Exchange-traded funds (ETFs) and listed investment companies (LICs) are both popular investment options for those looking to diversify their portfolios. While they share similarities, there are some key differences to be aware of when deciding which option is best for your financial goals. Both ETFs and LICs are traded on stock exchanges, but ETFs are open-ended funds that issue and redeem shares on demand, whereas LICs are closed-end funds with a fixed number of shares. ETFs tend to be passively managed, aiming to track the performance of an index, while LICs are actively managed, with investment managers selecting stocks with the aim of beating the market. ETFs are known for their transparency, typically disclosing their holdings daily, while LICs disclose quarterly. ETFs usually have lower fees, but LICs may offer the potential for higher returns.

What You'll Learn

ETFs are open-ended, LICs are closed-ended

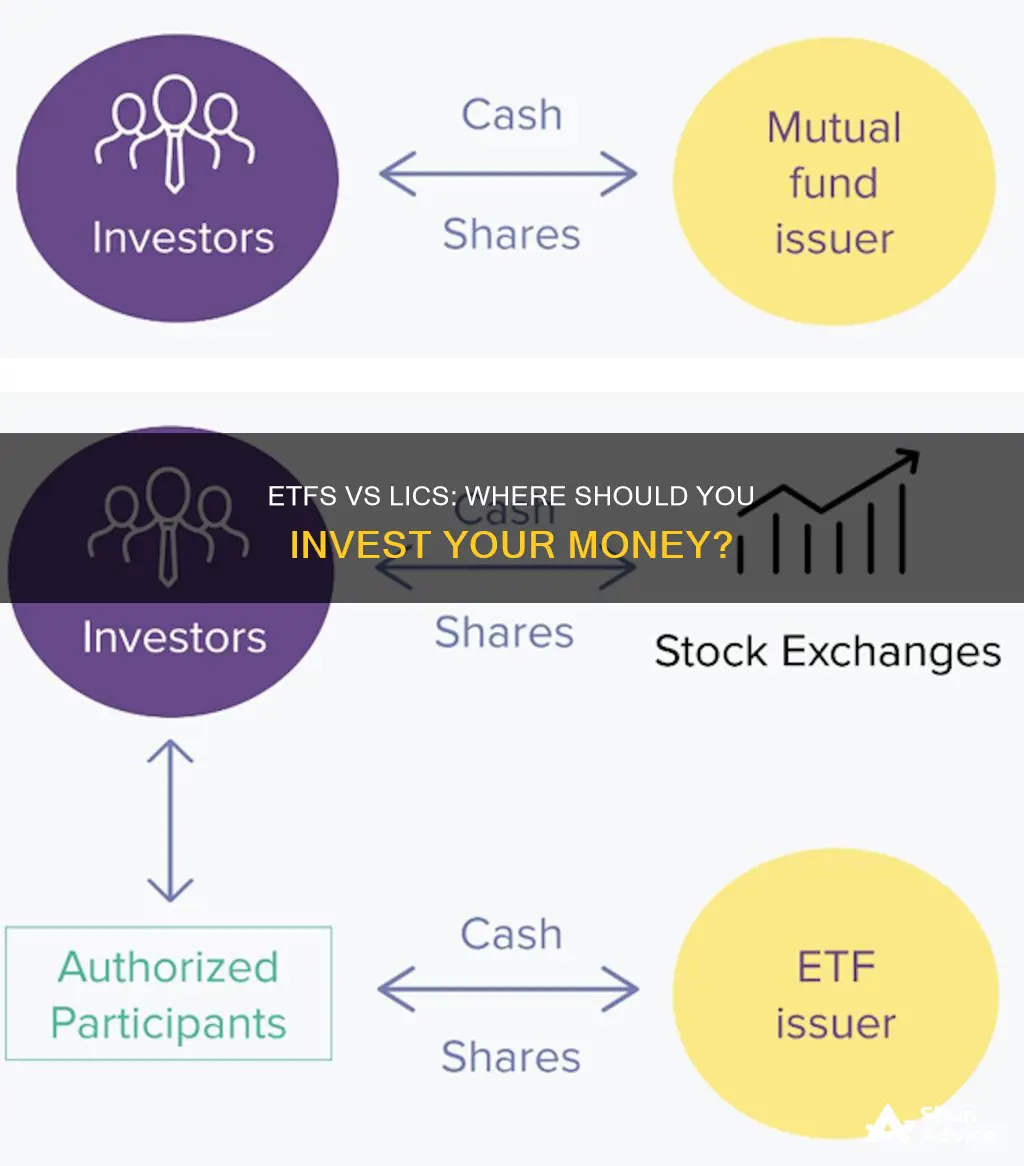

Exchange-Traded Funds (ETFs) and Listed Investment Companies (LICs) are both popular investment choices, particularly in Australia. While they share similarities, there are some key differences to be aware of when making investment decisions. One of the most significant differences is that ETFs are open-ended, while LICs are closed-ended.

