When it comes to investing, understanding the concept of percentage-based investments is crucial for making informed financial decisions. Many investors prefer to express their investments as a percentage of their total portfolio or a specific asset's value. This approach allows for a clear comparison of different investment options and helps assess risk and potential returns. Whether it's allocating funds across various assets or determining the proportion of one's savings to invest in a particular venture, percentages provide a standardized way to measure and communicate investment strategies. By considering the percentage allocation, investors can better manage their portfolios and make strategic choices to align with their financial goals and risk tolerance.

What You'll Learn

- Return on Investment (ROI): Measures the profitability of an investment as a percentage

- Risk-Adjusted Returns: Assesses investment performance relative to its risk exposure

- Compounding: The process of earning interest on both initial and accumulated investment earnings

- Diversification: Spreading investments across various assets to reduce risk, often expressed as a percentage

- Asset Allocation: The percentage distribution of investments among different asset classes

Return on Investment (ROI): Measures the profitability of an investment as a percentage

Return on Investment (ROI) is a critical metric used to evaluate the profitability and efficiency of an investment. It provides a clear and concise way to understand the financial gain or loss generated from an investment, expressed as a percentage. ROI is a versatile tool that can be applied to various investment scenarios, from business ventures to real estate purchases, and even personal financial decisions.

The formula for calculating ROI is straightforward: ROI = (Net Profit / Cost of Investment) * 100. Here, net profit refers to the total revenue generated from the investment minus all associated costs and expenses. The cost of investment is the initial amount of money or resources invested. By dividing the net profit by the cost and then multiplying by 100, you obtain the ROI as a percentage. For example, if an investor puts in $10,000 and generates a net profit of $4,000 over a year, the ROI would be 40%.

This metric offers a quick and easy way to compare the performance of different investments. A higher ROI indicates a more profitable investment, assuming all other factors are equal. Investors can use this information to make informed decisions about where to allocate their capital. For instance, if two investments have the same initial cost but different expected returns, the one with the higher ROI will be the more attractive option.

However, it's important to note that ROI is just one aspect of investment analysis. It doesn't consider the time value of money, which is crucial in long-term investments. Additionally, ROI doesn't provide insights into the risk associated with an investment. Investors should also consider factors like volatility, potential losses, and the overall market conditions when making investment choices.

In summary, ROI is a valuable tool for assessing investment profitability, offering a simple and understandable way to measure success. It allows investors to make informed decisions and compare opportunities effectively. While it has its limitations, ROI remains an essential concept in the world of finance, helping individuals and businesses alike to navigate the complex landscape of investment choices.

Notes Receivable: Short-Term Investment or Long-Term Liability?

You may want to see also

Risk-Adjusted Returns: Assesses investment performance relative to its risk exposure

When evaluating investment strategies, it is crucial to consider the concept of risk-adjusted returns, which provides a comprehensive assessment of an investment's performance in relation to its risk exposure. This approach allows investors to make informed decisions by understanding the true value of their investments beyond just the financial gains.

Risk-adjusted returns take into account the volatility and uncertainty associated with an investment. By analyzing the relationship between risk and return, investors can identify whether an investment has generated satisfactory outcomes relative to the risks taken. This is particularly important as it helps investors compare different investment options and make choices that align with their risk tolerance and financial goals. For instance, an investment with a higher risk profile should ideally offer a proportionally higher return to compensate for the increased uncertainty.

The calculation of risk-adjusted returns typically involves various metrics and ratios. One commonly used measure is the Sharpe Ratio, which quantifies the excess return per unit of volatility. A higher Sharpe Ratio indicates that an investment has achieved a better risk-adjusted return, meaning it has delivered more return for the level of risk taken. This metric is valuable for investors as it provides a standardized way to compare the performance of different investments.

Another approach is to use regression analysis to assess the relationship between an investment's returns and its risk factors. This method helps investors understand how much of the return can be attributed to the specific risks taken. By decomposing the returns, investors can make more informed decisions about the trade-off between risk and reward.

In summary, risk-adjusted returns are a critical concept in investment analysis, offering a more nuanced understanding of an investment's performance. It enables investors to evaluate whether the returns generated are commensurate with the risks incurred, allowing for better decision-making and the potential to optimize investment portfolios. This approach is essential for investors seeking to balance risk and reward effectively.

