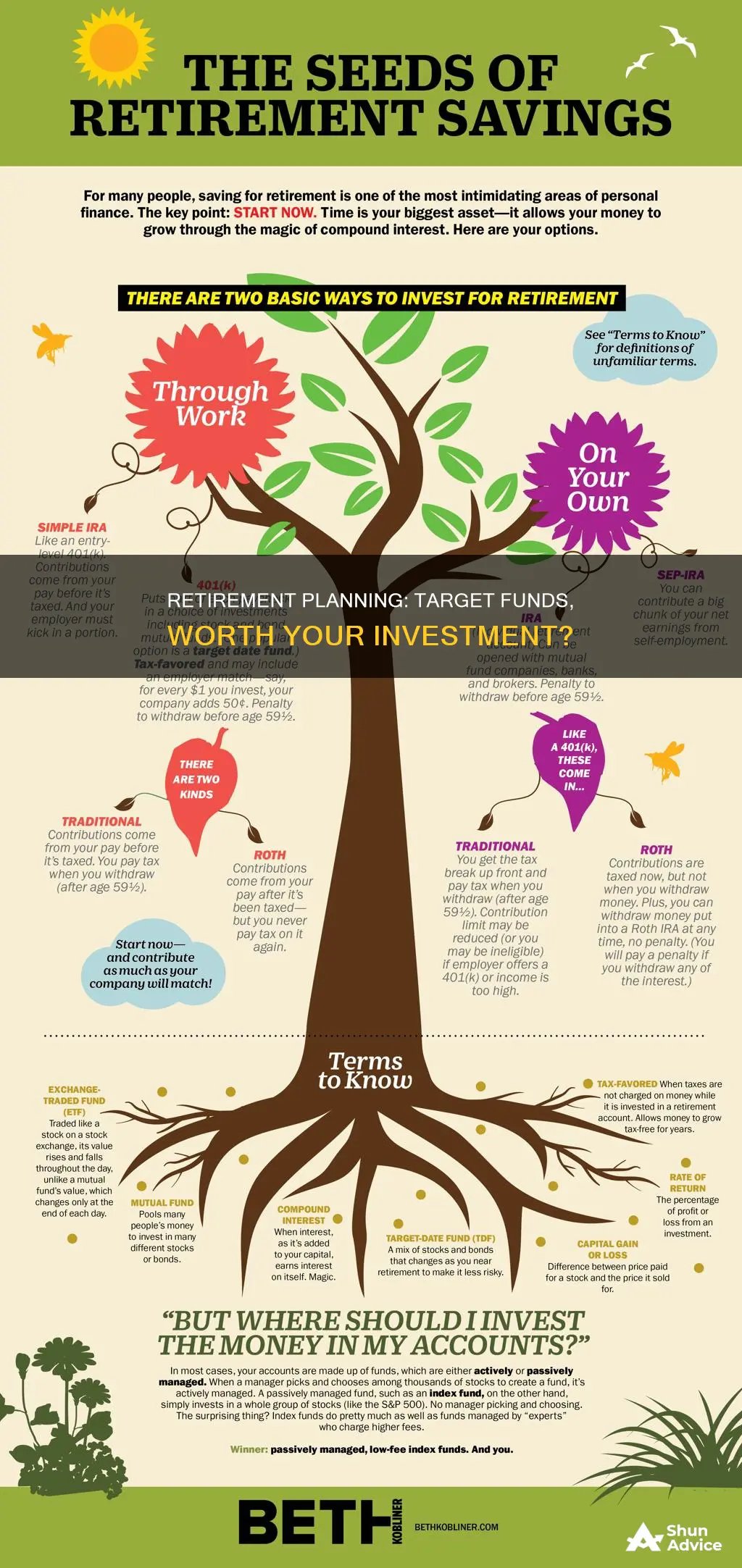

Target-date funds are a popular choice for investors saving for retirement. They are designed to reduce the stress of investing by automatically rebalancing your portfolio from growth investments to more conservative ones as retirement nears. These funds are a set it and forget it option, taking the hassle out of investing by managing your asset allocation for you. However, there are pros and cons to choosing a target-date fund, and it's important to understand the potential benefits and drawbacks before deciding if this type of fund is right for you.

