Unraveling Intangible Assets: Are Long-Term Investments a Wise Choice?

You may want to see also

Diversify Your Portfolio: Spread investments across asset classes to manage risk

When it comes to long-term investing, one of the fundamental principles to master is diversification. This strategy involves spreading your investments across various asset classes to minimize risk and maximize potential returns. By diversifying, you reduce the impact of any single investment's performance on your overall portfolio, ensuring a more stable and consistent growth trajectory.

The core idea is to allocate your capital among different asset classes such as stocks, bonds, real estate, commodities, and cash equivalents. Each asset class has its own unique characteristics, risks, and potential rewards. For instance, stocks offer the potential for high returns but come with higher risk, while bonds provide a more stable income stream but with lower potential growth. By diversifying, you create a balanced portfolio that can weather market volatility and economic downturns.

Start by identifying your investment goals and risk tolerance. Are you investing for retirement, a child's education, or a specific financial objective? Understanding your goals will help you determine the appropriate asset allocation. For long-term goals, a common strategy is to have a higher allocation to stocks, which can provide significant growth over time, complemented by a portion of bonds for stability. As you get closer to your goal, you can gradually shift your portfolio towards more conservative investments.

Research and understand the different asset classes available. Stocks, for example, can be further divided into various sectors and industries, each with its own unique characteristics. Similarly, bonds can be categorized by credit quality and maturity. By delving into these specifics, you can make informed decisions about where to allocate your funds. Diversification doesn't mean owning a small piece of every asset; it's about finding the right balance that aligns with your financial objectives and risk profile.

Regularly review and rebalance your portfolio to maintain your desired asset allocation. Market fluctuations can cause your initial allocation to shift, and rebalancing ensures that you stay on track. For instance, if stocks have outperformed bonds, you might reallocate some of your stock holdings to bonds to restore the original balance. This process helps to manage risk and maintain a diversified approach, even as market conditions change. Remember, diversification is a long-term strategy, and short-term market movements should not deter you from your well-thought-out investment plan.

George Soros' Short-Term Investing Strategy: Unlocking Market Secrets

You may want to see also

Research and Education: Stay informed through books, courses, and financial news

Learning about long-term investing requires a commitment to continuous research and education. This is a journey that involves acquiring knowledge, understanding market dynamics, and developing strategies to make informed investment decisions. Here's a guide on how to approach this process:

Reading Books and Articles: Start by exploring a variety of resources, including books, articles, and online publications. Look for titles that cover fundamental concepts of investing, such as "The Intelligent Investor" by Benjamin Graham, a classic text on value investing, or "One Up on Wall Street" by Peter Lynch, which offers insights into mutual funds and long-term investing strategies. Additionally, financial newspapers and magazines provide valuable market analysis and insights. Websites like The Wall Street Journal, Financial Times, and Bloomberg offer a wealth of financial news and articles that can keep you updated on market trends and economic developments.

Online Courses and Webinars: Enrolling in online courses can be an excellent way to gain structured knowledge. Many platforms offer courses on investing, covering topics like stock analysis, portfolio management, and market trends. Websites like Coursera, Udemy, and edX often have partnerships with universities and financial institutions to provide high-quality educational content. Webinars, which are online seminars or workshops, are another great resource. These interactive sessions allow you to learn directly from experts and ask questions, providing a more engaging learning experience.

Financial News and Market Updates: Staying informed about financial news is crucial. Set up alerts or create a routine to read or listen to daily financial news. Websites, podcasts, and YouTube channels dedicated to finance can provide real-time updates and insights. For example, podcasts like "The Dave Ramsey Show" or "The Motley Fool Money" offer educational content and discussions on various investment topics. Additionally, financial news networks like CNBC, Bloomberg TV, and BBC News provide live coverage and analysis of market events, making it easier to stay updated.

Financial Education Websites and Tools: There are numerous websites and tools designed to educate investors. These platforms often provide tutorials, calculators, and interactive tools to help you understand investment concepts. For instance, sites like Investopedia offer comprehensive explanations of financial terms and concepts, making it an excellent resource for beginners. Other platforms might offer investment calculators to help you estimate potential returns and risks based on your investment choices.

Networking and Community Engagement: Engaging with a community of investors can provide valuable learning opportunities. Join online forums, discussion groups, or local investment clubs where you can connect with like-minded individuals. These communities often share insights, discuss market trends, and provide support. Networking can also lead to mentorship opportunities, where experienced investors can guide and educate newcomers.

Remember, long-term investing is a continuous learning process. By dedicating time to research, education, and staying informed, you can develop the knowledge and skills necessary to make confident investment decisions.

Maximizing Long-Term Wealth: Understanding Your Investment Horizon

You may want to see also

Create a Plan: Develop a structured approach with clear milestones and adjustments

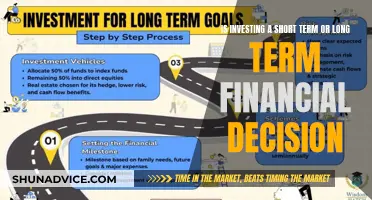

Learning long-term investing requires a structured approach to ensure you stay on track and make informed decisions. Here's a step-by-step guide to creating a plan that will help you navigate the world of long-term investing with confidence:

- Define Your Investment Goals: Begin by clearly defining your investment objectives. Are you saving for retirement, a house down payment, or a specific financial milestone? Each goal will influence your investment strategy. For example, a retirement goal might require a more conservative approach, while a short-term goal could allow for riskier investments. Understanding your goals is the foundation of your investment plan.

