Considering whether to invest in short-term reserves can be a crucial decision for anyone looking to manage their finances effectively. Short-term reserves are typically low-risk investments designed to provide liquidity and safety for your money while also offering a small return. These reserves are ideal for those who want to keep their funds accessible for immediate needs or short-term goals, such as a down payment on a house, a car purchase, or covering unexpected expenses. They can also serve as a safety net during economic downturns or market volatility. Understanding the benefits and potential risks of short-term investments is essential to making an informed decision about your financial strategy.

What You'll Learn

- Risk Management: Assess potential risks and benefits of short-term investments

- Market Volatility: Understand how short-term reserves handle market fluctuations

- Liquidity Needs: Evaluate the need for quick access to funds

- Interest Rates: Consider the impact of rates on short-term investment returns

- Diversification: Explore how short-term reserves fit into a broader investment strategy

Risk Management: Assess potential risks and benefits of short-term investments

When considering short-term investments, it's crucial to approach them with a comprehensive risk management strategy. Short-term investments are typically those with a maturity period of less than one year, designed to provide liquidity and potential returns in the near term. However, they come with their own set of risks and benefits that investors should carefully evaluate.

One of the primary risks associated with short-term investments is market volatility. These investments are often sensitive to market fluctuations, and their value can change rapidly. For instance, if you invest in short-term bonds or money market funds, a sudden market downturn could lead to a decrease in the value of your investment. This volatility can be a concern for risk-averse investors who prefer more stable, long-term options. To mitigate this risk, investors should consider diversifying their short-term portfolio across various assets to reduce the impact of any single investment's performance.

Another risk to consider is the potential for lower returns compared to longer-term investments. Short-term investments often offer lower yields because they provide a quick source of capital for investors seeking immediate access to their funds. This can be a trade-off for those seeking higher returns, as short-term investments may not provide the same level of growth potential as stocks or longer-term bonds. Investors should carefully assess their risk tolerance and financial goals to determine if the potential returns justify the risks.

On the benefits side, short-term investments offer liquidity, allowing investors to access their funds relatively quickly. This is particularly useful for those who need a reserve for unexpected expenses or short-term financial goals. Additionally, short-term investments can provide a hedge against longer-term market risks. For example, investing in short-term bonds can offer a safe haven during economic downturns, as these investments are often considered less risky than stocks.

In risk management, it's essential to strike a balance between risk and reward. Short-term investments can be a valuable tool in a well-diversified portfolio, providing a mix of liquidity, safety, and potential returns. However, investors should carefully assess their financial situation, risk tolerance, and investment goals before committing to short-term reserves. Conducting thorough research and seeking professional advice can help investors make informed decisions, ensuring that their short-term investments align with their overall financial strategy.

Mastering Long-Term Investing: Strategies to Outpace Inflation

You may want to see also

Market Volatility: Understand how short-term reserves handle market fluctuations

Market volatility can be a significant concern for investors, especially those looking to protect their capital in the short term. Short-term reserves, often in the form of money market funds or high-yield savings accounts, are designed to provide a safe haven during these turbulent times. When the market takes an unexpected turn, these reserves offer a layer of security, ensuring your money remains accessible and relatively protected from the immediate impact of market fluctuations.

The primary advantage of short-term reserves is their liquidity. These investments are typically highly liquid, meaning they can be quickly converted into cash without significant loss. This is crucial when markets become volatile, as it allows investors to act swiftly without being tied down by illiquid assets that might lose value during a market downturn. For instance, if you have a short-term reserve, you can quickly sell it to cover unexpected expenses or take advantage of a sudden market opportunity without the risk of losing a substantial portion of your investment.

In times of market volatility, short-term reserves can also provide a sense of stability and peace of mind. Knowing that your money is in a secure, easily accessible form can reduce stress and anxiety. This is particularly important for those who prefer a more conservative investment approach or have a short-term financial goal, such as saving for a down payment on a house or funding a child's education. By keeping a portion of your portfolio in short-term reserves, you can ensure that you have the financial flexibility to handle unexpected events without compromising your long-term investment strategy.

However, it's important to note that short-term reserves are not without their trade-offs. While they offer safety and liquidity, they often come with lower returns compared to more aggressive investment options. Money market funds, for example, typically offer slightly higher interest rates than traditional savings accounts but still provide a low-risk environment. This means that while your money is protected, it may not grow as rapidly as it would in riskier, long-term investments.

