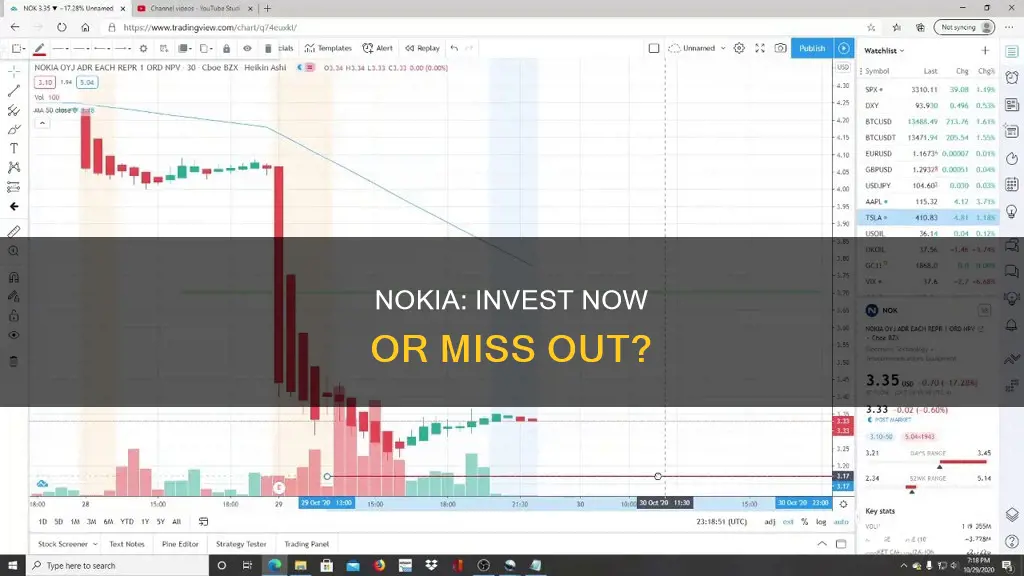

Investing in Nokia right now is a risky move. The company has shown significant recent growth, but this may not be sustainable. In January 2021, Nokia's stock skyrocketed, rising from $3.85 on January 1 to a high of $9.79 on January 27. This unprecedented surge in value was driven by the Reddit group WallStreetBets, which targeted highly shorted stocks such as GameStop. While there may be room for further growth, Nokia's stock could also crash rapidly and without warning.

Nokia is a Finnish technology company that provides software and telecom-grade networking equipment on a global scale. It is well-positioned to take advantage of the transition to 5G technology, having achieved 100 5G deals and 160 commercial 5G engagements. However, it has faced challenges in recent years, including losing a $6.6 billion contract with Verizon Communications to Samsung for the supply of 5G equipment.

Before investing in Nokia, it is crucial to do your own research and understand the risks involved.

| Characteristics | Values |

|---|---|

| Current Stock Price | $4.73 |

| 52-Week High | $9.79 |

| 52-Week Low | $3.85 |

| Market Capitalization | $26.46 billion |

| Price-to-Earnings Ratio | N/A |

| Dividend Yield | N/A |

| Revenue Growth | -3% |

| Earnings Growth | N/A |

| Profit Margin | N/A |

| Return on Equity | N/A |

| Debt-to-Equity Ratio | N/A |

| Recommendation | Hold |

What You'll Learn

Pros and cons of investing in Nokia

Pros of investing in Nokia:

Nokia is a Finnish technology company that provides state-of-the-art software and network equipment on a global scale. As the world transitions to 5G technology, Nokia is well-positioned to take advantage of this change as a global leader in the market for 5G wireless carrier equipment. Nokia has achieved a significant footprint in all of the world's early 5G adopter markets, including deals with the top four communication service providers in the United States and the top three providers in Japan and Korea.

Nokia has also been identified as a stock that Reddit users are hyping, similarly to Gamestop. This has resulted in a surge of interest in the stock, with its share price skyrocketing in January 2021, rising from $3.85 on January 1 to a high of $9.79 on January 27.

Cons of investing in Nokia:

Nokia has been dealing with significant difficulties over the last several quarters, including losing a $6.6 billion contract with Verizon Communications to Samsung for the supply of 5G equipment. This highlighted Nokia's declining competitiveness due to issues in integrating acquisitions and aligning research and development with customers' demands.

