Investment trusts are listed companies with shares that trade on the stock market. They are known as closed-end funds, meaning there is a fixed number of shares. Investment trusts can be riskier than unit trusts because their shares can trade at a premium or discount to the value of the assets they hold, known as the net asset value.

There are several ways to buy investment trusts, including through a stockbroker or an online investing platform. The best option depends on factors such as how much choice you want, how you intend to invest, and whether you want all your investments on one platform.

When buying an investment trust, you can hold the shares in an individual savings account or ISA, a self-invested personal pension, or a basic investment account. There are transaction costs and management charges to consider, which can vary depending on the platform and the size of your investment.

In the past, it was common advice not to buy a new investment trust at launch because similar trusts could often be purchased at a discount. However, times have changed, and new investment trusts are now more likely to move to a premium at launch, making it worthwhile to buy them during the initial public offering.

| Characteristics | Values |

|---|---|

| Cost | Investment trusts tend to have lower costs than funds |

| Trade | Investment trusts are traded on the stock market |

| Risk | Investment trusts can be riskier than unit trusts |

| Returns | Investment trusts are a great way to boost your returns |

| Charges | Fees for investment trusts tend to be lower than funds |

| Management | Management charges for investment trusts range from 0.4% to 1.5% of the investment |

| Access | Investors can buy or sell units to join or leave |

| Tax | Investment trusts can be held in an Isa to avoid capital gains tax |

| Choice | There are 350 investment companies and trusts on the London Exchange |

| Platform | Hargreaves Lansdown is the UK's largest fund supermarket |

What You'll Learn

Investment trusts are listed companies with shares that trade on the stock market

Investment trusts are a type of fund that can be bought and sold on the stock market. They are publicly listed companies that aim to make money by investing in other companies. They are traded on the London Stock Exchange, and investors can buy and sell shares in these trusts.

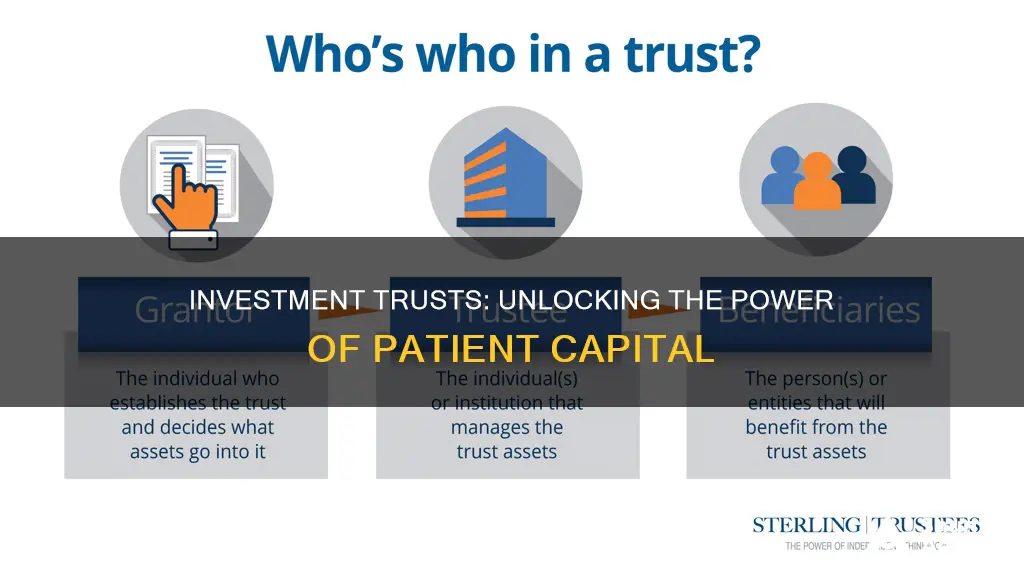

Investment trusts are closed-ended funds, meaning they have a fixed number of shares available. This is in contrast to open-ended funds, which can continue to issue new units in response to demand. As a result, investment trusts are able to take a long-term view and borrow money to increase their exposure to stock markets, potentially leading to higher returns.

When buying shares in an investment trust, investors become shareholders in that company. This gives them certain rights and protections, such as the ability to vote on issues such as the appointment of directors and key company policies. It also allows them to hold the company accountable and ensure their interests are being looked after.

There are a few ways to purchase investment trusts. One option is to use a stockbroker or an online investing platform, which provides access to a wide range of investment trusts. Another option is to buy directly from the investment trust provider, which may offer lower or no trading fees. It is also possible to buy investment trusts through an Individual Savings Account (ISA) or a self-invested personal pension (SIPP), which can provide tax benefits.

