The UTI Nifty 50 Index Fund is a mutual fund scheme from UTI Mutual Fund that invests in stocks of companies comprising the Nifty 50 Index. The objective of the fund is to achieve returns equivalent to the Nifty 50 Index through passive investment. Launched in 2002, the fund has an expense ratio of 0.19% and has delivered average annual returns of 13.87% since its inception. As of September 30, 2024, the fund had an AUM of ₹3,25,385 Cr, with the latest NAV valued at ₹172.63 as of October 10, 2024. Investing in the UTI Nifty 50 Index Fund can be done through platforms like ET Money, which offer a seamless and paperless investment process.

What You'll Learn

How to invest in UTI Nifty 50 Index Fund online

The UTI Nifty 50 Index Fund is a large-cap index mutual fund scheme from UTI Mutual Fund. The fund seeks to invest in stocks of companies comprising the Nifty 50 Index and aims to achieve returns equivalent to the Nifty 50 Index through passive investment. The fund has been in existence for over 11 years, with assets under management (AUM) of over ₹20,000 crore as of September 30, 2024.

Step 1: Visit the UTI Mutual Fund website

Go to the official website of UTI Mutual Fund: www.utimf.com.

Step 2: Register and login

If you are a new investor, you will need to register on the website by providing your personal details, such as name, email, and creating a password. If you already have an account, simply log in using your credentials.

Step 3: Select the UTI Nifty 50 Index Fund

Navigate to the page for the UTI Nifty 50 Index Fund. You will find detailed information about the fund, including its investment objective, current Net Asset Value (NAV), returns, and risk rating.

Step 4: Choose the investment type

Decide whether you want to invest a lump sum amount or opt for a Systematic Investment Plan (SIP). For a lump sum investment, you will need to provide the amount you wish to invest. For a SIP, you will need to specify the amount and frequency of your investments (monthly, quarterly, etc.).

Step 5: Payment details

Provide your bank account details from which you will be making the payment.

Step 6: Confirm your investment

Review your investment details and confirm your investment.

By following these steps, you can easily invest in the UTI Nifty 50 Index Fund online. It is important to note that mutual funds are subject to market risk, and past performance does not guarantee future returns. Therefore, carefully consider your investment objectives and risk tolerance before investing.

UK Index Funds: Where to Invest Your Money Wisely

You may want to see also

UTI Nifty 50 Index Fund Direct Plan

The UTI Nifty 50 Index Fund Direct Plan is a mutual fund scheme launched by UTI Mutual Fund. This fund seeks to invest in stocks of companies comprising the Nifty 50 Index and aims to achieve returns equivalent to the Nifty 50 Index through passive investment. The fund has been in existence for over 11 years, launching on 1st January 2013, and has delivered average annual returns of 13.87% since its inception.

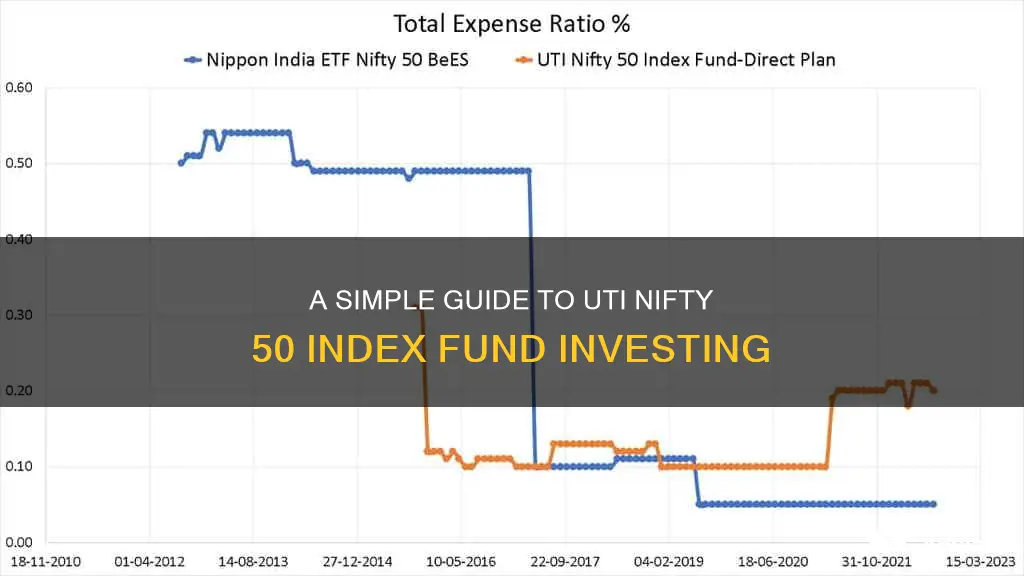

As of 30th September 2024, the fund had ₹20,432 Crores worth of assets under management (AUM) and an expense ratio of 0.19%, which is close to the average for Large Cap Index funds. The latest NAV (Net Asset Value) as of 15th October 2024 was 173.0271. The fund has no exit load, and short-term and long-term capital gains taxes apply for redemptions before and after 1 year, respectively.

You can invest in the UTI Nifty 50 Index Fund Direct Plan through the UTI Mutual Fund website or platforms like MF Central and MF Utility. Most banks also act as mutual fund distributors, so you can connect with your bank for assistance. SIP investments are also available for this fund.

Best Mutual Fund Platforms: Where to Invest?

You may want to see also

UTI Nifty 50 Index Fund Regular Plan

The UTI Nifty 50 Index Fund - Regular Plan is an open-ended large-cap equity scheme that was launched on 6 March 2000. The fund is managed by Sharwan Kumar Goyal and Ayush Jain. The scheme seeks to invest in stocks of companies comprising the Nifty 50 Index and aims to achieve returns equivalent to the Nifty 50 Index through passive investment.

