GUSH, or Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares, is a leveraged ETF that tracks the S&P Oil & Gas Exploration & Production Select Industry Index. On any given day, GUSH aims to return 200% of the performance of this target index. As such, this instrument is intended for investors with a bullish outlook on the domestic oil and gas exploration and production subsector. While GUSH has the potential to generate leveraged gains during favourable market conditions, it is also subject to amplified losses when the market declines. Therefore, it is crucial to carefully consider the associated risks before deciding whether to invest in GUSH at the present moment.

What You'll Learn

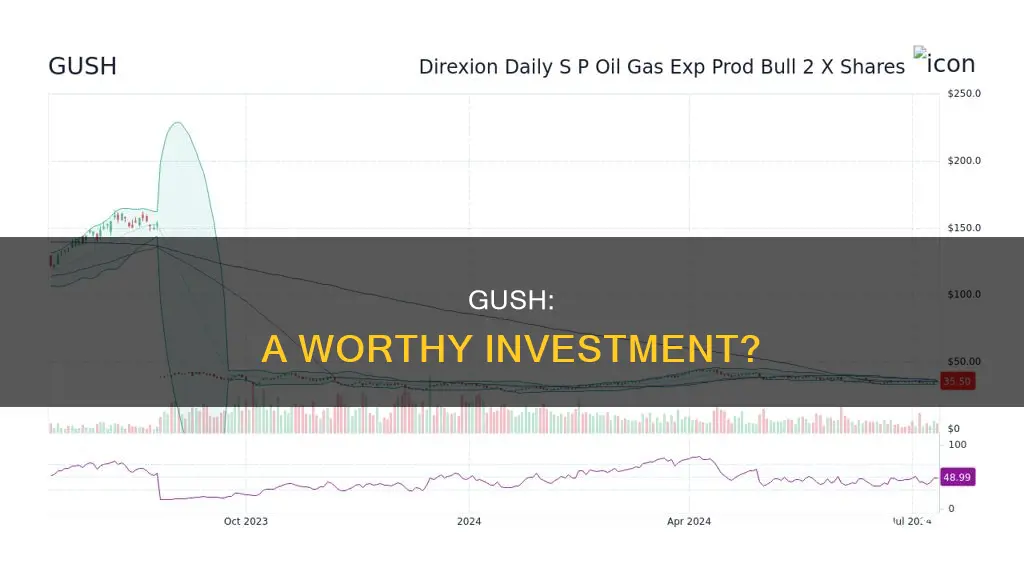

GUSH ETF price history

The Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares (GUSH) is an exchange-traded fund (ETF) that seeks to provide daily investment results of 200% of the daily performance of the S&P Oil & Gas Exploration & Production Select Industry Index.

As of April 24, 2024, the GUSH ETF price closed at $41.46, gaining 0.95% on the last trading day (Wednesday, April 24, 2024), rising from $41.07 to $41.46. The price fluctuated 2.74% from a day low of $40.43 to a day high of $41.54. The GUSH ETF has been on an upward trend, gaining for four consecutive days.

Looking at the broader price history, the 52-week high for GUSH ETF was $163.62, while the 52-week low was $27.81. On July 5, 2024, GUSH closed down 5.1% on 1.61 times the normal volume, falling below its 200-day moving average.

The GUSH ETF is considered to have medium risk, with average movements during the day and good trading volume. It is a buy or hold candidate since February 15, 2024, with a gain of 26.63%.

For the upcoming trading day on Thursday, April 25, 2024, the predicted opening price for GUSH is $41.14, and the ETF is expected to move between $39.91 and $43.01 during the day.

The GUSH ETF is expected to rise 45.17% during the next three months, and with a 90% probability, it will hold a price between $58.15 and $68.38 at the end of this period.

Wall Street's Annual Investors

You may want to see also

GUSH's investment strategy

GUSH, or Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares, is a non-diversified fund that seeks daily investment results of 200% of the daily performance of the S&P Oil & Gas Exploration & Production Select Industry Index. The fund typically invests at least 80% of its net assets in financial instruments and securities of the index, as well as ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index. This includes swap agreements, options on securities and indices, reverse repurchase agreements, and other ETFs.

GUSH is considered a buying opportunity by some analysts, who point to its short-term signals and general good trend. The ETF has seen a recent rise in price, gaining 0.95% on the last trading day, and is expected to rise 45.17% during the next 3 months. It is also rated as a 'Buy' by StockInvest.us, with a current score of 2.702.

However, there are mixed signals, with some sell signals being issued. The stock fell below its 200-day moving average, indicating a potential long-term outlook change. It has also been noted that the volume fell during the last trading day despite gaining prices, which may be an early warning.

