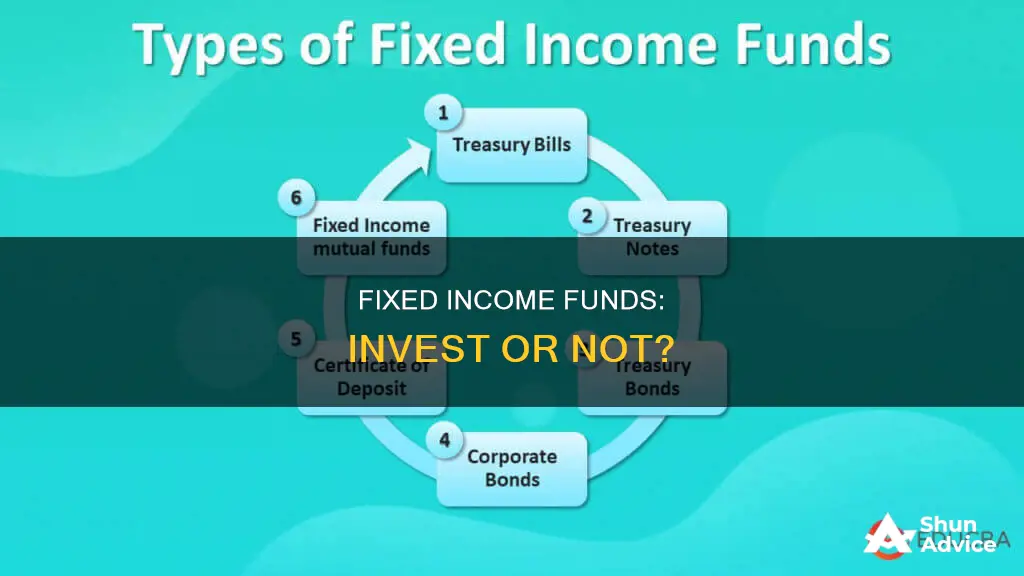

Fixed-income funds are a type of investment fund that focuses on generating consistent returns with low risk. These funds primarily invest in debt instruments, such as government and corporate bonds, offering a fixed rate of interest or regular dividend payments. Fixed-income funds are typically considered conservative investments, suitable for those seeking diversified portfolios with stable returns. They are often recommended for investors who want to avoid the higher risks associated with stocks and variable-income securities. While fixed-income funds provide lower returns than stocks, they offer a steady income stream and are less volatile. Additionally, these funds have the advantage of professional management, where fund managers make investment decisions based on market conditions.

What You'll Learn

Low-risk funds for short-term investors

Fixed-income funds are recommended for conservative investors seeking a diversified portfolio. Fixed-income securities are considered to have lower returns and lower risks than stocks. They are also less volatile than equities.

Fixed-income funds are a good option for those who are new to investing and are looking for low-risk investments. These funds are managed by professionals who help manage and grow the fund.

- Money Market Fund and Short-Term Fixed Income Fund: These funds invest in debt instruments with a maturity of less than one year, including deposits. They are low-risk and suitable for those seeking short-term investments with minimal risk.

- General Fixed Income Fund: This fund invests in various types of debt instruments, including government bonds and private debt instruments. It is suitable for investors who are comfortable with low risk as these debt instruments provide consistent interest returns. While bond prices may fluctuate with market conditions, the average return of this type of fund is relatively stable.

- Long-Term Fixed Income Fund: This fund invests in debt instruments with a portfolio duration of more than one year, making it suitable for those who can invest for the long term and are comfortable with low risk.

- Balanced Fund: This is a mutual fund that invests in both equity and debt instruments or other assets, maintaining at least 35% but not more than 65% of its net asset value in equity securities. It is suitable for those who accept moderate risk and want to diversify their investments across multiple assets.

Best Tracker Funds: Where to Invest Your Money

You may want to see also

Long-term fixed-income funds

Fixed-income funds are a good option for those who are new to investing and are looking for low-risk options. Debt instruments can be divided into two types: government debt instruments, such as government bonds, state enterprise bonds, and treasury bills; and private-sector debt instruments, such as debentures, secured and unsecured debentures, bills of exchange, and promissory notes.

Fixed-income funds are a type of mutual fund, where the funds raised are invested in various types of assets, according to the fund's policy. The fund manager helps manage and invest the funds to make them grow.

Fixed-income funds are considered to have lower returns and lower risk than stocks. They offer investors a steady stream of income over the life of the bond or debt instrument. The interest payments from fixed-income products can also help investors stabilize the risk-return on their investment portfolio.

In the current market circumstances, with higher bond yields, fixed-income investments have become an attractive asset class again from a risk-return perspective. Not only do they offer an attractive yield, but they also provide resilience against adverse market developments in risk assets like equities.

