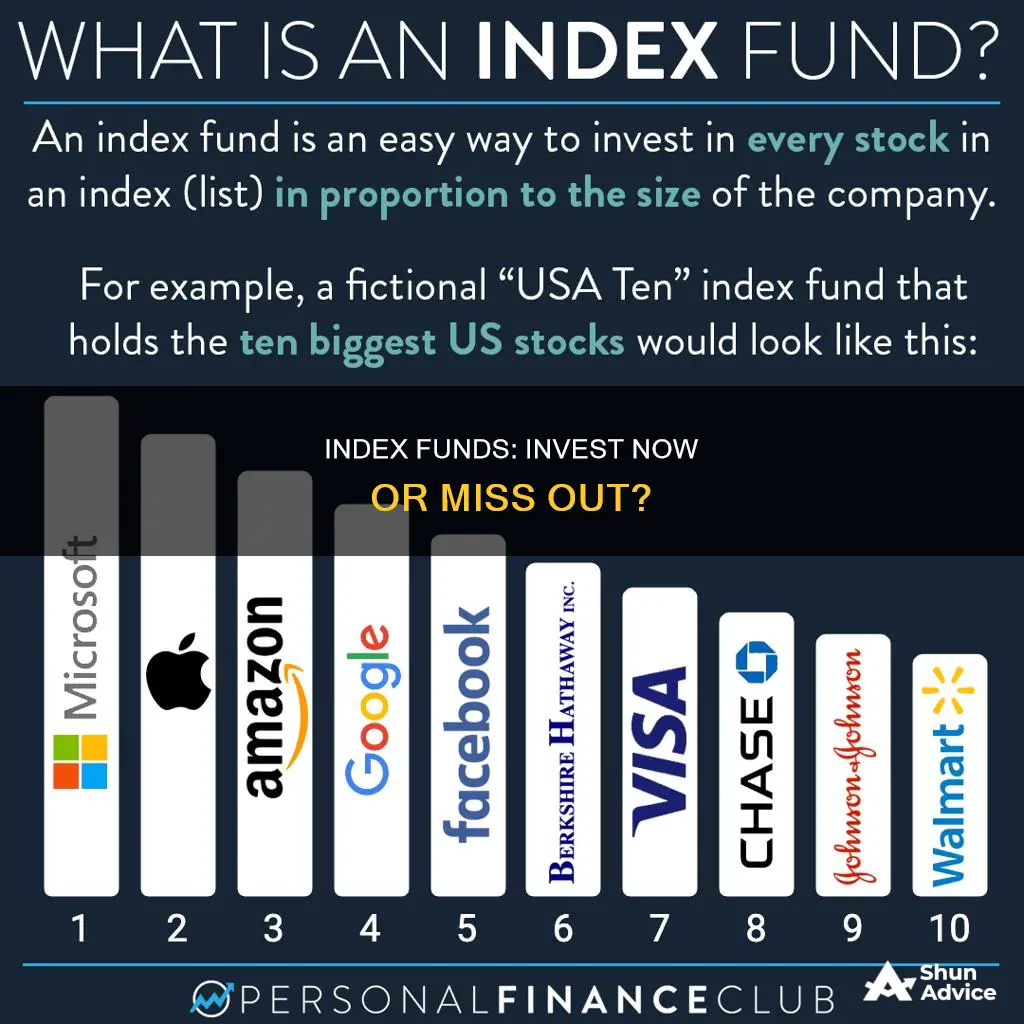

Index funds are a type of investment fund that tracks a stock market index, such as the S&P 500 or the Dow Jones Industrial Average. They are designed to mirror the performance of the index, and they have become increasingly popular due to their low cost and ease of use. Index funds are often seen as a passive investment strategy, as they do not require active management decisions about which stocks to buy or sell. So, is now a good time to invest in index funds?

What You'll Learn

What are the pros and cons of investing in index funds?

Index funds are a popular investment choice due to their potential for stable long-term returns, diversification of holdings, and low fees. However, there are also some downsides to investing in index funds. Here are the pros and cons of investing in index funds:

Pros of Investing in Index Funds:

- Passive Management: Index funds are passively managed, meaning fund managers take a hands-off approach and invest in companies included in the market index they are tracking. This passive approach results in lower management fees compared to actively managed funds, where managers actively research and choose investments.

