When it comes to growing your money, you have two main options: saving accounts or mutual funds. Both have their own advantages and disadvantages, and the right choice depends on your financial goals, risk tolerance, and time horizon.

Saving accounts offer a low-risk way to accumulate money with predictable returns. Your money is easily accessible, and there is minimal risk of losing your capital. On the downside, savings accounts typically offer lower returns, which may not even keep up with inflation.

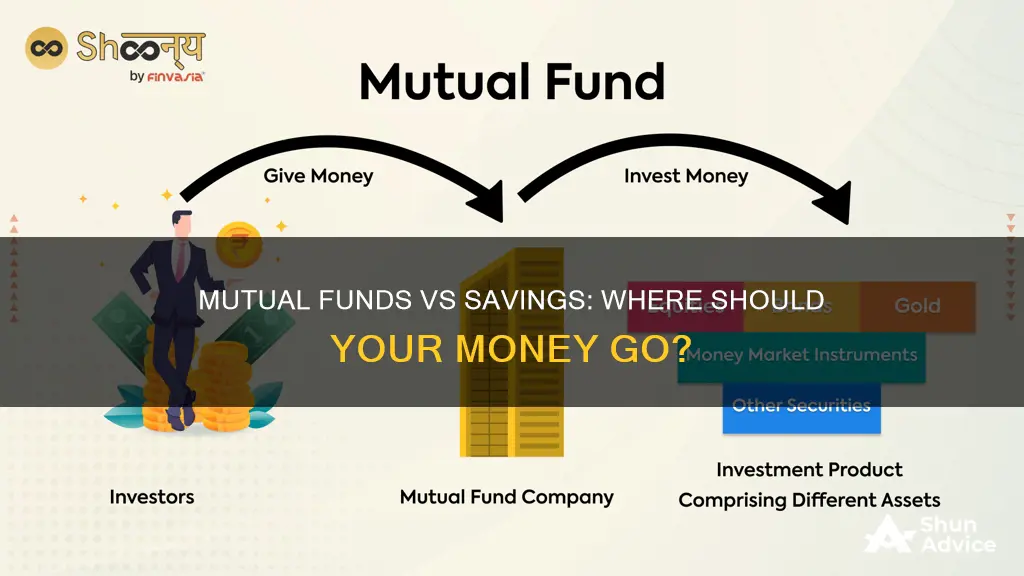

Mutual funds, on the other hand, offer the potential for higher returns and are a good option for long-term goals. By investing in a diversified range of stocks, bonds, or other assets, you can benefit from the historically high average annual returns of the stock market. However, there is a greater risk of losing money, as the value of your investments can fluctuate.

So, should you invest in mutual funds or savings accounts? The answer depends on your personal circumstances. If you have a long investment horizon (10 years or more), are comfortable with risk, and want to grow your wealth, mutual funds could be a good choice. If you need immediate or near-term access to your funds and want to avoid risk, a savings account may be more suitable. Ultimately, it's important to consider your financial goals, risk tolerance, and time horizon when deciding where to allocate your money.

| Characteristics | Values |

|---|---|

| Risk | Mutual funds have a higher risk than savings accounts |

| Returns | Mutual funds have higher potential returns than savings accounts |

| Access | Mutual funds have barriers to access, while savings accounts offer immediate access |

| Purpose | Mutual funds are for growing your money, while savings accounts are for preserving your money |

| Time horizon | Mutual funds are better for long-term goals, while savings accounts are better for short-term needs |

| Volatility | Mutual funds are more volatile than savings accounts |

| Liquidity | Mutual funds are less liquid than savings accounts |

| Fees | Mutual funds have higher fees than savings accounts |

What You'll Learn

Mutual funds vs savings accounts: risk and reward

When deciding whether to put your money into a mutual fund or a savings account, it's important to understand the differences between the two options. Both can be useful tools for achieving your financial goals, but they come with different levels of risk and potential rewards.

Risk

Saving typically carries a lower risk than investing. Savings accounts are FDIC-insured, which means your money is protected up to $250,000 per depositor, per FDIC-insured bank, and per ownership category. Mutual funds, on the other hand, are insured by the Securities Investor Protection Corporation (SIPC) for up to $500,000, including $250,000 in cash. While this provides some protection, there is still a possibility of losing some or all of your investment capital.

Reward

In terms of potential returns, mutual funds offer a higher reward than savings accounts. Savings accounts typically offer low interest rates, and the returns may not even keep up with inflation. Mutual funds, especially stock mutual funds, carry the highest potential rewards. However, it's important to note that higher potential returns also come with higher risk.