It is important to remember that investing in investment trusts carries risks, as the value of investments can fluctuate. There are also fees and charges associated with investing in trusts, which vary depending on the platform or provider chosen.

Hertz: Invest Now or Miss Out?

You may want to see also

Investment trusts are known as closed-end

The fact that investment trusts are closed-end funds has several implications for investors. Firstly, it means that investment trust managers know exactly how much capital they have to manage and can make long-term investment decisions without worrying about constant inflows and outflows of capital. This is in contrast to open-ended funds, where the amount of money can vary daily, and managers must be prepared to deal with the money as it comes in and goes out.

Secondly, the closed-end nature of investment trusts means that they are not required to buy back their shares from investors upon request. This is because investment trusts trade on the stock market, and investors can sell their shares to other investors without going through the fund managers. As a result, the shareholder capital that fund managers oversee is unaffected by investors coming and going.

Finally, the closed-end structure of investment trusts allows them to hold more shares in smaller companies and other specialist investments that may be difficult to sell in a falling market. This is because investment trust managers don't have to worry about ensuring there is enough cash to give departing investors, which can lead to selling investments at a loss.

Invest Wisely: Cash Strategies for Today

You may want to see also

Investment trusts can be riskier than unit trusts

Investment trusts and unit trusts are both collective investment vehicles that allow investors to pool their money and invest in a diversified portfolio of assets. However, there are some key differences between the two, and investment trusts can be considered riskier than unit trusts due to several factors.

Firstly, investment trusts are closed-ended funds, meaning they have a fixed number of shares available, while unit trusts are open-ended, and the number of units or shares can fluctuate according to investor demand. This difference has several implications for risk. Investment trusts can trade at a premium or discount to their net asset value (NAV), which is the value of their underlying assets. If shares in an investment trust are in high demand, they can trade at a premium, or excess of the NAV, whereas shares in low demand will trade at a discount, or below the NAV. This means that investors could potentially receive less than the value of the fund's underlying assets if they sell when the trust is trading at a discount.

In contrast, unit trusts have more stable pricing as their share price is directly linked to the NAV, which is calculated by dividing the total value of the fund's assets minus liabilities by the number of shares. Unit trusts also tend to be more liquid than investment trusts due to their larger size and higher trading volume, making it easier for investors to buy or sell units without significantly impacting the price.

Additionally, investment trusts are more likely to use leverage, or borrowing money, to boost returns during favourable market conditions or provide a cushion during downturns. While this can enhance returns, it also amplifies losses and increases the overall risk of the investment.

Furthermore, investment trusts typically have higher management fees and trading costs than unit trusts. Investment trusts are actively managed, requiring the expertise of skilled investment managers to navigate market conditions and make crucial "buy" or "sell" decisions. These higher fees can eat into investment returns over time.

Finally, unit trusts may offer more flexibility in terms of investment choices. They can be actively or passively managed, allowing investors to choose a fund that aligns with their investment goals and preferences. In contrast, investment trusts are more limited in their investment strategies and may not offer the same level of customization.

In conclusion, while both investment trusts and unit trusts have their advantages and disadvantages, investment trusts can be considered riskier due to the potential for trading at a discount, lower liquidity, the use of leverage, higher fees, and less flexibility in investment choices. However, it's important to note that risk tolerance and investment goals vary for each individual, and seeking independent financial advice is always recommended before making any investment decisions.

The Wall Street Code: Unlocking the Secret to Investing Success

You may want to see also

Fees for investment trusts tend to be lower than funds

Fees for investment trusts are generally lower than those for funds. This is mainly because investment trusts are passively managed, while funds are actively managed by portfolio managers.

Management fees

Investment trusts are typically managed by a board of directors who appoint a fund manager to do the actual investing. The board can query the performance, enforce discount/premium management policies, and put pressure on fees. This setup can help keep fees low.

On the other hand, funds usually have portfolio managers at the helm, who trade securities within the fund in an attempt to outperform the market. This active management triggers greater fees.

The management fee for investment trusts is typically between 0.4% and 1.5% of the investment. Funds, on the other hand, have an average expense ratio of 0.74%, and this can go up to 2%.

Other fees

Investment trusts are traded on the stock market, so you can buy them using a stockbroker or an online investing platform. This will usually involve paying a trading fee, a 0.5% stamp duty charge, and possibly other charges.