- Diversification: Index funds provide immediate diversification by investing in a wide range of stocks, bonds, or other securities. This diversification reduces the risk of your portfolio being significantly impacted by the poor performance of a single stock.

- Long-Term Performance: Index funds tend to provide more stable and predictable returns over the long term. They are often considered excellent core assets for retirement accounts, such as IRAs and 401(k) accounts.

- Low Fees: Index funds have low expense ratios, which means you pay less in management fees. For example, the Fidelity 500 Index Fund has an expense ratio of 0.015%, resulting in a minor management cost of $1.50 annually for a $10,000 investment.

- Better Returns: Index funds often provide better returns than actively managed funds. According to SPIVA, only 40% of actively managed funds beat or matched the returns of the S&P 500 in 2023.

Cons of Investing in Index Funds:

- Market Fluctuations: While index funds diversify your portfolio, they are still susceptible to market fluctuations and economic downturns. When the market or sector they track performs poorly, index funds will likely follow suit.

- Limited Flexibility: Index funds lack the flexibility to quickly respond to changing market conditions. They are designed for long-term investing and may not be suitable if you want to make short-term gains.

- Moderate Annual Returns: Index funds that hold a large number of assets tend to have diluted returns. For example, the Wilshire 5000, which tracks all publicly traded companies in the US, provides immense diversification but may result in lower annual returns.

- Fewer Opportunities for Short-Term Growth: Index funds are passively managed, so there is less opportunity to make quick adjustments and realize significant short-term gains.

- Lack of Downside Protection: Index funds do not provide protection from market corrections and crashes. If you have heavy exposure to stock index funds, a market downturn can significantly impact your portfolio.

- Lack of Reactive Ability: Index funds do not allow for advantageous behaviour. If a stock becomes overvalued, it carries more weight in the index, but this is when investors would typically want to reduce their exposure to that stock.

- No Control Over Holdings: Index funds are set portfolios, and investors have no control over the individual holdings. You cannot choose specific companies to invest in based on your personal preferences or research.

- Limited Exposure to Different Strategies: Index funds may not provide access to diverse investment strategies. There are other strategies that can provide better risk-adjusted returns, and diversification can also be achieved with a smaller, more targeted portfolio.

Monthly Mutual Fund Investments: A Guide to Getting Started

You may want to see also

What are some of the best index funds to invest in?

Index funds are a great way to build wealth over time, and there are many options to choose from. Here are some of the best index funds to invest in:

Fidelity ZERO Large Cap Index Fund

The Fidelity ZERO Large Cap Index Fund is a great option for investors looking for a broadly diversified index fund with low costs. The fund tracks the Fidelity U.S. Large Cap Index, which is similar to the S&P 500, but without the licensing fee, keeping costs lower for investors. It has a 0% expense ratio, meaning there are no fees associated with investing in this fund. The fund has delivered strong returns, with a 5-year annualized return of 16.0%.

Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF is one of the largest funds on the market, with hundreds of billions in assets. It tracks the S&P 500 index and is backed by Vanguard, a well-respected name in the industry. The fund has an expense ratio of 0.03%, which means you'll pay $3 annually for every $10,000 invested. It has delivered strong returns, with a 5-year annualized return of 16.0%.

SPDR S&P 500 ETF Trust

The SPDR S&P 500 ETF Trust is one of the most popular ETFs, with hundreds of billions in assets. It also tracks the S&P 500 index and is sponsored by State Street Global Advisors, another heavyweight in the industry. The fund has an expense ratio of 0.095%, which means you'll pay $9.50 annually for every $10,000 invested. It has a 5-year annualized return of 15.9%.

IShares Core S&P 500 ETF

The iShares Core S&P 500 ETF is another large ETF sponsored by BlackRock, one of the largest fund companies. This fund also tracks the S&P 500 and has been around since 2000, closely tracking the index over time. It has a low expense ratio of 0.03%, meaning you'll pay $3 annually for every $10,000 invested. It has delivered strong returns, with a 5-year annualized return of 16.0%.

Schwab S&P 500 Index Fund

The Schwab S&P 500 Index Fund is sponsored by Charles Schwab, a well-respected name in the industry known for its investor-friendly products. This mutual fund has been around since 1997 and has delivered strong returns, with a 5-year annualized return of 16.0%. It has a very low expense ratio of 0.02%, which means you'll pay just $2 annually for every $10,000 invested.

