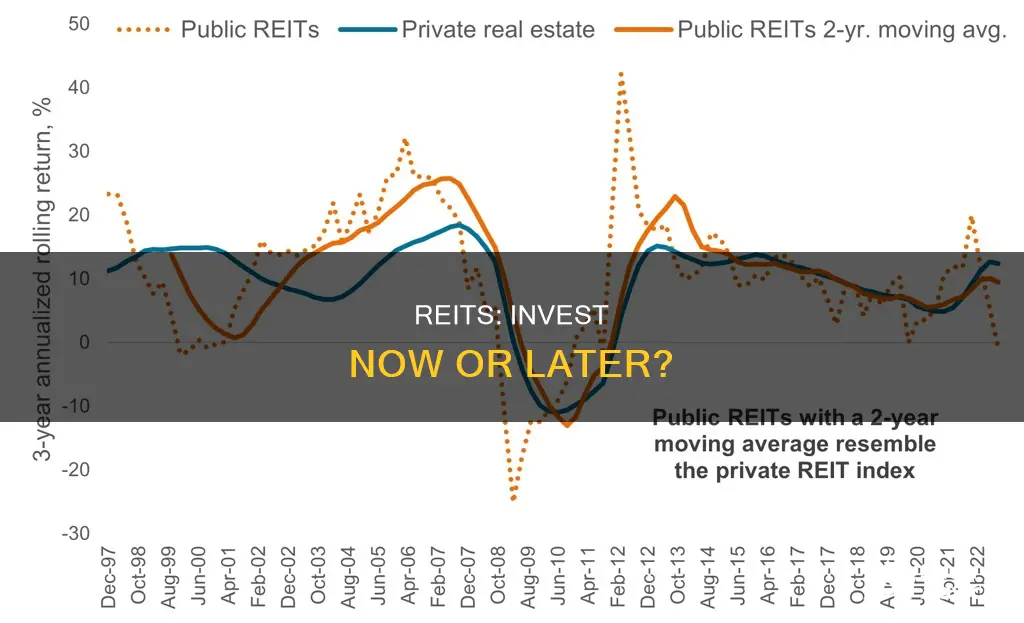

Real Estate Investment Trusts (REITs) are a good investment option for those looking to diversify their portfolio and gain exposure to the real estate market. REITs are companies that own, finance, or manage income-producing real estate, and they are required by law to distribute most of their income to investors as dividends.

REITs have historically delivered competitive returns, based on high dividend income and long-term capital appreciation. They are also an excellent portfolio diversifier, helping to reduce overall risk and increase returns.

However, it's important to note that REITs are not without their risks. They may have inconsistent returns, be sensitive to interest rate changes, and be subject to income taxes. Additionally, some REITs may not be liquid, and fees can impact total returns.

Overall, REITs can be a good investment option, but investors should carefully consider the pros and cons before making any decisions.

| Characteristics | Values |

|---|---|

| Returns | REITs have historically delivered competitive total returns, based on high, steady dividend income and long-term capital appreciation. |

| Correlation with other assets | Their comparatively low correlation with other assets makes them an excellent portfolio diversifier that can help reduce overall portfolio risk and increase returns. |

| Dividends | REITs are total return investments, providing high dividends plus the potential for moderate, long-term capital appreciation. |

| Liquidity | Shares of publicly listed REITs are readily traded on the major stock exchanges. |

| Transparency | REITs are monitored by independent directors, analysts and auditors, as well as the business and financial media, providing investors with a measure of protection and insight into their financial condition. |

| Tax implications | REIT dividends are taxed as ordinary income. |

| Interest rate sensitivity | REITs are sensitive to interest rate changes, which can impact their share prices and the cost of debt to finance properties. |

| Management | The choice of REIT manager can significantly impact portfolio performance. |

What You'll Learn

High dividend yields

Real estate investment trusts (REITs) are an attractive option for investors seeking regular income in the form of high dividend yields. By law, REITs are required to distribute at least 90% of their taxable income to shareholders annually, resulting in substantial dividend payments.

REITs provide investors with access to the real estate market and offer a stable stream of income through a variety of market conditions. They are also a good portfolio diversifier due to their low correlation with other stocks and bonds, helping to reduce overall portfolio risk and volatility.