| Characteristics | Values |

|---|---|

| Appeal | Simplicity |

| Type of fund | "Set it and forget it" retirement savings option |

| Purpose | Designed to age with you |

| Management | Automatic rebalancing of your portfolio |

| Investment choices | Limited |

| Enrollment | Easy |

| Diversification | Full |

| Trading | Four to five times less likely to engage in trading and active account management than other investors |

| Fees | Average expense ratio of 0.52% in 2020 |

| Risk | Too conservative near the retirement date |

| Investor involvement | Not actively involved in investment choices |

What You'll Learn

Target-date funds are a set it and forget it option

Target-date funds are a "set it and forget it" option for investors saving for retirement. They are designed to simplify the process of investing for retirement by creating a passively indexed portfolio that automatically rebalances based on an investor's time until retirement. The fund's asset allocation becomes more conservative as individuals get closer to retirement age to preserve wealth. This makes target-date funds a good option for those who want to take a hands-off approach to their retirement investments.

The main advantage of target-date funds is their simplicity. They provide investors with a well-balanced and diversified mix of stocks and bonds, with an asset allocation that automatically rebalances towards more conservative investments over time. This means that investors don't need to worry about deciding on a mix of assets or rebalancing their portfolio as they get older. Target-date funds are also typically low-cost, with average expense ratios of around 0.52% in 2020, although some funds may have higher fees.

Another advantage of target-date funds is that they can help investors avoid making emotional decisions in response to market fluctuations, such as buying high and selling low. Additionally, target-date funds are regulated by the U.S. Department of Labor (DOL), the Office of the Comptroller of the Currency (OCC), and the U.S. Securities and Exchange Commission (SEC), providing investors with some peace of mind.

However, there are also some potential drawbacks to consider. Target-date funds may be too conservative for some investors, especially as they get closer to retirement. Additionally, they may not be suitable for those with more complex financial situations or those who want more control over their investment choices. It's also important to compare the fees and investing philosophies of different target-date funds before investing. While the set-and-forget nature of target-date funds is convenient, experts recommend reviewing the performance of the fund annually to ensure it still aligns with your investment goals.

A Beginner's Guide to Exchange-Traded Funds Investing

You may want to see also

They automatically rebalance your portfolio

Target-date funds are designed to automatically rebalance your portfolio as you age, shifting from growth investments to more conservative ones as you near retirement. This means that the fund managers will adjust the mix of stocks, bonds, and money market accounts in your portfolio over time, without you having to lift a finger.

For example, when you are younger and have a longer investment horizon, a target-date fund will typically allocate a larger portion of your portfolio to stocks, as these tend to provide higher returns over the long term. As you get older and closer to retirement, the fund will gradually shift towards more conservative investments, such as bonds and money market accounts, which are safer but provide smaller returns. This adjustment is made to preserve your wealth as you approach retirement age.

The automatic rebalancing feature of target-date funds offers several benefits. Firstly, it saves you time and effort by eliminating the need to manually adjust your portfolio over the years. It also helps to take the emotion out of investing, as you are less likely to make impulsive decisions based on short-term market fluctuations. Additionally, target-date funds can help investors avoid common mistakes, such as buying high and selling low, by providing a disciplined approach to investing.

Furthermore, target-date funds can be particularly advantageous for investors who want a hands-off approach to their retirement savings. These funds allow investors to benefit from a professionally managed and diversified portfolio, without having to actively select and monitor individual investments. This can be especially useful for those who are new to investing or who don't have the time or interest to actively manage their portfolio.

However, it is important to note that the automatic rebalancing feature of target-date funds may not be suitable for everyone. Some investors may prefer to have more control over their portfolio and make their own adjustments as their risk tolerance and financial goals change. Additionally, while target-date funds offer a simplified investment approach, it is still important to regularly review the performance of your fund and ensure that it aligns with your investment goals.

Malaysia's Best Mutual Funds: Where to Invest?

You may want to see also

They're a default choice for many 401(k) plans

Target-date funds are a default option for many 401(k) plans. They are designed to be a "set it and forget it" retirement savings option, removing the need for investors to decide on a mix of assets and rebalance those investments over time. These funds are named according to the year nearest the investor's planned retirement date. For example, an investor planning to retire in 2060 would choose a target-date fund with 2060 in its name.

The chief appeal of target-date funds is their simplicity. They provide a well-balanced, diversified mix of stocks and bonds, with an asset allocation that automatically rebalances towards more conservative investments as the investor ages. This makes them a good option for people who want to take a hands-off approach to managing their retirement investments.

Target-date funds are also a good choice for people who are inclined to frequently change their fund allocation, as they help to keep investors disciplined in their investment choices. They are also a good default option for new investors, according to Keith Barberis of Barberis Wealth Management.

