Malaysia offers a wide range of investment opportunities for both residents and non-residents. Non-residents can invest in ringgit or foreign currency assets without restrictions, open bank accounts, and freely transfer funds in and out of the country.

For Malaysians, there are several options for investing, including Amanah Saham Bumiputera (ASB), a long-term, low-risk investment with no sales or redemption charges and Employees Provident Fund (EPF), which has generated returns of 5% to 6.4% per annum over the past five years. Other options include Private Retirement Schemes (PRS), Real Estate Investment Trusts (REITs), Exchange-Traded Funds (ETFs), and more.

Before investing, it is important to set financial goals and determine how much you need to save and invest to reach your target. It is also crucial to understand the different investment styles and choose the one that aligns with your risk profile, investment goals, and financial needs.

| Characteristics | Values |

|---|---|

| Minimum investment amount | RM1,000 |

| Returns | 4.25% to 10% per annum |

| Maximum investment amount | RM300,000 |

| Risk | Low |

| Charges | No sales or redemption charges |

| Investment type | Long-term |

| Other features | No negative returns |

What You'll Learn

Amanah Saham Bumiputera (ASB)

ASB has a minimum investment of 10 units (RM10.00) and a maximum of 300,000 units. The price per unit is fixed at RM1 and has never delivered negative returns. There are no sales or redemption charges. Returns range from 4.25% to 10% per annum.

ASB is open to Malaysian Bumiputeras only. You can visit any Maybank branch to start investing or call 1-300-88-6688 for more details. You can also top up or manage your ASB accounts via the MAE app or Maybank2u web.

Finding the Right Mutual Funds for Your Investment Portfolio

You may want to see also

Employees Provident Fund (EPF)

The Employees Provident Fund (EPF) is a federal statutory body under the purview of the Ministry of Finance. It was established on 1 October 1951 under the National Director of Posts and is now governed by the EPF Act 1991. The EPF manages the compulsory savings plan and retirement planning for private sector workers in Malaysia. Membership is mandatory for Malaysian citizens employed in the private sector and voluntary for non-citizens.

The EPF functions by requiring a contribution of at least 11% of each member's monthly salary, while the member's employer is obligated to fund at least 12% of the employee's salary (13% if the salary is below RM5,000). This money is stored in a savings account. While in savings, a member's EPF savings may be used to invest in companies deemed profitable and permissible by the organisation, and dividends are banked to respective members' accounts. Members may also use their EPF savings for their own investments, but such activities are not covered by the EPF and members must bear any losses made.

The EPF declares an annual dividend on funds on deposit, which has varied over time depending on investment results. Historically, the EPF has delivered decent dividends. In the past five years, it has generated returns of 5% to 6.4% a year, with 2024 generating around 5.50% returns for Simpanan Konvensional. It also guarantees a minimum of 2.5% dividend for conventional (i.e. non-Shariah) accounts.

As of 31 December 2020, the size of the EPF asset size stood at RM998 billion (US$238 billion), making it the fourth-largest pension fund in Asia and the seventh-largest in the world. As of 31 December 2012, the EPF had 13.6 million members, of which 6.4 million were active contributing members, and 502,863 contributing employers.

As a retirement plan, money accumulated in an EPF savings can only be withdrawn when members reach 50 years old, during which they may withdraw only 30% of their EPF. Members who are 55 years old or older may withdraw all of their EPF. Withdrawals are also possible when a member permanently emigrates, becomes disabled, or requires essential medical treatment.

Effective 1 January 2007, a member's EPF savings consist of two accounts that vary by their share of savings and withdrawal flexibilities. The first account, dubbed "Account I", stores 70% of the members' monthly contribution, while the second account, "Account II", stores 30%. Account I restricts withdrawals until the member reaches the age of 50, becomes incapacitated, leaves the country, or passes away. Withdrawal of savings from Account II is permitted for down payments or loan settlements for a member's first house, finances for education and medical expenses, investments, and when the member reaches 55 years of age.

