The timing of an investment's cash flows is an important consideration in financial analysis and business planning. It involves understanding the inflows and outflows of cash from a company's long-term investments and their impact on the overall financial health of the company. This information is typically presented in the cash flow statement, which is one of the key financial statements used by businesses, along with the balance sheet and income statement. The cash flow statement provides insights into how effectively a company manages its cash across operating activities, investing activities, and financing activities. While negative cash flow can be an indicator of poor performance, it is important to note that negative cash flow from investing activities may signal that a company is making strategic investments in long-term assets, research, or development projects, which could lead to significant growth and gains in the future if managed effectively.

| Characteristics | Values |

|---|---|

| Net Present Value | Unaffected by the timing of an investment's cash flows |

What You'll Learn

Cash flow from investing activities

Investing activities include the purchase of physical assets, investments in securities, or the sale of securities or assets. These can be long-term investments in the health or performance of the company, or they can generate income on their own.

Negative cash flow from investing activities does not always indicate poor financial health. It is often a sign that the company is investing in assets, research, or other long-term development activities that are important to the health and continued operations of the company.

For example, a company might be investing heavily in plant and equipment to grow the business. These long-term purchases would be cash-flow negative but could be positive in the long term.

There are a variety of investing activities that can make an appearance on the cash flow statement. These activities may generate either negative or positive cash flow. Purchases require spending money, which generates negative cash flow. Sales produce income, which generates positive cash flow.

Smart Ways to Generate Cash Flow with a $5000 Investment

You may want to see also

Long-term asset purchases

The CFI section of a cash flow statement provides insights into the cash generated or spent on various investment activities over a specific period. This includes purchases of physical assets, investments in securities, and the sale of securities or assets. Long-term asset purchases fall under this category, and they are crucial for the company's future performance.

When analysing long-term asset purchases, it's important to consider both the positive and negative cash flows associated with them. Purchases of long-term assets, such as property, plant, and equipment (PP&E), result in negative cash flow. However, these investments are essential for the company's long-term health and growth prospects. For example, investing in research and development (R&D) or acquiring other businesses can lead to significant future gains if managed effectively.

The impact of long-term asset purchases on a company's financial health should be assessed in conjunction with other financial statements, such as the balance sheet and income statement. This holistic analysis provides a more comprehensive understanding of the company's performance and the potential returns on these investments.

Additionally, long-term asset purchases can also include investments in marketable securities, such as stocks and bonds. These investments may generate positive cash flow if the proceeds from their sale are considered. However, the primary focus of long-term asset purchases is often on future growth and the maintenance of the company's competitive position rather than immediate positive cash flow.

In summary, long-term asset purchases are a vital aspect of a company's financial strategy, and they are reflected in the CFI section of the cash flow statement. While they may result in negative cash flow in the short term, they are crucial for the company's long-term growth, performance, and overall financial health.

Temporary Investments: Are They Really Cash?

You may want to see also

Investment income

Investing activities encompass the purchase or sale of physical assets, investments in securities, and acquisitions or disposals of other businesses. These activities can generate positive or negative cash flow. For instance, purchasing fixed assets, such as property, plant, and equipment, or investing in marketable securities, leads to negative cash flow. On the other hand, proceeds from selling assets or securities result in positive cash flow.

It is important to note that negative cash flow from investing activities does not always signify poor financial health. It could indicate that a company is investing in long-term assets, research, or other development activities vital for the company's health and continued operations. For example, a company with negative cash flow from investing activities due to heavy investment in plant and equipment may be positioning itself for future growth.

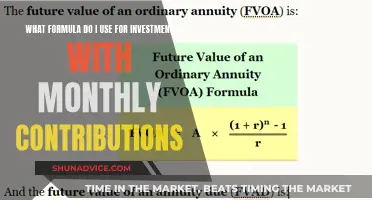

The net present value (NPV) is a concept related to investment income. NPV is the difference between the present value of cash inflows and outflows over time, and it is unaffected by the timing of an investment's cash flows.

Cash Value Investing: Strategies for Long-Term Wealth Preservation

You may want to see also

Negative cash flow

There are several ways to manage negative cash flow. These include being mindful of spending and investing, creating a cash flow statement and forecast, reviewing outgoing expenses regularly, and creating an emergency budget to accommodate unexpected expenses.

Investing Without Cash: Strategies for Building Wealth from Scratch

You may want to see also

Positive cash flow

A company with positive cash flow is in a position to pay dividends to shareholders and attract outside investment. This surplus of cash can be reinvested into the business to promote growth and sustainability. For example, a company with positive cash flow can invest in new equipment, research and development, or long-term assets.

There are three common types of cash flow:

- Operating cash flow: This type of cash flow relates to a company's day-to-day operations and involves money from sales and revenue, as well as outflows from salaries, taxes, and interest payments.

- Investing cash flow: Investing cash flow refers to money linked to long-term investments. It includes purchases or sales of securities, assets, or investments in startups.

- Financing cash flow: This type of cash flow is associated with financing activities that power a company's operations. It includes selling ownership shares, issuing debt or equity, and paying dividends.

In summary, positive cash flow is a critical indicator of a company's financial health and stability. It enables a company to meet its financial obligations, reinvest in its business, and promote growth. Positive cash flow is essential for a company's sustainability and ability to attract investment.

Surplus Cash Strategies: Smart Ways to Invest Extra Funds

You may want to see also

Frequently asked questions

The net present value is the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

The net present value is unaffected by the timing of an investment's cash flows.

As the required rate of return increases, the net present value decreases.