The world of finance offers a myriad of strategies for individuals seeking to grow their wealth. Two common approaches are trading and long-term investment, each with distinct characteristics and goals. While trading involves the frequent buying and selling of assets over short periods, often driven by market trends and short-term price movements, long-term investment focuses on holding assets for extended periods, typically years or even decades. This paragraph aims to explore the differences and similarities between these two financial strategies, shedding light on how they can be complementary or contrasting in an investor's portfolio.

What You'll Learn

- Market Timing: The art of predicting market trends to buy/sell assets at optimal times

- Risk Management: Strategies to minimize potential losses while maximizing gains

- Asset Allocation: Diversifying investments across different asset classes for long-term growth

- Technical Analysis: Using historical market data to forecast future price movements

- Fundamental Analysis: Evaluating a company's financial health to make informed investment decisions

Market Timing: The art of predicting market trends to buy/sell assets at optimal times

Market timing is a strategy that involves attempting to predict the optimal points in the market cycle to buy or sell assets, aiming to capitalize on short-term price movements. It is a complex and challenging endeavor, often associated with active trading and short-term market participants. The goal is to identify the right moment to enter or exit a position, taking advantage of market trends and price fluctuations. This practice requires a deep understanding of market dynamics, technical analysis, and often, a keen intuition for market sentiment.

The art of market timing is based on the idea that markets are not always efficient and that price movements can be predicted to some extent. Market participants use various tools and techniques to analyze historical data, identify patterns, and make informed decisions. These tools include technical indicators, such as moving averages, relative strength index (RSI), and candlestick charts, which provide insights into price trends, momentum, and potential support or resistance levels. By studying these indicators, traders aim to anticipate turning points in the market and make strategic moves.

One of the key aspects of market timing is recognizing market cycles and trends. Markets tend to move in cycles, with periods of growth followed by corrections or downturns. Identifying these cycles and understanding the underlying factors driving them is crucial. For example, economic indicators, geopolitical events, and industry-specific news can influence market sentiment and trigger price movements. Traders who can interpret these signals and align their trades with market trends may gain an edge in the short term.

However, market timing is not without risks. Predicting market trends accurately is challenging, and even experienced traders can make mistakes. The market is influenced by numerous factors, and unexpected events can cause rapid and significant price swings. Therefore, successful market timing often requires a disciplined approach, risk management strategies, and a well-defined trading plan. Traders must be prepared to adapt their strategies based on market conditions and continuously learn from their experiences.

In summary, market timing is a sophisticated approach to trading that involves predicting market trends to make strategic buy/sell decisions. It requires a combination of technical analysis, market understanding, and a keen eye for market sentiment. While it can be a profitable strategy for short-term traders, it also carries risks and demands a high level of skill and discipline. Market participants should approach this strategy with caution, ensuring they have the necessary knowledge and resources to navigate the complexities of market timing effectively.

Long-Term Trading: Balancing Risk and Reward in Securities

You may want to see also

Risk Management: Strategies to minimize potential losses while maximizing gains

Risk management is a critical aspect of trading and investment, especially when distinguishing between short-term trading and long-term investing. While both strategies aim to generate profits, they differ significantly in their time horizons, risk profiles, and approaches. Understanding these differences is essential for investors and traders to implement effective risk management techniques.

In the context of trading, risk management involves strategies to minimize potential losses while maximizing gains. Traders often focus on short-term price movements, utilizing various tools and techniques to capitalize on market volatility. One common approach is to employ stop-loss orders, which automatically trigger the sale of an asset when it reaches a predetermined price level, thus limiting potential losses. Traders may also use risk-reward ratios, such as the 1:2 or 1:3 ratio, to manage their positions, aiming to capture twice or three times the potential loss in potential profits.

For long-term investors, risk management takes a different approach. Long-term investing typically involves holding assets for an extended period, often years or even decades. The primary goal is to benefit from the long-term growth potential of investments rather than short-term market fluctuations. Investors often employ strategies like diversification, where they spread their investments across various assets to reduce the impact of any single investment's performance on their overall portfolio. This approach helps to minimize the risk of significant losses and provides a more stable investment journey.

- Set Realistic Goals: Define clear and achievable financial goals, considering your risk tolerance and investment timeframe. This helps in making informed decisions and managing expectations.

- Diversification: Diversify your investment portfolio by allocating assets across different sectors, industries, and asset classes. This strategy reduces the risk associated with any single investment and provides a more balanced approach.