Time Horizon

The time horizon for your financial goals is an important factor to consider when choosing between mutual funds and savings accounts. Savings accounts are generally better suited for short-term goals, such as building an emergency fund or saving for a down payment on a house or car. Mutual funds, on the other hand, are better for long-term goals, such as retirement planning or building generational wealth.

Liquidity

Liquidity refers to how easily you can access your money. Savings accounts offer high liquidity, allowing you to withdraw your money at any time. Mutual funds may have penalties or taxes for withdrawing investment gains early, so they are better suited for funds that you can keep invested for the long term.

Fees and Expenses

It's important to consider the fees and expenses associated with each option. Savings accounts typically have low fees, such as maintenance fees or transaction fees. Mutual funds, on the other hand, may have various fees, including expense ratios, management fees, and transaction fees. These fees can eat into your returns over time.

In conclusion, both mutual funds and savings accounts have their advantages and disadvantages. Mutual funds offer higher potential returns but come with higher risk and fees. Savings accounts are generally lower risk and more liquid, but the returns may not keep up with inflation. The best option for you depends on your financial goals, time horizon, and risk tolerance.

A Beginner's Guide to Mutual Funds on 5paisa

You may want to see also

Mutual funds: pros and cons

Mutual funds are a popular investment option, allowing investors to pool their money into a variety of securities, reducing risk through diversification. They are a relatively hands-off investment, making them appealing to those who don't want to pick and choose individual investments but still want to benefit from the stock market's high average annual returns.

Pros

Mutual funds offer several advantages:

- Diversification: Investing in mutual funds allows you to invest in a range of different stocks and bonds from various industries. This reduces your risk compared to purchasing individual securities, as poor performance in one area can be offset by gains in others.

- Small investment amounts: Mutual funds allow for smaller contributions that can grow over time.

- Professional management: Mutual funds are managed by professionals who buy and sell stocks, bonds, etc., on your behalf. This provides advanced portfolio management, which is convenient and can lead to fair pricing.

- Liquidity: Shares can be redeemed on any business day, and mutual funds are priced daily, so you always know the value of your investment.

- Potential for higher-than-average returns: Mutual funds can provide higher-than-average returns compared to other investment options.

Cons

There are also some disadvantages to consider:

- Fees: Mutual funds often have high fees, including sales charges, management fees, and expense ratios, which can eat into your gains.

- Tax implications: Dividends and interest payments are generally considered taxable income, even if you reinvest the money. Profits from the sale of shares are also typically considered taxable income.

- Potential for loss: Mutual funds are not FDIC-insured and may lose principal and fluctuate in value, meaning there is a potential for loss.

- Poor trade execution: Mutual funds may not be suitable for investors looking for faster execution times due to short investment horizons or day trading.

- Lack of control: Some investors prefer to be involved in trades and investment decisions, which is not possible with mutual funds as a fund manager handles these details.

Best Low-Risk UK Funds for Conservative Investors

You may want to see also

Savings accounts: pros and cons

Savings accounts are a good option for those who want to keep their money in a safe and easily accessible place. They are also a good way to develop a culture of saving. Here are some pros and cons of savings accounts to help you decide if it is the right option for you:

Pros of Savings Accounts:

- Earn Interest: Savings accounts often pay interest on the money you deposit. Traditional savings accounts offer a modest annual percentage yield (APY), while online-only savings accounts may pay higher APYs, sometimes 10 times higher than traditional accounts.

- Easy to Open: Many banks offer savings accounts, and they are usually easy to open. In many cases, you can apply and complete the process online within a few minutes.

- Accessible Funds: Savings accounts provide easy access to your money. The money is liquid and isn't tied up for a specific term, as it is in a certificate of deposit (CD). You can often manage your money online and schedule transfers or withdrawals as needed.

- FDIC-insured: If you choose a federally insured bank or credit union, your money in the savings account will be insured for up to $250,000. This means that if the institution goes bankrupt, your money will be safe.

- Low Risk: Savings accounts are considered a safe, low-risk investment. They offer returns without the risk of losing your money, which is not always the case with other types of interest-earning accounts.

- Low Minimum Balance: Savings accounts usually have a low minimum balance requirement, making them an affordable option for many people.

Cons of Savings Accounts:

- Fees: Some financial institutions charge fees, such as monthly fees if your balance drops below the minimum requirement. These fees can reduce your earnings.

- Low APYs: Savings accounts typically have lower interest rates compared to other options like CDs or money market accounts.