Single Malt Fund: A Smart Investment Strategy

You may want to see also

Balanced funds for moderate-risk investors

Fixed-income funds are recommended for conservative investors seeking a diversified portfolio. Fixed-income securities are considered to have lower returns and lower risk than stocks. They are suitable for investors who want to invest for the short term and need low risk.

Balanced funds are a type of mutual fund or ETF (exchange-traded fund) that typically invests in a mix of stocks and bonds, with a focus on income and capital appreciation. They are designed to help investors save for retirement and are suitable for those who can't stomach the volatility of owning only stocks but require higher returns than fixed income to meet their objectives.

Balanced funds are a good option for moderate-risk investors as they provide a smoother ride than an all-stock portfolio by including bonds, which offer better returns than cash and are less likely to lose money than stocks. An investor seeking a balanced portfolio is comfortable tolerating short-term price fluctuations, is willing to accept moderate growth, and has a mid- to long-range investment time horizon.

- Vanguard Wellington™ Inv

- T. Rowe Price Spectrum Moderate Allc I

- JPMorgan Global Allocation R6

- Vanguard Balanced Index I

Best Banks for Investment: Where to Invest Your Money?

You may want to see also

Impact bonds for positive environmental or social change

Fixed-income funds are an interesting solution for those who are new to investing and are looking for low-risk options. These funds are managed by professionals who invest in various types of assets, including government debt instruments and private-sector debt instruments.

Now, let's shift our focus to impact bonds for positive environmental or social change.

Impact bonds, also known as pay-for-success contracts, are innovative financial tools that have gained significant attention in recent years. They are designed to bring together key stakeholders and leverage private capital to address social and environmental challenges. The most common type of impact bond is the Social Impact Bond (SIB), which has been used to address issues such as social justice, education, and access to healthcare.

One example of an SIB is the Zero Waste Bond, which aims to support cities in their transition to zero waste by providing funding and expertise. This bond targets specific outcomes like job creation and waste reduction. Another type of impact bond is the Environmental Impact Bond (EIB), which focuses on financing sustainability and environmental outcomes.

Impact bonds have several advantages. They bring together diverse partners and build resilience to tackle complex issues. They also provide an opportunity for investors to combine financial gains with social and environmental benefits. Additionally, impact bonds can help create rewarding business models that foster a regenerative economy.

However, it's important to note that impact bonds have faced some criticism. Some argue that they may displace funding for other programs and that they rely on governmental funds, which can be a challenge for budgeting. Nonetheless, impact bonds offer a unique approach to addressing societal challenges and have the potential to create positive environmental and social change.

Overall, fixed-income funds, including impact bonds, can be a great option for those seeking low-risk investment opportunities while also driving positive change. They provide a steady income stream and are suitable for investors who want to diversify their portfolios with a mix of fixed-income products and stocks.

Growth Mutual Funds: Strategies for Smart Investing

You may want to see also

Fixed-income ETFs

One of the key advantages of fixed-income ETFs is their low cost. ETFs provide investors with a more efficient and cost-effective way to trade a diverse basket of bonds compared to purchasing individual bonds. This cost efficiency is further enhanced by the tax efficiency of bond ETFs, which may offer potential withholding and estate tax benefits over individual bonds.

Additionally, fixed-income ETFs offer a wide range of investment options, allowing investors to gain exposure to different sectors, credit qualities, durations, and sustainable strategies within the broad fixed-income universe. This diversification helps to manage risk and stabilize investment portfolios.

When considering investing in fixed-income ETFs, it is important to assess your investment objectives, risk tolerance, and financial circumstances. While fixed-income ETFs provide a relatively low-risk investment option, it is crucial to remember that all investments carry some degree of risk, including the potential loss of principal.

Investing in Commodity Funds: Why Do People Do It?

You may want to see also

Frequently asked questions

Fixed-income funds are a type of investment fund that focuses on fixed-income securities, such as bonds, which provide a steady stream of income in the form of fixed interest or dividend payments.

Fixed-income funds offer more stable and consistent returns compared to stocks, making them suitable for conservative investors seeking lower-risk investment options. They also provide diversification to an investment portfolio, helping to offset potential losses from more volatile equity investments. Additionally, fixed-income funds are managed by professionals, who make investment decisions on behalf of the investors.

While fixed-income funds generally have lower risk levels, they are still subject to certain risks. These include interest rate risk, where rising interest rates can cause the value of existing bonds to decline. Inflation can also impact the returns of fixed-income funds, as it erodes the purchasing power of the interest payments. Credit and default risk are other factors to consider, especially when investing in corporate bonds.

When selecting a fixed-income fund, it is important to study the fund's prospectus and investment policy. Consider the types of debt instruments the fund invests in, such as government bonds or corporate debt. Evaluate the fees and expenses associated with the fund, and review its past performance over different time periods. It is also beneficial to assess the fund manager's capabilities and their track record in generating consistent growth.