- Risk Assessment: Regularly evaluate the risk associated with each investment. Consider factors like volatility, market trends, and economic indicators. This assessment allows for better decision-making and the implementation of appropriate risk mitigation measures.

- Position Sizing: Determine the appropriate amount of capital to invest in each trade or position. Proper position sizing ensures that potential losses are manageable and aligns with your risk tolerance.

- Risk Monitoring: Continuously monitor your investments and market conditions. Stay updated on news and events that may impact your holdings. Regular monitoring enables you to make timely adjustments and protect your capital.

By implementing these risk management strategies, traders and investors can navigate the markets with confidence, aiming to minimize potential losses while maximizing gains. It is essential to strike a balance between taking calculated risks and preserving capital, ensuring that the chosen strategy aligns with one's financial objectives and risk appetite.

Unlocking Retirement Wealth: IRA's Long-Term Investment Potential

You may want to see also

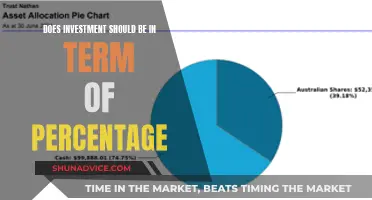

Asset Allocation: Diversifying investments across different asset classes for long-term growth

Asset allocation is a fundamental concept in investing, and it involves strategically distributing your investment portfolio across various asset classes to achieve long-term financial goals. This approach is essential for investors who aim to build wealth over an extended period, as it helps manage risk and optimize returns. Diversification is the key principle behind asset allocation, ensuring that your investments are not all in one basket, thus reducing the impact of any single asset's performance on your overall portfolio.

The primary objective of asset allocation is to create a balanced portfolio that aligns with your investment objectives, risk tolerance, and time horizon. It involves selecting a mix of assets such as stocks, bonds, cash, real estate, and alternative investments. Each asset class has its own characteristics, risk levels, and potential returns, and by diversifying, investors can smooth out the volatility of their portfolio. For instance, stocks generally offer higher potential returns but come with greater risk, while bonds provide more stability but with lower returns.

When allocating assets, investors should consider their investment goals. Long-term investors often focus on capital appreciation and income generation over an extended period. A common strategy is to have a higher allocation of stocks in the early years of retirement, gradually shifting towards more conservative investments like bonds as retirement approaches. This approach ensures that the portfolio remains aligned with the investor's risk tolerance and financial objectives.

One of the critical benefits of asset allocation is risk management. By diversifying across different asset classes, investors can reduce the overall risk of their portfolio. For example, during a market downturn, stocks may experience significant losses, but a well-diversified portfolio with a significant bond allocation can help offset these losses. This strategy ensures that the portfolio's value doesn't take a severe hit, providing investors with the confidence to weather market volatility.

Additionally, asset allocation allows investors to take advantage of the long-term growth potential of various asset classes. Historically, stocks have provided higher long-term returns compared to bonds and cash. However, this comes with higher risk. By diversifying, investors can strike a balance between risk and reward, ensuring that their portfolio grows steadily over time. This approach is particularly effective for long-term investors, as it enables them to benefit from the power of compounding returns while managing risk effectively.

In summary, asset allocation is a powerful tool for investors seeking long-term growth and stability. By diversifying investments across different asset classes, investors can manage risk, optimize returns, and align their portfolio with their financial goals. It is a strategic approach that enables investors to build wealth over time, making it an essential concept for anyone looking to make the most of their investment journey.

Maximizing Revenue: Understanding Short-Term Investments and Revenue Recognition

You may want to see also

Technical Analysis: Using historical market data to forecast future price movements

Technical analysis is a powerful tool for traders and investors, offering a systematic approach to predicting future price movements in financial markets. It involves the use of historical market data, primarily price and volume information, to identify patterns and trends that can be used to forecast future performance. This method is distinct from fundamental analysis, which focuses on intrinsic value and financial ratios. Instead, technical analysis relies on the assumption that market prices reflect all available information, and past price and volume data can provide valuable insights into future behavior.

The core principle of technical analysis is that historical price data can be used to predict future price movements. Traders analyze charts and graphs, often using various technical indicators and tools, to identify patterns and trends. These patterns can include support and resistance levels, which are price points where the market has historically paused or reversed. By identifying these levels, traders can anticipate potential price bounces or breaks, allowing them to make informed trading decisions. For example, if a stock's price has consistently reversed at a certain price level in the past, traders might expect a similar reaction in the future when the price approaches that level.

