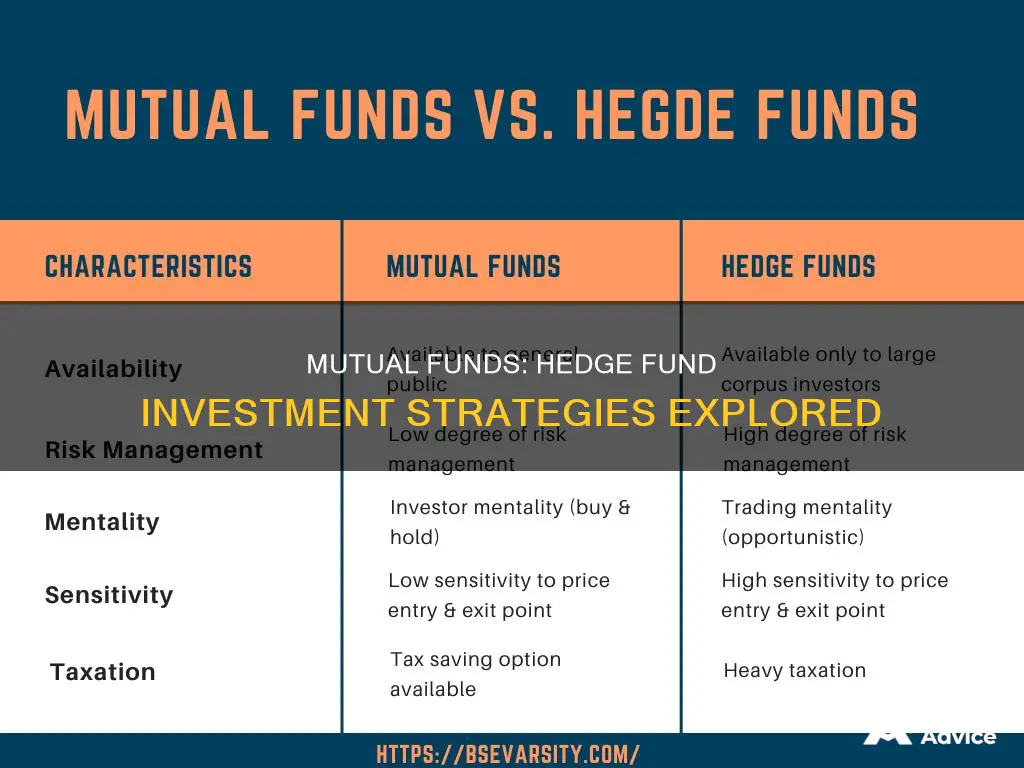

Hedge funds and mutual funds are both managed portfolios that pool money from investors to buy securities or other types of investments. However, there are several key differences between the two. Hedge funds are private investments that are only available to accredited investors with high net worth or income, while mutual funds are public and available to all investors. Hedge funds employ riskier strategies and are more loosely regulated, allowing them to invest in a wider range of assets such as real estate, art and currency. Mutual funds are more restricted in their investment strategies and typically invest in publicly traded securities. Hedge funds charge higher fees, including a management fee and a performance fee, while mutual funds charge a flat fee.

| Characteristics | Values |

|---|---|

| Type of investor | High-net-worth individuals |

| Investment type | High risk, high reward |

| Investment strategies | Derivatives, short-selling, leverage, debt-based investing, short-selling, real estate, art, currency |

| Minimum investment | $100,000 to upwards of $2 million |

| Fees | Management fee (1-2%) and performance fee (20%) |

| Liquidity | Low |

| Regulation | Less regulated than mutual funds |

What You'll Learn

- Mutual funds are open to all, hedge funds are exclusive

- Mutual funds are regulated, hedge funds have less oversight

- Mutual funds have defined strategies, hedge funds use diverse, risky strategies

- Mutual funds charge flat fees, hedge funds charge management and performance fees

- Mutual funds are safer investments, hedge funds are riskier

Mutual funds are open to all, hedge funds are exclusive

Mutual funds and hedge funds are both managed portfolios that pool investors' money to achieve returns through diversification. However, a key difference lies in their accessibility: mutual funds are open to all types of investors, while hedge funds are exclusive and limited to accredited investors.

Mutual funds are regulated investment products offered by institutional fund managers to the general public, including retail and institutional investors. They are available for daily trading on financial market exchanges and are subject to comprehensive regulation by the Securities and Exchange Commission (SEC) in the United States. While some mutual funds may have minimum investment requirements, these typically range from $250 to $3,000 or more, making them accessible to a wide range of investors.

