Dividend ETFs are a type of exchange-traded fund (ETF) that invests in a group of stocks with the potential to offer high dividends. They are typically passively managed, tracking a particular index of companies with a history of paying regular dividends, including blue-chip companies, which are seen as less risky. Dividend ETFs have gained popularity, especially in turbulent markets, as they provide investors with a regular income stream and diversification benefits. However, it's important to remember that dividend ETFs may not always outperform individual stocks and are subject to market risks, including sector concentration and interest rate risks. Therefore, investors considering dividend ETFs should carefully evaluate their financial goals, risk tolerance, and investment style before making a decision.

What You'll Learn

Dividend ETF vs Stocks: Performance

Dividend ETFs and stocks have some similarities, including trading, income potential, and risk. They are both traded on public exchanges, and their prices fluctuate based on supply and demand. Both can generate income for investors, and both involve some level of risk.

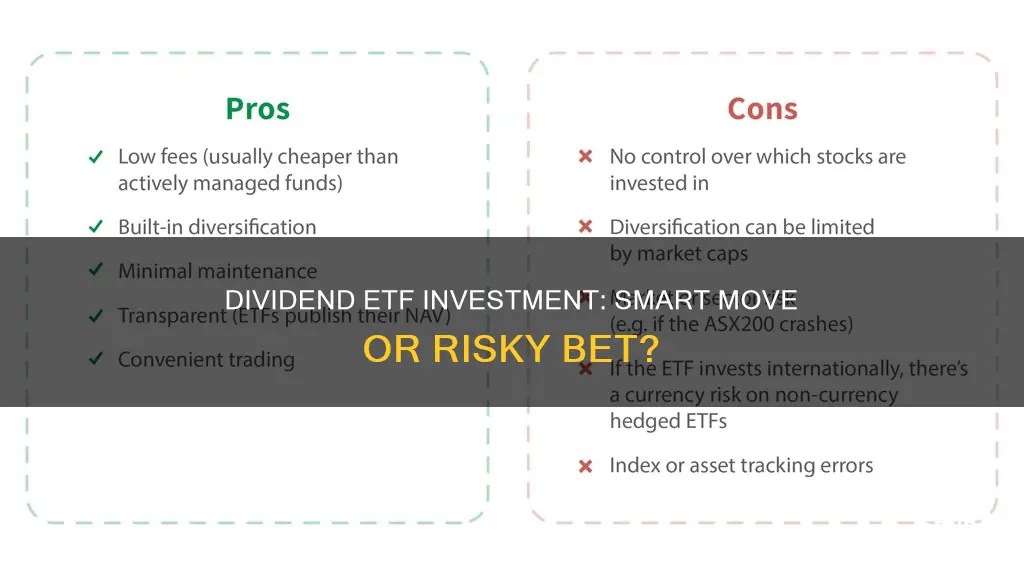

However, there are also several differences between dividend ETFs and stocks. Dividend ETFs invest in a portfolio of stocks, providing greater diversification and reduced risk. They are designed to provide consistent income through the dividends paid by the underlying stocks, and they have lower expense ratios than actively managed funds. Dividend ETFs are also managed by professional fund managers, whereas individual stocks require investors to make their own investment decisions.

When it comes to performance, whether dividend ETFs outperform individual stocks depends on various factors, such as the specific stocks in the ETF, the investment strategy, and market conditions. While a single stock can sometimes outperform a basket of stocks, dividend ETFs may provide more consistent income and reduced risk due to diversification. On the other hand, investing in individual stocks that experience rapid growth may offer higher returns than dividend ETFs.

Additionally, dividend ETFs may have lower upside potential due to their diversified nature. If a single stock increases significantly in value, the impact on the overall return of a diversified ETF may be diluted. Thus, the level of diversification in dividend ETFs can be a trade-off between risk reduction and upside potential.

In summary, dividend ETFs and stocks offer different performance characteristics. Dividend ETFs provide diversification, consistent income, and professional management, while stocks allow for more targeted investments with the potential for higher individual returns. The choice between dividend ETFs and stocks depends on an investor's financial goals, risk tolerance, and investment style.

Fidelity's X Shares ETF Strategy: Pros and Cons

You may want to see also

Dividend ETF vs Stocks: The Similarities

Dividend ETFs and stocks have a number of similarities, despite being distinct investment vehicles. Here are some of the key parallels between the two:

- Trading: Both dividend ETFs and stocks are traded on public exchanges, such as the New York Stock Exchange or Nasdaq. The prices of both are determined by supply and demand in the market and can be bought and sold continuously throughout the trading day.

