High-yield bond funds, also known as junk bond funds, are an investment option that promises impressive cash flow, a relatively high degree of price stability, and instant diversification. They are issued by corporations with lower credit ratings and carry a higher risk of default, but also offer a higher yield than investment-grade bonds. While investing in high-yield bond funds can be risky, they can be a good option for investors with a high-risk tolerance and a diversified portfolio. These funds offer benefits such as monthly distributions and transparency, and can be purchased through online brokerages or mutual funds.

| Characteristics | Values |

|---|---|

| Returns | High-yield bond funds offer greater yields than government bonds and investment-grade bonds. |

| Risk | High-yield bonds carry a higher risk of default and higher volatility than investment-grade bonds. |

| Credit rating | High-yield bonds have lower credit ratings than investment-grade bonds. |

| Creditworthiness | High-yield bonds are issued by companies with poorer credit quality. |

| Credit risk | High-yield bonds carry a much higher level of credit risk than investment-grade bonds. |

| Diversification | High-yield bond funds provide diversification across several issues of high-yield bonds. |

| Professional money management | High-yield bond funds give investors access to professional money management. |

| Liquidity | High-yield bonds have higher liquidity risk than investment-grade bonds. |

| Interest rate sensitivity | High-yield bonds are more sensitive to changes in interest rates than investment-grade bonds. |

| Recession risk | High-yield bonds are the first to go during a recession. |

What You'll Learn

- High-yield bonds offer greater returns than government bonds

- High-yield bonds are more stable than the stock market

- High-yield bonds are a good investment during economic downturns

- High-yield bonds are less vulnerable to interest rate fluctuations

- High-yield bond funds offer monthly distributions and transparency

High-yield bonds offer greater returns than government bonds

High-yield bonds, also known as junk bonds, are corporate debt securities that pay higher interest rates than investment-grade bonds. They are issued by corporations and carry a higher risk of default, which is why they offer greater returns.

High-yield bonds have lower credit ratings than investment-grade bonds, and the companies that issue them tend to be start-ups or capital-intensive firms with high debt ratios. Despite the higher risk, they can be an excellent option for investors as they offer a higher payout, and if the company improves its credit standing, the bond may appreciate.

High-yield bonds also offer a more dependable return on investment than stocks. While the high payout of stocks can vary based on company performance, the payout of a high-yield bond will be consistent unless the company defaults. They also offer a middle ground between the higher-payout, higher-risk stock market and the more stable, lower-payout, lower-risk bond market.

Additionally, some companies that issue high-yield bonds are recession-resistant, making them safer and more attractive during economic downturns. Examples include discount retailers and gold miners.

However, it is important to note that high-yield bonds are not as liquid as investment-grade bonds, and their value can be affected by changes in the issuer's credit rating and interest rates. They are also the first to go during a recession, so investors should carefully research the market, industry, and company before investing.

Corporations' Hesitance Towards Mutual Funds: Exploring the Why

You may want to see also

High-yield bonds are more stable than the stock market

High-yield bonds, also known as junk bonds, are issued by corporations with lower credit ratings than investment-grade bonds. They are considered riskier investments due to their higher likelihood of defaulting. However, despite their higher risk profile, high-yield bonds offer several advantages that contribute to their stability:

Higher Yields

High-yield bonds provide investors with the potential for higher returns compared to investment-grade bonds. The higher yields compensate investors for taking on additional credit risk. This makes high-yield bonds attractive to investors seeking higher returns while assuming a higher level of risk.

Reduced Volatility

Although high-yield bonds are associated with higher volatility than investment-grade bonds, they exhibit less volatility than the stock market. This relative stability makes high-yield bonds appealing to investors who want to balance risk and return. The lower volatility of high-yield bonds compared to stocks provides a middle ground between the higher-risk, higher-reward nature of stocks and the lower-risk, lower-reward nature of traditional bonds.

Priority in Liquidation

In the event of a company's bankruptcy, bondholders are prioritized over stockholders for repayment. During the liquidation of assets, bondholders have a greater chance of recovering at least a portion of their investment. This feature of high-yield bonds adds a layer of stability and reduces the overall risk for investors.