Open-ended funds, such as ETFs, can issue new shares or repurchase shares from investors as needed. In other words, they can create new shares when someone makes a purchase and remove shares from circulation when someone sells. There is no limit to the number of shares that can be issued by open-ended funds, and they are typically bought and sold at their net asset value (NAV). Mutual funds and ETFs are the most common types of open-ended funds.

On the other hand, closed-ended funds, like LICs, have a fixed number of shares available in the market. These shares are traded among investors on an exchange, similar to stocks. The share price of a closed-ended fund is determined by supply and demand and can trade at a premium or discount to its NAV. After a LIC lists on the stock market, most trade at a discount to their NAV. Closed-ended funds are typically traded on the New York Stock Exchange (NYSE) or Nasdaq until the fund achieves its goal, liquidates, and returns capital to investors.

The open-ended structure of ETFs offers some benefits. For instance, ETFs can be bought and sold on demand, minimising what is known as 'tracking error' and helping to maintain the fund's value close to its NAV. Additionally, open-ended funds offer more liquidity than closed-ended funds. The fund managers are continuously looking for buyers for your shares, allowing you to quickly earn cash for your investment.

However, open-ended funds must keep cash on hand to buy back investor shares if necessary, preventing them from fully investing all their assets. In contrast, closed-ended funds can invest nearly every dollar because they are not obliged to regularly repurchase shares. This ability to invest in less liquid asset categories and use leverage is an advantage of closed-ended funds. Nevertheless, the use of leverage is a risky investment strategy as it can amplify both positive and negative outcomes.

Best ETFs to Invest in This Year

You may want to see also

ETFs are passively managed, LICs are actively managed

Exchange-traded funds (ETFs) and listed investment companies (LICs) are two of the most popular investment options in Australia. While they share similarities, there are some key differences between the two that investors should be aware of. One of the most significant differences is that ETFs are typically passively managed, while LICs are actively managed.

Passively managed ETFs aim to track the performance of an underlying index. They are designed to mirror the index as closely as possible, rather than trying to outperform it. The fund manager's role is limited to tracking the value or performance of a specific index. By replicating the index's performance, passively managed ETFs offer a cost-efficient way to achieve broad market exposure. They tend to have lower management fees compared to actively managed funds, as there is less active decision-making and research involved. This passive approach can result in lower costs for investors, potentially impacting long-term returns.

On the other hand, LICs are actively managed, meaning they rely on a team of professional fund managers who actively select and manage the investments within the fund. The goal of active management is to outperform a benchmark index and generate returns that exceed the market's performance. LIC fund managers use their expertise and strategies to make investment decisions and adjust the portfolio as needed. While active management offers the potential for higher returns, it also comes with higher costs. The fees associated with active management, including research and trading expenses, are typically passed on to investors.

The passive nature of ETFs provides more transparency to investors, as many disclose their holdings daily. This allows investors to closely monitor their portfolios and take a more involved approach to their investments. In contrast, LICs are not required to disclose their holdings as frequently and usually do so on a quarterly basis. This lower transparency may be better suited to investors who prefer a more hands-off approach and are comfortable trusting the decision-making process of the professional fund managers.

The decision between investing in ETFs or LICs depends on an investor's individual goals, risk tolerance, investment horizon, and strategy. ETFs are often chosen by those who prefer a long-term, buy-and-hold strategy, while LICs may appeal to those seeking the potential for higher returns and active portfolio management.

Schwab ETF Investing: A Beginner's Guide

You may want to see also

ETFs are more transparent, LICs are less transparent

Exchange-Traded Funds (ETFs) and Listed Investment Companies (LICs) are both popular investment choices in Australia. While they share similarities, there are some key differences that investors should be aware of. One of the most notable differences is the level of transparency offered by each investment vehicle.

ETFs generally provide more transparency as they disclose their holdings daily. This daily disclosure offers investors a detailed view of where their money is being invested. This level of transparency can be beneficial for investors who want to actively monitor their portfolios and make informed decisions about their investments. The transparency of ETFs also allows investors to know exactly what they are investing in, ensuring that their investments align with their risk tolerance and financial goals.

On the other hand, LICs are less transparent and are only required to disclose their holdings quarterly. This means that investors in LICs may not have a clear understanding of the underlying portfolio of their investment. LICs are better suited for investors who prefer a more hands-off approach and are comfortable trusting the decision-making process of the professional fund managers who actively manage the LIC portfolios.