Vanguard Russell 2000 ETF

The Vanguard Russell 2000 ETF is a great option for investors looking for exposure to small-cap companies. It tracks the Russell 2000 Index, which includes about 2,000 of the smallest publicly traded companies in the U.S. As a Vanguard fund, it focuses on keeping costs low, with an expense ratio of 0.10%. It has delivered solid returns, with a 5-year annualized return of 9.4%.

Vanguard Total Stock Market ETF

The Vanguard Total Stock Market ETF offers broad diversification by covering the entire universe of publicly traded stocks in the U.S., including small, medium, and large companies across all sectors. With Vanguard as the sponsor, you can expect low costs, and the fund has an expense ratio of 0.03%. It has delivered strong returns, with a 5-year annualized return of 15.2%.

SPDR Dow Jones Industrial Average ETF Trust

The SPDR Dow Jones Industrial Average ETF Trust is one of the earlier ETFs, having debuted in 1998. It tracks the Dow Jones Industrial Average, an index of 30 large-cap stocks. The fund has tens of billions in assets and an expense ratio of 0.16%, which means you'll pay $16 annually for every $10,000 invested. It has a 5-year annualized return of 11.7%.

Shelton NASDAQ-100 Index Direct

The Shelton NASDAQ-100 Index Direct ETF tracks the performance of the largest non-financial companies in the NASDAQ-100 Index, which are primarily tech companies. This fund has been around since 2000 and has delivered strong returns, with a 5-year annualized return of 21.8%. However, it has a higher expense ratio of 0.52%, which means you'll pay $52 annually for every $10,000 invested.

Invesco QQQ Trust ETF

The Invesco QQQ Trust ETF is another index fund that tracks the NASDAQ-100 Index. It is managed by Invesco and has been around since 1999. This fund is a top-performing large-cap growth fund, and it has an expense ratio of 0.20%, which means you'll pay $20 annually for every $10,000 invested. It has delivered strong returns, with a 5-year annualized return of 21.9%.

Real Estate Investment Fund: Structuring for Success

You may want to see also

How do I choose an index fund to invest in?

Index funds are a great investment for building wealth over the long term, especially for retirement. They are a group of stocks that mirror the performance of an existing stock market index, such as the Standard & Poor's 500 Index.

- Investment objective and index selection: Before choosing a specific index fund, determine your investment objectives and the index you want to track. Different indexes focus on different sectors, geographies, and company sizes. Common benchmarks include the S&P 500, Dow Jones Industrial Average, Nasdaq Composite, and Russell 2000 Index.

- Representative and diversified: Choose an index fund that provides a full range of opportunities and a wide array of holdings to diversify your investments.

- Liquidity and transparency: Select an index fund that invests in liquid securities that are easy to track. Look for funds that are transparent about their investment strategies, with clearly defined indexes.

- Low fees and turnover: Opt for index funds with low expense ratios and management fees. Avoid funds with high management costs, as these can eat into your investment returns over time.

- Passive management: Index funds are typically passively managed, meaning they require less active decision-making and can be more tax-efficient than actively managed funds.

- Fund type and accessibility: Decide whether you want to invest in an index mutual fund or an exchange-traded fund (ETF). Mutual funds may have minimum investment requirements, while ETFs usually do not. ETFs also offer more trading flexibility and can be traded throughout the day like stocks.

- Fund performance and long-term track record: Evaluate the fund's long-term performance and how closely it mirrors the underlying index. Compare the returns of different funds tracking the same index to ensure you're getting the best value.

- Brokerage and convenience: Consider purchasing your index fund through a brokerage account or directly from a mutual fund company. Evaluate factors such as fund selection, convenience, trading costs, and commission-free options.

Remember to do your research, analyze different index funds, and consider your investment goals before making a decision.

Pure Alpha Funds: A Guide to Investing Wisely

You may want to see also

What are the risks of investing in index funds?

Index funds are a popular investment choice due to their low costs, passive nature, and diversification benefits. However, they are not without risks, and understanding these risks is crucial for investors. Here are some key points about the risks associated with investing in index funds:

Risk of Market Downturns

Index funds are designed to mirror the performance of the underlying index or market they track. This means that they will participate in any market downturns, and investors can potentially lose money during these periods. For example, during the 2008 financial crisis, the S&P 500 lost around 38%, and index funds tracking this index would have incurred similar losses.

