The current ratio is a financial metric that measures a company's ability to pay its short-term obligations. It is calculated by dividing a company's current assets by its current liabilities. Short-term investments, such as treasury bills and money market funds, are considered current assets and are a crucial component of a company's liquidity. Understanding the role of short-term investments in the current ratio is essential for assessing a company's financial health and its capacity to meet its short-term financial commitments.

What You'll Learn

- Cash and Cash Equivalents: Short-term investments like marketable securities are often included in the current ratio's numerator

- Marketable Securities: These are highly liquid assets that can be quickly converted to cash within one year

- Accounts Receivable: The ability to collect these debts within a year is crucial for the current ratio

- Inventory: Efficient inventory management ensures that goods can be sold quickly, impacting the current ratio

- Payables: Managing short-term liabilities is essential to maintain a healthy current ratio

Cash and Cash Equivalents: Short-term investments like marketable securities are often included in the current ratio's numerator

When evaluating a company's financial health, the current ratio is a critical metric that investors and analysts closely examine. This ratio provides insight into a company's ability to meet its short-term financial obligations. One of the key components that contribute to the numerator of the current ratio is 'Cash and Cash Equivalents'. This term encompasses a variety of highly liquid assets that a company can quickly convert into cash within a short period, typically one year or less.

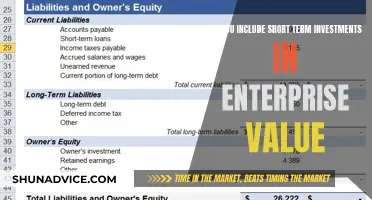

'Cash and Cash Equivalents' primarily includes physical currency, bank deposits, and short-term investments. These investments are considered highly liquid because they can be readily converted into cash without significant loss of value. Marketable securities, such as treasury bills, certificates of deposit, and short-term government bonds, fall under this category. These short-term investments are often included in the current assets section of a company's balance sheet.

The inclusion of short-term investments in the current ratio's numerator is essential for several reasons. Firstly, it provides a more accurate representation of a company's liquidity. By including these investments, the current ratio reflects the company's ability to access and utilize its liquid assets to meet immediate financial demands. This is particularly important for businesses that rely on quick access to cash for day-to-day operations or to pay off short-term liabilities.

Secondly, the presence of short-term investments in the current ratio can indicate a company's investment strategy. Companies may choose to invest in marketable securities as a way to generate a return on their excess cash while still maintaining easy access to funds. This approach allows them to balance the need for liquidity with the potential for earning a modest return on their investments.

In summary, short-term investments, such as marketable securities, are integral to the current ratio's numerator as they represent highly liquid assets that can be quickly converted into cash. This inclusion provides a more comprehensive view of a company's financial health and its ability to manage short-term obligations. Understanding this aspect of financial reporting is crucial for investors and analysts when assessing a company's overall liquidity and financial stability.

Understanding Short-Term Investments: A Balance Sheet Guide

You may want to see also

Marketable Securities: These are highly liquid assets that can be quickly converted to cash within one year

Marketable securities are a crucial component of a company's short-term financial strategy and are an essential element in understanding a company's liquidity and financial health. These securities are highly liquid assets that can be quickly and easily converted into cash within a short period, typically one year or less. This characteristic makes them an attractive option for companies seeking to manage their short-term financial obligations and take advantage of potential investment opportunities.

In the context of financial reporting, marketable securities are considered part of a company's current assets. Current assets are those that a company expects to convert into cash or use up within one year. This classification is significant because it directly impacts a company's current ratio, a key financial metric. The current ratio is calculated by dividing a company's current assets by its current liabilities. Marketable securities contribute to this ratio by increasing the numerator, thus improving the overall liquidity and financial stability of the company.

The inclusion of marketable securities in the current ratio is essential for several reasons. Firstly, it provides a more accurate representation of a company's ability to meet its short-term financial obligations. Highly liquid assets like marketable securities can be readily sold or redeemed, ensuring that the company has the necessary funds to pay off its debts and expenses in the near future. Secondly, it allows investors and creditors to assess the company's financial health more effectively. A higher proportion of marketable securities in the current ratio can indicate a more conservative and financially stable approach, especially if these securities are of high quality and low risk.