Dependable Returns

High-yield bonds offer a more dependable and consistent return compared to stocks. The payout of high-yield bonds remains fixed for each pay period, unless the company defaults. In contrast, the returns on stocks can vary based on the company's performance and are subject to fluctuations in stock value.

Recession-Resilience

Some companies that issue high-yield bonds are recession-resistant and may even thrive during economic downturns. Examples include discount retailers and gold miners. Investing in high-yield bonds from such companies can provide stability and potentially higher returns during challenging economic periods.

While high-yield bonds offer stability compared to the stock market, it is important to remember that they still carry a higher level of risk than investment-grade bonds. Default risk, liquidity risk, and interest rate risk are all factors to consider when investing in high-yield bonds. Diversification and thorough research are essential to mitigate these risks effectively.

Funding Sources for Your Real Estate Investment

You may want to see also

High-yield bonds are a good investment during economic downturns

High-yield bonds, also known as junk bonds, are a good investment during economic downturns for several reasons.

Firstly, high-yield bonds offer a higher payout compared to traditional investment-grade bonds. Companies issuing these bonds do not have an investment-grade rating and therefore offer a higher return on investment. This means that if a high-yield bond pays out, the payout will be higher than a similar investment-grade bond.

Secondly, high-yield bonds can provide a safer investment than stocks during economic downturns. Bondholders will get paid out before stockholders during the liquidation of assets if a company fails. While a company defaulting usually means that the bonds and stocks it issued become worthless, bondholders have a greater chance of getting some money back on their investment than stockholders.

Thirdly, high-yield bonds offer a more dependable return than stocks. While the high payout of stocks can vary based on company performance, the payout of a high-yield bond will be consistent each pay period unless the company defaults.

Additionally, some companies that issue high-yield bonds are recession-resistant and may even thrive during economic downturns. Examples include discount retailers and gold miners. These companies can be attractive investment opportunities during economic downturns as they are less likely to be impacted negatively.

Finally, high-yield bonds can provide portfolio diversification and enhanced current income. High-yield bonds typically have a low correlation to investment-grade fixed-income sectors, so adding them to a broad fixed-income portfolio can enhance diversification and decrease overall portfolio risk. They also usually offer significantly greater yields than government bonds and many investment-grade corporate bonds, providing enhanced income for investors.

In summary, while high-yield bonds carry additional risks, they can be a good investment during economic downturns due to their higher payout potential, safer position compared to stocks, more dependable return, recession-resistant issuers, and diversification benefits.

Bloomberg's Best Investment Fund Options: Where to Start?

You may want to see also

High-yield bonds are less vulnerable to interest rate fluctuations

High-yield bonds, also known as junk bonds, are less vulnerable to interest rate fluctuations. This is because they are issued by corporations with lower credit ratings, and thus higher yields, than investment-grade bonds. As a result, they can provide a higher return for investors, even if there is a small increase in interest rates.

Junk bonds are issued by companies with a higher probability of defaulting. This means that they are considered riskier than investment-grade bonds and usually have higher price volatility. However, they can be a good investment option for those seeking higher returns, as the higher yield compensates for the greater risk of default.

The higher yield of junk bonds means that even if interest rates rise slightly, they can still provide a higher return compared to investment-grade bonds. This makes them less vulnerable to interest rate fluctuations in the short term.

Additionally, high-yield bonds are often issued by start-up companies or capital-intensive firms with high debt ratios. These companies may be in a phase of growth and expansion, and thus, the increased spending in the economy can offset the negative impact of rising interest rates.

However, it is important to note that high-yield bonds are still vulnerable to significant interest rate changes and economic downturns, as these factors can increase the likelihood of default for the issuing companies.

Overall, while high-yield bonds are less vulnerable to minor interest rate fluctuations, they are still riskier than investment-grade bonds and should be approached with caution.