Concentration Risk

Index funds that track market-cap-weighted indices, such as the S&P 500, can become heavily concentrated in a few large companies. This concentration can lead to increased risk if the performance of these large companies declines. For example, as of October 2023, seven stocks, known as the "Magnificent Seven," accounted for about 28% of the S&P 500, up from 20% at the start of the year. This concentration can reduce the diversification benefits of index funds.

Underperformance Risk

While index funds aim to replicate the performance of their underlying index, they may not always succeed. Various factors, such as tracking errors, transaction costs, and management fees, can cause an index fund to underperform its target index. Additionally, some indices may have a shorter live track record, making it challenging to accurately assess their risk and return potential.

Risk of Higher Expenses

Although index funds are known for their low costs, expenses can vary significantly between different index funds. Funds with higher expense ratios can eat into your investment returns over time. It is important to carefully evaluate the fees associated with a particular index fund before investing.

Risk of Not Outperforming the Market

Index funds are passive investments that aim to mirror the market rather than outperform it. By design, they are unlikely to provide returns significantly above the market average. Investors seeking to beat the market may need to consider alternative investment strategies.

Risk of Specific Sector or Industry Exposure

Some index funds focus on specific sectors or industries, such as technology or healthcare. Investing in these funds can provide exposure to these areas but also increases the risk associated with concentrating your investments in a particular sector or industry. The performance of these funds is closely tied to the fortunes of the sector or industry they track.

In conclusion, while index funds offer benefits such as low costs and diversification, they also carry risks that investors should carefully consider. Understanding the composition, fees, and historical performance of an index fund can help investors make more informed decisions about their investments.

Liquid Fund Investment Strategies: Where to Invest?

You may want to see also

How do I invest in an index fund?

Investing in an index fund is a passive investment strategy that can be an easy way to build wealth over the long term. Here is a step-by-step guide on how to invest in an index fund:

Have a goal for your index fund

Before investing in index funds, it is important to understand your financial goals and what you want to achieve with your investments. Index funds are generally suitable for long-term investment goals, such as retirement planning, as they tend to provide slow and steady returns over time.

Research and analyse index funds

There are various types of index funds available, tracking different stock market indexes such as the S&P 500, Dow Jones Industrial Average, Nasdaq Composite, and Russell 2000. You can also find index funds focused on specific sectors, industries, geographies, or investment styles. Consider your investment objectives and risk tolerance when researching index funds.

Decide which index fund to buy

When choosing an index fund, it is essential to consider the fund's expenses, such as the expense ratio and sales load. Compare the costs of different funds tracking the same index, as these fees can eat into your investment returns over time.

Decide where to buy your index fund

You can purchase index funds directly from a mutual fund company or a brokerage firm. If you already have a brokerage account, check if they offer the index fund you want to invest in. Otherwise, you may need to open a new account with a broker that provides access to the desired fund.

Purchase your index fund

Once you have selected the index fund and determined how much you can afford to invest, you can proceed to buy the fund through your chosen broker or fund company. You will need to set up a trade, specifying the fund's ticker symbol and the number of shares you wish to purchase.

Monitor your index fund

While index funds are passively managed, it is still important to periodically review their performance. Ensure that the index fund is mirroring the performance of the underlying index and that the fees are not excessively impacting your returns.

Index funds offer a simple and cost-effective way to invest in a diversified portfolio of stocks or bonds. By following these steps, you can start investing in index funds and work towards achieving your financial goals.

Emergency Fund: Admiral Shares Investment Strategy?

You may want to see also

Frequently asked questions

An index fund is a group of stocks that aims to mirror the performance of an existing stock market index, such as the Standard & Poor's 500 index. Index funds are considered a passive management strategy because they don't require active decisions about which investments to buy or sell.

Index funds are a great investment for building wealth over the long term. They are a low-cost, easy way to build wealth and are popular with retirement investors. Index funds tend to outperform actively managed funds, which try to beat the market.

As with all investments, it is possible to lose money in an index fund. Index funds are also prone to underperforming and losing money for years.

When choosing an index fund, consider the geographic location of the investments, the market sector, and the market opportunity. Compare the expenses of each fund and consider the fund's long-run performance.

If you're investing for the long term, it's always a good time to invest in index funds. If the market is down, it's essentially on sale, and you may be able to pick up an index fund for less money.