Moreover, marketable securities offer companies a strategic advantage in managing their cash flow. These assets provide a source of immediate cash that can be utilized for various purposes, such as funding day-to-day operations, investing in short-term projects, or taking advantage of market opportunities. By having a diverse portfolio of marketable securities, companies can ensure a steady supply of liquid funds, enabling them to respond quickly to changing market conditions and business needs.

In summary, marketable securities are an integral part of a company's short-term financial strategy and play a significant role in determining its current ratio. Their high liquidity and quick conversion to cash make them a valuable asset for managing short-term financial obligations and taking advantage of investment opportunities. Understanding the impact of marketable securities on a company's financial health is essential for investors, creditors, and management alike, as it provides valuable insights into the company's ability to meet its short-term financial commitments.

Understanding NAV: The Key to Investment Clarity

You may want to see also

Accounts Receivable: The ability to collect these debts within a year is crucial for the current ratio

The current ratio is a critical financial metric that provides insight into a company's liquidity and short-term financial health. It is calculated by dividing a company's current assets by its current liabilities, and it is a key indicator of a company's ability to meet its short-term obligations. One of the most significant components of current assets is Accounts Receivable, which represents the money owed to the company by its customers for goods or services sold on credit.

Accounts Receivable is essential because it directly impacts a company's ability to generate cash flow and maintain its current ratio. The current ratio is highly sensitive to the timing of cash inflows and outflows, and Accounts Receivable plays a pivotal role in this regard. Efficient management of Accounts Receivable is crucial to ensuring that a company can convert its short-term assets into cash within a year, which is the primary focus of the current ratio.

The ability to collect debts within a year is a critical aspect of Accounts Receivable management. If a company struggles to collect its receivables promptly, it can lead to several financial challenges. Firstly, it may result in a delay in cash flow, affecting the company's ability to pay its short-term debts and obligations. This delay can have a cascading effect, potentially leading to late payment fees, penalties, or even legal issues if the company is unable to meet its financial commitments.

Secondly, poor collection of Accounts Receivable can distort the current ratio. If a company's receivables are not collected within the desired timeframe, it will artificially inflate the current assets, making the current ratio appear healthier than it actually is. This misrepresentation can mislead investors, creditors, and other stakeholders, potentially leading to incorrect financial decisions.

To maintain a healthy current ratio, companies should focus on implementing efficient Accounts Receivable management practices. This includes setting clear credit policies, offering incentives for prompt payments, and utilizing technology to streamline the collection process. By ensuring that debts are collected within a year, companies can improve their liquidity, enhance their financial stability, and provide a more accurate representation of their short-term financial health.

Unlocking Wealth: Discover the Ultimate Long-Term Investment Strategy

You may want to see also

Inventory: Efficient inventory management ensures that goods can be sold quickly, impacting the current ratio

Efficient inventory management is a critical aspect of a company's financial health, especially when it comes to the current ratio, a key liquidity metric. The current ratio measures a company's ability to meet its short-term financial obligations and is calculated by dividing current assets by current liabilities. One of the most significant components of current assets is inventory, which represents the goods a company has available for sale.

When inventory is managed effectively, it directly influences the current ratio. Efficient inventory management ensures that the stock is well-organized, easily accessible, and ready for sale. This efficiency allows for quicker sales cycles, reducing the time goods spend in storage. As a result, the company can convert its inventory into cash more rapidly, thereby increasing its current assets. A higher current asset value directly impacts the current ratio, making it more favorable.

The impact of efficient inventory management on the current ratio is twofold. Firstly, it improves the company's liquidity by ensuring that a larger portion of its assets is readily convertible into cash. This is particularly important for meeting short-term financial commitments, such as paying suppliers, employees, and other creditors. Secondly, efficient inventory practices can lead to cost savings. By reducing the time goods spend in storage, the company minimizes holding costs, such as storage fees, insurance, and potential obsolescence.