- Income Potential: Both dividend ETFs and stocks offer the potential for income generation. Stocks can provide income through dividends, and dividend ETFs are designed to provide income through the dividends paid by the underlying stocks they hold.

- Risk: Both types of investment carry some level of risk. The value of a stock or a dividend ETF is influenced by various factors, including the performance of the company or companies, economic conditions, and market trends.

- Liquidity: Dividend ETFs and stocks are both highly liquid investments. They can be easily bought and sold on public exchanges, providing investors with the ability to make timely investment decisions and quickly execute trades based on changing market conditions.

- Transparency: The holdings of most ETFs are transparent and available daily, allowing investors to know what they own. Similarly, when investors hold individual stocks, they have a clear understanding of their ownership in a specific company.

- Transaction Fees: ETFs and individual stocks are generally subject to transaction fees or commissions when bought and sold on an exchange. However, some online brokers offer commission-free trading for both stocks and ETFs.

While there are notable similarities between dividend ETFs and stocks, it is important to recognise their differences as well, which can significantly impact investment decisions and outcomes.

A Smart Guide to Investing in 3x ETFs

You may want to see also

Dividend ETF vs Stocks: The Differences

A dividend ETF is an exchange-traded fund that invests in a collection of dividend-paying stocks. These ETFs are designed to track the performance of an underlying index, such as the S&P 500 Dividend Aristocrats or the Dow Jones Select Dividend Index. Dividend ETFs are passively managed and are composed of companies with a history of consistently paying and increasing their dividends over time.

A dividend stock is a stock issued by a company that regularly pays a portion of its profits to shareholders in the form of dividends. Dividend stocks are usually issued by well-established, financially stable companies with a history of paying dividends. Dividends are typically paid out quarterly, although some companies may pay them out annually or semi-annually.

Diversification:

One of the key differences between dividend ETFs and stocks is diversification. Dividend ETFs invest in a portfolio of stocks, providing greater diversification and helping to reduce risk. On the other hand, individual stocks represent ownership in a single company, which can be riskier.

Income Consistency:

Dividend ETFs are designed to provide consistent income to investors through the dividends paid by the underlying stocks. While individual stocks may also pay dividends, their payouts may be less consistent and can be reduced or eliminated by the company at any time.

Expense Ratios:

Dividend ETFs typically have lower expense ratios than actively managed funds. They may also have lower expenses and trading costs than buying a diversified portfolio of individual dividend stocks.

Management:

Dividend ETFs are managed by professional fund managers who decide which stocks to include and when to buy or sell them. With individual stocks, investors need to make their own investment decisions.

Risk:

While dividend ETFs offer greater diversification and may be less risky, they are still subject to market risk and can experience declines in value. Individual stocks also carry market risk, and the value of a single stock can be impacted by company-specific factors, such as poor financial performance or negative news.

Suitability:

Dividend ETFs are generally suitable for retirees and income-seeking investors who want a regular stream of income. They are also a good option for long-term investors, risk-averse investors, and passive investors. On the other hand, dividend stocks may be better for do-it-yourself investors who prefer to select their own investments and have more control over their portfolio.

Both dividend ETFs and dividend stocks can generate income and provide long-term growth, but they carry similar market risk. The choice between the two depends on an investor's personal preferences, investment goals, and risk tolerance.

Choosing the Right ETF: A Guide to Smart Investing

You may want to see also

Dividend ETF vs Stocks: The Risks

While dividend ETFs and stocks share some similarities, such as income generation and market risk, there are some key differences in their risk profiles that investors should be aware of. Here are some of the risks associated with dividend ETFs and stocks, which investors should carefully consider before deciding which type of investment is right for them.

Risks of Dividend ETFs

Market Risk

Dividend ETFs are subject to market risk, which means their value can fluctuate based on market conditions and the performance of the underlying stocks in the ETF. If the market experiences a downturn, the value of dividend ETFs can decline.

Sector Concentration Risk

Some dividend ETFs may heavily focus on specific sectors, increasing the risk of loss if those sectors underperform or experience difficulties.

Interest Rate Risk

Rising interest rates can negatively impact dividend ETFs, as investors may find other income-generating assets, such as bonds, more attractive. This could lead to a decrease in the value of dividend ETFs.

Payout Fluctuations

Dividend ETFs are collections of dividend-paying stocks, and the dividend amounts can vary as the stocks within the ETF are bought and sold. While not necessarily negative, investors should be aware of this potential for fluctuation.

Dividend Cuts or Elimination

There is a risk that a company within the ETF basket may cut or eliminate its dividend payout due to financial stress or other factors. This could impact the overall income generated by the ETF.