Nokia's stock has shown significant recent growth, and there is a risk that it could crash down in value rapidly and with little notice. Additionally, Nokia's transformation plan to improve its competitiveness will span over several years, and there are uncertainties related to the company's late start in this multiyear plan.

Who Invests and Why?

You may want to see also

Nokia's 5G market position

However, Nokia has also made strides towards improving its 5G market position. In 2023, the company reported sales growth and profitability across all its major business units, with sales rising 16% year-over-year in the final quarter of 2022 to about €7.4 billion. The network infrastructure unit, made up of former Alcatel parts, was a key driver of this growth. Nokia's mobile unit, responsible for about 40% of revenues, also showed improvement, with fourth-quarter sales growing by 7%.

Nokia has recognised the need to better align its investments and focus on areas where it can lead and generate profits. The company has committed to investing more in research and development, which had previously suffered from a lack of investment. In 2022, Nokia spent nearly €4.6 billion in this area, an 11% increase compared to 2020.

In addition, Nokia has undergone management reshuffles to position the company for the 5G telecoms era. The company merged its mobile networks and fixed networks business groups into a new unit called Access Networks, aiming to improve customer focus and simplify its management structure.

While Nokia has made progress, it faces strong competition from rivals such as Ericsson and China's Huawei. Ericsson has been ramping up its research and development efforts and has gained market share outside China. As of 2020, Nokia's mobile and network infrastructure businesses were less profitable than Ericsson's, with lower gross and operating margins.

Overall, while Nokia has faced challenges, it is working to improve its 5G market position by investing in research and development, streamlining its management structure, and capitalising on sales growth. However, strong competition and industry headwinds may impact its ability to gain market share in the 5G space.

Investment Advisor: Helping People Navigate Finances

You may want to see also

Nokia's history and current standing

Nokia Corporation is a Finnish multinational telecommunications, information technology, and consumer electronics company established in 1865. The company has a long history of innovation, from developing the first GSM call and text message technology to creating the first 3G network. It has operated in various industries over the past 150 years, initially founded as a pulp mill and later focusing on large-scale telecommunications infrastructure, technology development, and licensing.

In the late 2000s, Nokia faced a series of challenges due to poor management decisions, which led to a sharp drop in its share of the mobile phone market. Despite these setbacks, Nokia continued to be a significant player in the industry, and in 2014, Microsoft bought Nokia's mobile phone business, incorporating it as Microsoft Mobile. After the sale, Nokia shifted its focus to telecommunications infrastructure and Internet of Things technologies.

In recent years, Nokia has made strategic acquisitions, such as purchasing Alcatel-Lucent, including its Bell Labs research organization, and partnering with HMD Global to re-enter the mobile phone market. In 2020, Nokia announced Pekka Lundmark as its new CEO, and the company is currently accelerating its carbon neutrality target by 10 years to 2040.

Nokia is recognised as a leader in 5G infrastructure, although it has faced challenges in maintaining its competitiveness due to issues with integrating acquisitions and aligning research and development with customer demands. The company has a strong presence in over 100 countries and continues to be a major patent licensor for large mobile phone vendors.

With its long history of innovation and recent strategic moves, Nokia is positioning itself for future growth and success in the telecommunications industry. However, investors should carefully consider the risks and uncertainties associated with the company's late start in its multiyear plan to improve competitiveness before making investment decisions.

Wealth Management: Helping Clients Build Investment Portfolios

You may want to see also

How to buy Nokia stock

Should I invest in Nokia right now?

There are a few things to consider before investing in Nokia. Firstly, while Nokia is still a multi-billion-dollar tech giant, it is no longer the mobile phone powerhouse it once was, with Samsung and Apple now dominating the global mobile phone market. However, Nokia has been actively involved in the telecommunications scene, particularly in the 5G venture, and has interests in other sectors like consumer electronics and information technology.

Nokia's stock price has seen a significant decline since its all-time high in 2007, when shares were valued at just under 27 EUR. As of early 2020, the same shares were trading within the 3-4 EUR range, which amounts to a stock price downfall of over 85%.