- Assess Your Risk Tolerance: Long-term investing involves various levels of risk. Evaluate your risk tolerance by considering your financial situation, time horizon, and emotional comfort with market fluctuations. Are you comfortable with potential short-term losses for long-term gains? Understanding your risk tolerance will guide your asset allocation and investment choices.

- Create a Timeline: Long-term investing is, as the name suggests, a long-term commitment. Develop a timeline that outlines your investment journey. Break down your investment period into manageable segments, such as years or milestones. This timeline will help you stay focused and make adjustments as needed. For instance, you might have a 10-year plan for retirement, with annual milestones to review and rebalance your portfolio.

- Research and Education: Educate yourself about long-term investing strategies, market trends, and various investment vehicles. Read books, articles, and research papers to gain a comprehensive understanding. Consider taking online courses or attending workshops to enhance your knowledge. The more you learn, the better equipped you'll be to make informed decisions. Focus on building a strong foundation of financial literacy.

- Set Clear Milestones: Divide your investment plan into achievable milestones. These milestones should be specific and measurable. For instance, your first milestone could be to open a retirement account and contribute a certain amount monthly. Other milestones might include reaching a specific investment amount, achieving a certain net worth, or reviewing your portfolio's performance quarterly. Regularly reviewing these milestones will keep you motivated and allow for course correction.

- Regular Review and Adjustment: Long-term investing is an ongoing process that requires regular attention. Schedule periodic reviews of your investment plan to assess its performance and make necessary adjustments. Market conditions and personal circumstances can change, so stay proactive. Review your risk tolerance, investment strategy, and milestones annually or when significant life events occur. This process ensures your plan remains aligned with your goals and allows for strategic adjustments to optimize your long-term success.

Remember, long-term investing is a journey, and flexibility is key. By creating a structured plan with clear milestones, you can navigate the market's ups and downs with confidence, making informed decisions that align with your financial aspirations. Stay disciplined, educate yourself continuously, and be prepared to adapt as you progress towards your investment goals.

Maximize Returns: Strategies for Short-Term High-Interest Investments

You may want to see also

Monitor and Review: Regularly assess performance, rebalance, and make informed adjustments

Monitoring and reviewing your investment portfolio is a critical aspect of long-term investing, as it allows you to stay on track and make necessary adjustments to optimize your financial goals. Here's a detailed guide on how to approach this process:

Regular Performance Assessment: Set a schedule to review your investments periodically, such as monthly or quarterly. During these reviews, analyze the performance of each asset in your portfolio. Compare the actual returns with your initial expectations and the market performance of similar investments. This assessment will help you identify areas of success and potential weaknesses. For instance, you might notice that a particular stock has underperformed despite your research and analysis. By regularly reviewing, you can catch such discrepancies early on.

Key Metrics and Indicators: Utilize various financial metrics to gauge the health of your portfolio. Return on investment (ROI), net asset value (NAV), and risk-adjusted returns are essential indicators. Calculate and track these metrics over time to identify trends and patterns. For example, a consistent positive ROI indicates that your investment strategy is working. Additionally, consider using risk metrics like volatility and correlation to understand how different assets in your portfolio are performing relative to each other.

Rebalancing: Rebalancing is the process of adjusting your portfolio to maintain your desired asset allocation. Over time, market fluctuations can cause your initial allocation to become imbalanced. For instance, if you initially allocated 60% of your portfolio to stocks and 40% to bonds, but stocks have outperformed, your allocation might shift to 70% stocks and 30% bonds. Regular reviews will help you identify such imbalances and take corrective action. Rebalancing ensures that your portfolio aligns with your risk tolerance and investment strategy, providing a more stable long-term performance.

Informed Adjustments: Based on your performance assessments and rebalancing exercises, make informed decisions to improve your portfolio. If a particular investment is underperforming, consider selling it and reinvesting the proceeds in a more promising opportunity. Diversification is key, so ensure your portfolio includes a range of asset classes and sectors. You might also want to review your investment strategy and make changes to align with your long-term goals. For example, if you're approaching retirement, you may want to shift your portfolio towards more conservative investments.

Remember, long-term investing requires discipline and patience. Regular monitoring and review will help you stay committed to your strategy, make timely adjustments, and ultimately achieve your financial objectives. It's a continuous process that ensures your investments remain aligned with your personal financial journey.

Gold and Silver: Timeless Long-Term Investments?

You may want to see also

Frequently asked questions

Long-term investing is a strategy where you invest in assets or securities with the goal of holding them for an extended period, often years or even decades. It involves a patient approach, allowing your investments to grow and compound over time, which can be a powerful way to build wealth.

Begin by setting clear financial goals. Determine what you want to achieve, such as retirement planning, buying a house, or saving for your child's education. Then, assess your risk tolerance and create a diversified investment portfolio. Consider consulting a financial advisor to help you build a strategy tailored to your goals and risk profile.

Long-term investors often utilize various investment options like stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate. Diversification is key, so you might want to invest in a mix of these assets. Stocks offer ownership in companies, bonds provide fixed income, and ETFs and mutual funds allow for diversification across different markets and sectors.

Long-term investing requires discipline and a long-term perspective. Stay informed about your investments and the market, but avoid making impulsive decisions based on short-term market fluctuations. Regularly review and rebalance your portfolio to maintain your desired asset allocation. Keep your investment strategy aligned with your financial goals, and celebrate the milestones you achieve along the way.