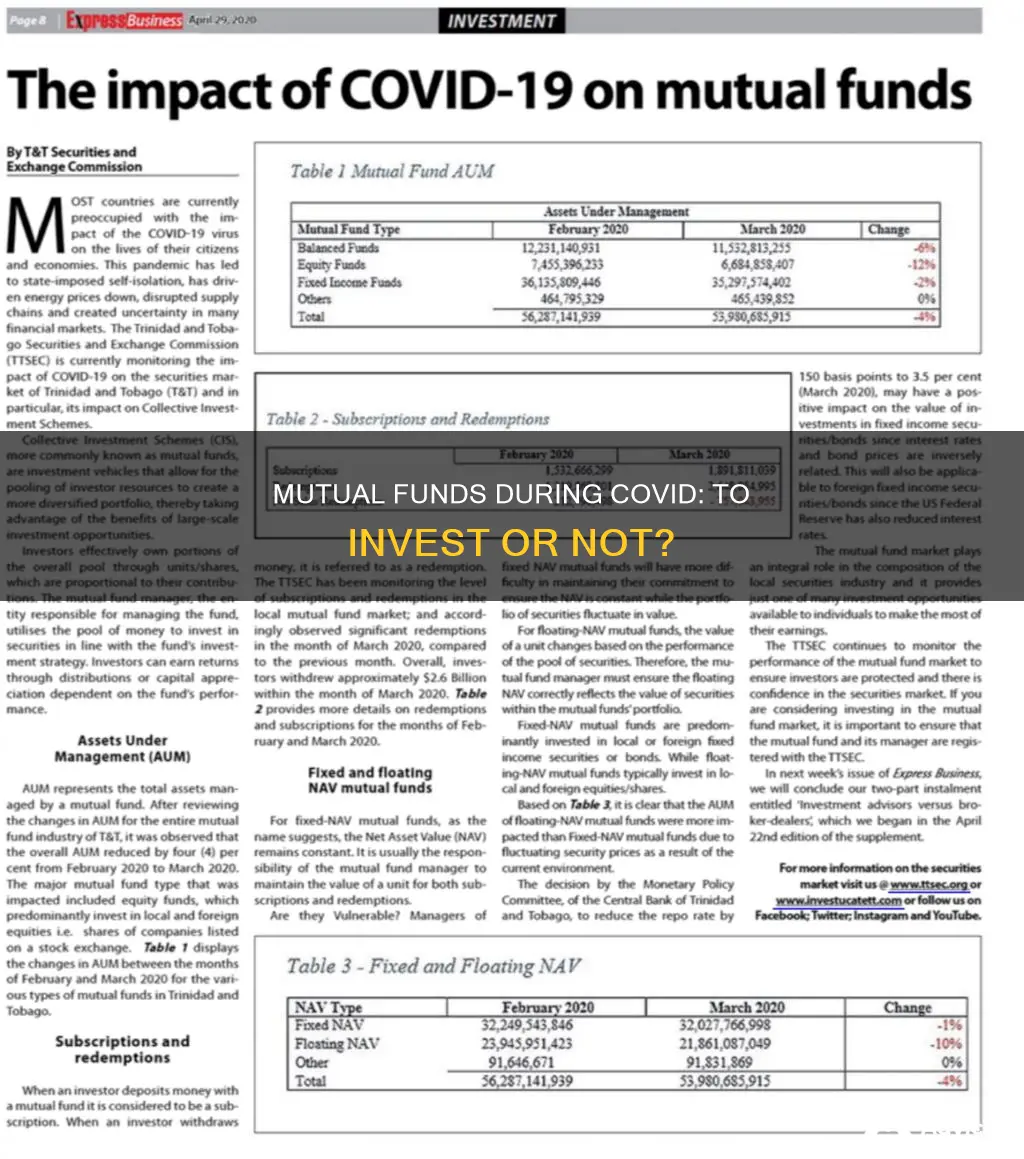

The COVID-19 pandemic has had a significant impact on the performance of mutual funds, with most active funds underperforming passive benchmarks during the crisis. This contradicts the popular hypothesis that active funds make up for their poor performance by excelling during recessions. However, some funds with high sustainability and star ratings have fared better than others. The pandemic has also led to a shift in investor preferences, with a focus on sustainability, indicating that investors view sustainability as a necessity rather than a luxury.

With over 9,000 mutual funds managing more than $16 trillion in assets, it is essential to carefully consider your investment options and seek expert advice before making any financial decisions.

| Characteristics | Values |

|---|---|

| Number of mutual funds | Over 9,000 |

| Assets held by mutual funds | Over $16 trillion |

| Average expense ratio | 0.63% (2016) |

| Investment options | Equities, bonds, real estate, commodities |

| Trading frequency | Once per day |

What You'll Learn

- Active vs passive funds: which is the better investment

- How did active funds perform during the Covid crisis?

- What are the pros and cons of investing in mutual funds during a pandemic?

- What are the risks of investing in mutual funds during a financial crisis?

- How do mutual funds compare to other investment options?

Active vs passive funds: which is the better investment?