Funds, meanwhile, often have load fees, which are charged whenever shares are purchased. These typically go to the intermediary who facilitated the sale, such as a stockbroker or financial advisor.

Funds may also have 12b-1 fees, which cover the marketing and selling of fund shares and can be used for shareholder services. These fees are capped at 1% of fund assets.

Funds also tend to have higher initial entry costs, ranging from $500 to $3,000. In contrast, the initial buy-in for investment trusts is much lower.

Quarterly Payouts: Exploring Investments with Regular Dividend Schedules

You may want to see also

You can buy investment trusts online

If you've decided to buy some investment trusts, you can easily do so online. Investment trusts are traded on the stock market, so you can buy them using a stockbroker or an online investing platform.

If you already have a broker, you should be able to buy the investment trust you want using their platform. This will involve paying a trading fee, a 0.5% stamp duty charge, and possibly other charges. When choosing a broker, consider the fees, the user-friendliness of the platform, and their customer service record.

If you know which trusts you want to invest in, it may be cheaper to go directly to an investment company, but this will obviously limit your choice of trusts. Some investment houses will allow you to invest in their trusts directly, either as part of an Individual Savings Account (ISA) or a straightforward investment.

If you haven't used up your ISA allowance for the year, you can also buy investment trusts through your ISA. This will allow you to avoid capital gains tax (CGT) on any gains made (up to the annual CGT allowance of £11,100). You will not have to pay tax on dividend income received on investment trusts held in the ISA.

There will typically be an administration fee for opening an ISA wrapper with the platform or provider of your choice. Remember, if you plan to go direct, you can only open one stocks and shares ISA per year (though you can open a new ISA with a different provider each year).

Several well-known investment companies offer the option to buy investment trusts directly, and this can provide a straightforward way of setting up an inexpensive drip-feed investment plan.

If you are happy investing without financial advice, the best option tends to be through an online platform as these tend to have cut dealing fees below those of traditional brokers. It may cost more than buying direct, but allows you to hold all your investments in one place.

The important questions to ask yourself before you decide how to invest are whether you want to hold your trust in an ISA and hold all your investments in one place.

By choosing an online ISA platform product, you can invest in an ISA wrapper which you can put around a number of trusts in the same year, as long as you don't exceed the annual ISA limit.

The advantage of investing through a platform is that you can see and monitor your holdings in one place, whether you opt for an ISA product or a straightforward investment account. The disadvantage is that you may pay a small fee for holding trusts, and dealing charges can range from £5 to £12.50.

If you buy direct with an ISA wrapper, then that is your investing ISA allowance for that year, and you may only be able to invest tax-free either in that trust or the investment houses' other trusts in that financial year.

Online platforms

Hargreaves Lansdown (HL) is the UK's largest fund supermarket and is very popular with investors. As with many platforms, HL's dealing charges vary depending on how frequently you trade. If you carry out up to nine trades per month, a deal in the following month will cost you £11.95. This is cut to £5.95 when you've carried out 20 or more trades. Holding investment trusts within HL's Vantage Fund & Share Account is free, while there is a 0.45% charge to hold investment trusts in the Vantage ISA or Sipp (capped at £45 a year in the ISA, or £200 in the Sipp). You can save regularly into FTSE 350 trusts for £1.50 per deal.

AJ Bell Youinvest is also popular with investors. When buying investment trusts through AJ Bell, you will pay nothing to set up your account, but will pay £9.95 for buying and selling trusts. As with HL, the fee falls the more frequently you trade. You can also drip-feed money into investment trusts as part of a regular investment plan, with a minimum investment of £25 a month, again at a charge of £1.50 per investment.

The Share Centre offers two pricing options for dealing, depending on trading frequency. The standard dealing fee is 1%, with a minimum of £7.50. If buying via an ISA, you will pay a monthly administration fee of £4; 1% per deal commission; 0.5% for regular investing, and 0.5% for automatic dividend reinvestment.

If you choose to go through Fidelity, investment trust trades incur a charge of 0.1% per deal. The fee for holding investment trusts is capped at £45 per year, no matter the size of your holding. (Note that Fidelity no longer offers individual share dealing.)

In terms of customer service, both HL and AJ Bell score highly, while the Share Centre was less impressive. Finally, keep in mind that although platforms reward you for frequent trading, this is not a cost-effective strategy in the long run – trading too frequently ends in tears for the vast majority of investors.

Apartment Investment: A Smart Move or Money Pit?

You may want to see also