Debt Securities: Unlocking the Investment-Finance Connection

You may want to see also

Compounding: The process of earning interest on both initial and accumulated investment earnings

Compounding is a fundamental concept in finance that highlights the power of reinvesting earnings, especially in the context of investments. It refers to the process of earning interest not only on the initial amount invested but also on the accumulated earnings generated from previous periods. This concept is particularly important when considering the growth potential of investments over time.

When you invest a certain amount of money, you typically earn interest or returns on that initial investment. However, compounding takes this a step further. As you generate returns, those earnings are then reinvested, earning interest themselves. This creates a snowball effect, where your investment grows exponentially. For example, if you invest $1000 at an annual interest rate of 5%, the first year you earn $50 in interest, bringing your total to $1050. In the second year, you earn interest on this new total of $1050, resulting in a higher amount of interest earned. This process continues, and your investment grows at an accelerating rate.

The key to understanding compounding is recognizing that it works on both the initial investment and the subsequent earnings. As time progresses, the interest earned becomes a larger portion of the total, leading to significant growth. This is why long-term investments with compounding can be highly advantageous. The effect is more pronounced over extended periods, allowing your money to grow substantially.

To illustrate, consider a scenario where you invest $5000 at a 7% annual interest rate. After the first year, you earn $350 in interest, bringing your total to $5350. In the second year, you earn interest on this new amount, resulting in $374.50 in interest. As you can see, the interest earned each year increases, and your investment grows faster than if it were simply earning interest on the initial amount.

Compounding is a powerful tool for investors, as it maximizes the potential return on their money. It encourages investors to start early, as the longer the investment period, the more significant the impact of compounding. Additionally, understanding compounding can help individuals make informed decisions about their investment strategies, allowing them to optimize their financial growth.

Bid-Ask Spread: A Long-Term Investing Perspective

You may want to see also

Diversification: Spreading investments across various assets to reduce risk, often expressed as a percentage

Diversification is a fundamental strategy in investing, aiming to minimize risk by allocating capital across a variety of assets. This approach is particularly crucial in the context of percentage-based investments, where the goal is to optimize returns while managing potential losses. The core principle is to spread your investments so that a potential downturn in one asset class doesn't significantly impact your overall portfolio.

When considering diversification, investors often look to invest in a mix of asset classes such as stocks, bonds, real estate, commodities, and even alternative investments like derivatives or cryptocurrencies. Each asset class carries its own level of risk and return potential, and by diversifying, you can balance these risks. For instance, stocks are generally considered riskier but offer higher potential returns, while bonds are more stable but provide lower returns. By holding a combination of these, investors can create a well-rounded portfolio.

The percentage allocation to each asset class is a critical decision. A common strategy is to use a asset allocation model, such as the 60/40 model, which suggests investing 60% in stocks and 40% in bonds. This allocation is often tailored to an investor's risk tolerance, age, and financial goals. Younger investors might opt for a higher stock allocation, while older investors may prefer a more conservative mix. The key is to regularly review and adjust these allocations as your financial situation and market conditions evolve.

Diversification also involves geographic diversification, where investments are spread across different countries and regions. This strategy reduces the impact of country-specific risks and economic events. For example, if a particular country's economy experiences a downturn, a diversified portfolio would be less affected by this event. Similarly, industry-specific diversification means investing in various sectors to avoid concentration risk.

In summary, diversification is a powerful tool for managing risk in investments, especially when expressed as a percentage allocation. It involves a strategic distribution of capital across different asset classes, sectors, and regions, ensuring that your portfolio is not overly exposed to any single risk factor. This approach allows investors to potentially benefit from a variety of market opportunities while also being prepared for potential downturns.