- Competitive Long-Term Performance: REITs have historically delivered total returns comparable to those of other stocks, providing a steady income source.

- Stable Dividend Yields: The dividend yields of REITs have remained consistent, even during market fluctuations, ensuring a reliable income for investors.

- Liquidity: Shares of publicly listed REITs are easily traded on major stock exchanges, providing investors with the flexibility to buy and sell.

- Transparency: REITs are monitored by independent entities, providing investors with performance insights and a measure of protection.

- Portfolio Diversification: REITs offer exposure to the real estate market and help reduce the overall risk associated with investing in a single asset class.

- Retirement Planning: The steady dividend income from REITs makes them a valuable investment option for retirement savers and retirees who rely on a consistent income to meet their expenses.

- Tax Considerations: While REITs themselves don't pay corporate taxes, investors are taxed on the dividends they receive, unless the REITs are held in a tax-advantaged account, such as an IRA.

- Risk Management: REITs are sensitive to interest rate changes, and certain types of REITs, such as those investing in hotels, may perform poorly during economic downturns. Therefore, it is essential to assess the fundamentals and ensure that high dividend yields are sustainable.

In summary, REITs offer high dividend yields, making them a compelling investment option for those seeking regular income and portfolio diversification. However, it is important to carefully evaluate the risks and tax implications associated with REIT investments.

Investments: Are They for Everyone?

You may want to see also

Long-term capital appreciation

Real Estate Investment Trusts (REITs) have historically delivered competitive total returns, based on high, steady dividend income and long-term capital appreciation.

REITs are total return investments, providing high dividends and the potential for moderate, long-term capital appreciation. Long-term total returns of REIT stocks tend to be similar to those of value stocks and more than the returns of lower-risk bonds.

REITs are an important investment for retirement savers and retirees due to their strong dividend income. They are required to distribute at least 90% of their taxable income to their shareholders annually, and these dividends are fuelled by the stable stream of contractual rents paid by tenants.

REITs have also been shown to provide competitive long-term performance, with returns similar to those of other stocks. They have produced substantial, stable dividend yields through a variety of market conditions.

Long-term Performance

REITs have historically delivered competitive long-term performance, with returns similar to those of other stocks. From 1972 to 2019, REITs returned an average total annual return of 11.8% compared to the S&P 500's 10.6%.

Dividend Yields

REITs provide substantial and stable dividend yields, making them attractive for investors seeking a steady income stream. The high dividends are a result of the requirement to distribute at least 90% of taxable income to shareholders.

Liquidity

Shares of publicly listed REITs are readily traded on major stock exchanges, providing investors with easy access to buy and sell.

Transparency

REITs are subject to oversight by independent directors, analysts, and auditors, and the business and financial media. This provides investors with protection and multiple barometers to assess a REIT's financial condition.

Portfolio Diversification

REITs offer access to the real estate market and are known for their low correlation with other stocks and bonds. This helps to reduce overall portfolio risk and increase returns.

In summary, REITs have a strong track record of delivering long-term capital appreciation, competitive returns, and stable dividend yields. They are a valuable option for investors seeking diversification, steady income, and long-term capital growth.

NPS: Invest Now or Miss Out

You may want to see also

Portfolio diversification

Real estate is an important asset class that every investor should consider owning as part of a well-diversified portfolio. REITs have historically provided investors with an efficient way to diversify their investments, reduce risk, and increase long-term returns.

Reducing Risk

REITs are a good portfolio diversifier because they are a distinct asset class with a low-to-moderate correlation with other sectors of the stock market, as well as bonds and other assets. This means that REIT returns tend to be uncorrelated with the returns of other assets, smoothing a portfolio's overall volatility.

Increasing Returns

Investors who diversify their portfolios have historically had a better chance of ending up with higher returns. REITs have delivered competitive total returns, based on high, steady dividend income, and long-term capital appreciation.

Liquidity

Shares of publicly listed REITs are readily traded on major stock exchanges, providing liquidity to investors.

Transparency

Listed REITs are monitored by independent directors, analysts, auditors, and the business and financial media, providing investors with a measure of protection and insight into the REIT's financial condition.