The difference in transparency between ETFs and LICs is primarily due to their structures. ETFs are open-ended funds, allowing them to issue and redeem shares on demand to closely track their net asset value (NAV). In contrast, LICs are closed-end funds with a fixed number of shares, which may trade at a premium or discount to their NAV. This closed-end structure means that the share price of an LIC can deviate significantly from its NAV, depending on market sentiment and demand for the shares.

Additionally, the management style of ETFs and LICs contributes to the difference in transparency. ETFs are typically passively managed, tracking the performance of an index without attempting to outperform it. On the other hand, LICs are actively managed, relying on a team of professionals to actively select and manage investments with the aim of achieving returns that outperform a benchmark index. This active management approach may result in higher fees for LICs compared to ETFs.

In summary, ETFs offer greater transparency by disclosing their holdings daily, while LICs provide less frequent disclosures and are more suited for investors comfortable with a less hands-on approach.

Invest in SBI ETF Sensex: A Guide to Getting Started

You may want to see also

ETFs have lower fees, LICs have higher fees

When it comes to fees, there are notable differences between ETFs and LICs. Exchange-Traded Funds (ETFs) are often passively managed, aiming to track an index. This passive management style results in lower fees compared to actively managed funds. The management fees for ETFs are generally lower than those of LICs, making them a more cost-effective option for investors.

On the other hand, Listed Investment Companies (LICs) tend to have higher fees due to their structure and management style. LICs are actively managed, with a team of professionals who actively select and manage the investments. This active management approach aims to achieve returns that outperform a benchmark index. As a result, LICs usually come with higher costs attached to their investment strategies.

The fee structure of ETFs and LICs is an important consideration for investors, as fees can significantly impact the overall returns on their investments over time. Lower fees mean that more of an investor's money remains invested and has the potential to grow. Therefore, when deciding between ETFs and LICs, it is essential to consider the fee structures and how they align with your financial goals and investment strategies.

ETFs: Vanguard's Smart Investment Strategy?

You may want to see also

ETFs are more tax-efficient, LICs have different tax implications

Exchange-Traded Funds (ETFs) and Listed Investment Companies (LICs) are both popular investment choices in Australia. While they share similarities, there are some key differences that investors should be aware of. One notable distinction lies in their tax implications.

ETFs are generally considered more tax-efficient due to their unique structure and lower turnover rates compared to actively managed funds. They are taxed like shares, and capital gains tax will apply if you sell ETF units for a profit. However, their passive management style and lower portfolio turnover can result in fewer tax liabilities over time. Additionally, ETFs pass on all tax obligations to investors, attributing income and capital gains tax to unitholders.

On the other hand, LICs have different tax implications, particularly regarding capital gains and dividend distribution. LICs pay company tax on their income and realised capital gains, which they can hold onto or payout as dividends. Investors are then taxed at their marginal tax rate. If an LIC receives unfranked dividends from underlying investments, it will pay tax on those dividends at the company tax rate and deliver franked dividends to shareholders.

The tax implications of investing in ETFs or LICs can be complex, and it's always advisable to consult a licensed tax professional for personalised advice.

Investing in Bharat 22 ETF: Is It Worth It?

You may want to see also

Frequently asked questions

Exchange-Traded Funds (ETFs) and Listed Investment Companies (LICs) are both investment vehicles that provide investors with exposure to a diversified portfolio of assets. However, there are some key differences:

- Structure: ETFs are open-ended funds that issue and redeem shares on demand, while LICs are closed-end funds with a fixed number of shares.

- Transparency: ETFs generally provide more transparency by disclosing their holdings daily, whereas LICs only disclose their holdings quarterly.

- Management: LICs are actively managed by a team of professionals, while most ETFs are passively managed, tracking the performance of an index.

- Fees: LICs tend to have higher fees due to their active management style.

- Dividends: ETFs must pay out all profits as distributions to shareholders annually, while LICs can set aside profits for later use, creating a more consistent income stream.

- Tax implications: Both are taxed similarly as shares, but ETFs pass on all dividend earnings to unit holders, while LICs pay tax on dividends at the company tax rate and deliver franked dividends to shareholders.

ETFs and LICs are popular investment choices due to their low cost, diversification benefits, and high liquidity.

The choice between ETFs and LICs depends on your personal goals and preferences. However, for long-term investors using a dollar-cost averaging strategy, ETFs may offer several advantages, including lower costs, greater transparency, broader diversification, liquidity, and tax efficiency.