The debate between active and passive investing has been ongoing for some time, with each side having its own advantages and disadvantages. However, the question of which is the better investment strategy is a complex one and depends on various factors, including an investor's personal priorities, timelines, and goals.

Active investing involves a hands-on approach, with investors or portfolio managers actively buying and selling investments based on their performance or expected performance. The goal of active investing is typically to "'beat the market' and generate returns that outperform certain benchmarks, such as the S&P 500 or Russell 3000. Active investing requires extensive research and analysis, and active managers often charge higher fees to cover these costs. Additionally, active investing offers flexibility, as managers are not required to hold specific stocks or bonds and can use various hedging strategies to manage risk.

On the other hand, passive investing involves buying and holding investments over the long term, often in the form of index funds or exchange-traded funds (ETFs) that track a particular market index. Passive investing is a more hands-off approach, with lower fees, good transparency, and tax efficiency due to the buy-and-hold strategy. Passive funds have ultra-low fees because there is no need to pay for extensive research and analysis, and the investments simply follow a specific index. However, passive funds are limited to the holdings of the index they track, and they rarely beat the market in terms of returns.

During the COVID-19 crisis, active funds underperformed passive benchmarks, contradicting the popular hypothesis that active funds outperform during market downturns. This finding adds to the body of evidence that passive investing generally produces better results for most investors.

However, it's important to note that active and passive investing are not mutually exclusive, and many investment advisors believe that blending the two strategies can help minimize the wild swings in stock prices during volatile periods and further diversify a portfolio. The decision to invest actively, passively, or use a blended strategy depends on various factors, including an investor's risk tolerance, investment goals, and the type of investments being considered.

For example, passive management may be more suitable for well-known and easily traded holdings like stocks in large corporations, as there is already a wealth of information available about these companies, making it less likely for active managers to gain any special insight. In contrast, active management may be more advantageous in niche markets, such as emerging markets and small-company stocks, where assets are less liquid and there are fewer participants, allowing active managers to spot hidden gems.

Additionally, high-net-worth investors with access to elite financial advisors may find that active investing becomes more appealing, as the management fee becomes less burdensome relative to their larger investment portfolios.

Unlock Real Estate Funding: Strategies for Investors

You may want to see also

How did active funds perform during the Covid crisis?

Active funds' performance during the Covid-19 crisis was mixed. Some sources claim that active funds underperformed passive benchmarks, with 74% of active equity mutual funds underperforming the S&P 500 and 58% underperforming their style benchmarks in the ten weeks after the February 2020 market peak. The average fund underperformed the S&P 500 index by 5.6% during the ten-week period (29.1% annualized).

However, other sources indicate that active funds outperformed passive funds during the Covid-19 crisis, particularly in the UK. A study by Bowmore Wealth Group found that actively managed funds returned an average of 8.3% over the last six months of the Covid-19 pandemic, compared to 5.1% for passive funds. The greater exposure to value stocks and the comeback of cyclical stocks were credited for the outperformance of active funds.

Index Funds: Smart Investment or Risky Business?

You may want to see also

What are the pros and cons of investing in mutual funds during a pandemic?

Investing in mutual funds during a pandemic has its pros and cons. Here is a detailed breakdown:

Pros:

- Diversification: Mutual funds pool money from multiple investors, allowing you to invest in a variety of securities from different industries. This diversification reduces investment risk as gains in some areas can offset losses in others.

- Professional Management: Mutual funds offer professional management and ongoing supervision of your holdings, which is especially beneficial if you don't want to actively pick and choose individual investments.

- Liquidity: Mutual fund shares can be redeemed on any business day, providing liquidity. Additionally, shares are priced daily, so you always know the value of your investment.

- Small Investment Amounts: Depending on the fund's rules, you may be able to make smaller contributions that can grow over time.

- Potential for Higher Returns: Actively managed funds aim to beat the market, which could result in competitive returns.

Cons:

- Potential for Loss: Mutual funds are not FDIC-insured and may lose principal and fluctuate in value. During a pandemic, the potential for loss may be higher due to market volatility.

- Fees and Charges: Mutual funds often have high management fees, sales charges, and expense ratios that can eat into your investment returns. These fees cover the fund's operating costs and the salaries of professionals managing it.

- Tax Inefficiency: Dividends and interest payments from mutual funds are generally considered taxable income by the IRS, even if you reinvest the money.

- Poor Trade Execution: Mutual funds may not be suitable for investors seeking faster execution times, as they are traded only once per day at the closing net asset value (NAV).

- Management Abuses: There is a risk of management abuses, such as unnecessary trading, excessive replacement, and selling losers before quarter-end to fix the books.

- Lack of Control: Some investors prefer to be involved in trades and investment decisions, which is not possible with mutual funds as a fund manager handles these details.

In summary, investing in mutual funds during a pandemic offers potential diversification and professional management but also carries higher risks and fees. The decision to invest depends on your financial goals, risk tolerance, and investment timeline.

A Guide to Investing in India's Thriving Funds Market

You may want to see also

What are the risks of investing in mutual funds during a financial crisis?