In conclusion, understanding how short-term reserves can help manage market volatility is essential for anyone considering this investment strategy. It provides a safety net during turbulent market conditions, ensuring your capital remains accessible and relatively secure. By carefully considering the balance between liquidity, safety, and potential returns, investors can make informed decisions about whether short-term reserves are a suitable component of their investment portfolio.

The Long-Term Viability of Land as an Investment: Exploring Opportunities and Risks

You may want to see also

Liquidity Needs: Evaluate the need for quick access to funds

When considering whether to invest in short-term reserves, it's crucial to evaluate your liquidity needs, which refer to the requirement for quick access to funds. This evaluation is essential to ensure that your investment strategy aligns with your financial goals and obligations. Here's a detailed breakdown of how to assess your liquidity requirements:

- Emergency Funds: One of the primary purposes of short-term reserves is to provide a safety net for emergencies. Consider your potential short-term financial obligations, such as unexpected medical bills, car repairs, or home maintenance. Calculate the estimated costs of these potential emergencies and determine how much you need to set aside to cover them. Having a dedicated fund for emergencies ensures that you don't have to rely on high-interest credit or deplete your long-term savings.

- Short-Term Financial Goals: Evaluate your short-term financial goals, such as saving for a down payment on a house, funding a child's education, or starting a business. These goals often require a specific amount of money to be set aside in the near future. Assess the timeline for these goals and calculate the total amount needed. By investing in short-term reserves, you can ensure that you have the necessary funds available when the time comes without disrupting your long-term investment strategy.

- Business Operations: If you own a business, short-term reserves are vital for maintaining smooth operations. Consider the cash flow cycle of your business, including accounts payable, inventory management, and customer payments. Ensure that you have sufficient funds to cover short-term expenses, such as supplier payments, rent, or payroll. Adequate liquidity reserves can help your business withstand fluctuations in cash flow and provide a buffer during slow periods.

- Debt Management: Assess your short-term debt obligations, such as credit card balances, personal loans, or outstanding bills. Determine the total amount you need to pay off within the next few months. By investing in short-term reserves, you can avoid the penalties and interest associated with late payments and ensure that your debt is managed effectively.

- Investment Strategy: Consider your overall investment strategy and the time horizon for your investments. If you have a long-term investment plan, short-term reserves can provide a safe haven for funds that need quick access. Diversify your short-term investments to ensure liquidity and potential growth. This approach allows you to maintain control over your financial decisions while also providing a safety net for unexpected needs.

By carefully evaluating your liquidity needs, you can make an informed decision about investing in short-term reserves. It ensures that you have the necessary funds readily available, whether for personal emergencies, financial goals, business operations, or debt management. Remember, a well-planned liquidity strategy contributes to a more secure and stable financial future.

Tesla's Long-Term Potential: A Sustainable Investment?

You may want to see also

Interest Rates: Consider the impact of rates on short-term investment returns

When considering short-term investments, understanding the role of interest rates is crucial. Interest rates directly influence the returns on these investments, and being aware of this relationship can help you make more informed financial decisions. Here's a detailed breakdown of how interest rates impact short-term investment returns:

Understanding Interest Rates:

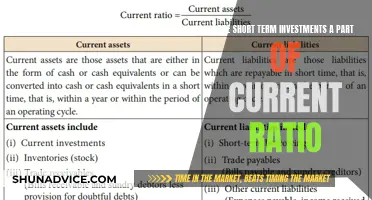

Interest rates represent the cost of borrowing money and the reward for lending it. They are typically expressed as a percentage and can vary depending on the type of investment and the market conditions. When interest rates rise, borrowing becomes more expensive, and lending becomes more attractive. Conversely, when rates fall, borrowing becomes cheaper, potentially impacting the returns on short-term investments.

Impact on Short-Term Investments:

- Fixed-Income Securities: Short-term fixed-income investments, such as treasury bills or certificates of deposit (CDs), are particularly sensitive to interest rate changes. When rates rise, the value of existing fixed-income securities may fall because new investments offer higher returns. This can result in a loss if you sell your securities before maturity. On the other hand, rising rates can also lead to higher returns on new investments, making them more attractive.

- Money Market Accounts: These are a type of short-term investment that typically offers higher interest rates than traditional savings accounts. When interest rates increase, money market account providers may raise their rates to remain competitive. This can lead to higher returns for investors, especially those with large balances.