However, Nokia has diversified into new markets, including software, digital health services, and the internet of things (IoT). The company's primary revenue streams as of Q2 2020 were its presence in the mobile network infrastructure space and licensing the Nokia brand name to third-party products and services.

Nokia has also been working to improve its competitiveness in the 5G market by better aligning its investments and focusing on areas where it can lead and generate profits. The company has announced new partnerships with companies like Intel and Marvell to accelerate its 5G journey, and Nokia stands to benefit from the projected growth in global sales of 5G kits, which are expected to surpass $4 billion in 2021.

On the other hand, Nokia faces fierce competition in the 5G race from companies like Huawei and Ericsson, and its 5G and network business has faced significant difficulties in recent quarters, including losing a $6.6 billion contract with Verizon Communications.

Now that we've discussed some of the considerations for investing in Nokia, here is a step-by-step guide on how to buy Nokia stock on a trading platform:

Step 1: Find an Online Broker

Since Nokia is listed on the Stockholm Stock Exchange, you will need to find an online broker that gives you access to Sweden- or Finland-based companies. One option is Plus500, a specialist CFD platform that allows you to place more sophisticated trades with leverage.

Step 2: Open an Account and Fund It

Once you've chosen a broker, you will need to open an account and fund it with a minimum deposit. For example, Plus500 requires a minimum deposit of $100 and accepts payments via debit/credit card, PayPal, and bank wire.

Step 3: Search for Nokia Stock

At the top of your broker's trading platform, there should be a search box. Enter 'Nokia' and click on the corresponding result.

Step 4: Click on 'Trade'

To go to the Nokia trading page, click on the 'Trade' button.

Step 5: Set Up Your Order and Buy Nokia Stock

After clicking on the trade icon, set up the trade parameters:

- Amount: The amount you wish to invest in Nokia stock, usually in US dollars.

- Set Rate: It is best to leave this as a 'market order' so that your trade is executed at the next available price.

- Stop Loss: Set up a stop-loss order if you want to sell your Nokia stocks automatically when they hit a certain price to mitigate losses.

- Take Profit: Set up a take-profit order to lock in a profit target.

- Finally, click on 'Buy' to complete your Nokia stock order.

When Investors Stop Investing

You may want to see also

Nokia's competitors

Google, Apple, and Samsung are well-known technology giants with a diverse range of products and services. Siemens is a large industrial manufacturing company with a strong presence in the electronics and electrical equipment industry. BlackBerry, once a popular smartphone manufacturer, has since transitioned to a software company, offering solutions in the field of cybersecurity and autonomous vehicles.

Telefonica, NEC, Huawei, Ericsson, and ZTE are all companies that operate within the telecommunications and information technology sectors, providing network solutions, electronics, and smart devices.

In the context of investing in Nokia, it is worth considering the competitive landscape in which the company operates. While Nokia has a strong presence in the 5G infrastructure market, it has faced challenges due to late investments in 5G and networks. Competitors like Ericsson have gained market share by ramping up research and development efforts earlier. Nokia's delayed response to evolving market demands has resulted in a decline in competitiveness, as evident from losing a significant contract with Verizon Communications to Samsung.

Therefore, when considering an investment in Nokia, it is crucial to carefully assess the company's ability to maintain its market position and adapt to industry changes in the face of strong competition.

Investments: Where Does the Money Go?

You may want to see also

Frequently asked questions

Nokia's stock price has fluctuated in 2024, trading at £4.73 on 25 January and rising to £9.79 on 27 January.

As the world transitions to 5G technology, Nokia is well-positioned to take advantage of this shift. With its recent deal-making prowess, Nokia could be an interesting long-term investment for those looking to invest in the rapidly expanding 5G space.

Nokia stock has shown significant recent growth, which may not be sustainable. The current increase in price continues to gain media attention, and the stock could crash down in value rapidly and with little notice.

Headquartered in the greater Helsinki, Finland area, Nokia was founded in 1865 and now employs over 100,000 people in over 100 countries. The company has transformed from a mobile phone manufacturer to a global leader in 5G wireless carrier equipment.

Analysts at SEB, one of the largest financial institutions in Scandinavia, rate Nokia stock as a buy. They argue that Nokia's stock is undervalued compared to its Swedish rival LM Ericsson, and they expect Nokia to reinstate its dividend policy.