Investing in mutual funds during a financial crisis, such as the COVID-19 pandemic, comes with several risks. Firstly, active equity mutual funds have been known to underperform passive benchmarks net of fees. During the COVID-19 crisis, most active funds underperformed passive benchmarks, contrary to the popular hypothesis that they would make up for their poor performance by excelling during recessions. This means that investors who chose active funds may have experienced lower returns compared to those who opted for passive funds.

Secondly, investing in mutual funds during a financial crisis can be risky due to the potential for insolvency and default. While government-issued bonds are generally considered safer, investing in mutual funds that focus on debt from riskier countries or industries can increase the chance of default and loss. The financial industry's misuse of leverage was a key factor in the 2008 crisis, and while mutual funds have restrictions on the amount of leverage they can use, it still elevates the risk of insolvency during a market downturn.

Thirdly, investing in mutual funds during a financial crisis may result in higher volatility and market downturns. Stocks tend to be more volatile during recessions, and investors may be more inclined to panic sell, locking in losses. It is crucial to take a long-term approach, resist daily portfolio checks, and avoid making rash decisions based on short-term market fluctuations.

Additionally, the level of risk in a mutual fund depends on its underlying investments. Equity or stock funds are generally riskier than fixed-income or bond funds. Specialty mutual funds that focus on emerging markets or specific industries may offer higher potential returns but also carry a greater risk of significant losses.

Finally, it is essential to assess the fund's performance and stability before investing. Evaluating how much the fund's returns fluctuate year-to-year can indicate its risk level. Diversification is key to minimizing risk; investing in a variety of assets and industries can help weather downturns in specific sectors. Consulting a financial advisor to ensure that your investments align with your risk tolerance and financial goals is always a prudent step.

Funding an Investment Account: Strategies for Success

You may want to see also

How do mutual funds compare to other investment options?

Mutual funds are a good investment option for investors who want to diversify their portfolios without having to pick and choose individual investments. They are also a good option for those who want to benefit from the stock market's high average annual returns without having to select individual stocks.

Mutual Funds vs. Stocks

Mutual funds and stocks are both popular types of investments that allow investors to build portfolios and grow their wealth. However, they have some key differences:

- Stocks: Represent shares of ownership in a company. When a company does well, the stock price usually goes up, giving investors the opportunity to sell shares for a profit. Stocks offer the potential for large gains but also come with the risk of large losses. They are easy and low-cost to trade but can be time-consuming to research.

- Mutual Funds: Are pooled investments that contain shares of many different assets, including stocks and bonds. They offer instant diversification, lower risk, and potentially lower costs compared to investing in individual stocks. However, they may also have high fees and can be less tax-efficient.

Mutual Funds vs. Other Investment Options

Mutual funds are just one of many investment options available, including stocks, bonds, real estate, and money market accounts. Here are some key differences between mutual funds and other investment options:

- Bonds: Mutual funds may invest in bonds, which are considered a safer investment than stocks as they provide a more stable rate of return. Bond mutual funds have lower potential returns than stock mutual funds but also lower risk.

- Money Market Funds: Are a type of mutual fund that invests in short-term, high-quality debt. They are considered one of the safest investments but typically offer lower returns than other mutual funds.

- Exchange-Traded Funds (ETFs): Are similar to mutual funds but are not professionally managed. This means they often have lower fees than mutual funds.

- Index Funds: Are a type of mutual fund or ETF that tracks a specific market index, such as the S&P 500. They are passively managed and have low fees.

Factors to Consider

When comparing mutual funds to other investment options, there are several factors to consider:

- Diversification: Mutual funds offer instant diversification, which can help reduce the risk of potential losses.

- Costs and Fees: Mutual funds may have various fees, including expense ratios, sales loads, and management fees. It's important to understand and compare these fees when considering different investment options.

- Risk and Returns: Different types of mutual funds have different levels of risk and potential returns. For example, stock mutual funds have higher potential returns but also higher risk compared to bond mutual funds.

- Investment Horizon: Mutual funds are typically considered a long-term investment, especially equity mutual funds. If you need access to your money in the short term, other investment options may be more suitable.

- Tax Efficiency: Mutual funds may be less tax-efficient than other investment options, as gains from the sale of assets may be taxable even if you haven't sold your mutual fund shares.

In summary, mutual funds offer a relatively hands-off, diversified, and affordable investment option. They are a good choice for investors who want to benefit from the stock market's high average returns without having to select individual stocks. However, it's important to consider the fees, risk, and returns associated with different types of mutual funds and compare them to other investment options before making a decision.

Balanced Funds: Diversified, Stable, and Smart Investment Strategy

You may want to see also

Frequently asked questions

It depends on your financial goals and risk tolerance. While mutual funds are considered a relatively safe investment, active mutual funds have underperformed during the COVID-19 crisis.

Active mutual funds are professionally managed and aim to beat the market. However, they often come with higher fees and have underperformed passive benchmarks during the COVID-19 crisis.

Passive mutual funds, or index funds, aim to mimic the market rather than beat it. They are a more hands-off approach and typically have lower fees than active funds.

It's important to assess your financial goals, risk tolerance, and the overall health of the market. Mutual funds can be a good option for those seeking a diversified investment strategy, but it's crucial to understand the risks and potential returns of any investment before committing.