As of 30 September 2024, the fund has assets under management (AUM) of ₹20,432 crores, with an expense ratio of 0.25% for the regular plan and 0.19% for the direct plan. The minimum SIP investment amount is ₹500, while the minimum investment and additional investment amounts are ₹1,000 each. The fund has no exit load.

The UTI Nifty 50 Index Fund - Regular Plan has delivered average annual returns of 13.87% since its inception. Its trailing returns over different time periods are: 26.95% (1yr), 12.54% (3yr), 18.06% (5yr) and 12.2% (since launch). The fund's portfolio is largely conservative, with holdings mostly in large-cap stocks and debt instruments. As of 30 July 2023, the fund had invested 99.93% in equity, 0.07% in cash & cash equivalents, and 0% in debt.

The fund is suitable for conservative equity investors as it tends to fall less when stock prices decline. However, investors should be prepared for ups and downs in their investment value. It is recommended to invest in this fund only if you can remain invested for at least five years.

High Net Worth Investors: Hedge Funds for Long-Term Growth

You may want to see also

UTI Nifty 50 Index Fund Growth

The UTI Nifty 50 Index Fund Growth is a mutual fund scheme launched by UTI Mutual Fund. The scheme was made available to investors on 14 November 2002 and is currently managed by Kaushik Basu. The fund has an Asset Under Management (AUM) of ₹3,25,385 Crore and a Net Asset Value (NAV) of ₹172.63 as of 10 October 2024. The investment objective of the fund is to invest in stocks of companies comprising the Nifty 50 Index and to achieve returns equivalent to the Nifty 50 Index through passive investment. The fund has a minimum SIP investment of ₹500 and a minimum lumpsum investment of ₹1,000. The expense ratio of the fund is 0.19%, and it is rated as a Very High-risk investment.

The UTI Nifty 50 Index Fund Growth has consistently underperformed the benchmark, with lower annualised returns than the category average for the past 1 year, 3 years, 5 years, and 10 years. The fund has a lower alpha of -1.6, indicating that it has generated returns lower than the NIFTY 50 Total Return Index in the last 3 years. The fund has an exit load of 0.005% if redeemed within one year, and returns are taxed at 20%. If redeemed after one year, returns exceeding ₹1.25 lakh in a financial year are taxed at 12.5%.

The fund has a majority of its investments in the Financial, Energy, Technology, Consumer Staples, and Automobile sectors. The top holdings of the fund include HDFC Bank Ltd., Reliance Industries Ltd., ICICI Bank Ltd., Infosys Ltd., and ITC Ltd. The fund has underperformed at beating the benchmark and has poor risk-adjusted returns, with a Sharpe Ratio of 0.72 compared to the category average of 3.83. The fund has a standard deviation of 12.19, indicating higher volatility in performance compared to other funds in its category.

To invest in the UTI Nifty 50 Index Fund Growth, individuals can visit the UTI Mutual Fund website or use investment platforms such as ET Money, which offers a paperless and fast investment process. Investors need to provide their email address, investment amount, and bank account details to initiate the investment process.

Smart Mutual Fund Investing with 1 Lakh

You may want to see also

UTI Nifty 50 Index Fund returns

The UTI Nifty 50 Index Fund is a mutual fund scheme launched by UTI Mutual Fund with the objective of investing in stocks of companies that comprise the Nifty 50 Index. The fund aims to achieve returns equivalent to the Nifty 50 Index through passive investment. The fund was made available to investors on November 14, 2002, and is considered a high-risk investment option.

In terms of returns, the UTI Nifty 50 Index Fund has delivered annualised returns of 13.87% since its inception. Over the last year, the fund has generated returns of 27.76%. The fund has consistently delivered returns, doubling the invested money every four years. However, its ability to control losses during market downturns is average.

When compared to other funds in its category, the UTI Nifty 50 Index Fund has underperformed in beating the benchmark, with an alpha value of -1.6. It has also delivered poor risk-adjusted returns, as indicated by its Sharpe ratio of 0.72. The fund is more sensitive to market volatility, with a beta value of 0.97.

The expense ratio of the UTI Nifty 50 Index Fund is 0.19%, which is close to the average for Large Cap Index funds. The fund has an Asset Under Management (AUM) of ₹3,25,385 Cr as of October 10, 2024, and the latest Net Asset Value (NAV) as of that date was ₹172.63.

UK Fund Investment: A Beginner's Guide to Getting Started

You may want to see also

Frequently asked questions

On ET Money, investing in the UTI Nifty 50 Index Fund is fast, easy, and 100% paperless. Click on the "Invest Now" button, enter your email, select whether you want to do a one-time investment or start a SIP, add the amount, and provide a few more details. That's it! Your SIP or one-time investment is done.

The NAV of a Mutual Fund is the per-unit price, which changes every day. The NAV of UTI Nifty 50 Index Fund as of October 15, 2024, was 173.0271.

The expense ratio of the direct plan of UTI Nifty 50 Index Fund is 0.19%. This is the annual fee charged by the Mutual Fund company for managing your investments, taken from the returns generated by the fund. A lower expense ratio is better because it means more returns for you.

Redeeming your investments is super easy. If you invested via ET Money, log in to the app, go to the investment section, and put in the redemption request. If you invested elsewhere, go to the fund house website and put in a request there.

The AUM of UTI Nifty 50 Index Fund is ₹20,432 Crore. AUM indicates the popularity of a fund—a high AUM means a lot of money has been invested, and investors like it. However, AUM should not be the primary criterion when selecting a fund.