In contrast, hedge funds are private investments that exclusively target high-net-worth individuals or institutional investors, such as pension funds and insurance companies. These funds require investors to meet specific accredited characteristics, as defined by the SEC. Accredited investors typically have a high liquid net worth, often exceeding $1 million, or an annual income above a certain threshold, such as $200,000 for individuals or $300,000 for married couples. The exclusivity of hedge funds is further emphasised by their limited windows for investment and withdrawal, as well as their higher fees compared to mutual funds.

The distinct investor bases of mutual funds and hedge funds also influence their investment strategies. Mutual funds are generally more restricted in their trading and tend to employ less complex and volatile strategies. On the other hand, hedge funds have more freedom to pursue aggressive and risky strategies, such as investing in non-traditional assets like real estate, art, and currency. They are also known for taking on higher-risk positions to aim for higher returns for their investors.

In summary, while both mutual funds and hedge funds offer managed portfolios, their accessibility differs significantly. Mutual funds are designed to be accessible to a broad range of investors, providing an easy way to gain exposure to a diversified portfolio of securities. Hedge funds, on the other hand, are exclusive and targeted towards high-net-worth individuals or institutions, utilising aggressive strategies to pursue higher returns.

Schwab S&P 500 Index Fund: A Comprehensive Investment Guide

You may want to see also

Mutual funds are regulated, hedge funds have less oversight

Mutual funds and hedge funds are both managed portfolios that pool money from investors to buy securities or other types of investments. However, they differ in several key ways, one of the most significant being the level of regulation and oversight each receives.

Mutual funds are regulated investment products offered to the public and available for daily trading. In the United States, they are comprehensively regulated by the Securities and Exchange Commission (SEC) through two regulatory directives: The Securities Act of 1933 and the Investment Company Act of 1940. The 1933 Act requires mutual funds to provide a documented prospectus for investor education and transparency, while the 1940 Act provides the framework for their structuring. Mutual funds must also register with the SEC in order to sell shares publicly and are subject to various other regulations and requirements.

On the other hand, hedge funds are private investments that are only available to accredited investors, typically high-net-worth individuals or organisations. They are not as strictly regulated by the SEC as mutual funds and have more flexibility in their investing provisions and investor terms. Hedge funds are required to register with the SEC once they reach total assets under management of above $100 million, and they must abide by Regulation D of the Securities Act of 1933, which mandates that a majority of their investors be accredited. This allows hedge funds to remain exempt from most reporting to the SEC, making them much more opaque than mutual funds.

The difference in regulation and oversight between mutual funds and hedge funds is largely due to the types of investors they target and the investment strategies they employ. Mutual funds are available to all types of investors and are commonly known in the investment industry, while hedge funds target high-net-worth, accredited investors and employ more complex, volatile, and risky investment strategies. Mutual funds are limited in their ability to use riskier strategies and are restricted to investing in publicly traded securities, while hedge funds have more freedom to employ aggressive and risky strategies and can invest in a wider range of assets, including private real estate, cryptocurrency, and derivatives.

The higher risk and volatility associated with hedge funds mean that they are not suitable for the average investor. The SEC places restrictions on who can invest in them due to the higher levels of risk, and hedge funds themselves often have high minimum investment requirements, further limiting their accessibility. Mutual funds, on the other hand, are designed to be accessible to everyday investors, with many having low minimum investment thresholds.

Monitoring IndMoney Mutual Fund Investments: A Direct Guide

You may want to see also

Mutual funds have defined strategies, hedge funds use diverse, risky strategies

Mutual funds and hedge funds are both managed portfolios that pool money from investors to purchase securities that fit a specific strategy. However, they differ in several key ways, including the strategies they employ and the level of risk they involve.

Mutual funds have defined strategies that are aligned with the fund's investment objectives. These strategies may include investing in a diverse portfolio of stocks, bonds, or other securities to achieve capital appreciation, income, or a combination of both. Mutual funds are subject to regulations and are offered to the public, making them accessible to a wide range of investors. The strategies employed by mutual funds are designed to balance risk and return, with a focus on long-term growth.

On the other hand, hedge funds are known for using diverse and risky strategies to achieve higher returns for their investors. They are private investments that are only available to accredited investors, who are deemed to have a higher risk tolerance and are willing to bypass the standard protections offered to mutual fund investors. Hedge funds often employ aggressive investment strategies, such as leveraged investing, short-selling, and investing in alternative assets like real estate, art, and currency. These strategies are designed to produce returns regardless of market conditions and can result in higher gains but also come with significant risk.