GUSH has a 52-week high of $163.62 and a 52-week low of $27.81. As of April 24, 2024, the price of a GUSH share was $41.46, and the market capitalization was 541.318M.

Madoff's Victims: A Global Reach

You may want to see also

GUSH's performance against the market

GUSH, or Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares, is a leveraged ETF that tracks the S&P Oil & Gas Exploration & Production Select Industry Index (SPSIOP). On any given day, GUSH aims to return 200% (or 2X) of the performance of this target index.

GUSH's performance has been influenced by various factors, including rising fuel prices, oil market volatility, and macroeconomic conditions such as renewed lockdowns in China and fears of a recession in the United States. These factors have impacted oil prices and demand, which are heavily correlated with the underlying index tracked by GUSH.

Looking at more recent performance, GUSH closed down 5.1% on Friday, July 5, 2024, on 1.61 times normal volume. This drop caused the stock to fall below its 200-day moving average, damaging its long-term outlook.

In terms of short-term signals, GUSH has had a green day on Wednesday, April 24, 2024, gaining 0.95% and rising from $41.07 to $41.46. It has now gained four days in a row, and it remains to be seen if this trend will continue or take a minor break.

Overall, GUSH's performance against the market has been mixed, with some indicators suggesting possible buying opportunities, while others highlight the high risks involved, especially for long-term investors or those with a conservative approach.

College: A Risky Bet?

You may want to see also

GUSH's suitability for short-term investors

GUSH, or Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares, is a leveraged exchange-traded fund (ETF) that tracks the S&P Oil & Gas Exploration & Production Select Industry Index (SPSIOP). On any given day, GUSH aims to return 200% (2X) of the performance of this target index.

GUSH is a short-term instrument that may be useful for highly risk-tolerant active traders. It is designed for investors with a bullish outlook on the domestic oil and gas exploration and production subsector. GUSH is a good investment opportunity for short-term investors if the underlying index, which is heavily correlated with oil prices and demand, begins to rise again.

GUSH has the potential to generate leveraged gains that can make up for higher expenses during favourable market conditions. However, it is important to note that GUSH's 2X leverage can also magnify losses during unfavourable market conditions.

As of April 24, 2024, GUSH closed at $41.46, gaining 0.95% on the last trading day. The ETF has gained for four consecutive days and is expected to rise 45.17% during the next three months. Short-term signals and the overall positive trend indicate that GUSH may be a good short-term investment opportunity.

However, it is essential to carefully consider the risks associated with leveraged ETFs like GUSH. The fund has experienced significant losses in the past, and its value can rapidly decline if the underlying index drops. Therefore, while GUSH may offer short-term investment potential, it is crucial for investors to closely monitor market conditions and be prepared for potential volatility.

Should You Invest Now?

You may want to see also

GUSH's suitability for long-term investors

GUSH, or Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares, is a leveraged ETF that tracks the S&P Oil & Gas Exploration & Production Select Industry Index (SPSIOP). On any given day, GUSH aims to return 200% (2X) of the performance of this target index. This makes it suitable for investors with a bullish outlook on the domestic oil and gas exploration and production subsector.

However, GUSH is not suitable for long-term investors due to the risks introduced by its leverage. While leveraged ETFs can magnify returns, they also have the same effect on losses. As a result, these ETFs can have disastrous effects when the assets or indexes they track drop. GUSH has demonstrated this ability to rapidly shed value, and its value was all but erased during the unexpected market shocks of 2020.

GUSH's high expense ratio of 1.01% also makes it expensive to hold. While leveraged gains can make up for these higher expenses during good times, they further accent the steep losses that occur when the fund drops.

In addition, GUSH has a history of reverse stock splits, with the most recent one being the most drastic, consolidating shares on a 1-for-40 basis in 2020. This was in response to market conditions that had wiped out nearly 98% of GUSH's value, making it the worst-performing ETF of that year.

Therefore, GUSH is largely a short-term instrument that may be useful for highly risk-tolerant active traders. For long-term investors or those with a more conservative approach to the market, the risks introduced by GUSH's leverage will likely be too high to tolerate.

Whataburger: A Texas Treasure

You may want to see also

Frequently asked questions

GUSH is an oil and gas double-levered exchange-traded fund (ETF) that seeks to provide investors with exposure to the oil and gas field. The fund is managed by Direxion, an investment company that offers investors access to a variety of ETFs and investing opportunities.

As of 5th July 2024, the price of a GUSH share was $34.60.

GUSH is a high-risk investment that is largely a short-term instrument that may be useful for highly risk-tolerant active traders. It is not a sound investment for long-term investors or those with a conservative approach to the market due to the risks introduced by its leverage.