As of 11 May 2024, a third account, Account III (Akaun Fleksibel), was introduced as part of the EPF restructuring to provide even more financial flexibility to members. This new account stores 10% of the member’s contributions and allows for withdrawals at any time for any purpose, with a minimum withdrawal amount of RM50. The introduction of Account III reflects a shift toward accommodating the short-term financial needs of EPF members while still safeguarding their retirement savings in Accounts I and II.

Convince Your Family to Invest in Hedge Funds

You may want to see also

Private Retirement Schemes (PRS)

PRS offers a choice of retirement funds from which individuals may choose to invest in based on their own retirement needs, goals and risk appetite. The funds are intended to enhance long-term returns for members within a regulated framework.

The minimum initial investment starts at RM100, which is a low barrier to entry for investors to diversify their money through unit trust funds. There is also a tax incentive for those who invest in PRS. You can claim tax relief of up to RM3,000 when you invest in PRS until 2025, depending on your income bracket, you could save up to RM900 in taxes.

However, it is important to note that there are fees associated with PRS. There is an upfront sales charge of up to 3% and an annual management fee of up to 5%. These fees can eat into your returns over time. Additionally, PRS funds cannot be easily withdrawn if you are under 55. Withdrawals are generally limited to a portion of your funds and may be subject to an 8% tax, depending on the purpose of the withdrawal.

As of the time of writing, the top eight PRS funds produced annualised returns of 6.22% to 10.55% p.a. in the past five years.

Hedge Fund GPs: Benefits of Investing in Their Own Fund

You may want to see also

Real Estate Investment Trusts (REITs)

REITs are a type of security that invests in real estate and are often listed publicly on stock exchanges. The first REIT was created in the United States in 1960, and the first Malaysian REIT, Axis REIT, was formed in 2004.

REITs are a very underrated security in Malaysia, but they have been gaining traction over the past few years as a good defensive stock for every portfolio. They are perfect for beginners due to their low-risk nature and high dividend yield.

Benefits of Investing in Listed REITs

- Low initial investment: With as little as RM1,000, you can invest in a variety of properties, including shopping malls, office towers, industrial warehouses, and hotels.

- Liquidity: Compared to physical properties, shares in Malaysian REITs can be bought and sold in just a few minutes.

- Professional management: REITs are managed by professionals who will add value for a higher yield.

- Stable income stream: REITs pay out steady incomes (similar to dividends) derived from rents paid by tenants.

- Exposure to large-scale real estate: REITs allow you to benefit from the real estate market without having to buy properties directly.

- Tax advantages: Most income earned by REITs is exempted from income tax, and they are also exempt from stamp duties and real property gains tax when acquiring or disposing of assets.

How to Invest in REITs in Malaysia

REITs are shares, so you can buy them in the same way you would purchase shares.

- High dividend yield: To take advantage of tax benefits, REITs distribute at least 90% of their earnings to shareholders.

- Diversification: By investing in a single REIT, your funds are spread across multiple property types and locations.

- Low fees and costs: Compared to unit trusts, REITs have much lower fees and costs, which will eat into your returns over time.

Examples of Top-Performing Malaysian REITs

- Axis REIT (annualised return: 10.90%)

- MRCB-Quill REIT (annualised return: 6.86%)

- Al-Aqar Healthcare REIT (annualised return: 6.50%)

- UOA REIT (annualised return: 6.34%)

- Amanah Harta Tanah PNB (annualised return: 5.99%)