- No Tax Benefits: The interest earned from a savings account is taxable in the year it is paid.

- Account Restrictions: Savings accounts often have restrictions such as minimum balance or deposit requirements, withdrawal limits, and limited deposit or withdrawal methods.

- Limited FDIC Insurance: If you plan to keep more than $250,000 in an account, any amount above this limit will not be protected by federal insurance.

- Inflation Risk: If your savings account doesn't offer a competitive interest rate, inflation could reduce the value of your earned interest over time.

Retirement Planning: 401k vs Index Funds

You may want to see also

When to choose a savings account over mutual funds

There are several scenarios in which it would be more beneficial to opt for a savings account over mutual funds. Firstly, if you need access to your money within the next few years, a high-yield savings account is a safer option than investing in mutual funds. This is because investing in the stock market comes with a higher level of risk and volatility, and you could lose money if you need to withdraw your funds during a market downturn.

Secondly, if you don't already have an emergency fund in place, it's advisable to build one up before investing. Financial experts generally recommend having three to six months' worth of expenses set aside in an emergency fund. This will ensure that you have a financial cushion to fall back on if you encounter unexpected costs or a loss of income. High-yield savings accounts are well-suited for this purpose, as they offer easy access to your money without the risk of losing your principal.

Thirdly, if you have high-interest debt, such as credit card balances, it's advisable to prioritise paying off this debt before investing. This is because the interest rates on credit cards and other forms of high-interest debt are typically much higher than the returns you could expect to earn from mutual funds. By paying off this debt first, you'll save money in the long run.

Finally, if you're saving for a specific short-term goal, such as a down payment on a house or car, a large upcoming expense, or a vacation, it's generally better to use a savings account. This is because you want to avoid the risk of losing money in the stock market right before you need to withdraw your funds. Savings accounts provide a safe and easily accessible place to park your money in the short term.

Best Mutual Funds for One-Time Investments: Where to Invest?

You may want to see also

When to choose mutual funds over a savings account

Mutual funds and savings accounts are both useful tools for achieving different financial goals. While mutual funds are a type of investment that pools money from multiple investors to purchase stocks, bonds, or other assets, savings accounts are a safe and accessible way to store money in a bank or credit union. Here are some scenarios where choosing mutual funds over a savings account may be more advantageous:

- Long-term goals: Mutual funds are typically better suited for long-term financial goals, such as retirement planning or building generational wealth. They offer the potential for higher returns over time, making them ideal for goals that are at least three to five years away. This allows for a greater likelihood of recovery if the investment's value decreases.

- Risk tolerance: If you have a higher risk tolerance and are comfortable with potential fluctuations in your investment value, mutual funds can provide the opportunity for higher returns. While there is no guarantee of returns, mutual funds historically tend to outperform savings accounts after considering fees.

- Diversification: Mutual funds offer instant diversification as they invest in a collection of companies or assets. This diversification can help spread risk and is especially beneficial if you want to invest in the stock market but prefer a more hands-off approach.

- Compound interest: Mutual funds benefit from compound interest, which can lead to significant growth over time. This makes them a powerful tool for building wealth, especially for long-term goals.

- Professional management: Many mutual funds are actively managed by financial professionals who research and make investment decisions on your behalf. This can be advantageous if you don't have the time or expertise to manage your investments actively.

- Tax advantages: Certain types of mutual funds, such as retirement accounts (IRAs, 401(k)s) and 529 savings plans for education, offer tax advantages. These accounts allow you to contribute pre-tax income, defer taxes on investment earnings, or provide tax breaks on contributions.

However, it's important to remember that mutual funds come with higher risk and usually have associated fees, such as expense ratios and management fees. Therefore, it's crucial to carefully consider your financial goals, risk tolerance, and time horizon before choosing between mutual funds and a savings account.

Indexed Funds: Smart Investment or Risky Business?

You may want to see also

Frequently asked questions

The pros of saving are that it's safe, easy to do, and you can access the funds quickly. The cons are that the returns are low, and you may lose purchasing power over time due to inflation.

The pros of investing are that it has the potential for higher returns, and it's likely to beat inflation over long periods of time. The cons are that there is a good chance you will lose money in the short term, and fees can be higher.

Saving is for preserving your money, while investing is for growing it. When you save money, you earn a steady amount of interest, and your principal remains intact. When you invest, your returns can fluctuate daily. Additionally, you can withdraw savings from a bank account at any time, whereas money invested through a brokerage or retirement account may have some barriers to access.