- High-Yield Savings Accounts: Similar to money market accounts, high-yield savings accounts offer competitive interest rates. With rising interest rates, these accounts can provide more attractive returns, making them a viable option for short-term savings.

Strategic Considerations:

- Rate Sensitivity: Be mindful of the duration of your short-term investments. Longer-term investments may be more affected by interest rate fluctuations. If you plan to invest for a short period, consider more liquid options that can be easily converted to cash without significant loss.

- Market Timing: Keep an eye on economic indicators and central bank announcements to anticipate interest rate changes. If you believe rates will rise, you might consider investing in fixed-income securities with longer maturity dates to benefit from potential future rate increases.

- Diversification: Diversifying your short-term investments across different types of assets can help mitigate the impact of interest rate changes. For example, combining fixed-income securities with money market funds or high-yield savings accounts can provide a balance between stability and potential returns.

In summary, interest rates play a significant role in shaping the returns on short-term investments. Rising rates can offer higher returns on new investments but may also impact the value of existing securities. Understanding these dynamics allows investors to make strategic choices, ensuring their short-term reserves are aligned with their financial goals and risk tolerance.

Square's Long-Term Investment Potential: A Deep Dive

You may want to see also

Diversification: Explore how short-term reserves fit into a broader investment strategy

When considering short-term reserves as part of your investment strategy, it's essential to understand how they contribute to a well-diversified portfolio. Diversification is a key principle in investing, aiming to spread risk across various asset classes to minimize potential losses. Short-term reserves, often in the form of cash or highly liquid assets, play a unique role in this context.

In a diversified investment approach, short-term reserves act as a strategic tool to maintain liquidity and ensure financial flexibility. These reserves are typically held in assets that can be quickly converted into cash with minimal impact on their value. Examples include money market funds, high-yield savings accounts, or even a portion of your portfolio in cash. The primary goal is to have readily available funds that can be utilized for various purposes, such as taking advantage of investment opportunities, covering unexpected expenses, or managing cash flow during market fluctuations.

By holding short-term reserves, investors can ensure they have a safety net while still participating in the market. This strategy allows for a more dynamic approach to investing, enabling individuals to react promptly to market changes or seize emerging opportunities. For instance, if a diversified portfolio includes both stocks and bonds, short-term reserves can be used to quickly capitalize on a sudden market dip or to provide immediate funds for a potential investment in a growing sector.

Furthermore, short-term reserves contribute to diversification by reducing the overall risk exposure. When a portion of your portfolio is in highly liquid assets, it becomes easier to manage cash flow and maintain a balanced approach. This is especially important during volatile market conditions, where having accessible funds can help investors stay invested and potentially benefit from market recovery.

Incorporating short-term reserves into your investment strategy requires careful consideration of your financial goals, risk tolerance, and time horizon. It is a strategic decision that can enhance your overall investment approach, providing both liquidity and the ability to adapt to changing market conditions. Diversification, with short-term reserves as a key component, allows investors to navigate the market with a sense of control and confidence.

Unlocking Long-Term Wealth: A Comprehensive Guide to Smart Investing

You may want to see also

Frequently asked questions

Short-term reserves refer to liquid assets or funds that are easily accessible and held for a short duration, typically within a year. These can include cash, cash equivalents, and highly liquid investments like money market funds, certificates of deposit (CDs), and treasury bills.

Investing in short-term reserves is often a strategy for individuals seeking a safe and liquid option to meet their short-term financial goals. It provides a way to keep money accessible while also earning a small return, as these investments generally offer higher yields than traditional savings accounts but with lower risk compared to long-term investments.

The primary advantage is liquidity, ensuring you have access to your funds when needed without penalties. Short-term reserves also offer a sense of security, as they are typically low-risk investments. Additionally, they can provide a modest return, which can be useful for covering unexpected expenses or small, short-term financial goals.

While short-term reserves are generally safe, they may not keep up with inflation over the long term, potentially eroding the purchasing power of your investment. Also, the returns might be lower compared to more aggressive investment strategies, so it's important to assess your risk tolerance and financial goals before making a decision.

You can start by evaluating your current savings and identifying the amount you want to allocate for short-term goals. Diversify your portfolio by considering various short-term investment options like money market funds, CDs, or high-yield savings accounts. Regularly review and adjust your portfolio to ensure it aligns with your financial objectives and risk profile.