Master Limited Partnerships (MLPs) are publicly listed limited partnerships that trade on a national securities exchange. They are known for high yields, favourable taxation, and exposure to the oil and gas sector. MLPs are considered attractive income investments due to their high cash returns in the form of quarterly distribution payments. They also offer tax advantages as a pass-through entity, where a portion of distributions is treated as a return on capital and remains tax-deferred until the unit holder sells. However, investing in MLPs also comes with certain drawbacks, such as complicated taxes, limited capital appreciation potential, and the inability to own them in tax-deferred accounts.

| Characteristics | Values |

|---|---|

| Investment type | Investment partnerships, not corporations |

| Taxation | Pass-through tax treatment, tax-advantaged |

| Income | High yields, significant income |

| Sector | Energy (oil and gas) |

| Liquidity | Publicly traded, highly liquid |

| Risk | High volatility, interest rate risk, legislation risk |

What You'll Learn

MLPs offer high yields, but also complicated taxes

Master Limited Partnerships (MLPs) are known for their high yields, but they also come with complicated taxes. MLPs are investment partnerships, not corporations. They are primarily involved in the ownership of oil and gas assets, such as pipelines, and can also own oil refiners. These partnerships collect income from the use of these assets and distribute that income to the general and limited partners.

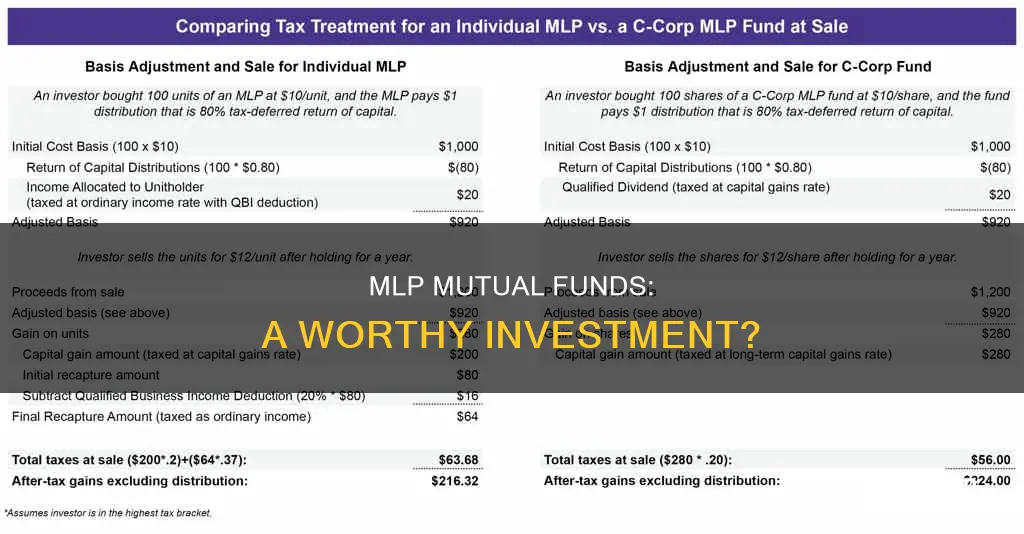

MLPs offer high yields in the form of quarterly distribution payments, making them attractive income investments. They also provide tax advantages as pass-through entities. A portion of the distributions is treated as a return on capital and remains tax-deferred until the unit holder sells. However, MLPs can complicate an investor's taxes as they require a Schedule K-1 form, which can create extra work when filing taxes.

The tax structure of MLPs is different from that of corporations. In an MLP, all the cash is sent back to the investors, even the part that should be earmarked for depreciation. This can result in a return of capital, which is taxed at capital gains tax rates once the cost basis falls to zero. Additionally, investors may have to file non-resident tax returns in multiple states, as MLPs often operate across multiple states.

Another complication is that MLPs are already tax-advantaged, so investors cannot own them in most tax-deferred or tax-free accounts like a traditional IRA or Roth IRA. This makes MLPs less suitable for retirement savings vehicles.

Overall, while MLPs offer high yields, investors should be aware of the complicated tax consequences that come with them. MLPs are best suited for those with a large amount of investment capital who are willing to deal with the additional tax complexities and hold their investments for the long term.

Dave Ramsey's Investment Strategy: Specific Fund Choices

You may want to see also

MLPs are investment partnerships, not corporations

Master Limited Partnerships (MLPs) are investment partnerships, not corporations. A partnership is an arrangement between many different partners, usually one or two general partners and then limited partners. General partners control all decision-making and operational decisions, while limited partners are investors in the MLP.

MLPs are publicly traded limited partnerships. They combine the tax benefits of a private partnership with the liquidity of a publicly traded company. They are considered low-risk, long-term investments, providing a slow but steady income stream.

MLPs have two types of partners: general partners, who manage the MLP and oversee its operations, and limited partners, who are investors in the MLP. Investors receive tax-sheltered distributions from the MLP.

MLPs are taxed as partnerships, not corporations, so their profits are not subject to the double taxation that corporations face. Corporations pay corporate tax, and then shareholders must pay personal taxes on their holdings. MLPs are treated as limited partnerships for tax purposes, which is a significant tax advantage for investors.