Risks of Dividend Stocks

Market Risk

Similar to dividend ETFs, dividend stocks are also subject to market risk, where overall market conditions and economic factors can cause stock prices to fluctuate.

Company-Specific Risk

The value of an individual dividend stock can be influenced by company-specific issues, such as poor financial performance, management changes, or negative news. This risk is heightened if an investor has a concentrated position in a single stock.

Dividend Reduction or Elimination

Companies may reduce or stop paying dividends for various reasons, such as financial difficulties or changes in business strategies. This can result in a loss of income for investors and potentially lead to a decline in the stock's value.

Interest Rate Risk

Dividend stocks, especially those with high dividend yields, can be sensitive to changes in interest rates. When rates rise, income-generating assets like bonds may become more attractive, causing a decline in the demand and price of dividend stocks.

Both dividend ETFs and dividend stocks carry their own set of risks. Dividend ETFs offer diversification and potentially more stable income but are still subject to market and interest rate risks. Dividend stocks provide the opportunity to choose specific companies but come with the risk of company-specific issues and potential dividend reductions. Investors should carefully consider their financial goals, risk tolerance, and investment style before deciding between dividend ETFs and stocks.

ETFs: Smart Investment Strategy or Just a Fad?

You may want to see also

Dividend ETF for Income-Seeking Investors

A Dividend ETF (Exchange-Traded Fund) is a type of fund that invests in a group of stocks with the potential to offer high dividends. These funds are passively managed, meaning they track a particular index, such as the S&P 500 Dividend Aristocrats or the Dow Jones Select Dividend Index, which are composed of companies with a history of consistently paying dividends. Dividend ETFs are suitable for investors seeking regular income, and they offer several advantages over other types of investments.

Advantages of Dividend ETFs

One of the main advantages of dividend ETFs is diversification. By investing in a dividend ETF, you gain exposure to a diversified portfolio of dividend-paying stocks across multiple sectors, reducing the risk associated with investing in individual stocks. Additionally, dividend ETFs are easy to manage compared to individual dividend stocks, as investors only need to find a single ETF that suits their needs rather than analysing multiple stocks.

Dividend ETFs also provide regular income through the dividends paid by the underlying stocks. These funds tend to invest in blue-chip companies that are perceived to be less risky, providing stability and a steady stream of income for investors. The expense ratios of dividend ETFs are typically lower than those of actively managed funds, and they may have lower expenses than buying a diversified portfolio of individual stocks.

Factors to Consider

When choosing a dividend ETF, it is important to consider the overall portfolio's dividend yield, as this can help estimate the potential income. It is also crucial to understand that future dividends are not guaranteed. Therefore, investors should carefully consider their investment goals and risk tolerance before investing in dividend ETFs. Additionally, fees, liquidity, and tracking errors should be taken into account, as not all ETFs perform the same way, even if they track the same index.

Recommended Dividend ETFs

Some recommended dividend ETFs include the Vanguard High Dividend Yield ETF (VYM), Schwab US Dividend Equity ETF (SCHD), Franklin US Low Volatility High Dividend ETF (LVHD), and WisdomTree US High Dividend ETF (DHS). These ETFs have provided strong yields and moderately better returns than the broader market. However, it is important to remember that past performance does not guarantee future results, and investors should carefully evaluate their investment decisions.

Hedged vs Unhedged ETFs: Which Investment Option is Better?

You may want to see also

Frequently asked questions

A dividend ETF is a type of Exchange-Traded Fund (ETF) that invests in a group of stocks with a history of paying dividends or the potential to offer high dividends. These funds are passively managed and track a particular index, such as the S&P 500 Dividend Aristocrats or the Dow Jones Select Dividend Index.

Dividend ETFs offer several benefits, including diversification, convenience, regular income, and stability. They provide investors with an opportunity to invest in a diversified portfolio of dividend-paying stocks, making them easier to manage compared to individual dividend stocks. Additionally, dividend ETFs tend to be less volatile than broader market indexes.

Dividend ETFs are particularly suitable for investors who are risk-averse and seeking regular income. They are also a good option for retirees, long-term investors, and those with a conservative investment strategy.

Dividend ETFs invest in a portfolio of stocks, providing greater diversification and reducing risk compared to investing in individual dividend stocks. Dividend ETFs are also managed by professional fund managers, while dividend stocks require investors to make their own investment decisions.

Dividend ETFs carry similar market risks as investing in individual stocks. Additionally, they face sector concentration risk, interest rate risk, and the risk of dividend reduction or elimination by the companies in the ETF. It's important for investors to carefully consider their investment goals and risk tolerance before investing in dividend ETFs.