Understanding Long-Term Investment Strategies: Key Factors to Consider

You may want to see also

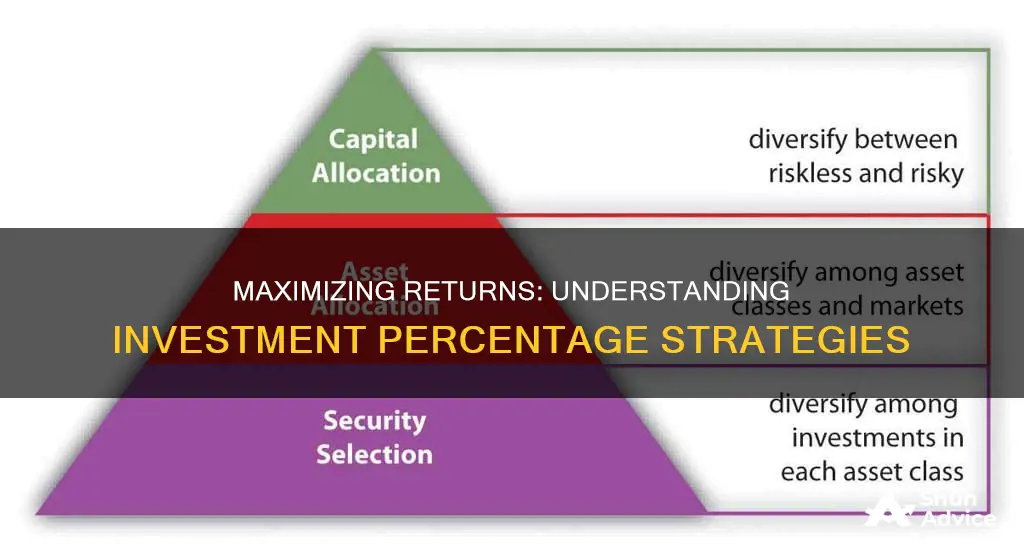

Asset Allocation: The percentage distribution of investments among different asset classes

Asset allocation is a fundamental concept in investing, referring to the strategic distribution of an investor's portfolio across various asset classes. This approach is crucial as it determines the risk and return profile of the investment, allowing investors to align their portfolios with their financial goals and risk tolerance. The primary objective of asset allocation is to optimize the balance between risk and reward, ensuring that investments are diversified to manage potential losses and maximize long-term gains.

The asset classes commonly included in investment portfolios are stocks, bonds, cash, and alternative investments such as real estate, commodities, and derivatives. Each asset class has its own characteristics, risk levels, and potential returns, which investors must consider when deciding on their allocation strategy. For instance, stocks are generally associated with higher risk but also offer the potential for significant growth, while bonds provide a more stable, lower-risk investment with steady income.

Determining the optimal percentage allocation for each asset class is a complex task that requires careful analysis and consideration of various factors. Investors often use asset allocation models, which are mathematical frameworks that help in making these decisions. These models take into account an investor's risk tolerance, investment horizon, and financial goals to suggest an appropriate asset mix. A common rule of thumb is the 60/40 model, where 60% of the portfolio is allocated to stocks for growth, and 40% to bonds for stability, but this ratio can vary based on individual circumstances.

The allocation percentages are not set in stone and can be adjusted over time as an investor's life changes or market conditions evolve. For example, a young investor with a long investment horizon might allocate a higher percentage to stocks to maximize growth potential, while an older investor near retirement might opt for a more conservative mix, favoring bonds and cash to preserve capital. Regular reviews of asset allocation are essential to ensure the portfolio remains aligned with the investor's changing needs and market dynamics.

In summary, asset allocation is a critical strategy for investors to manage risk and optimize returns. By allocating investments across different asset classes in specific percentages, investors can create a well-diversified portfolio that aligns with their financial objectives. This approach requires careful consideration of various factors and the use of appropriate models to determine the right mix, ensuring that investments are both secure and potentially profitable.

Unraveling the True Nature of Short-Term vs. Long-Term Investments

You may want to see also

Frequently asked questions

To determine the percentage return, you need to calculate the difference between the current value and the initial investment, then divide it by the initial investment amount and multiply by 100. The formula is: (Current Value - Initial Investment) / Initial Investment * 100. This will give you the return as a percentage.

Percentage-based investments, such as stocks or mutual funds, offer returns that are directly proportional to the percentage change in the value of the investment. For example, if you invest $1000 and the value increases by 10%, your return is $100. Fixed-term investments, like bonds or certificates of deposit (CDs), typically offer a guaranteed return over a specific period, and the return is usually stated as an annual percentage rate (APR).

Both strategies have their advantages. Investing a larger percentage of your income upfront can lead to significant growth, especially if you have a substantial amount to invest. However, it may require careful planning and could impact your short-term financial goals. On the other hand, investing a smaller amount regularly (dollar-cost averaging) can be less risky and more manageable, allowing you to build a diversified portfolio over time without the pressure of a large lump sum.