However, it's important to note that target-date funds may not be suitable for everyone. Some critics argue that they are too conservative, especially for younger investors who may want to take on more risk. Additionally, while target-date funds are designed to be a one-stop investment solution, some investors may prefer to have more control over their investment choices and actively manage their portfolio.

It's also worth considering the fees associated with target-date funds. While they tend to have low fees, some funds may charge higher expense ratios, which can eat into investment returns over time. Therefore, it's important for investors to carefully evaluate the costs and investment strategies of different target-date funds before making a decision.

Vanguard Real Estate Index Fund: Closed or Open?

You may want to see also

They're simple and convenient

Target-date funds are a "set it and forget it" retirement savings option. They are designed to be simple and convenient, removing the need for investors to decide on a mix of assets and rebalance those investments over time.

The funds are named according to the year nearest your planned retirement date. For example, if you are 40 years old and plan to retire at 65, you would choose a target-date fund with a name like "Retirement 2060".

The funds are designed to age with you, automatically rebalancing your portfolio from growth investments toward more conservative ones as retirement nears. This is known as a glide path. Early in your working life, a target-date fund is set for growth, with a larger slice of your portfolio in stocks. As retirement approaches, the fund gradually shifts toward more bonds, money market accounts, and other lower-risk investments.

The chief appeal of target-date funds is their simplicity. They provide a well-balanced, diversified mix of stocks and bonds, with an asset allocation that rebalances towards more conservative investments as you age. You don't need to worry about rebalancing your portfolio or keeping on top of shifting markets—the fund managers take care of that. All you need to understand is the year you want to retire.

Target-date funds are also convenient because they are the default plan of choice for many providers of employer-backed retirement plans such as 401(k) accounts. They are also easy to enrol in and provide full diversification.

IRA Investments: Understanding Fund Unavailability

You may want to see also

They may be too conservative

Target-date funds are designed to become more conservative as retirement approaches. This is achieved by gradually shifting from stocks to fixed-income investments such as bonds, which are safer but provide smaller returns. While this approach is intended to preserve wealth, some investors argue that target-date funds can become too conservative too early, potentially resulting in missed opportunities for higher returns.

Research by academics at the University of Illinois at Urbana-Champaign and MIT found that target-date funds typically start becoming too conservative for most people around the age of 50. According to the study, while these funds initially do a good job of prioritising stock ownership, they become too conservative after this age, with a decline in stock holdings that may be more rapid than necessary.

For example, a 2020 target-date fund typically allocates between 40% and 50% in stocks, while a 2015 fund may have around 60% in stocks. This shift towards conservative investments may be more rapid than what is suitable for all investors, particularly those with a higher risk tolerance or a longer investment horizon.

The "glide path" of target-date funds, which refers to the shift from riskier to more conservative investments over time, can vary significantly across different funds. Some funds may be more conservative than others, so it is important for investors to understand the specific "glide path" and underlying investments of their chosen fund.

While target-date funds offer a simple, hands-off approach to retirement investing, it is important to periodically review the fund's performance and ensure that it aligns with your risk tolerance, investment goals, and overall financial plan. Seeking advice from a certified financial planner can help investors make more informed decisions about their retirement portfolio, especially as their circumstances change over time.

Mutual Funds: A Million Dollar Dream?

You may want to see also

Frequently asked questions

A target-date fund is a type of investment fund designed to help people save for retirement. The "target date" is the investor's anticipated year of retirement, and the fund automatically adjusts its mix of investments to become more conservative as this date approaches.

Target-date funds offer a "set it and forget it" approach to retirement savings. They automatically rebalance your portfolio to strike a balance between growth and conservative investments as you age, removing the need for investors to actively manage their portfolio. They are also typically well-diversified and have low fees.

Target-date funds may be too conservative, especially for younger investors. They also offer a one-size-fits-all approach, which may not suit everyone's needs. Some target-date funds may also charge high fees, eating into overall returns.

Target-date funds are a common preset option for 401(k) plans. You can also open a brokerage account with a fund manager or online broker to shop for target-date funds, or purchase one directly from a fund provider.

Compare the fees and investing philosophies of different funds. Understand the fund's "glide path", or how its asset mix will change over time. Consider whether you want a “to” fund, which freezes your asset allocation at retirement, or a “through” fund, which continues to adjust your asset allocation for several years after retirement.