Energy Funds: A Smart Investment for Your Future

You may want to see also

High-yield bond funds offer monthly distributions and transparency

High-yield bond funds, also known as "junk bond funds", are an attractive investment option for those seeking impressive cash flow, price stability, and instant diversification. Here are some reasons why high-yield bond funds offer monthly distributions and transparency:

Monthly Distributions

High-yield bond funds provide monthly distributions, in contrast to the semi-annual coupons offered by traditional bonds. This means investors can receive regular income streams, which is particularly advantageous for those seeking consistent cash flow. The frequency of payouts makes high-yield bond funds appealing to income investors.

Transparency

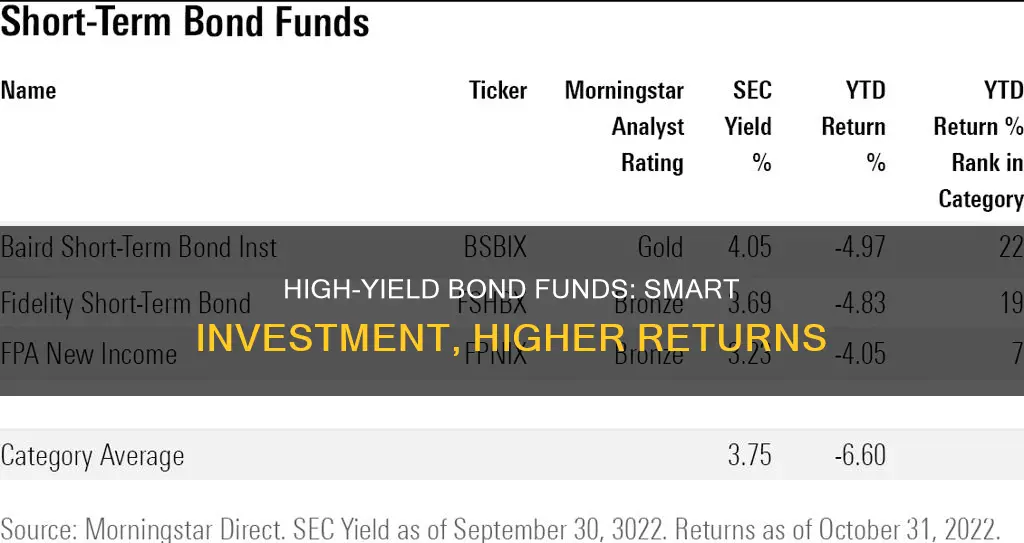

High-yield bond funds offer transparency by providing investors with access to portfolio metrics such as average credit quality, duration (a measure of interest rate sensitivity), and the 30-day SEC yield. This information helps investors make informed decisions and assess the risk and return potential of their investments.

Diversification

High-yield bond funds allow investors to diversify their portfolios by pooling bonds from multiple issuers through mutual funds or exchange-traded funds (ETFs). This diversification reduces the overall risk of the portfolio and provides a level of protection against default risk.

Higher Yields

High-yield bond funds offer higher yields than government bonds and investment-grade bonds. They are issued by corporations with lower credit ratings, and the higher yields compensate investors for the increased risk of default.

Recession-Resistance

Some companies issuing high-yield bonds are recession-resistant, such as discount retailers and gold miners. Investing in these bonds during economic downturns can provide a safer option, as these companies may perform well when other industries struggle.

In conclusion, high-yield bond funds offer monthly distributions, transparency through portfolio metrics, and the benefits of diversification and higher yields. While there are risks associated with investing in junk bonds, they can provide attractive returns and consistent income for investors with a higher risk tolerance.

Aquabounty's Mutual Fund Investors: Who's Taking the Plunge?

You may want to see also

Frequently asked questions

High-yield bond funds offer greater yields than government bonds, which can be beneficial to income investors with a higher risk tolerance.

High-yield bond funds offer added bonuses, including monthly distributions, and provide transparency. They can also be a way to boost your portfolio's returns.

High-yield bond funds are riskier than traditional bonds and are more likely to default. They are also less liquid, meaning they can be more difficult to resell. Additionally, the value of a high-yield bond can be affected by changes in the issuer's credit rating and interest rates.