Diversified Equity Funds: Smart Investment, Smart Returns

You may want to see also

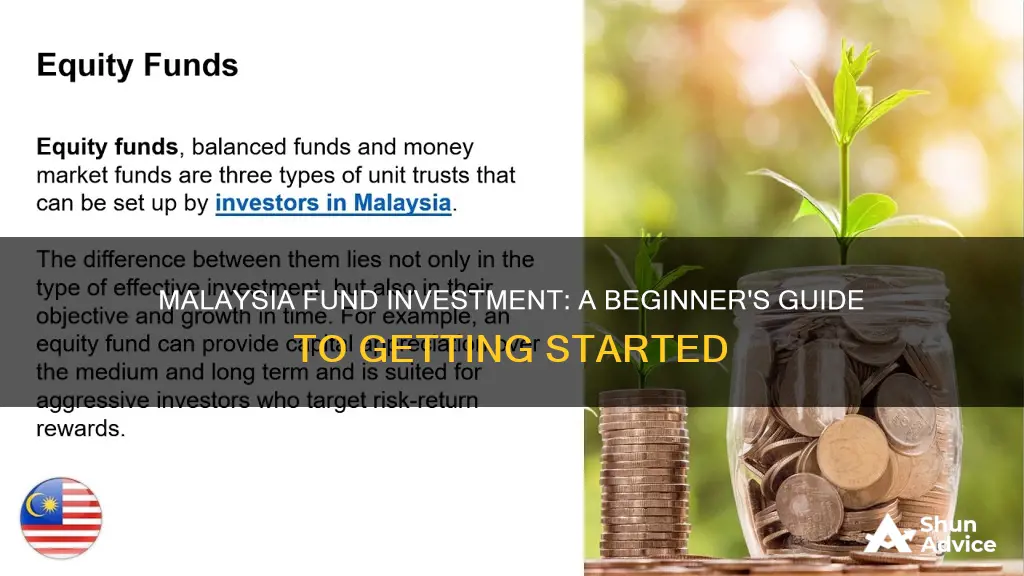

Exchange-Traded Funds (ETFs)

Here's how ETFs work in Malaysia:

ETFs are traded on the stock exchange, so to invest in local ETFs, investors need to open a stock trading account. There are also options to invest through an international broker or a robo advisor. When buying or selling ETFs, investors incur transaction costs, including brokerage commissions, stamp duty, and clearing fees. ETFs are bought and sold in minimum board lots of 100 units on Bursa Malaysia, but can be traded as low as 1 unit on international markets.

Investors can make money from ETFs through capital appreciation and dividends. Capital appreciation occurs when the price of the ETF increases, and investors sell at a profit. Some ETFs also pay dividends on a half-yearly or yearly basis, which is outlined in the ETF's prospectus on its company website.

There are several advantages to investing in ETFs:

- Low fees: As ETFs are passively managed, they tend to have lower fees, typically between 0.08% and 1.09% per year.

- Diversification: ETFs allow investors to invest in multiple assets with a small amount of money, reducing the impact on their portfolio if any individual investment underperforms.

- Easy to buy and sell: As ETFs are traded on the stock market, they are quick and easy to buy and sell.

- Passive investment strategy: ETFs automatically select individual stocks for investors, so there is no need to spend time researching and selecting stocks.

While ETFs offer many benefits, there are also some disadvantages to consider:

- Market performance: ETFs usually match the performance of the market or a segment of the market, so investors will not outperform the market with their returns.

- Lack of control: Investors cannot include or exclude specific stocks from an ETF, giving up some control over their portfolio.

- Brokerage and other fees: While ETFs have lower fees than mutual funds or unit trusts, investors still incur brokerage and other transaction fees, which can add up with frequent trading.

An ETF has an underlying net asset value (NAV) calculated by subtracting liabilities from the sum of all the fund's investments and dividing by the number of shares held by shareholders. However, an ETF's trading price is determined by supply and demand and can differ from its NAV.

There are several common types of ETFs available on Bursa Malaysia and international stock markets:

- Equity ETFs: These invest in stocks and may focus on a specific region or industry.

- Fixed-income ETFs: These invest in low-risk fixed-income securities such as bonds or sukuk.

- Leveraged ETFs: These use debt to increase returns or losses for every price movement of the index.

- Inverse ETFs: These allow investors to gain returns when the underlying index loses value and lose money when the index gains value.

- Commodity ETFs: These track commodity indices and measure the performance of commodities like gold, silver, and oil.

A list of Malaysian ETFs and their performance in recent years is provided by iMoney. Some examples of Malaysian ETFs include:

- ABF Malaysia Bond Index Fund

- FTSE Bursa Malaysia KLCI ETF

- Kenanga KLCI Daily (-1x) Inverse ETF

- MyETF Dow Jones Islamic Market Malaysia Titan 25

- TradePlus NYSE FANG+ Daily (-1x) Inverse Tracker

Navigating the Investment Landscape: Choosing the Right Funds

You may want to see also