In practice, efficient inventory management involves several strategies. These include implementing just-in-time inventory systems, which minimize storage costs and reduce the risk of excess stock. Additionally, companies can use advanced inventory management software to track stock levels, predict demand, and optimize reordering processes. This ensures that inventory levels are maintained at optimal levels, balancing the need for stock against the risk of overstocking.

In summary, efficient inventory management is a powerful tool for improving a company's current ratio. By ensuring that goods are sold quickly and efficiently, companies can increase their current asset value, thereby enhancing their financial liquidity and overall financial health. This strategic approach to inventory management is essential for businesses aiming to maintain a strong balance sheet and meet their short-term financial obligations effectively.

Unlock Short-Term Gains: A Beginner's Guide to Treasury Bills

You may want to see also

Payables: Managing short-term liabilities is essential to maintain a healthy current ratio

Managing short-term liabilities, or payables, is a critical aspect of financial management for any business. It directly impacts a company's current ratio, which is a key financial metric used by investors, creditors, and analysts to assess a company's liquidity and financial health. The current ratio is calculated by dividing a company's current assets by its current liabilities. It provides insight into a company's ability to meet its short-term financial obligations.

Payables, which include accounts payable, notes payable, and other short-term debts, are a significant component of current liabilities. Effective management of these liabilities is essential to ensure that a company can maintain a healthy current ratio. When a company's payables are well-managed, it indicates efficient operations and a strong financial position. This is because efficient payables management often results in shorter payment terms with suppliers, which can lead to better cash flow management and reduced financial risk.

One key strategy for managing payables is to negotiate favorable payment terms with suppliers. This may involve extending payment periods, which can provide a short-term boost to cash flow. However, it is crucial to balance this with the need to maintain good relationships with suppliers to ensure continued access to credit and supplies. Another important aspect is to implement robust accounts payable processes, including accurate and timely invoice processing, payment scheduling, and reconciliation.

Additionally, companies should regularly review and analyze their payables data. This includes identifying trends, such as increasing or decreasing payables balances over time, and understanding the reasons behind these changes. By doing so, businesses can make informed decisions about their payment strategies and identify areas for improvement. For instance, if a company notices a consistent increase in payables, it may need to re-evaluate its purchasing and inventory management practices to optimize cash flow.

In summary, managing short-term liabilities, or payables, is a vital task for businesses to maintain a healthy current ratio. It involves strategic negotiation with suppliers, efficient accounts payable processes, and regular financial analysis. By effectively managing payables, companies can improve their financial stability, attract investors, and ensure they have the necessary liquidity to meet their short-term obligations. This, in turn, contributes to the overall success and sustainability of the business.

Maximize Your Short-Term Cash: Top Investment Strategies

You may want to see also

Frequently asked questions

The current ratio is a liquidity metric used to measure a company's ability to meet its short-term financial obligations. It is calculated by dividing a company's current assets by its current liabilities. Short-term investments are considered part of current assets and can significantly impact this ratio.

Short-term investments, such as marketable securities, treasury bills, or short-term bonds, are highly liquid assets that can be quickly converted into cash. When included in the current ratio calculation, they increase the numerator (current assets) and can potentially improve the overall ratio, indicating a stronger liquidity position.

While short-term investments can contribute to a higher current ratio, it is essential to consider other current assets as well. A high current ratio might be a result of a combination of factors, including efficient management of accounts receivable, inventory, and other liquid assets. It is not solely dependent on short-term investments.

Yes, short-term investments are typically included in the current ratio calculation as they are considered highly liquid and can be readily converted into cash within a year. However, the specific classification and treatment of these investments may vary depending on their maturity and the company's accounting policies.

Companies can strategically manage their short-term investments to enhance their current ratio. This can involve investing in low-risk, highly liquid assets that can be quickly sold without significant loss. By maintaining a healthy balance between short-term investments and other current assets, businesses can improve their liquidity and financial flexibility.