The diverse and risky strategies employed by hedge funds aim to generate higher returns, but they do not always guarantee better performance compared to mutual funds. Hedge funds tend to take more outsized risks, while mutual funds usually take more constrained risks, resulting in smaller but more consistent returns.

In summary, mutual funds have defined strategies that are aligned with their investment objectives and are designed to balance risk and return. Hedge funds, on the other hand, employ diverse and risky strategies to achieve higher returns, and their private nature allows them more flexibility in their investment provisions and investor terms.

A Simple Guide to Investing in the SPY Index Fund

You may want to see also

Mutual funds charge flat fees, hedge funds charge management and performance fees

Mutual funds and hedge funds are both managed portfolios that pool funds from multiple investors to invest in securities that fit a specific strategy. However, they differ in their fees and investor requirements.

Mutual funds are regulated investment products offered to the public and available for daily trading. They are available for all types of investors, although some funds may have minimum investment requirements ranging from $250 to $3,000 or more. Mutual funds generally have two types of fees: annual fund operating expenses and shareholder fees. Annual fund operating expenses cover the cost of paying managers, accountants, legal fees, marketing, and other expenses. These fees typically range from 0.25% to 1% of the fund's net assets. Shareholder fees include sales commissions and other one-time costs incurred when buying or selling mutual fund shares.

On the other hand, hedge funds are private investments that are only available to accredited investors, such as institutional investors or individuals with a net worth of at least $1 million. Hedge funds are known for taking higher-risk positions and employing more aggressive investment strategies than mutual funds. They typically have two types of fees: management fees and performance fees. Management fees are charged as a percentage of the total assets under management (AUM) and cover the fund's operating expenses, such as salaries, office space, technology, and compliance costs. These fees can range from 1% to 2% of AUM. Performance fees, also known as incentive fees, are charged as a percentage of the fund's profits and are designed to reward the fund manager for generating positive returns. These fees typically range from 15% to 20% of the fund's profits.

In summary, mutual funds charge flat fees that are typically lower than those of hedge funds, while hedge funds charge a combination of management and performance fees that can result in higher overall costs. It's important for investors to carefully consider the fee structures of both types of funds before making investment decisions.

Best Mutual Funds: Where to Invest Smartly

You may want to see also

Mutual funds are safer investments, hedge funds are riskier

Mutual funds and hedge funds are both managed portfolios, pooling money from investors to buy securities or other types of investments. However, there are some key differences between the two, with mutual funds being considered a safer investment option compared to hedge funds.

Mutual funds are regulated investment products offered to the public and are suitable for everyday investors. They provide diversification and convenience at a low cost, investing across dozens or sometimes hundreds of individual stocks, bonds, or other securities. Mutual funds are also more liquid than hedge funds, allowing investors to redeem their units on any given business day. While mutual funds do charge fees, they are generally lower than those of hedge funds, with industry-wide expense ratios averaging 0.54% in 2020.

On the other hand, hedge funds are private investments that are only available to accredited investors, who have a net worth of at least $1 million or an annual income exceeding $200,000. Hedge funds employ more aggressive and riskier investment strategies, such as leveraging, debt-based investing, and short-selling, and can invest in assets that mutual funds cannot, like real estate, art, and currency. Hedge funds also carry higher fees, typically charging an asset management fee of 1-2% and a performance fee of 20% of the fund's profit.

Due to their riskier nature, hedge funds may produce higher returns during favourable market conditions, but they can also lead to significant losses. Mutual funds, on the other hand, are designed to provide steady returns with minimal risk, making them a safer investment option for those seeking to diversify their portfolios.

In summary, while hedge funds may offer the potential for higher returns, they come with greater risk and are only accessible to a limited group of accredited investors. Mutual funds, on the other hand, are widely accessible, regulated, and provide diversification with lower fees and minimal risk, making them a safer investment choice for most individuals.

Lump Sum Mutual Fund Investments: Good Idea or Not?

You may want to see also

Frequently asked questions

A hedge fund pools money from investors to buy securities or other types of investments. They are known for using higher-risk investing strategies with the goal of achieving higher returns for their investors.

A mutual fund is an investment product that offers a managed portfolio of publicly traded securities such as stocks and bonds. They are available to any investor and are regulated by the U.S. Securities and Exchange Commission (SEC).

Hedge funds are exclusive to high-net-worth individuals and employ aggressive investment strategies. Mutual funds, on the other hand, are available to all investors and are more restricted in their investment strategies.

To invest in a hedge fund, you typically need to be an accredited investor with a net worth of at least $1 million or an annual income of over $200,000. These requirements are set by the SEC to ensure that investors can withstand the volatility and risk associated with hedge funds.