The L&T India Value Fund is an open-ended equity fund that has been in operation since 2010. It is considered a moderately high-risk investment option that focuses on generating long-term capital growth through a diversified portfolio of equity and equity-related securities in the Indian markets, with a particular emphasis on undervalued securities. The fund has a strong performance history, with a CAGR return of 17.9% since its launch, and annual returns of 39.4% in 2023, 5.2% in 2022, and 40.3% in 2021. The minimum investment amount for a lump sum is INR 5,000, while the minimum SIP amount is INR 500. The fund's expense ratio is 0.77%, and it is managed by Venugopal Manghat, Gautam Bhupal, and Sonal Gupta.

What You'll Learn

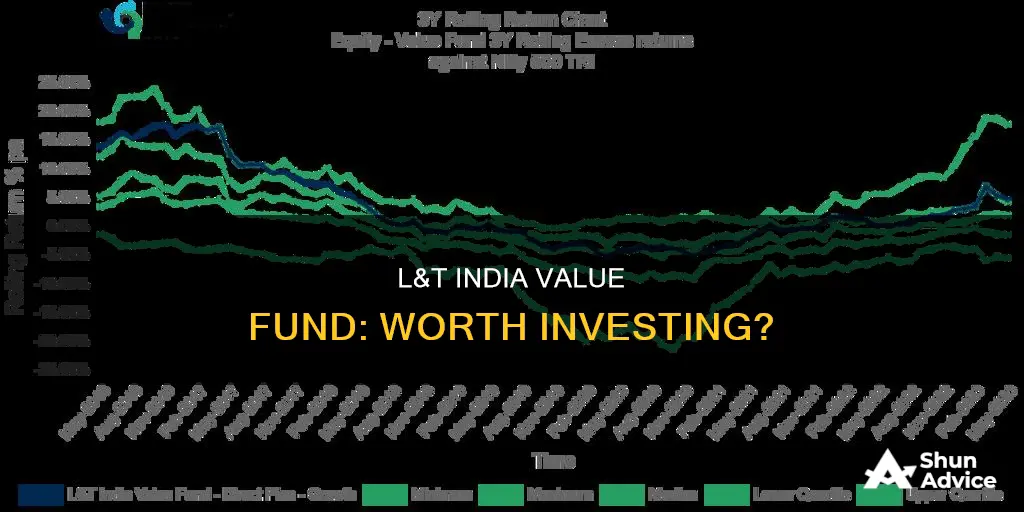

L&T India Value Fund's performance and returns

L&T India Value Fund is an equity fund that was launched on 8 January 2010. It has a moderately high risk and has given a Compound Annual Growth Rate (CAGR) return of 17.9% since its launch. The fund had a return of 39.4% in 2023, 5.2% in 2022, and 40.3% in 2021. As of 30 September 2024, the Net Asset Value (NAV) of the fund was ₹112.862, with a -0.57 (-0.51%) change. The fund has a 4/5 FundExpert Rating and a minimum investment of ₹5000.

The L&T India Value Fund aims to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity-related securities in the Indian markets, with a higher focus on undervalued securities. The fund may also invest in foreign securities in international markets.

The fund has a portfolio of various securities holdings, including utilities, financial services, basic materials, energy, and consumer cyclical. The top holdings include NTPC Ltd, ICICI Bank Ltd, State Bank of India, and Mahindra & Mahindra Ltd.

The L&T India Value Fund has performed well compared to similar funds and has a ranking of 4 in the Value category. The fund has continuously performed better than similar funds, and investors can consider investing in this fund. However, past performance does not guarantee future results, and investors should carefully consider their specific investment requirements before making any decisions.

Blackstone Funds: A Guide to Investing in Their Success

You may want to see also

How to invest in L&T India Value Fund

Investing in the L&T India Value Fund can be done through Systematic Investment Plans (SIPs) or as a lump sum. The L&T India Value Fund is a moderately high-risk fund that has given a Compound Annual Growth Rate (CAGR) return of 17.9% since its launch in 2010. It is an equity fund that focuses on undervalued securities in the Indian market and has ranked 4th in the Value category.

As of September 30, 2024, the Net Asset Value (NAV) of the fund was ₹112.862, with a decrease of -0.57 (-0.51%) from the previous day. The minimum investment amount for this fund is ₹5000, with a minimum SIP investment of ₹500 and an additional purchase amount of ₹1000.

Before investing, it is important to consider your financial goals and risk tolerance. The L&T India Value Fund has historically provided higher returns compared to similar funds, but it is important to note that past performance does not guarantee future results.

To invest in the L&T India Value Fund, you can follow these steps:

- Research and understand the fund: Review the fund's historical performance, risk metrics, portfolio holdings, and fees. Understand the fund's investment strategy and ensure it aligns with your financial goals.

- Consult with a financial advisor: Consider seeking advice from a professional investment advisor, who can provide personalized guidance based on your financial situation and goals.

- Decide on the investment amount: Determine how much you want to invest as a lump sum or through SIPs. Ensure you meet the minimum investment requirements.

- Open an account with a broker or mutual fund platform: You can invest in the L&T India Value Fund through a broker or an online mutual fund platform. Compare the fees and features of different platforms before choosing one that suits your needs.