One of the key advantages of technical analysis is its ability to provide short-term trading signals. Traders often use technical indicators like moving averages, relative strength index (RSI), and exponential moving averages (EMAs) to generate buy and sell signals. These indicators help identify overbought or oversold conditions, potential trend reversals, and areas of support or resistance. For instance, a crossover of short-term and long-term moving averages can signal a potential trend change, prompting traders to adjust their positions.

Additionally, technical analysis allows traders to identify trading ranges and channels, which are essential for managing risk and setting stop-loss orders. By recognizing the historical price patterns within a range, traders can determine the likely direction of future price movements and place stop-loss orders at appropriate levels to limit potential losses. This risk management aspect is crucial for long-term success in trading.

In summary, technical analysis is a valuable skill for traders and investors, enabling them to make informed decisions based on historical market data. It provides a structured approach to identifying patterns, trends, and potential price movements, which can be particularly useful for short-term trading strategies. By utilizing technical indicators and chart patterns, traders can gain a competitive edge in the market and potentially improve their overall trading performance.

Long-Term Investment Strategies: Understanding Setup Investments

You may want to see also

Fundamental Analysis: Evaluating a company's financial health to make informed investment decisions

Fundamental analysis is a critical approach to evaluating a company's financial health and making informed investment decisions. It involves a deep dive into a company's financial statements, industry trends, and economic factors to assess its intrinsic value. This method is often used by long-term investors who aim to make strategic decisions based on the company's long-term potential rather than short-term market fluctuations.

The core of fundamental analysis lies in understanding a company's financial performance and stability. Investors analyze various financial ratios and metrics to gauge a company's efficiency, profitability, and financial stability. For instance, they might examine the company's revenue growth rate, profit margins, return on equity, and debt-to-equity ratio. These indicators provide insights into how well the company manages its resources, generates profits, and maintains a healthy balance sheet. By comparing these ratios across different companies within the same industry, investors can identify undervalued or overvalued stocks.

One of the key aspects of fundamental analysis is assessing a company's competitive advantage and industry position. Investors look for companies with strong market positions, innovative products or services, and a history of consistent performance. They study industry trends, market share, and competitive dynamics to understand the company's long-term prospects. For example, a company with a dominant market position in a growing industry might be considered a strong investment opportunity.

Additionally, fundamental analysis involves evaluating a company's management team and corporate governance. Investors assess the experience and track record of the management, their ability to make strategic decisions, and their commitment to shareholder value. Strong corporate governance, transparent reporting, and a history of ethical business practices are also essential factors in this analysis.

In the context of long-term investment, fundamental analysis plays a pivotal role in identifying companies with sustainable growth potential. Long-term investors aim to hold investments for extended periods, allowing the power of compounding to work in their favor. By conducting thorough fundamental analysis, they can make informed decisions, ensuring that their investments are aligned with their financial goals and risk tolerance. This approach helps them avoid short-term market volatility and focus on the long-term value creation potential of the companies they invest in.

Unlocking Long-Term Wealth: Strategies for Smart Investment Choices

You may want to see also

Frequently asked questions

Trading and long-term investment are two distinct approaches to the financial markets. Trading involves buying and selling assets frequently, often within a short time frame, to profit from short-term price movements. It requires active monitoring and quick decision-making. Long-term investment, on the other hand, is a strategy where investors hold assets for an extended period, typically years or even decades, with the goal of capital appreciation and income generation over time.

Risk tolerance plays a significant role in determining whether one should trade or invest for the long term. Trading often involves higher risk due to the frequent buying and selling, which can lead to substantial losses if market conditions turn unfavorable. Long-term investors generally aim to weather short-term market volatility and focus on the long-term growth potential of their investments.

Absolutely! Many investors adopt a diversified approach, combining both trading and long-term investment strategies. For instance, you might have a portion of your portfolio dedicated to active trading, taking advantage of short-term market opportunities, while also holding long-term investments for wealth accumulation. Finding the right balance depends on your financial goals, risk tolerance, and investment time horizon.

Tax considerations differ between trading and long-term investment. Short-term capital gains, typically from trading activities, are often taxed at a higher rate than long-term gains. Long-term investments may offer tax advantages, such as reduced tax rates or tax-free growth, depending on the jurisdiction and investment type. It's essential to understand the tax rules in your region to make informed decisions.

Both trading and long-term investment require knowledge and research, but the level of expertise may vary. Trading often demands a deeper understanding of market dynamics, technical analysis, and risk management. Long-term investors need to grasp investment principles, asset allocation, and the factors influencing long-term market trends. However, with the right resources and education, anyone can develop the necessary skills to navigate these strategies effectively.