MLPs have units, while corporations have stock or shares. MLPs pay distributions, while corporations make dividend payments. MLPs send investors a Schedule K-1 to file taxes, while corporations send a Form 1099-DIV.

MLPs are not suitable for everyone. They can complicate an investor's taxes and are not allowed in most tax-deferred or tax-free accounts. They also have limited capital appreciation potential.

A Guide to Investing in Money Market Funds

You may want to see also

MLPs are liquid like stocks but provide income like bonds

Master Limited Partnerships (MLPs) are a type of business that combines the tax advantages of a partnership with the liquidity of a public enterprise. They are traded on national exchanges and usually operate in the energy industry, providing and managing resources.

MLPs are attractive to investors because they are liquid like stocks but provide income like bonds. They are taxed only when profits are distributed, and they offer high cash returns in the form of quarterly distribution payments. This makes them ideal for investors seeking to generate passive income.

However, it is important to note that MLPs can complicate an investor's taxes. They send a Schedule K-1 form, which can create extra work when filing taxes. Additionally, because MLPs are already tax-advantaged, investors cannot own them in most tax-deferred or tax-free accounts.

MLPs are also limited by sector as they mostly operate in oil and gas logistics, which can make diversification difficult. They have had limited upside historically, which means reliable income can take a while to accumulate.

Overall, MLPs offer unique benefits that can be useful as part of a well-balanced portfolio. However, investors should carefully weigh the opportunities and risks, especially when comparing MLPs to traditional dividend stocks.

High-Yield Funds: Risky Business or Smart Investment Strategy?

You may want to see also

MLPs are not suitable for an IRA

Master Limited Partnerships (MLPs) are not suitable for an Individual Retirement Account (IRA) due to the tax complications they can create. While it is possible to hold MLPs in an IRA, there are several reasons why this may not be a good idea.

Firstly, one of the main benefits of investing in MLPs is the tax advantages they offer. However, these advantages are negated when MLPs are held in a retirement account like an IRA, as the income is already tax-deferred in these accounts. This means that the tax benefits of MLPs are essentially wasted in an IRA.

Secondly, holding MLPs in an IRA can result in the account owing tax. This is due to the concept of "unrelated business income tax" (UBIT) in the tax code. Under UBIT rules, tax-exempt organizations and retirement accounts must pay tax on their "unrelated business taxable income" (UBTI) – income from a business that is not related to their exempt purpose. When an IRA invests in an MLP, it becomes a limited partner and is considered to be "earning" its share of the MLP's business income. As the MLP's business is not related to the retirement account's tax-exempt purpose, the IRA's share of the income is treated as UBTI and is taxed accordingly. The tax rate on this income is currently 37%, with a deduction for the first $1,000 of UBTI.

Additionally, MLPs can be complicated investment vehicles that require a significant amount of research and can complicate an investor's taxes. MLPs send a Schedule K-1 form, which can create extra work when filing taxes. The K-1 form may also be distributed later in the tax season, delaying the filing of tax returns.

Furthermore, MLPs have limited capital appreciation potential, as most of the returns come from cash distributions rather than unit price appreciation. This means that the advertised yields may not be as attractive as they seem, especially when compared to untaxed municipal bonds or dividends, which are taxed at a lower long-term rate.

Overall, while it is possible to hold MLPs in an IRA, the tax complications, wasted tax benefits, and additional complexity may make this a less attractive option for investors.

Setting Up an Investment Fund in Ireland: Where to Start?

You may want to see also

MLPs are a long-term investment

Master Limited Partnerships (MLPs) are a long-term investment strategy. MLPs are investment partnerships, not corporations. They are a popular investment choice due to their high yields, favourable tax treatment, and exposure to the oil and gas sector. MLPs offer stable revenues because their income is not tied to the current price level of oil and gas.

MLPs are considered a long-term investment for several reasons. Firstly, they offer tax advantages that create an income stream with minimal taxation. MLPs are pass-through entities, which means that all profits and losses pass through to the limited partners, who report them on their taxes. MLPs don't pay corporate taxes, which results in tax-efficient income for investors. However, this also means that investors have to deal with more complex taxes, as they will receive a Schedule K-1 form instead of a standard 1099 form.

Secondly, MLPs are a long-term investment because they provide stable cash flows and attractive yields to investors through dividends, also known as distributions. The revenues from MLPs are mostly based on fees from pipelines, processing plants, or storage facilities, which tend to generate stable cash flows. This stability supports consistent distributions to investors.

Thirdly, MLPs are a long-term investment because they operate energy infrastructure assets that are critical for the economy. These assets, such as pipelines, processing plants, and storage facilities, are essential for the economy to function and grow, ensuring steady cash flows for MLPs.

Finally, MLPs are a long-term investment because they offer the potential for higher yields compared to bonds and stocks. This is due to the favourable tax structure and the nature of the business, which provides stable cash flows. However, it is important to note that MLPs have historically experienced higher volatility than stocks and bonds, so they should be considered part of the equities allocation of a portfolio rather than fixed income.

A Monthly Guide to Index Fund Investing

You may want to see also