- Place your investment order: Once your account is set up, place your investment order by following the platform's instructions. Provide the necessary details, such as the investment amount and payment information.

- Monitor your investment: Regularly review the performance of the fund and ensure it remains aligned with your investment goals. Remember that mutual funds are subject to market risks, and it is essential to make informed investment decisions.

Investing in Your 20s: Index Funds for Early Investors

You may want to see also

L&T India Value Fund's investment options

L&T India Value Fund is an open-ended equity fund that was launched on 8 January 2010. It is a moderately high-risk fund that has given a CAGR return of 17.9% since its launch. The fund's performance in the last few years has been good, with returns of 39.4% in 2023, 5.2% in 2022, and 40.3% in 2021. The latest NAV of the fund is ₹ 112.862 as of 30 September 2024. The minimum investment amount for L&T India Value Fund is ₹ 5,000, and the minimum SIP investment is ₹ 500. The fund has a total expense ratio of 0.77% as of 2 October 2024.

The investment objective of the L&T India Value Growth Direct Plan is to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity-related securities in the Indian markets, with a higher focus on undervalued securities. The scheme may also invest in foreign securities in international markets. The fund has a very high-risk category, and the top holdings include NTPC Ltd, ICICI Bank Ltd, State Bank of India, and Jindal Stainless Ltd.

When considering investing in mutual funds, it is essential to factor in the mutual fund fees, including the expense ratio and net asset value (NAV). Mutual funds make investing easy, and the longer you invest, the larger the corpus. L&T India Value Fund has performed better than similar funds, and you can consider investing in this fund.

One of the benefits of investing in L&T India Value Fund is the potential for long-term capital growth. The fund has a diversified portfolio of equity and equity-related securities, focusing on undervalued securities in the Indian markets. This means that the fund managers invest in stocks that are considered to be trading at a lower price than their intrinsic value, with the expectation that these stocks will provide higher returns in the long run.

Another advantage of investing in L&T India Value Fund is the flexibility of investment options. The fund offers both SIP (Systematic Investment Plan) and lump sum investment options. SIP allows you to invest a small amount of money regularly, which can be monthly or quarterly. This helps in rupee cost averaging and makes it easier to invest without requiring a large sum of money upfront. On the other hand, lump sum investment is a one-time investment where you invest a larger amount of money upfront.

The Global Investment Hub: Where Funds Call Home

You may want to see also

L&T India Value Fund's fees and charges

L&T India Value Fund is a moderately high-risk equity fund launched on 8 January 2010. It has a total expense ratio (TER) of 0.77% as of 2 October 2024. The minimum SIP amount is INR 500, and the minimum lump sum investment is INR 5000. The fund has a category risk of average to very high.

The expense ratio is an annual charge that covers the fund's daily net assets, including sales, marketing, administration, distribution, and fund manager's fees. It is calculated by dividing the total expenses incurred by the scheme by the AMC's total Assets Under Management (AUM). According to SEBI guidelines, the TER for an asset management company or fund house must adhere to specific limits based on the AUM.

In addition to the expense ratio, there are other fees and charges associated with investing in mutual funds. These include advisory fees, operational costs, investment management fees, registrar and transfer agent fees, legal and audit fees, and agent/sales commissions. These charges are approved by the Securities and Exchange Board of India (SEBI) and are collectively referred to as the Total Expense Ratio (TER).

It is important to note that mutual fund investments are subject to market risks, and past performance is not indicative of future returns. Individuals should carefully review the fees and charges associated with mutual funds before investing.

A Beginner's Guide to Index Funds Investing in Dubai

You may want to see also

L&T India Value Fund's tax implications

When considering investing in mutual funds, it is important to understand the tax implications. Mutual funds can help you save tax, and one way to do this is by investing in ELSS (Equity Linked Savings Scheme) to avail of tax deductions. Mutual fund portfolios offer a range of investment objectives, including funds and target date funds that align with market indices.

With professional investment management, individual investors can optimize their tax-saving potential by strategically diversifying their portfolios with tax-saving funds like ELSS.

If you invest in the L&T India Value Fund, you should be aware of the following tax implications:

- If you sell your investment after 1 year from the purchase date, long-term capital gains tax will be applicable. The current tax rate is 10% if your total long-term capital gain exceeds 1 lakh. Any cess or surcharge is not included in this rate.

- If you sell your investment before 1 year from the purchase date, short-term capital gains tax will be applicable. The current tax rate is 15%. Again, any cess or surcharge is not included in this rate.

Strategies for Investing in the Wallace Global Fund

You may want to see also

Frequently asked questions

The minimum lump-sum investment amount is INR 5,000, and the minimum SIP amount is INR 500.

The L&T India Value Fund aims to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity-related securities in the Indian markets, with a higher focus on undervalued securities. The scheme may also invest in foreign securities in international markets.

The L&T India Value Fund has provided returns of 51.6% over the last year, 26.8% over the last three years, 28.1% over the last five years, and 21.8% since its inception. The return for 2023 was 39.4%, 5.2% for 2022, and 40.3% for 2021.

The L&T India Value Fund is considered a "Very High Risk" investment, according to SEBI regulations.

As of 02/10/2024, the fund managers are Venugopal Manghat, Gautam Bhupal, and Sonal Gupta.