Access to Real Estate Market

REITs offer investors access to the real estate market, which may otherwise be difficult to access for those without the ability to purchase commercial real estate directly.

Other Considerations

REITs are sensitive to interest rates, and their prices tend to fall when the Federal Reserve raises interest rates. Additionally, there are property-specific risks associated with different types of REITs, such as hotel REITs performing poorly during economic downturns.

Delinquent Debt: Invest Wisely

You may want to see also

Low correlation with other stocks

Real estate investment trusts (REITs) are an excellent way to diversify your portfolio due to their low correlation with other stocks. This means that they can help reduce overall portfolio risk and increase returns.

REITs are total return investments that provide high dividends and the potential for moderate, long-term capital appreciation. They are required by law to distribute at least 90% of their taxable income to investors as dividends, which are fuelled by the stable stream of contractual rents paid by tenants. This makes them an important investment for retirement savers and retirees who require a continuing income stream to meet their living expenses.

The relatively low correlation of listed REIT stock returns with the returns of other equities and fixed-income investments makes them a good portfolio diversifier. REIT returns tend to "zig" when those of other investments "zag", reducing a portfolio's overall volatility and improving its returns for a given level of risk.

For example, during the 2000–2002 stock market slump, REITs delivered highly positive returns, while during the 2008 crash and subsequent rebound in 2009, they performed almost identically to stocks. This shows that it's tough to predict how REITs will perform during future stock market crashes, but their low correlation with other stocks can help to smooth out the overall performance of your portfolio.

In addition, most REITs are less volatile than the S&P 500, with some only half as volatile as the market at large. This is because they are less sensitive to market turmoil, as their cash flow drivers come from the real estate market cycle rather than the business cycle that drives most non-REIT stocks. The real estate market cycle has an average duration of 18 years, compared to just four years for the business cycle. This dramatic difference helps to diversify your portfolio and reduce risk.

Overall, the low correlation of REITs with other stocks makes them an attractive investment option for those looking to diversify their portfolio, reduce risk, and increase returns.

Investments: Where People Put Their Money

You may want to see also

Liquidity

REITs are companies that own or finance income-producing real estate. They are traded on major stock exchanges and can be bought and sold daily, providing an efficient way to invest in real estate. This ease of buying and selling REITs means that investors can quickly convert their investment into cash if needed.

Publicly traded REITs are the most liquid type of REIT. They are traded on exchanges like stocks and ETFs, and investors can buy and sell them through ordinary brokerage accounts. In contrast, non-traded REITs are illiquid and may not be sold for at least ten years.

The liquidity of REITs also makes them a good diversification tool for investors' portfolios. They can be used to reduce an investor's risk profile without negatively impacting returns.

However, it is important to note that the liquidity of a REIT investment can depend on the specific type of REIT and the broader market conditions. For example, during the COVID-19 pandemic, empty office spaces and the shift to remote work may have impacted investors' confidence in REITs, particularly those investing in office spaces.

Overall, the liquidity of REITs is a significant advantage for investors, providing an accessible way to invest in real estate and the flexibility to buy and sell as needed.

Dubai's Investment Trends

You may want to see also

Frequently asked questions

REITs offer investors several benefits, including competitive long-term performance, attractive income through dividends, liquidity, transparency, diversification, and lower overall risk.

You can invest in REITs by opening a brokerage or investment account and purchasing shares in a REIT, similar to buying stocks. You can also invest in REIT mutual funds or exchange-traded funds (ETFs) that focus on REITs.

REITs are not risk-free. They may have inconsistent and variable returns, are sensitive to interest rate changes, may be illiquid, and can be affected by fees and management quality. Additionally, REIT dividends are taxed as ordinary income.

REITs have historically performed well compared to stocks and bonds, especially over long periods. They offer higher dividend yields and can act as a hedge against the volatility of other asset classes.

There are three main categories of REITs: equity REITs, mortgage REITs, and hybrid REITs. Equity REITs operate like landlords and own the underlying real estate. Mortgage REITs invest in debt securities backed by properties. Hybrid REITs combine both strategies. The choice depends on your investment objectives and risk tolerance.